Printable K 1 Tax Form Schedule K 1 Form 1065 2023 Partner s Share of Income Deductions Credits etc Department of the Treasury Internal Revenue Service See separate instructions OMB No 1545 0123 For calendar year 2023 or tax year beginning 2023 ending 651123 Final K 1 Amended K 1 Part I Information About the Partnership A

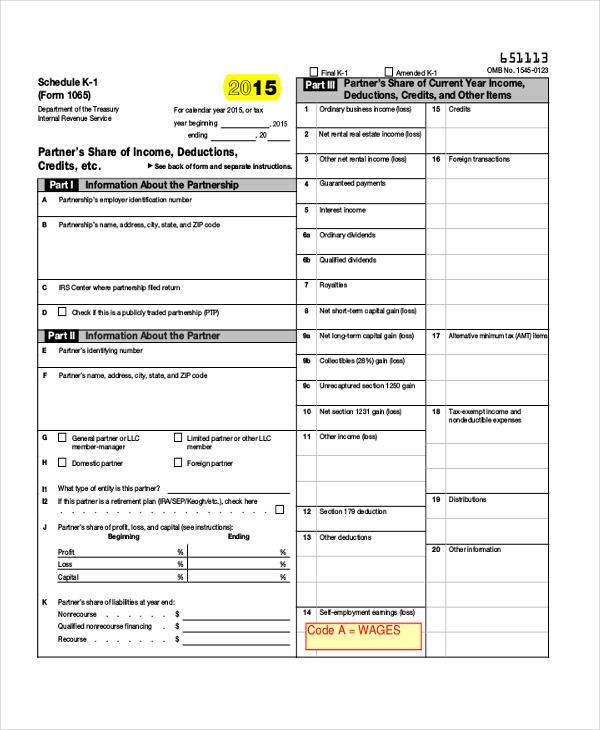

The Schedule K 1 is the form that reports the amounts that are passed through to each party that has an interest in an entity such as a business partnership or an S corporation The parties use the information on the K 1 to prepare their separate tax returns Schedule K 1 Form 1065 Department of the Treasury Internal Revenue Service 2020 For calendar year 2020 or tax year beginning 2020 ending Partner s Share of Income Deductions Credits etc See separate instructions 651119 Final K 1 Amended K 1 OMB No 1545 0123

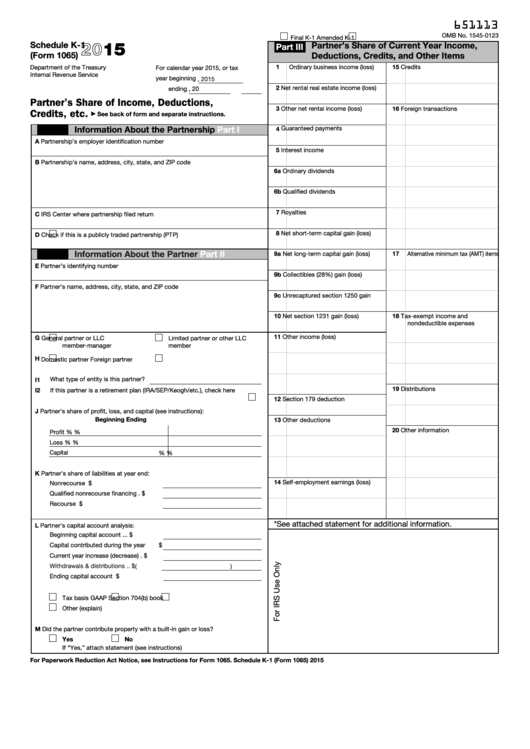

Printable K 1 Tax Form

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Printable K 1 Tax Form

https://www.investopedia.com/thmb/xl7oJhyv0H1CugNUYfDP2uUh7pQ=/1308x1092/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png

Sample K1 Tax Form Verhotline

https://www.irs.gov/pub/xml_bc/33347002.gif

Schedule K 1 Tax Form Here s What You Need To Know LendingTree

https://www.lendingtree.com/content/uploads/2020/03/Schedule-K-one-instructions-for-partnerships-one.png

