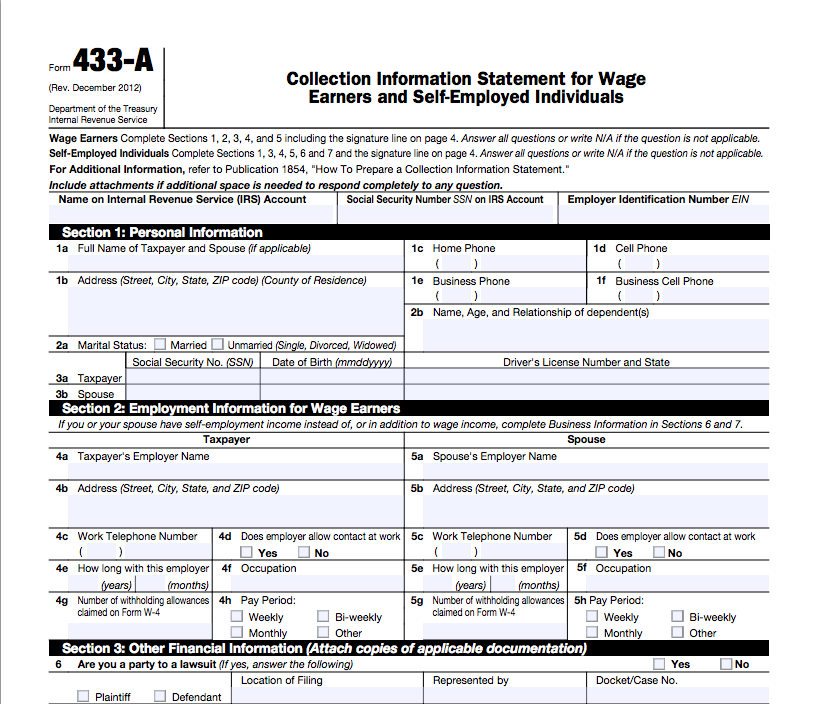

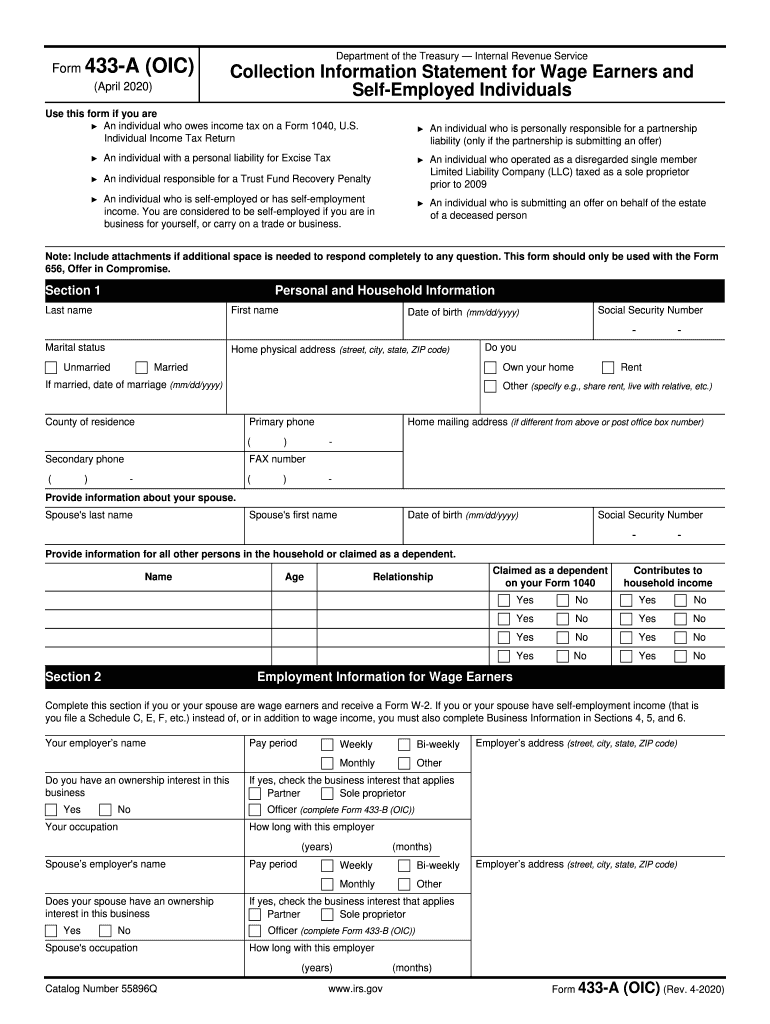

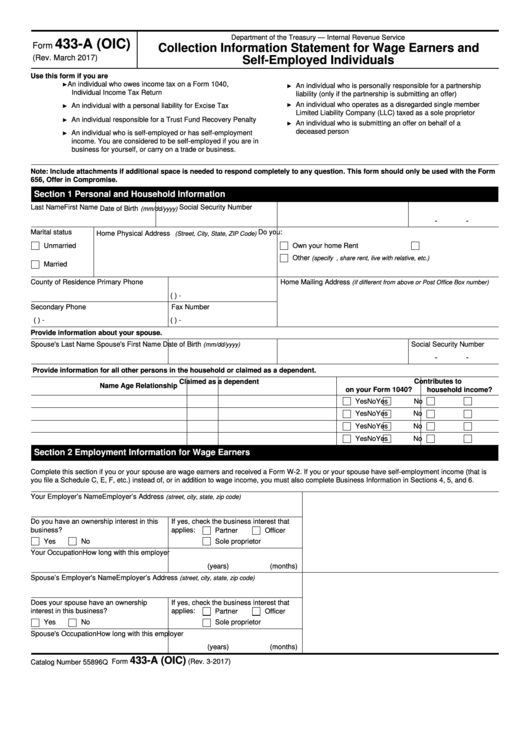

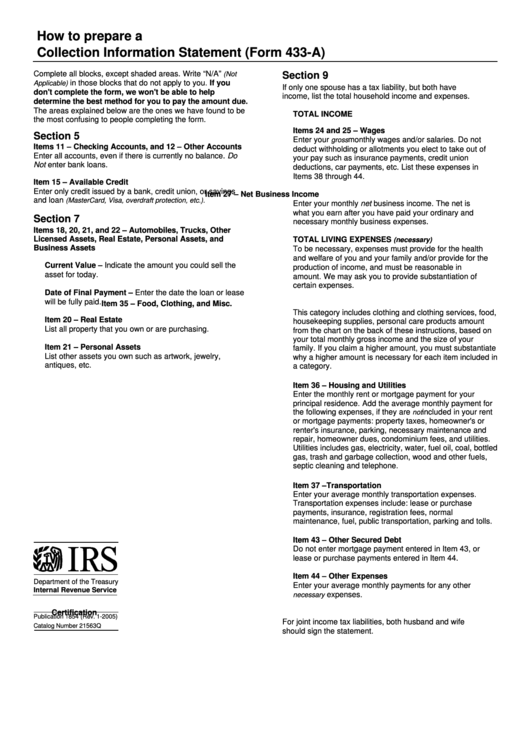

Printable Irs Form 433 A Catalog Number 55896Q www irs gov Form 433 A OIC Rev 4 2023 Form 433 A OIC April 2023 Department of the Treasury Internal Revenue Service Collection Information Statement for Wage Earners and Self Employed Individuals Use this form if you are An individual who owes income tax on a Form 1040 U S Individual Income Tax Return

An individual with a personal liability for Excise Tax An individual responsible for a Trust Fund Recovery Penalty An individual who is personally responsible for a partnership liability An individual who is self employed or has self employment income Who should use Form 433 A Form 433 A is used to obtain current financial information necessary for determining how a wage earner or self employed individual can satisfy an outstanding tax liability You may need to complete Form 433 A If you are an individual who owes income tax on Form 1040

