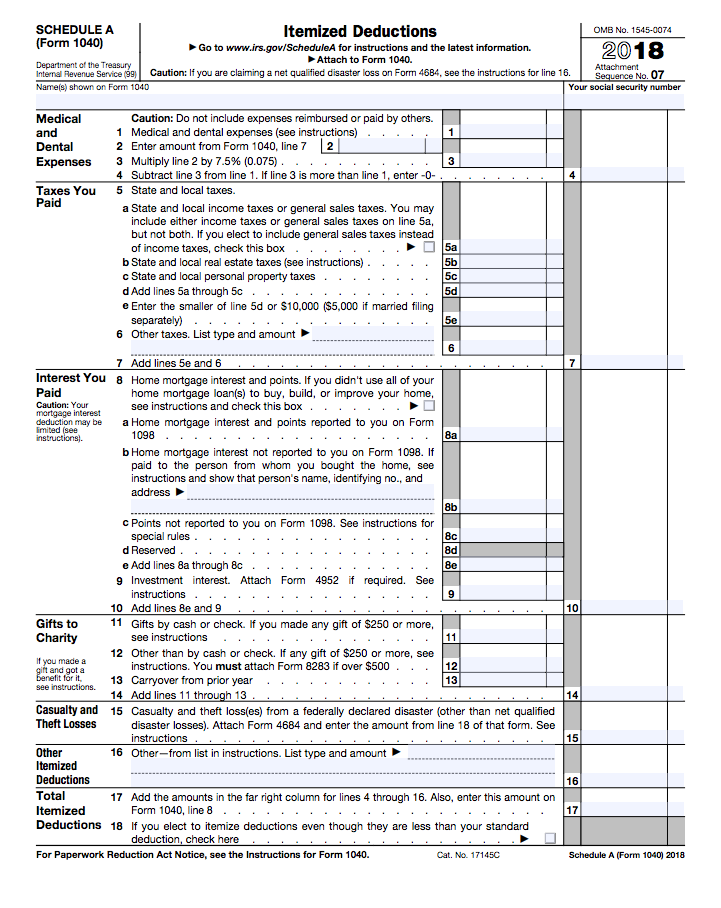

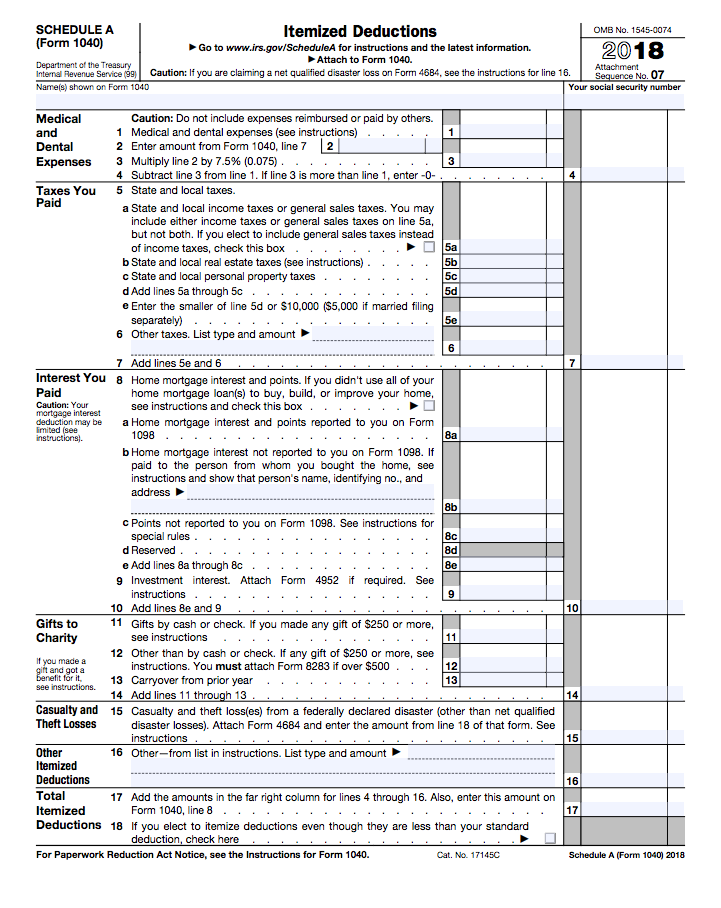

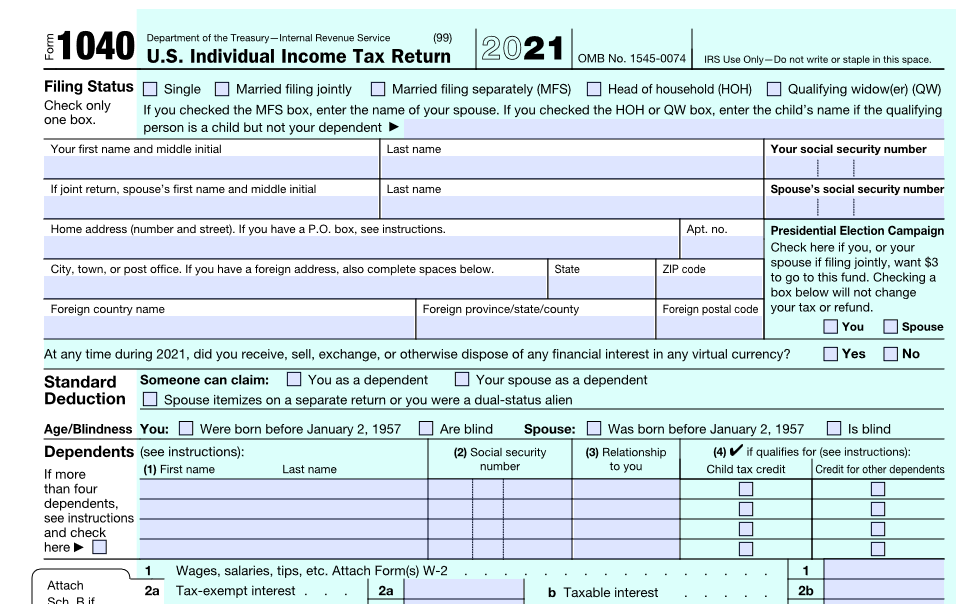

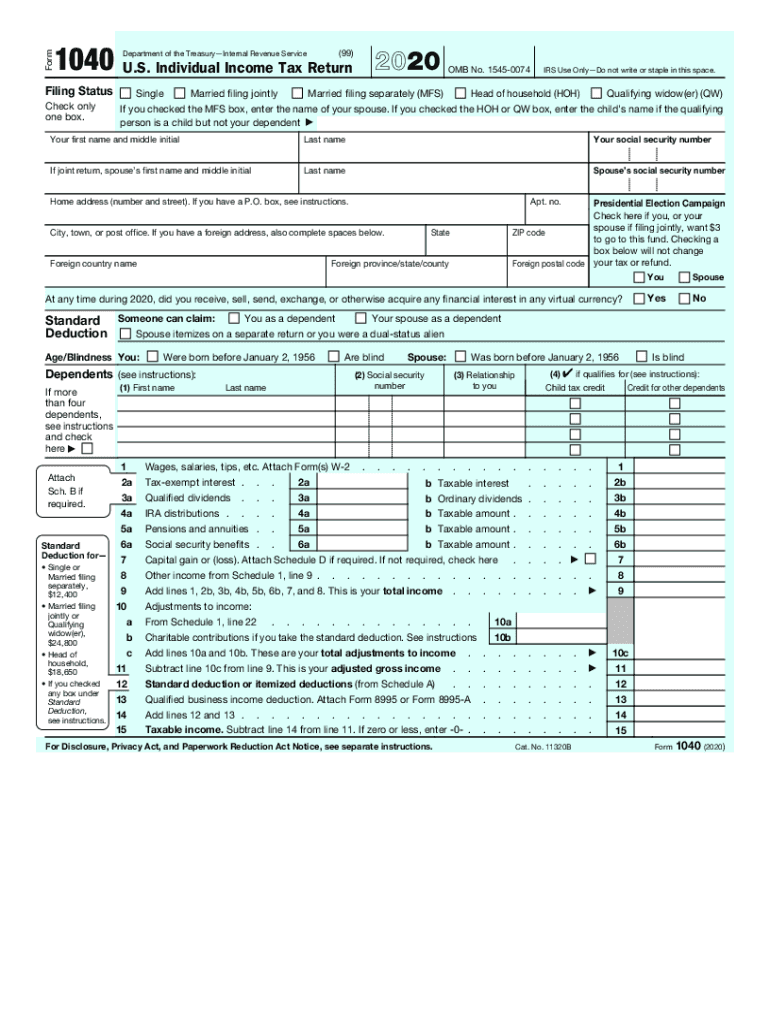

Printable Shedule 1040 A Gambling Losses Form You may deduct gambling losses only if you itemize your deductions on Schedule A Form 1040 and kept a record of your winnings and losses The amount of losses you deduct can t be more than the amount of gambling income you reported on your return Claim your gambling losses up to the amount of winnings as Other Itemized Deductions