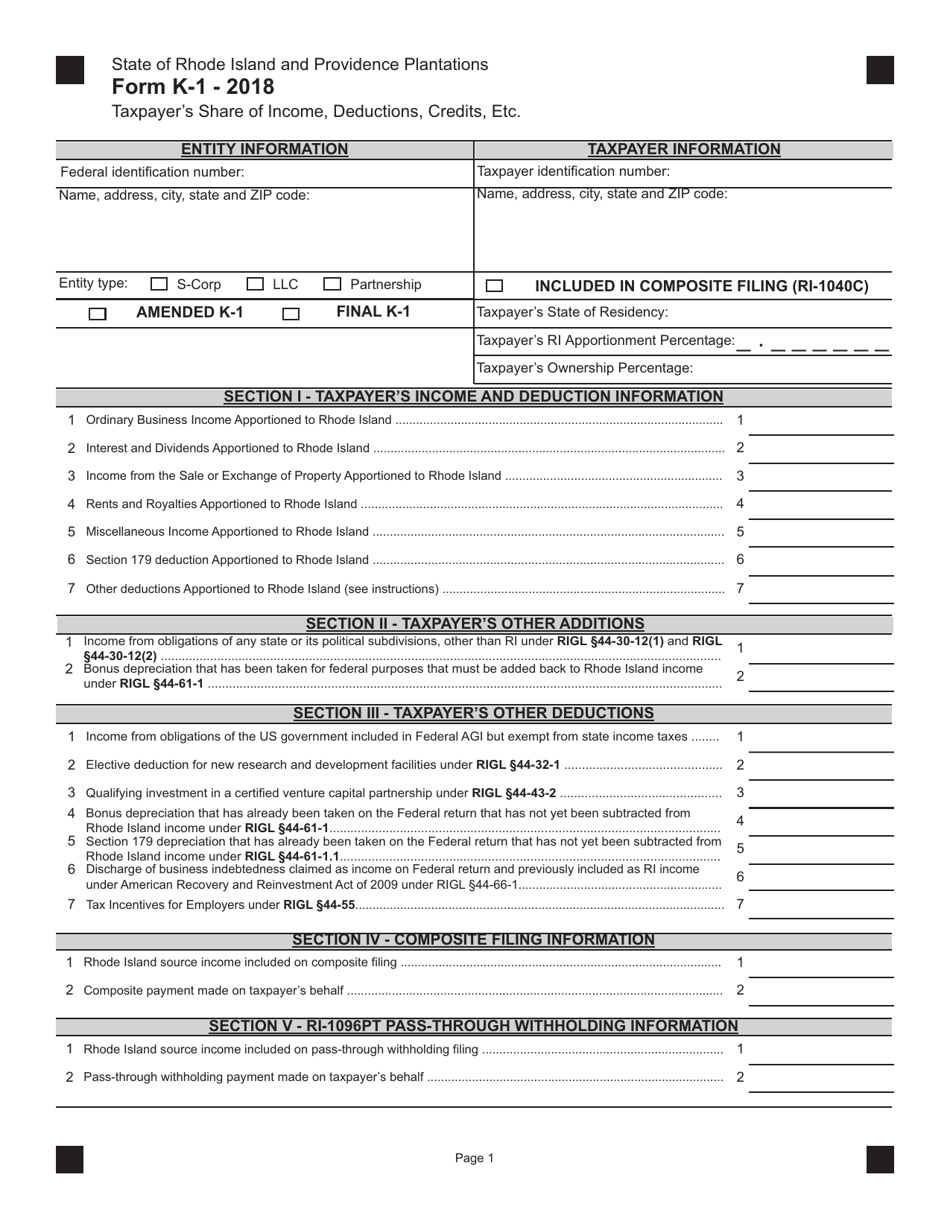

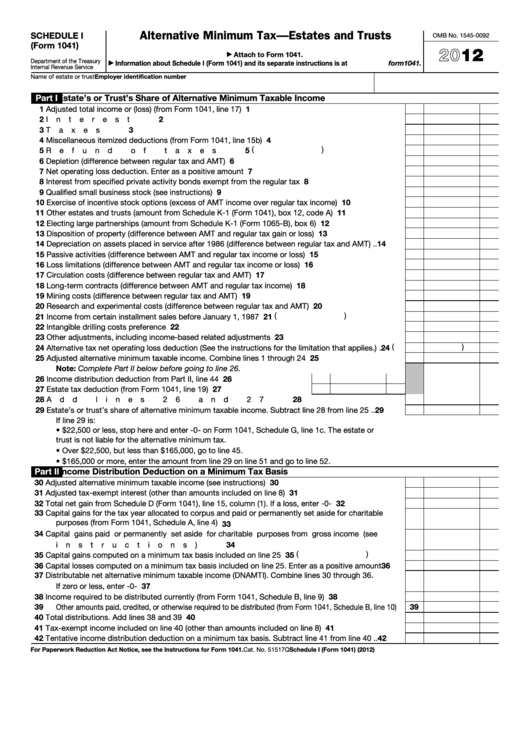

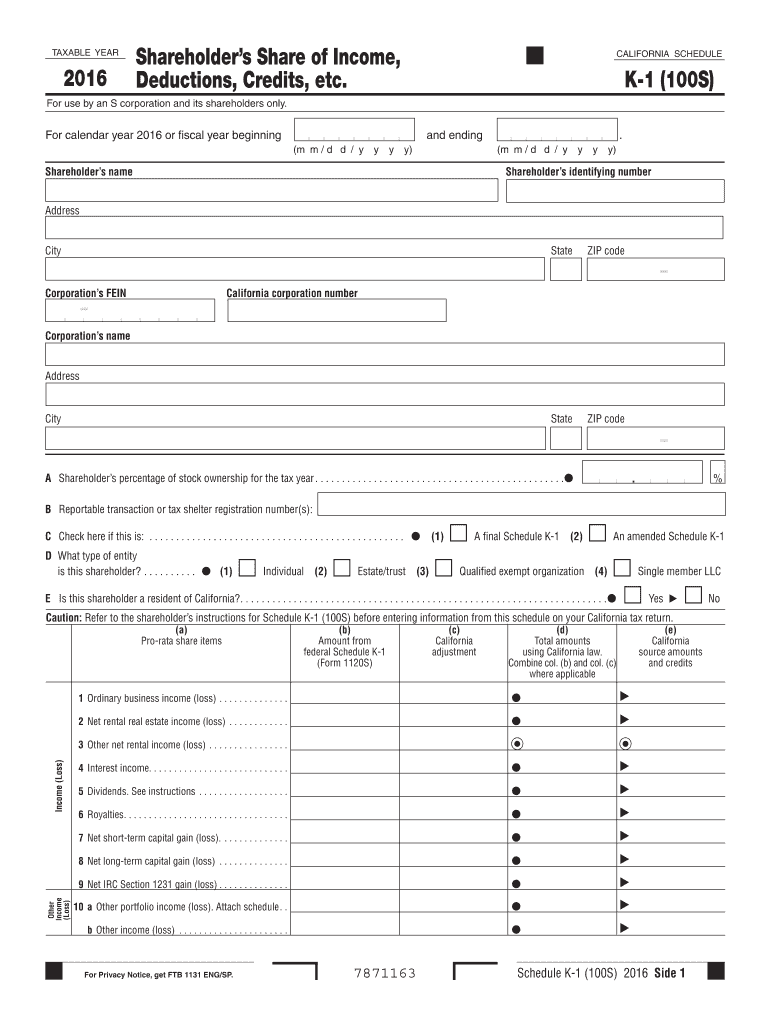

SEC Form 1 An application for and amendments to an application for registration as a national securities exchange or exemption from registration pursuant to section 5 of the Securities Exchange Schedule K 1 1120S This form is used to report pass through income to S corporation shareholders in a business on Form 1120 S It s possible to get multiple versions of the Schedule K 1 in the same tax year the K 1 1065 the K 1 1120 S and K 1 1041