Printable Irs Form 433 A

Printable Irs Form 433 A

https://www.mcc4tax.com/wp-content/uploads/2017/03/Form-433-a.png

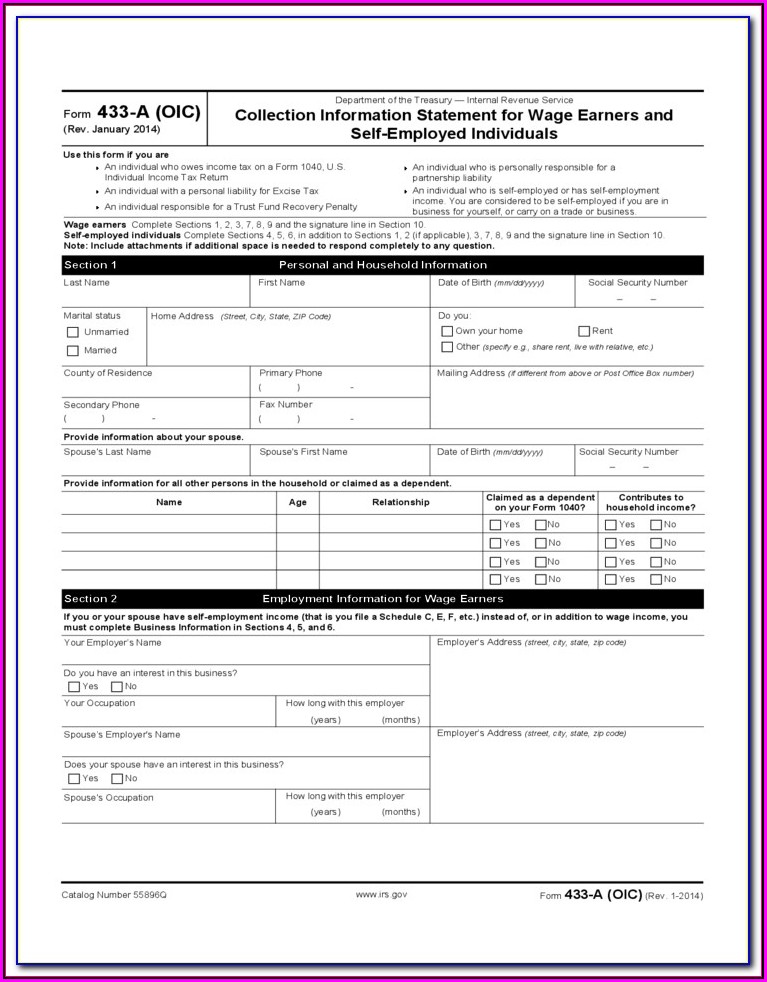

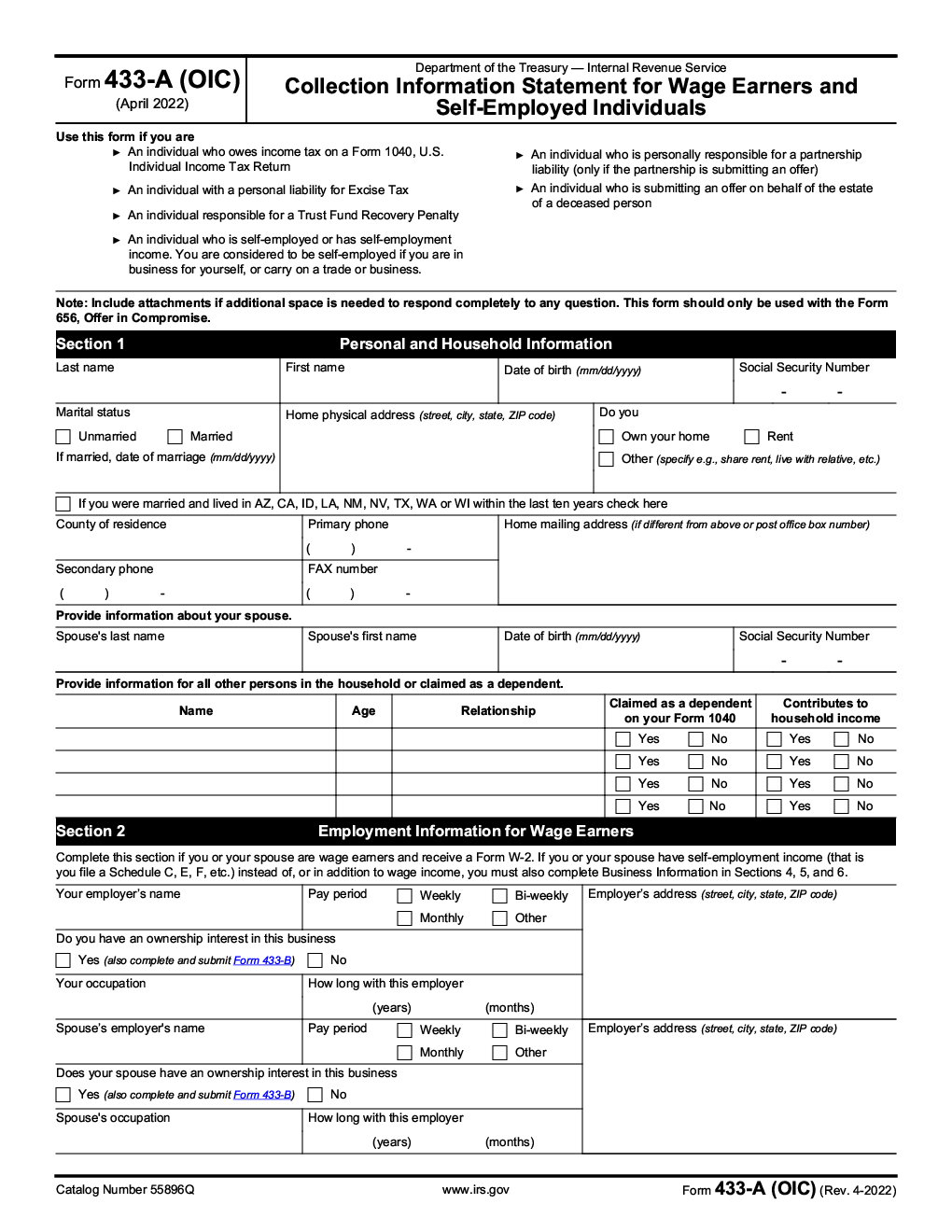

Form 433 A Collection Information Statement For Wage Earners And Individuals 2013 Free Download

https://www.formsbirds.com/formimg/tax-support-document/7811/form-433-a-collection-information-statement-for-wage-earners-and-individuals-2013-l5.png