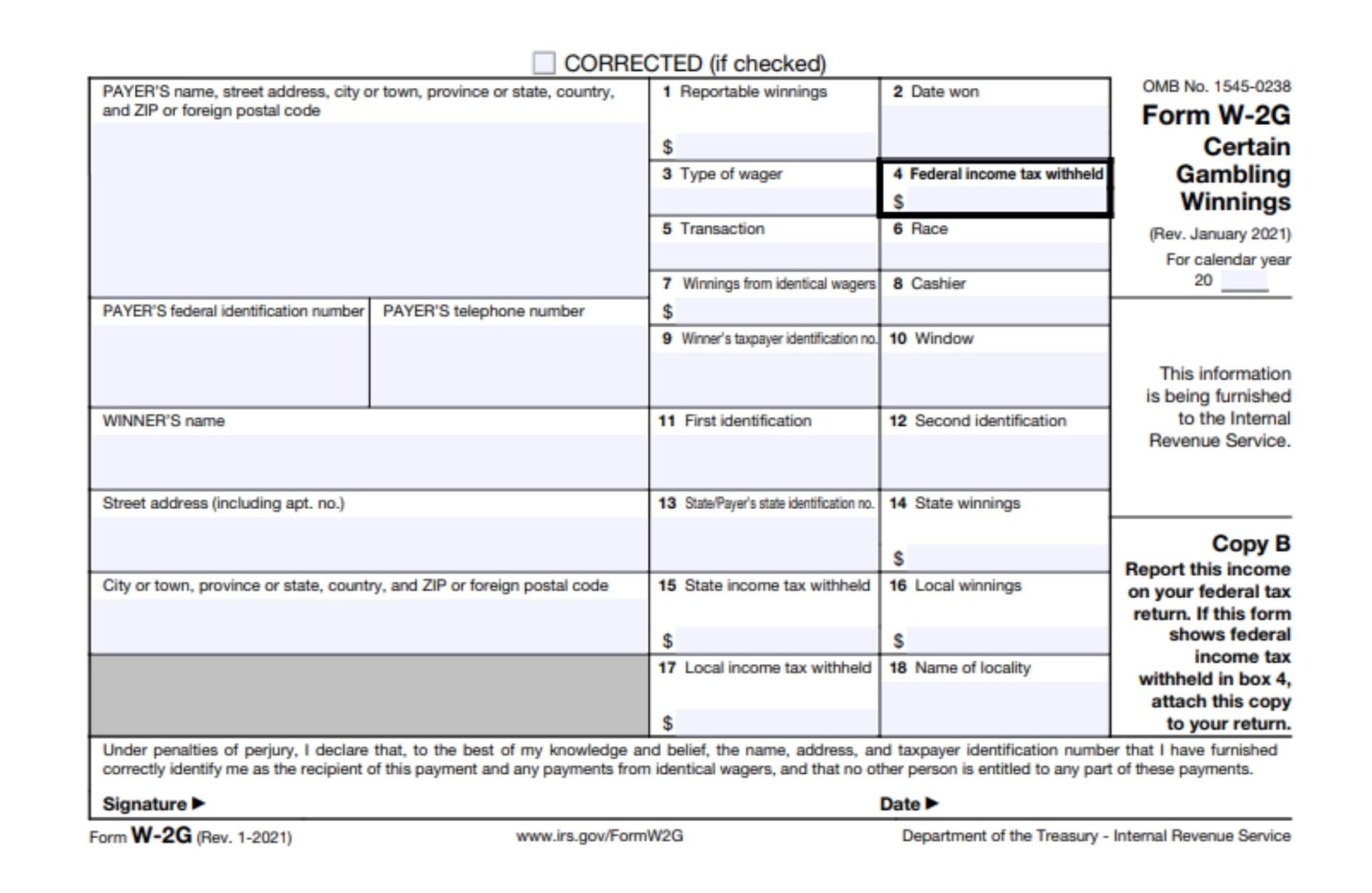

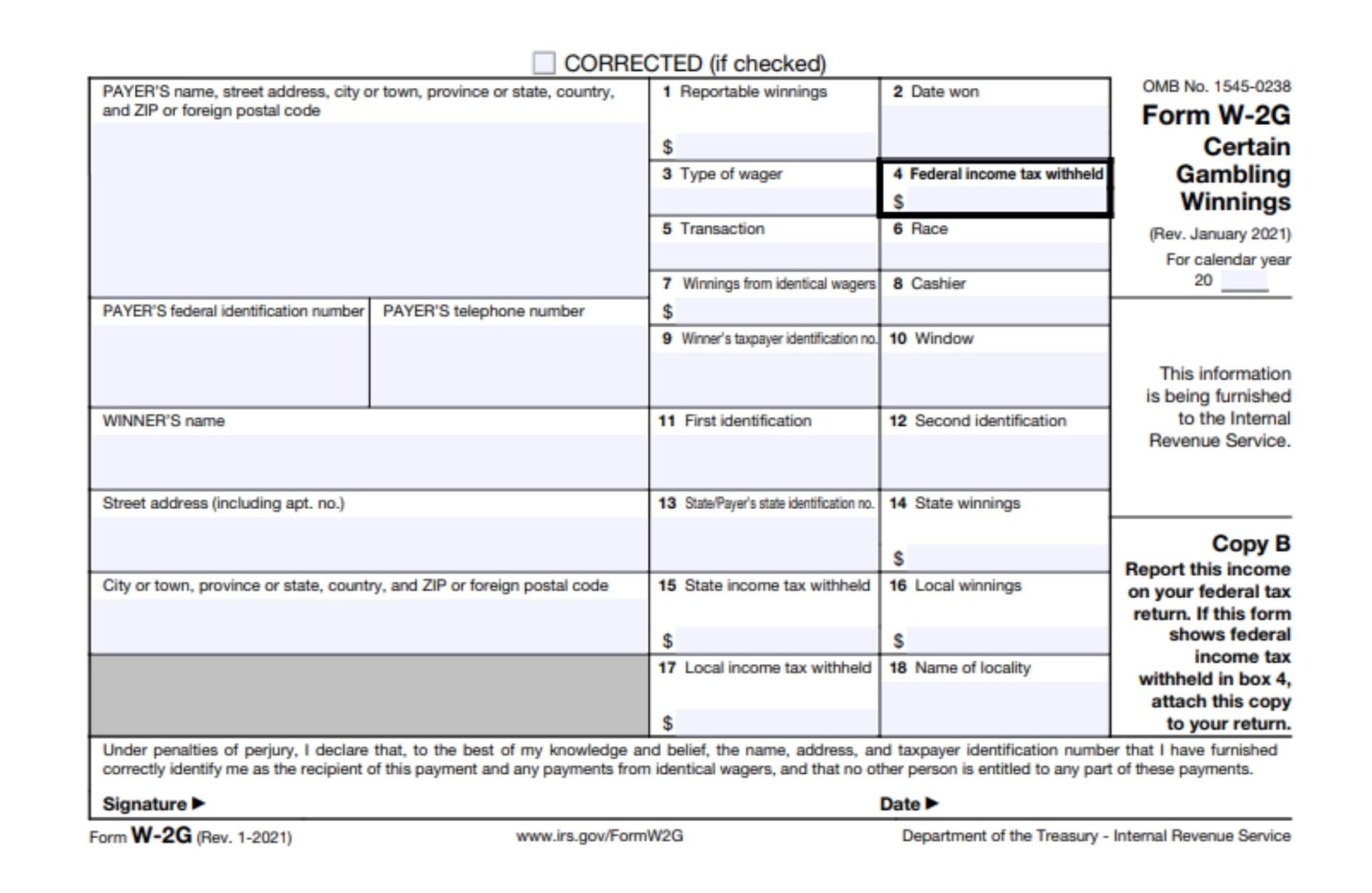

You must provide a statement to the winner Copies B and C of Form W 2G The types of gambling are discussed in these instructions under the following four headings 1 Horse Racing Dog Racing Jai Alai and Other Wagering Transactions Not Discussed Later 2 Sweepstakes Wagering Pools and Lotteries 3 Key Takeaways You can deduct your gambling losses but only to offset the income from your gambling winnings You can t deduct your losses without reporting any winnings The amount of gambling losses you can deduct can never exceed the winnings you report as income To report your gambling losses you must itemize your income tax

Printable Shedule 1040 A Gambling Losses Form

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-f619eccef6a84e3ab500003fcc088ce8.png)

