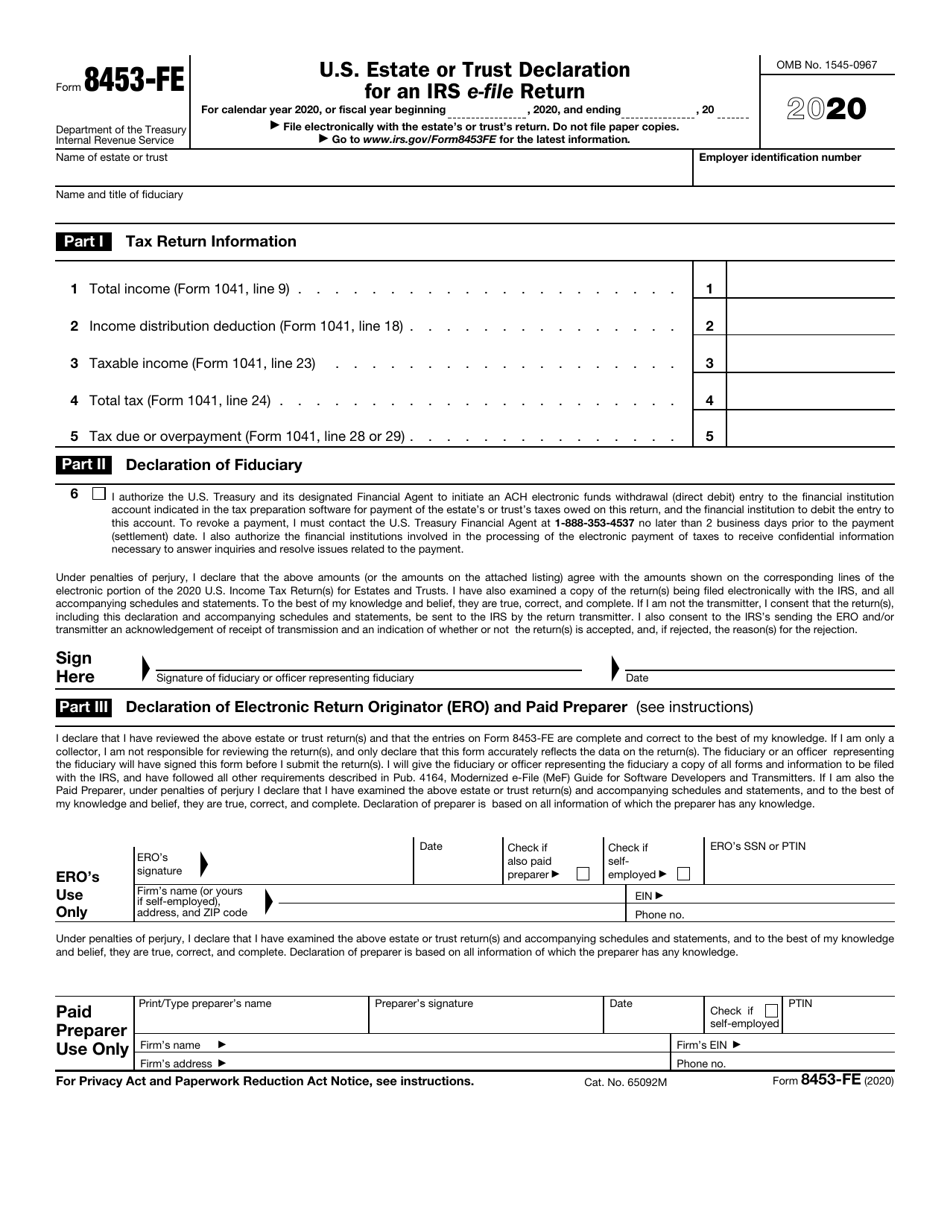

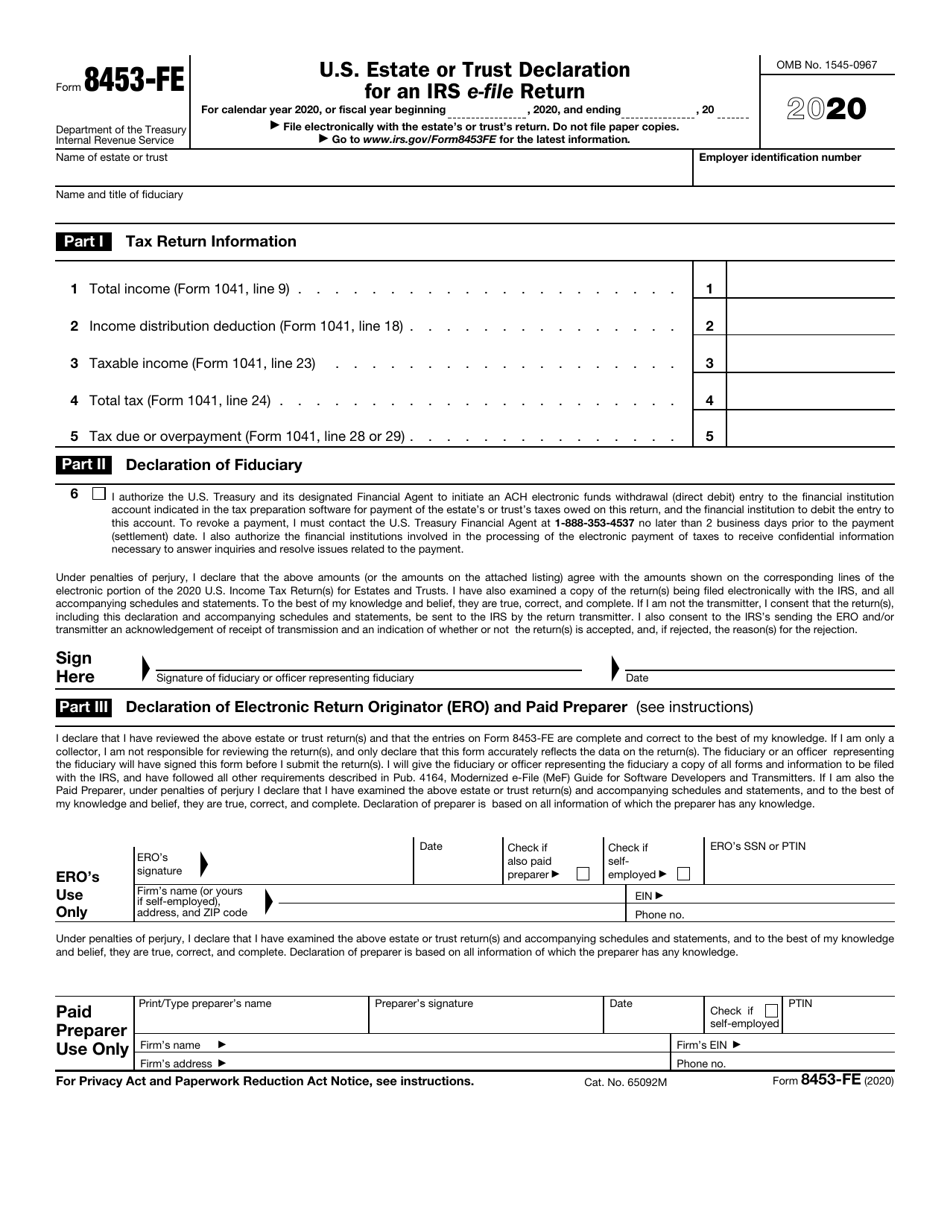

Printable Mi 8453 Fe Form Forms and Instructions About Form 8453 FE U S Estate or Trust Declaration for an IRS e file Return Use this form to Authenticate the electronic Form 1041 U S Income Tax Return for Estates and Trusts Authorize the electronic filer to transmit via a third party transmitter and