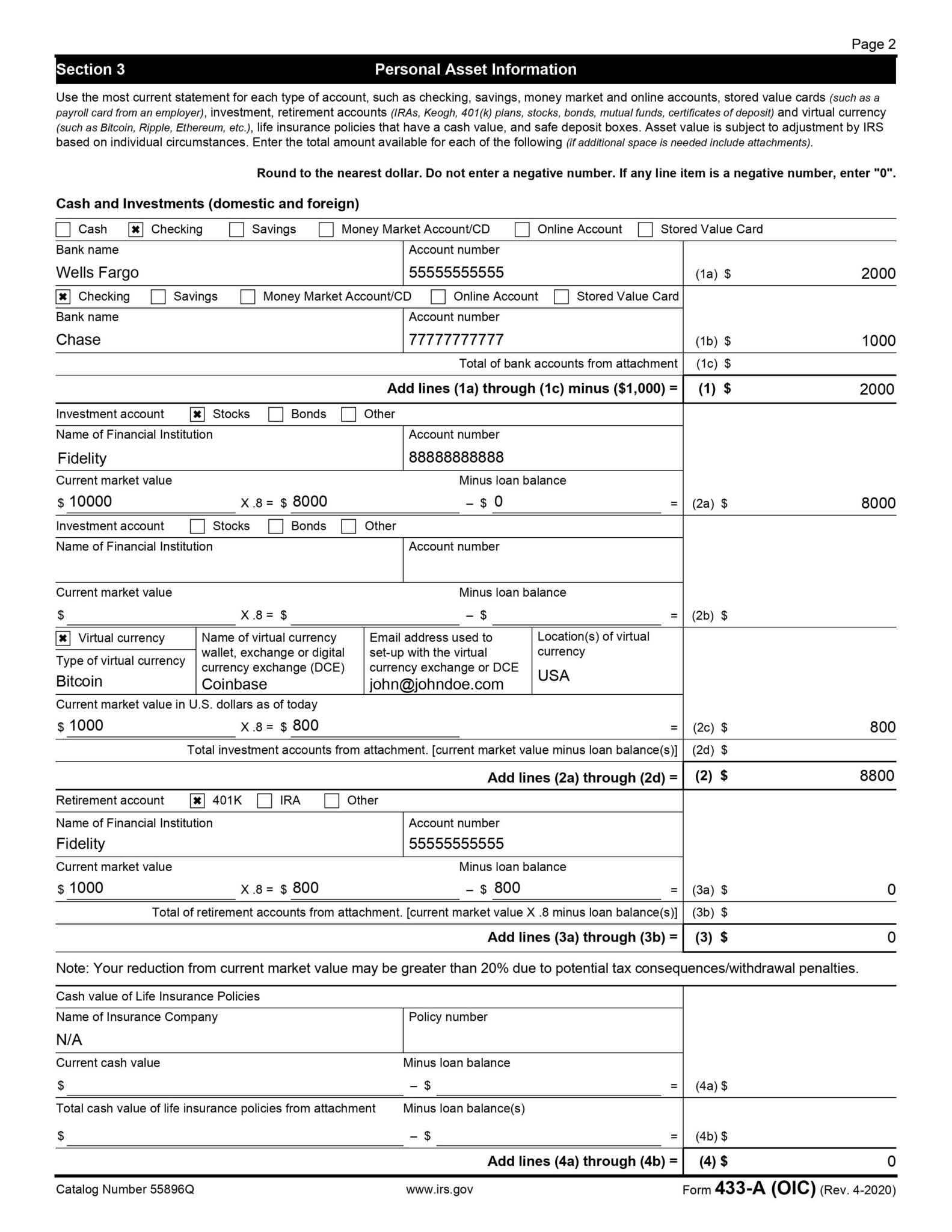

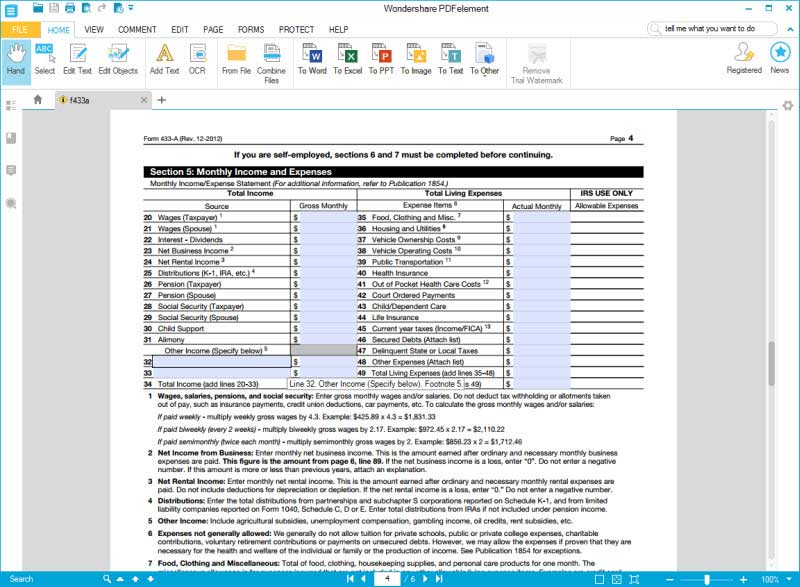

How To Fill Out Form 433 A OIC 2019 Version Detailed Instructions From IRS 656 Booklet