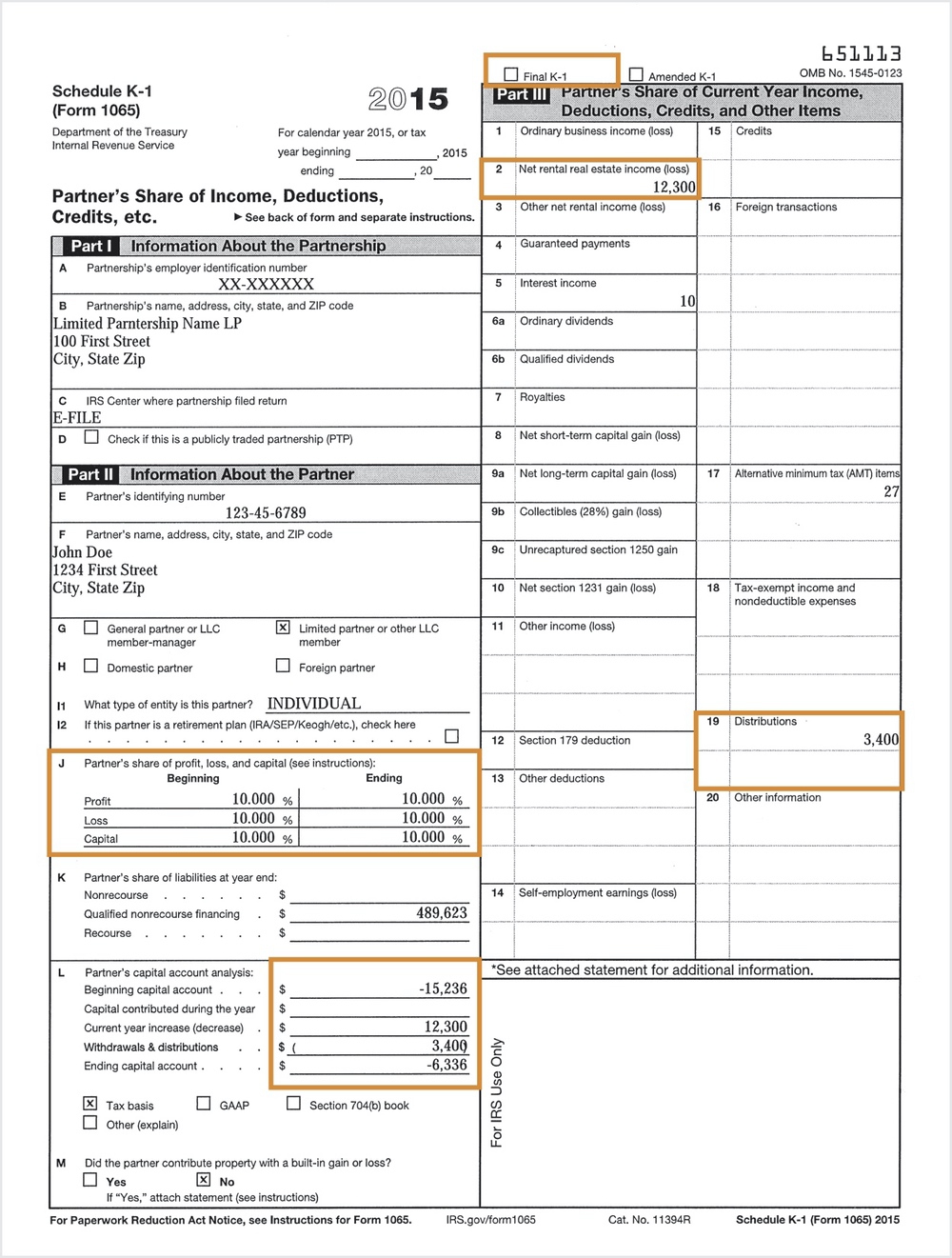

Schedule K 1 is a schedule of IRS Form 1065 U S Return of Partnership Income It s provided to partners in a business partnership to report their share of a partnership s profits losses deductions and credits to the IRS Schedule K 1 is a federal tax document used to report the income losses and dividends for a business or financial entity s partners or an S corporation s shareholders The K 1 form is