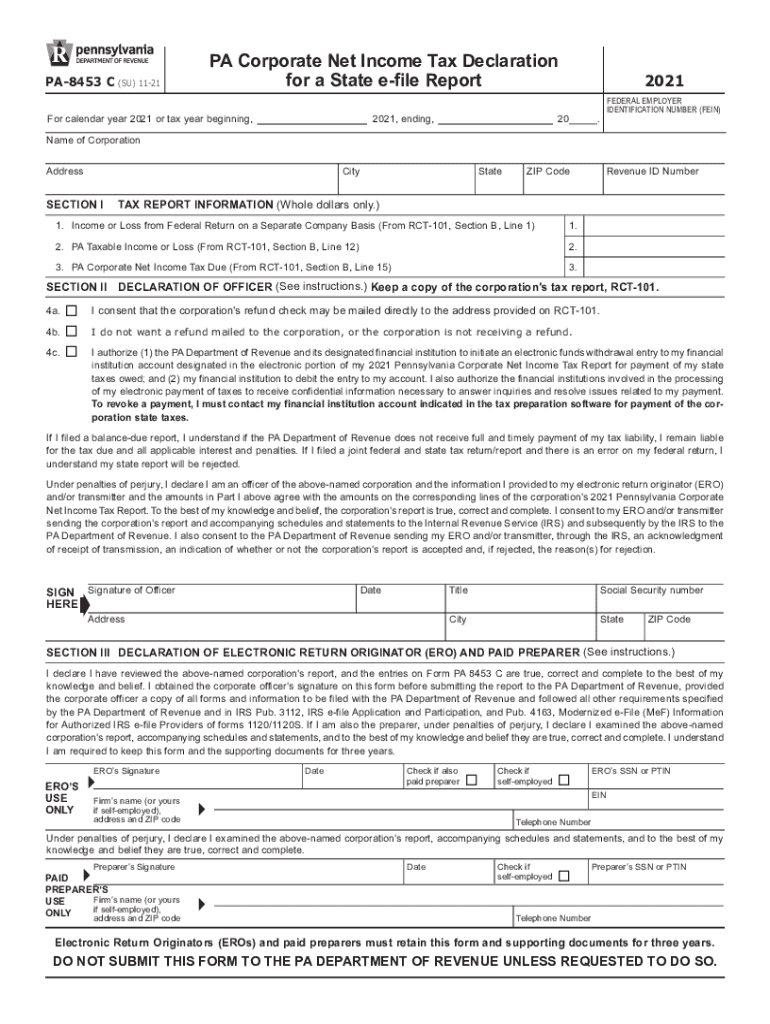

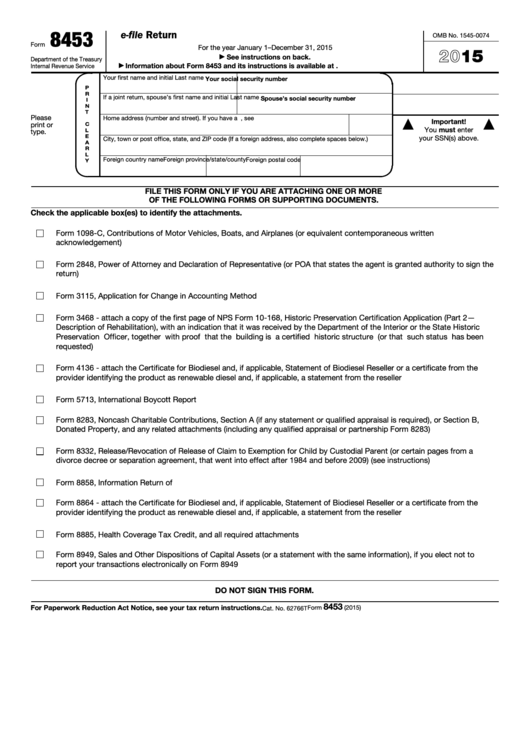

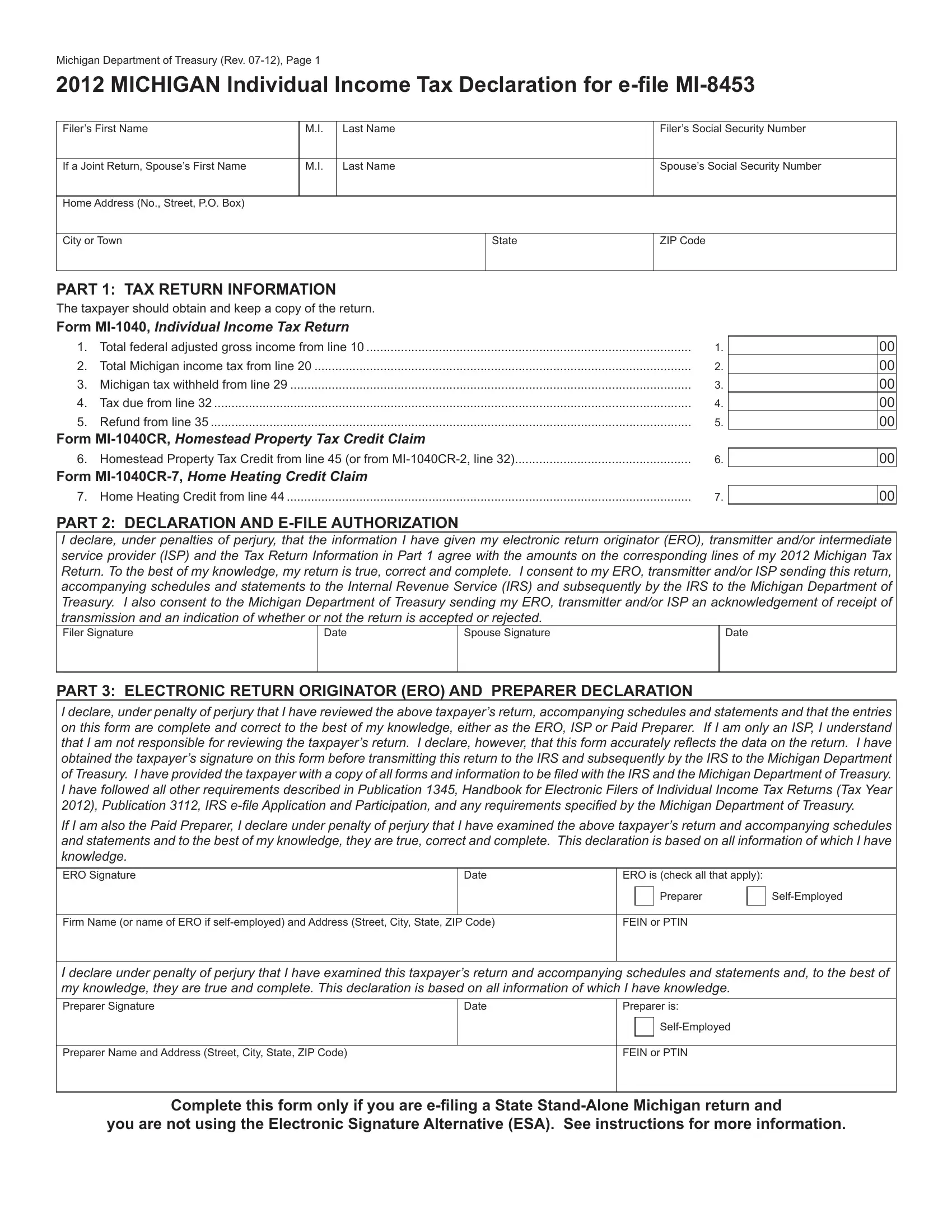

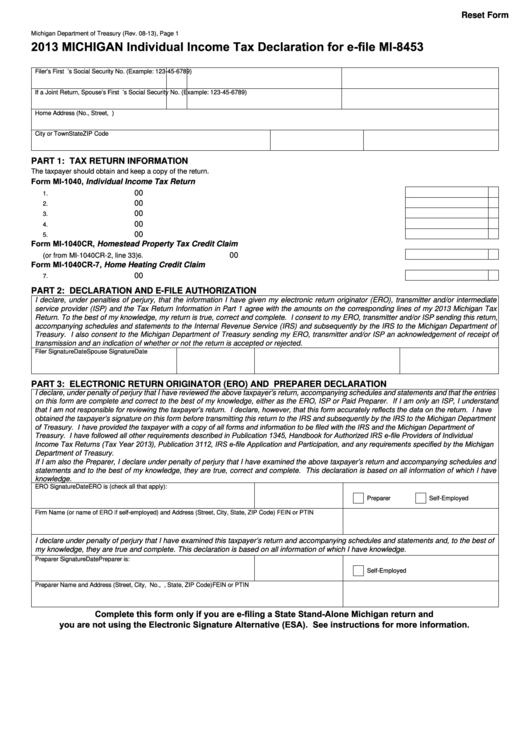

Print This Form More about the Michigan Form MI 8453 Individual Income Tax We last updated the Individual Income Tax Declaration for e file in April 2021 and the latest form we have available is for tax year 2020 This means that we don t yet have the updated form for the current tax year If Form MI 8453 is used the tax preparer should retain a copy of Form MI 8453 Do not mail this form to the Department Other preparer requirements of the Taxpayer Protection Act In addition to the requirement that a paid preparer sign a return and include an identification number which is either the preparer s Social Security number or

Printable Mi 8453 Fe Form

Printable Mi 8453 Fe Form

https://data.formsbank.com/pdf_docs_html/334/3341/334125/page_1_thumb_big.png

Mi 8453 Form Fill Out Printable PDF Forms Online

https://formspal.com/data/LandingPageImages/Image/1/135/135155.JPEG

2018 2022 Form Mi Mi 1040cr 7 Fill Online Printable Fillable Blank Free Hot Nude Porn Pic Gallery