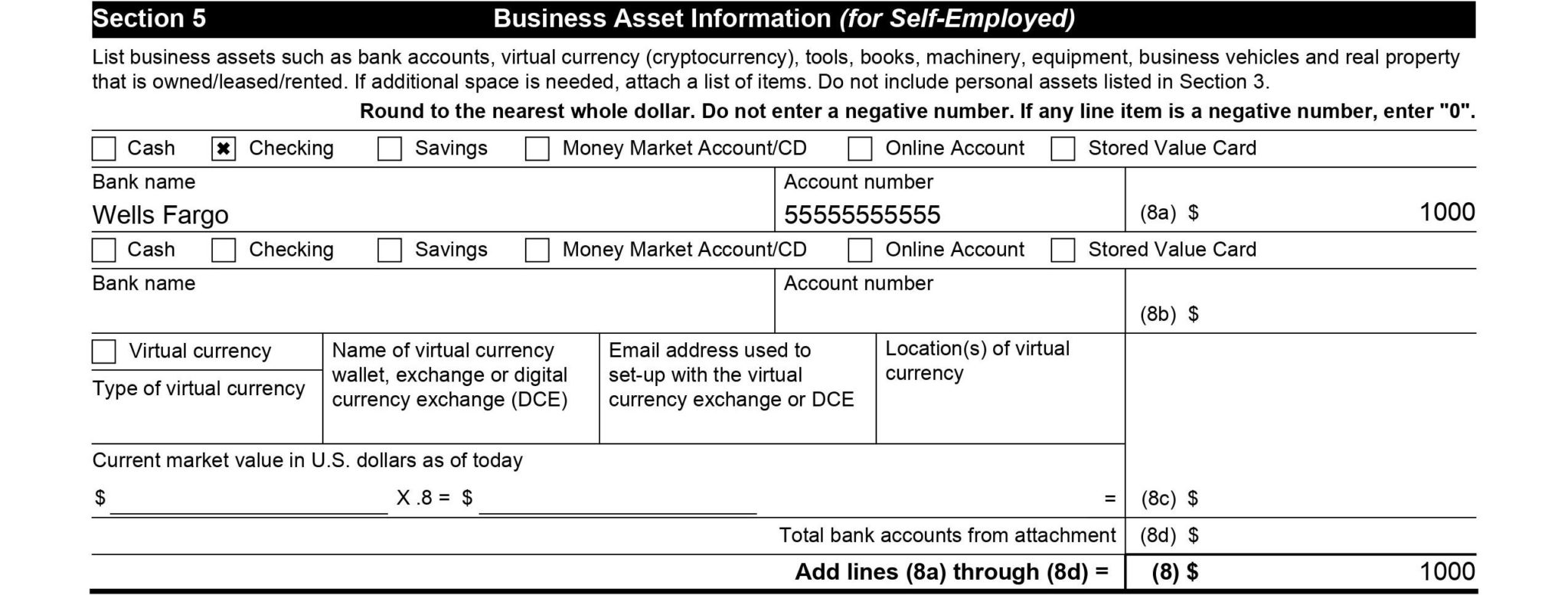

https://trp.tax/wp-content/uploads/2015/03/OIC_Sec-3-Form-433-A-OIC-Cash-and-Investments.jpg