Printable Shedule 1040 A Gambling Losses Form

https://www.thebalancemoney.com/thmb/1cEUH5Oa1-t5yljXMTyP9lWfJfM=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-f619eccef6a84e3ab500003fcc088ce8.png

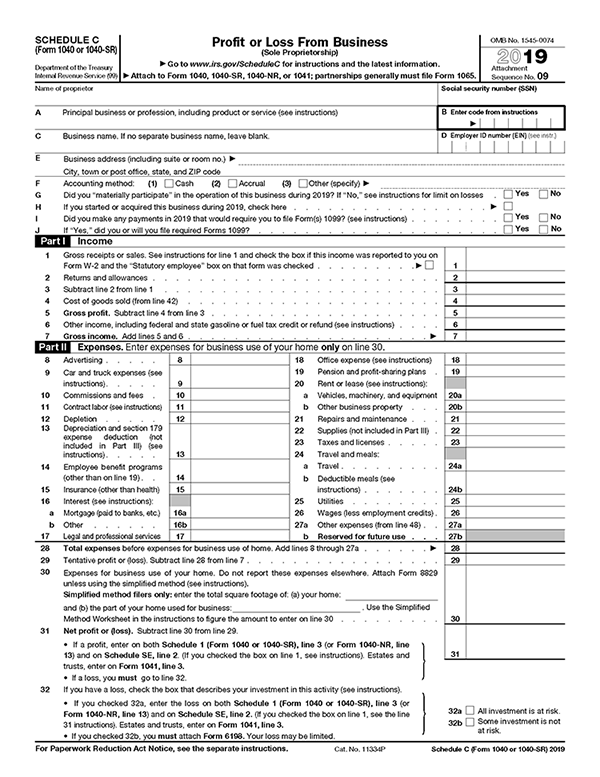

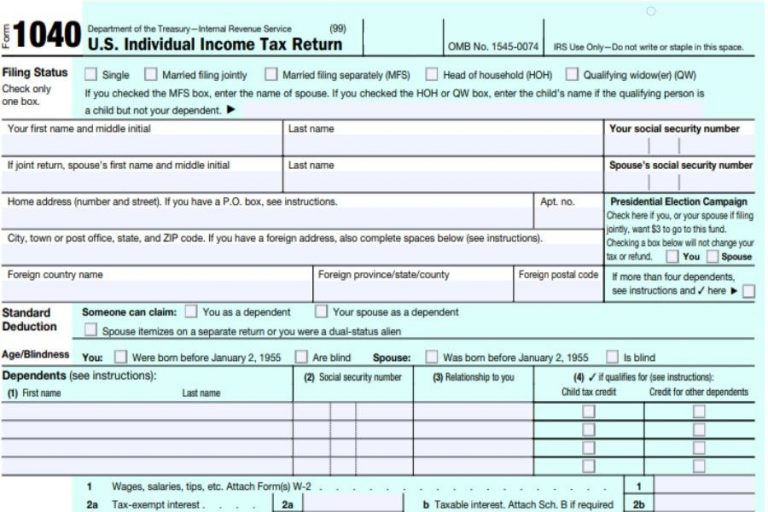

Irs 1040 Form 2019 How To Fill Out Your 1040 Form 2019 2020 SmartAsset

https://1044form.com/wp-content/uploads/2020/08/2019-irs-tax-form-1040-schedule-c-2019-profit-or-losses-1.png