More picture related to Printable K 1 Tax Form

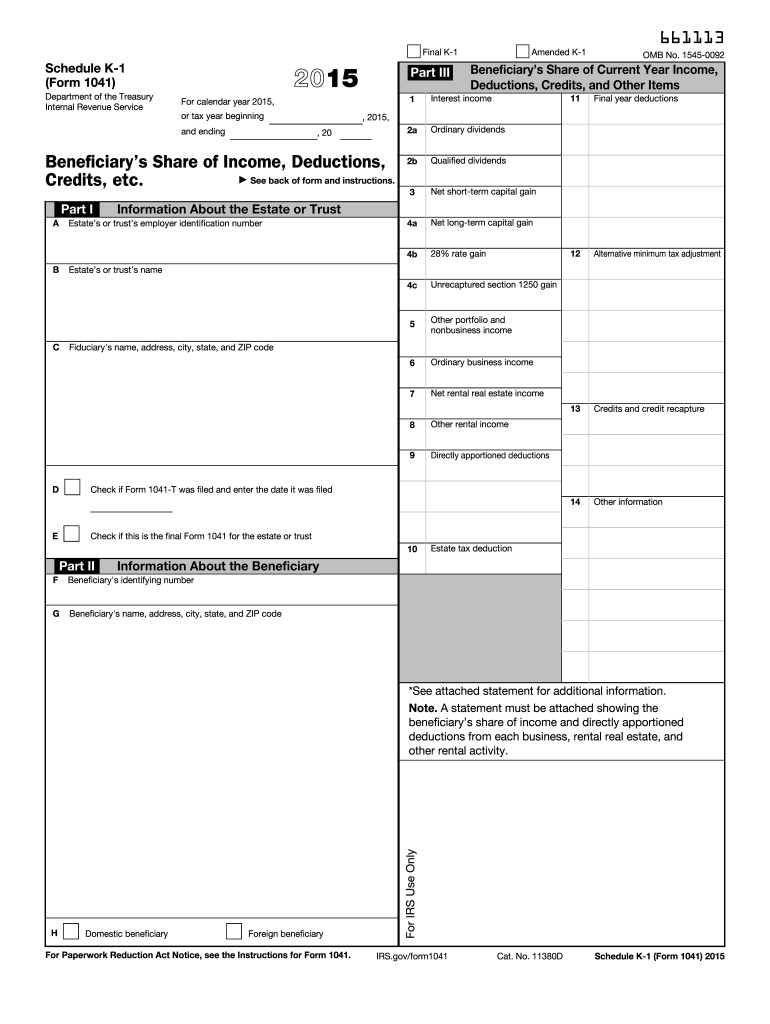

Irs Fillable K 1 Form 1041 Printable Forms Free Online

https://us.meruaccounting.com/wp-content/uploads/2020/04/Structure-of-Form-1041.gif

Instructions For Schedule K 1 Form 1041 For A Beneficiary Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/578/291/578291825/big.png

Form 1041 Schedule K 1 Beneficiary s Share Of Income Deductions Credits Etc 2015 Free

http://www.formsbirds.com/formimg/more-tax-forms/8135/form-1041-schedule-k-1-beneficiarys-share-of-income-deductions-credits-etc-2015-l1.png