https://www.pdffiller.com/preview/465/679/465679973/large.png

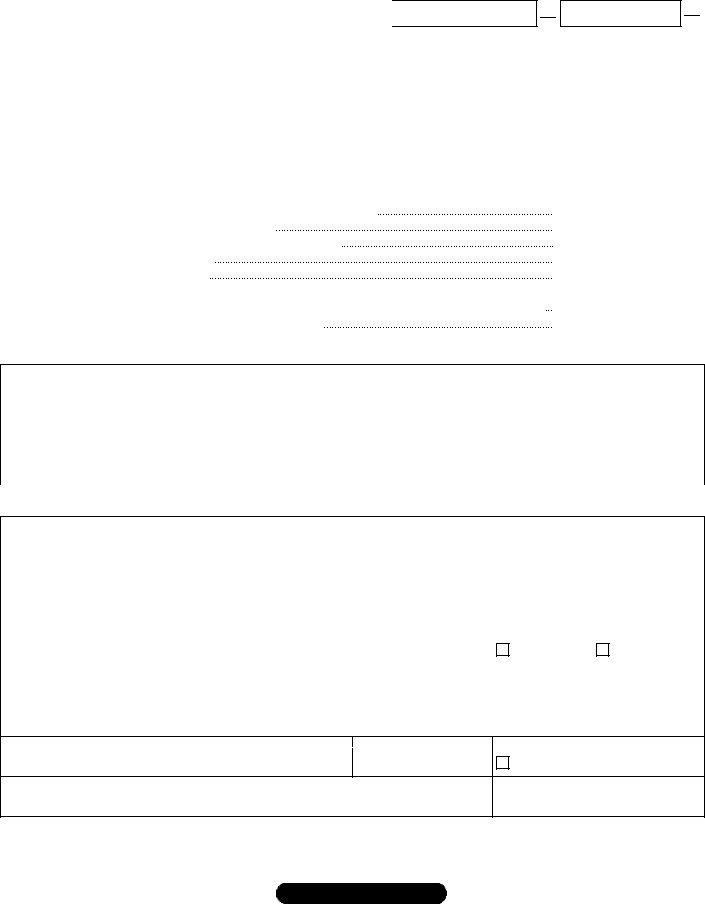

MI 8453 FE Michigan Fiduciary Income Tax e file Payment Voucher MI 1041 V 2 8 1041 MeF Program Tax preparers and transmitters accepted into the IRS efile program may participate in the 1041 Fed State e file Program and e file the State return through the MeF program Michigan accepts two kinds of submissions Fed State linked Form MI 8453 must be completed before the taxpayer electronic return originator ERO or preparer signs it ERO Tax Preparer Responsibilities Enter the name s address and Social Security number s of the taxpayer at the top of the form Complete Part 1 using the amounts from the taxpayer s 2013 MI 1040

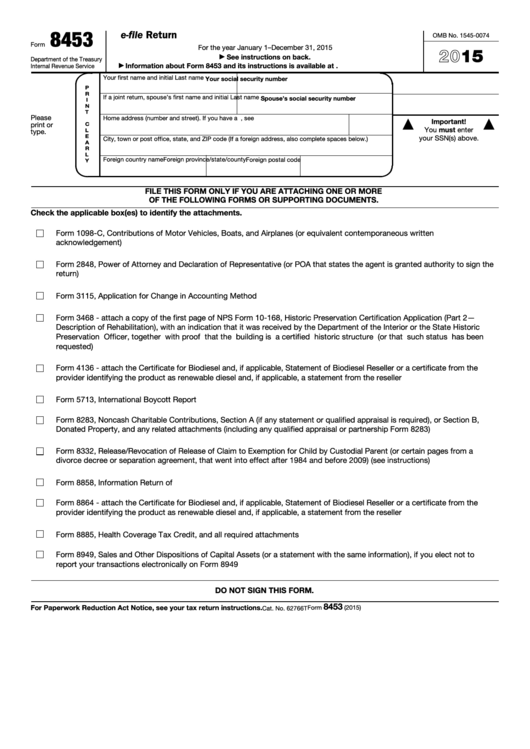

Form 5596 Michigan Estate or Trust Certification for e file MI 8453 FE must be provided to the filer for their records Form MI 8453 FE may also be used by tax preparers as a signature document to retain for their records Form 5596 MI 8453 FE should not be mailed to Treasury 2 14 IRS Form 8453 FE U S Estate or Trust Declaration for IRS e file Return is used to authorize The electronic Form 1041 U S Income Tax Return for Estates and Trusts The electronic filer to transmit the completed return via a third party transmitter and An electronic funds withdrawal of federal taxes owed by the trust or estate

More picture related to Printable Mi 8453 Fe Form

Pa 8453 C Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/626/585626409/large.png

Printable Form Mi 8453 Fe Printable Forms Free Online

https://www.pdffiller.com/preview/6/961/6961701/big.png

Instructions For Michigan Individual Income Tax Declaration For Electronic Filing Form Mi 8453

https://data.formsbank.com/pdf_docs_html/309/3098/309810/page_1_thumb_big.png

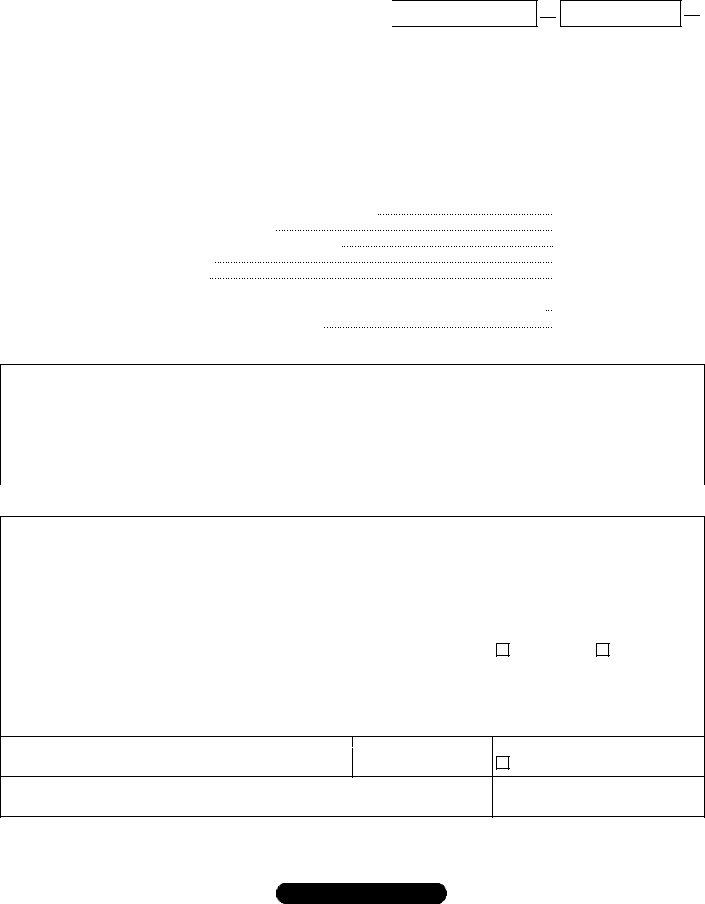

Once the IRS accepts your return you ll need to print Form 8453 sign it and mail it into the IRS with the appropriate forms and documents attached Forms and Supporting Documents Requiring a Federal Tax Signature Form You ll need to file this federal tax signature form if you re attaching the following forms and documents File Now with TurboTax We last updated Michigan Form MI 8453 in April 2021 from the Michigan Department of Treasury This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Michigan government