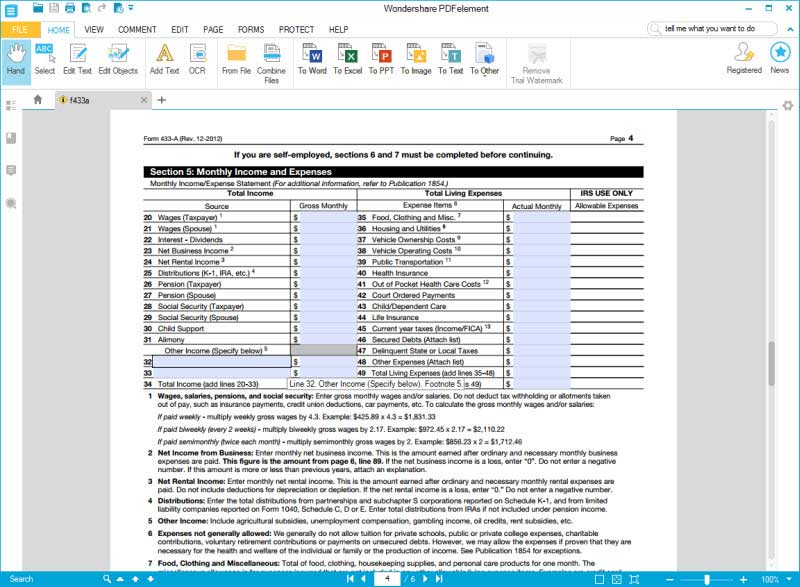

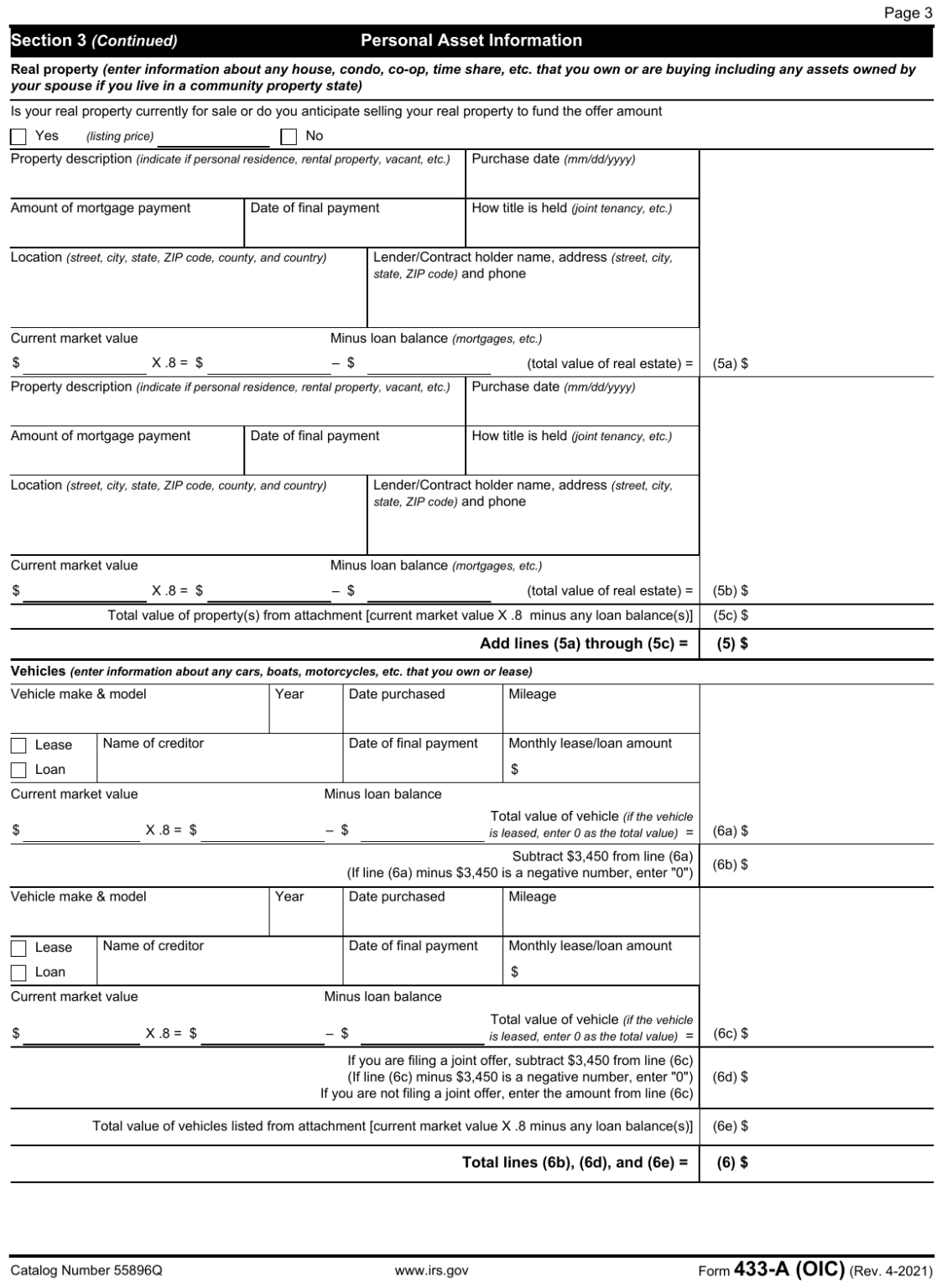

Catalog Number 20312N www irs gov Form 433 A Rev 5 2020 Form 433 A Rev 2 2019 Page 4 If you are self employed sections 6 and 7 must be completed before continuing Section 5 Monthly Income and Expenses Monthly Income Expense Statement For additional information refer to Publication 1854 Total Income How to Complete Form 433 A OIC Offer In Compromise Personal and Household Information 2 12 Wage Earners Employment Information Section 2 0 43 Personal Assets Information Section 3 0 46 Personal Assets Checking Section 3 1 39 Personal Assets Investments Retirement and Insurance Section 3 2 00 Personal Assets Real Estate Section 3

IRS Form 433 A is a tax form that collects information about your finances including any debts and assets you have The IRS uses this form to determine whether you re able to satisfy an outstanding tax liability Key Takeaways Form 433 A is required for individuals and self employed people who are seeking an offer in compromise with the IRS Form 433 A is a collection information statement for wage earners and self employed individuals This form provides the IRS with a complete overview of your financial situation by gathering details about your assets liabilities income and expenses This information allows the IRS to assess if you qualify for certain tax relief programs If

More picture related to Printable Irs Form 433 A

433a Tax 2000 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/76/100076892/large.png