What Is Schedule K 1 Form 1041 Schedule K 1 Form 1041 is an official IRS form that s used to report a beneficiary s share of income deductions and credits from an estate or Its full name is U S Income Tax Return from Estates and Trusts The estate or trust is responsible for filing Schedule K 1 for each listed beneficiary with the IRS Schedule K 1 Form 1065 Department of the Treasury Internal Revenue Service For calendar year 2021 or tax year beginning 2021 ending Partner s Share of Income Deductions Credits etc See back of form and separate instructions Final K 1 Amended K 1 Part I Information About the Partnership A Partnership s employer identification number

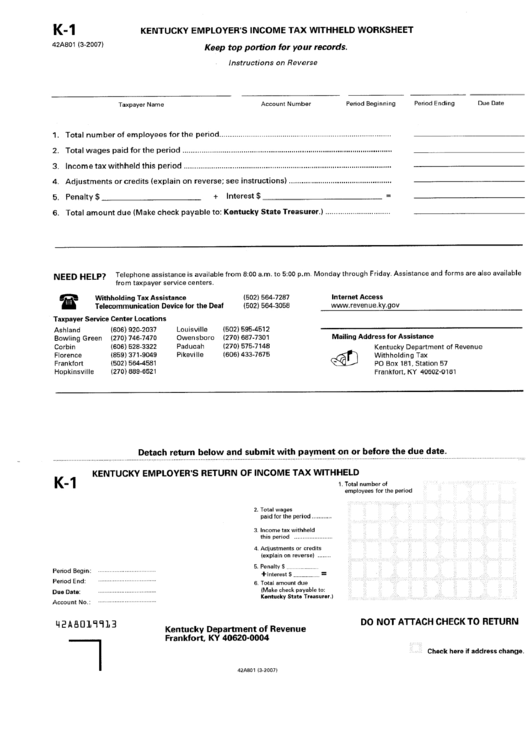

Follow these steps to print a K 1 package Open the business entity s tax return Go to the File Return tab Select K 1 Package on the left side menu Click the button to Export zip file The zip file will be organized by partner shareholder or beneficiary names in the order you entered them in the program Did you receive a K 1 form It s not a common form for most taxpayers but questions about K 1s are some of the top questions we are seeing at this time in the season This is a document that partnerships LLCs S corps estates and trusts use to describe to owners shareholders what income they are receiving from the entity

2020 Form IRS 1065 Schedule K 1 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/541/91/541091596/large.png

Sample Of K1 Form Primarylio

https://images.sampleforms.com/wp-content/uploads/2016/11/Schedule-K-1-Form-1065.jpg

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png?w=186)

https://www.irs.gov/pub/irs-pdf/f1065sk1.pdf

Schedule K 1 Form 1065 2023 Partner s Share of Income Deductions Credits etc Department of the Treasury Internal Revenue Service See separate instructions OMB No 1545 0123 For calendar year 2023 or tax year beginning 2023 ending 651123 Final K 1 Amended K 1 Part I Information About the Partnership A

https://turbotax.intuit.com/tax-tips/small-business-taxes/what-is-a-schedule-k-1-tax-form/L95lj0sJq

The Schedule K 1 is the form that reports the amounts that are passed through to each party that has an interest in an entity such as a business partnership or an S corporation The parties use the information on the K 1 to prepare their separate tax returns

Printable K 1 Tax Form Printable World Holiday

2020 Form IRS 1065 Schedule K 1 Fill Online Printable Fillable Blank PdfFiller

Form K 1 Kentucky Employer S Income Tax Withheld Worksheet Printable Pdf Download

Printable K 1 Tax Form Printable World Holiday

Fillable Schedule K 1 Form 1065 Partner S Share Of Income Deductions Credits Etc 2015

2014 Schedule K 1 Examples And Forms

2014 Schedule K 1 Examples And Forms

Online Ft State Of Ca Schedule K 1 For S Corp Form Fill Out And Sign Printable PDF Template

K 1 Form Fill Out And Sign Printable PDF Template SignNow

Schedule K 1 1065 Tax Form Guide LP Equity

Printable K 1 Tax Form - Schedule K 1 is a federal tax document used to report the income losses and dividends for a business or financial entity s partners or an S corporation s shareholders The K 1 form is