Go to General Electronic Filing Select Section 11 Additional Information In line 5 Form 8453 print option use the lookup feature double click or click F4 to select Mandatory printing In lines 6 through 17 Form 8453 Supporting Document enter information as appropriate Calculate the return Form MI 8453 If the EF1 screen is not completed above a MI stand alone filing that is ready to transmit will generate an MI 8453 which you should print sign and retain for 6 years The Michigan Treasury does not require Form MI 8453 Michigan Individual Income Tax Declaration for Electronic Filing to be mailed It is recommended that

Printable Form Mi 8453 Fe Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/2129/21297/2129791/irs-form-8453-fe-u-s-estate-or-trust-declaration-for-an-irs-e-file-return_print_big.png

Mi 8453 Form Fill Out Printable PDF Forms Online

https://formspal.com/pdf-forms/other/mi-8453-form/mi-8453-form-preview.webp

https://www.irs.gov/forms-pubs/about-form-8453-fe

Forms and Instructions About Form 8453 FE U S Estate or Trust Declaration for an IRS e file Return Use this form to Authenticate the electronic Form 1041 U S Income Tax Return for Estates and Trusts Authorize the electronic filer to transmit via a third party transmitter and

https://www.taxformfinder.org/michigan/form-mi-8453

Print This Form More about the Michigan Form MI 8453 Individual Income Tax We last updated the Individual Income Tax Declaration for e file in April 2021 and the latest form we have available is for tax year 2020 This means that we don t yet have the updated form for the current tax year