Download Form 433 A For Free Page 4 FormTemplate

https://cdn.formtemplate.org/images/600/form-433-a-4.png

2020 Form IRS 433 A OIC Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/512/562/512562277/large.png

Form 433 A also known as the Collection Information Statement is a document needed by the Internal Revenue Service IRS when an individual or business owes a tax debt The form is used to determine the taxpayer s ability to pay and come to a favourable resolution regarding the owed amount Download This Form Print This Form More about the Federal Form 433 A Other TY 2023 We last updated the Collection Information Statement for Wage Earners in February 2024 so this is the latest version of Form 433 A fully updated for tax year 2023 You can download or print current or past year PDFs of Form 433 A directly from TaxFormFinder

Www irs gov Form 433 D Rev 8 2022 Part 1 IRS Copy Form 433 D August 2022 Department of the Treasury Internal Revenue Service Installment Agreement See Instructions on the back of this page Name and address of taxpayer s Submit a new Form W 4 to your employer to increase your withholding If you re requesting an installment agreement or similar tax debt management solution from the Internal Revenue Service IRS you ll need to submit Form 433 A Collection Information Statement for Wage Earners and Self Employed Individuals This six page form provides the IRS with detailed information about your financial situation

IRS Form 433 A How To Fill It Right

https://pdfimages.wondershare.com/pdf-forms/tax-form/irs-form-433a-section-5.jpg

Irs Form 433 A Printable Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/286/2862/286295/page_1_thumb_big.png

https://www.irs.gov/pub/irs-pdf/f433aoi.pdf

Catalog Number 55896Q www irs gov Form 433 A OIC Rev 4 2023 Form 433 A OIC April 2023 Department of the Treasury Internal Revenue Service Collection Information Statement for Wage Earners and Self Employed Individuals Use this form if you are An individual who owes income tax on a Form 1040 U S Individual Income Tax Return

https://www.irs.gov/pub/irs-access/f433aoi_accessible.pdf

An individual with a personal liability for Excise Tax An individual responsible for a Trust Fund Recovery Penalty An individual who is personally responsible for a partnership liability An individual who is self employed or has self employment income

Irs Form 433 A Printable Printable Forms Free Online

IRS Form 433 A How To Fill It Right

How To Fill Out Form 433 A OIC 2019 Version Detailed Instructions From IRS 656 Booklet

Download Form 433 A For Free Page 6 FormTemplate

How To Fill Out Form 433 A OIC 2019 Version Detailed Instructions From IRS 656 Booklet

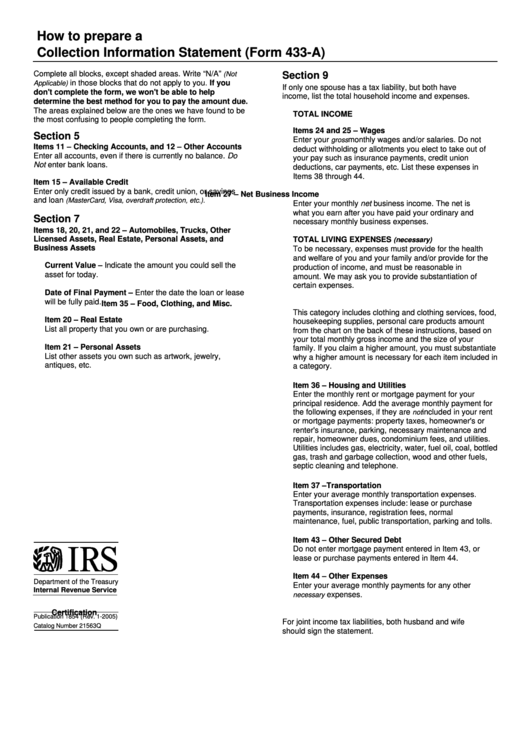

Instructions For Form 433 A 2005 Printable Pdf Download

Instructions For Form 433 A 2005 Printable Pdf Download

IRS Form 433 A Collection Information Statement For Wage Earners And Self Employed Individuals

2014 Form IRS 433 A OIC Fill Online Printable Fillable Blank PdfFiller

How To Fill Out Form 433 A OIC 2021 Version Detailed Instructions From IRS 656 Booklet

Printable Irs Form 433 A - Form 433 A is a collection information statement for wage earners and self employed individuals This form provides the IRS with a complete overview of your financial situation by gathering details about your assets liabilities income and expenses This information allows the IRS to assess if you qualify for certain tax relief programs If