Form Mi 8453 Fill Out Printable PDF Forms Online

Printable Form Mi 8453 Fe Printable Forms Free Online

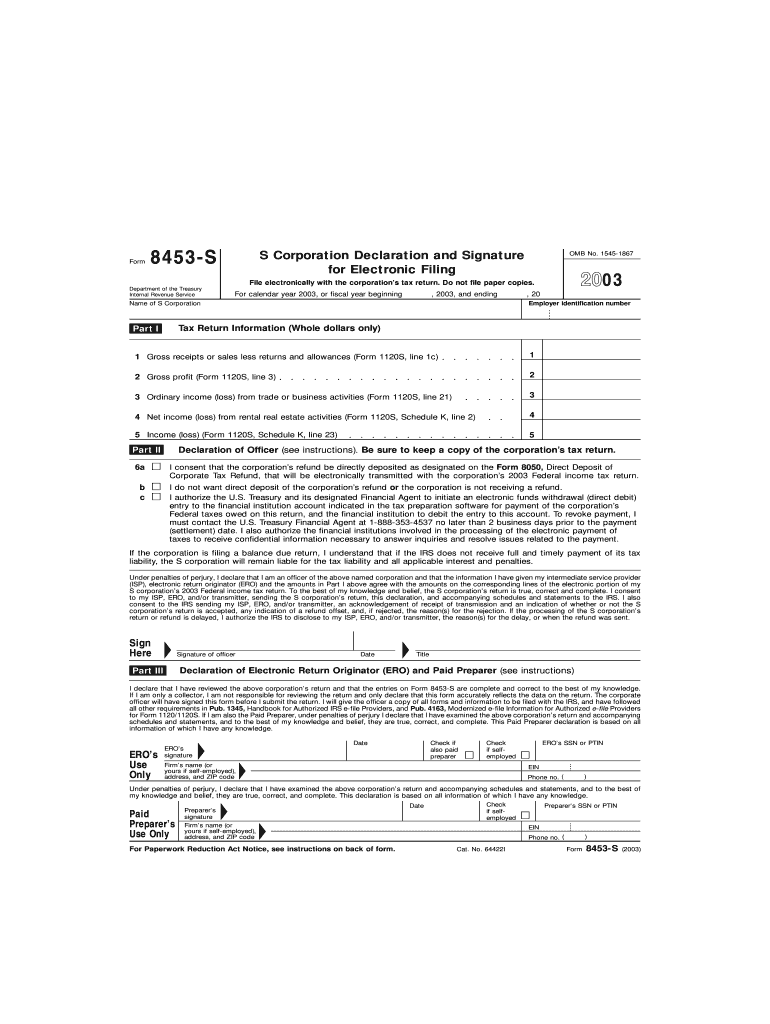

Form 8453 S Printable Fillable Sample In Pdf Images

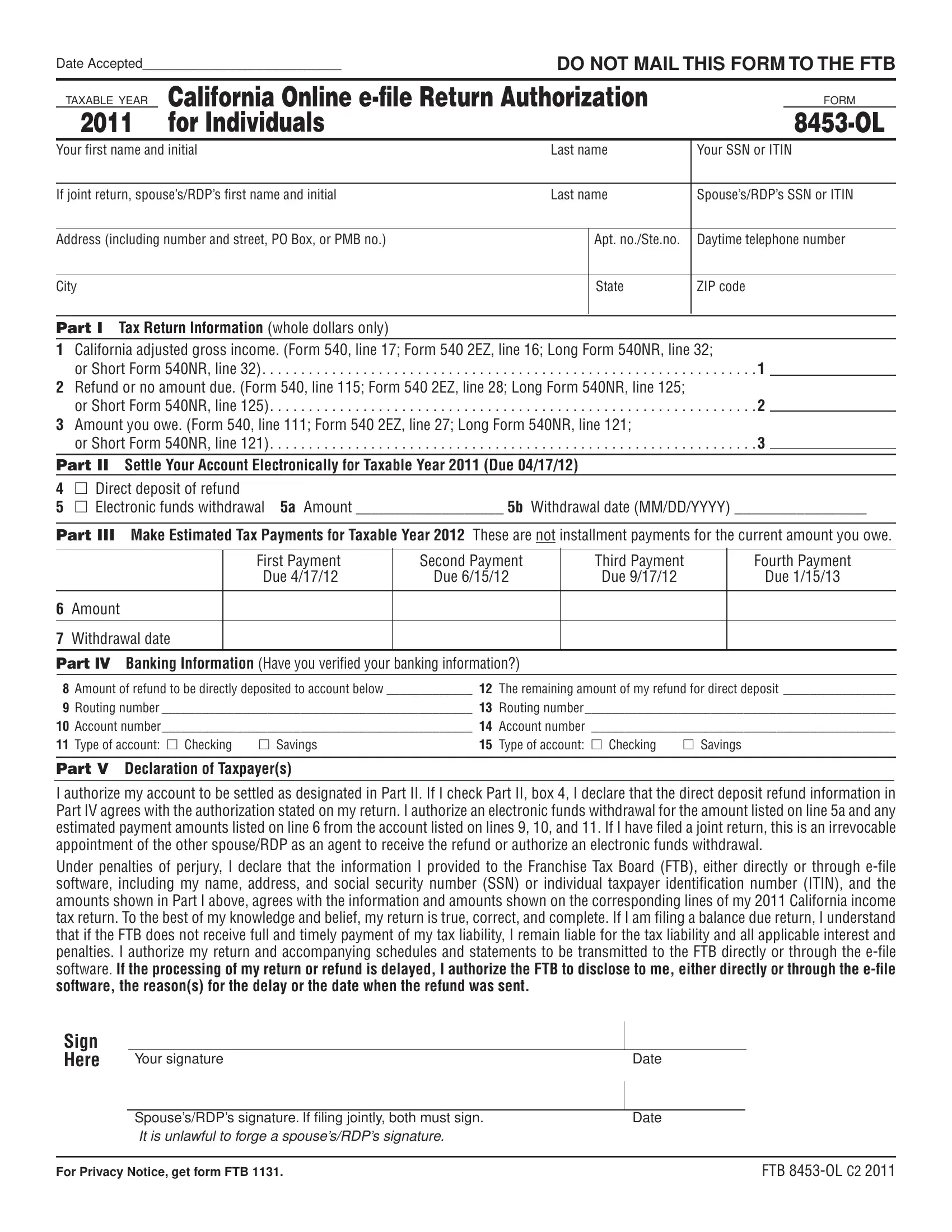

Form 8453 Ol Fill Out Printable PDF Forms Online

Printable Form Mi 8453 Fe Printable Forms Free Online

IRS Form 8453 FE Estate Trust Declaration For IRS E file Return

IRS Form 8453 FE Estate Trust Declaration For IRS E file Return

Fillable Form Mi 8453 Michigan Individual Income Tax Declaration For E File 2013 Printable

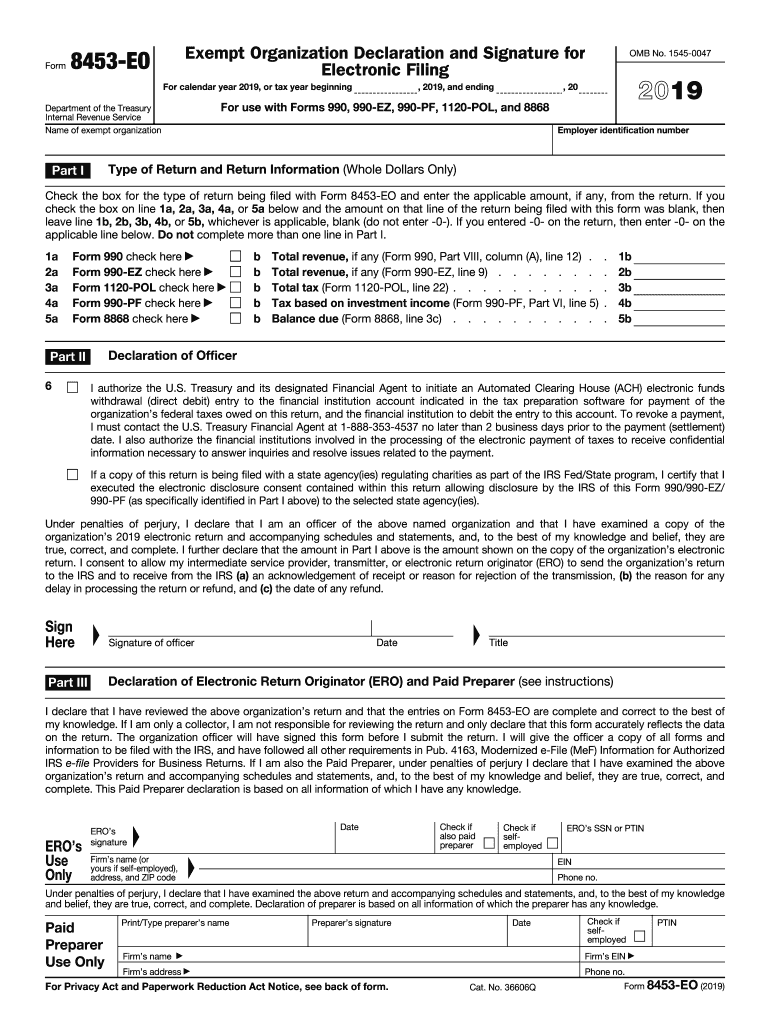

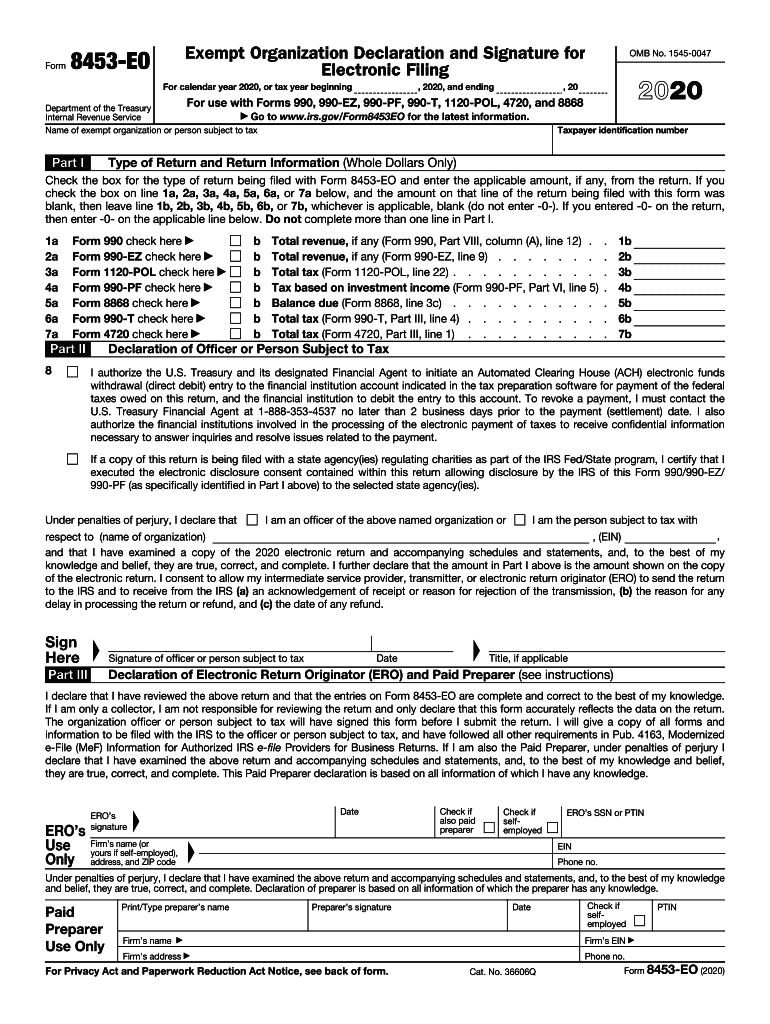

2019 Irs Form 8453 Fill Out And Sign Printable PDF Template SignNow

8453 Fill Out Sign Online DocHub

Printable Mi 8453 Fe Form - Form 5596 Michigan Estate or Trust Certification for e file MI 8453 FE must be provided to the filer for their records Form MI 8453 FE may also be used by tax preparers as a signature document to retain for their records Form 5596 MI 8453 FE should not be mailed to Treasury 2 14