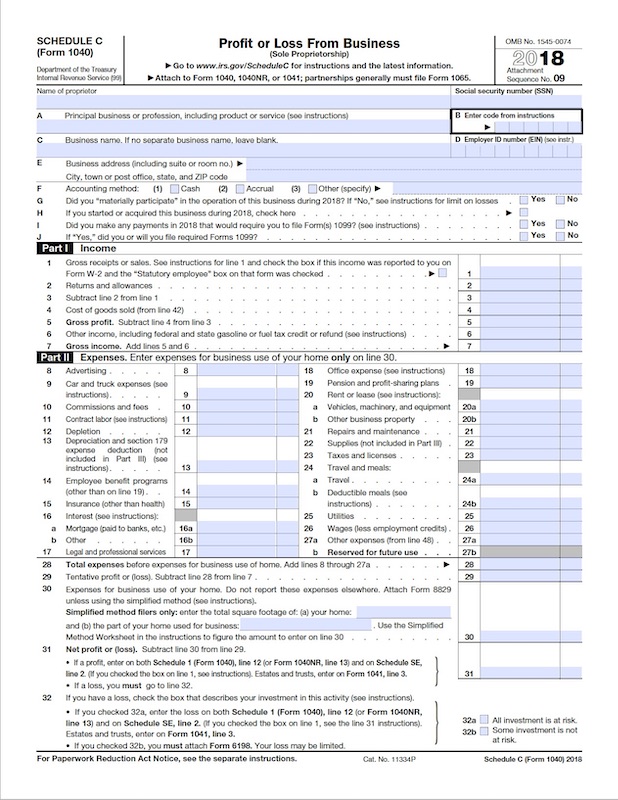

The 2018 Form 1040 How It Looks What It Means For You The Pastor s Wallet

https://i2.wp.com/pastorswallet.com/wp-content/uploads/2019/01/1040-front.png?ssl=1

Start filing The IRS allows you to claim your gambling losses as a deduction as long as you don t claim more than you won The deduction can only be claimed if you choose to file Schedule A Itemized Deductions You should also have receipts tickets statements and documentation such as a diary or similar record of your losses and winnings There is one golden rule to keep in mind when deducting gambling losses on your tax return You can t unfortunately deduct losses that total more than your winnings So if you made 10 000 on gambling last year but lost 12 000 you can only deduct 10 000 in losses nothing more

At a glance Report all gambling winnings as taxable income on your tax return If you itemize deductions you can offset your winnings by deducting gambling losses Casinos send a W 2G form to the IRS for winnings above specific thresholds 600 or more for most games Specifically your income tax return should reflect your total year s About Form W 2 G Certain Gambling Winnings File this form to report gambling winnings and any federal income tax withheld on those winnings The requirements for reporting and withholding depend on the type of gambling the amount of the gambling winnings and generally the ratio of the winnings to the wager

More picture related to Printable Shedule 1040 A Gambling Losses Form

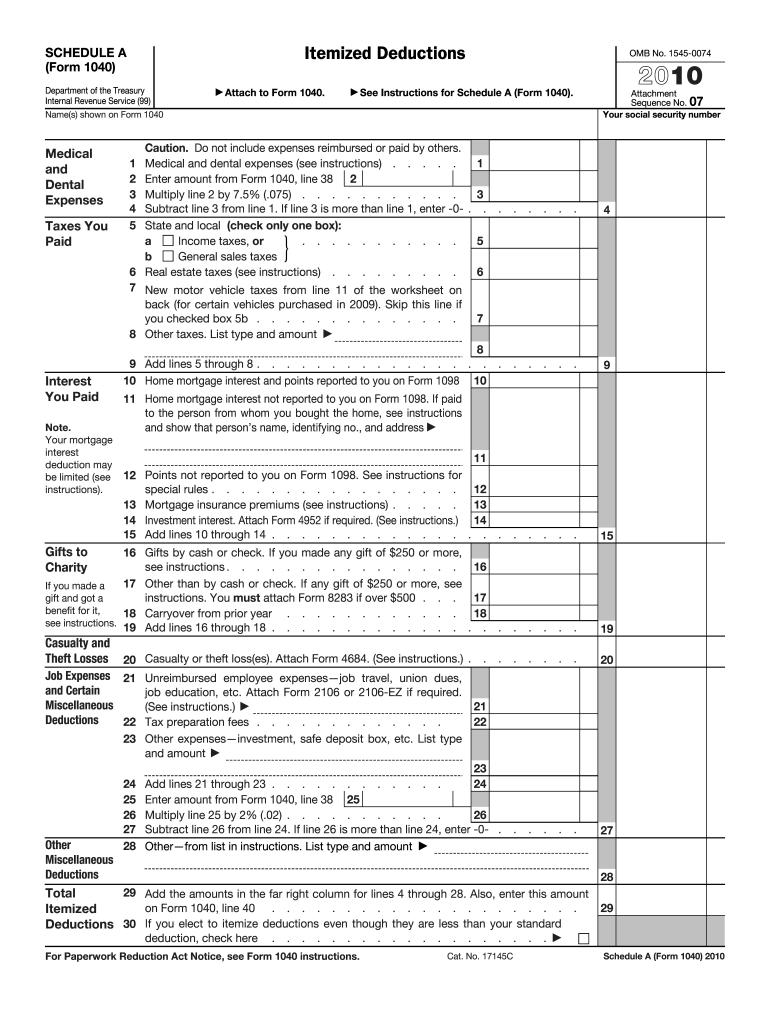

Form 2010 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/24/100024174/large.png

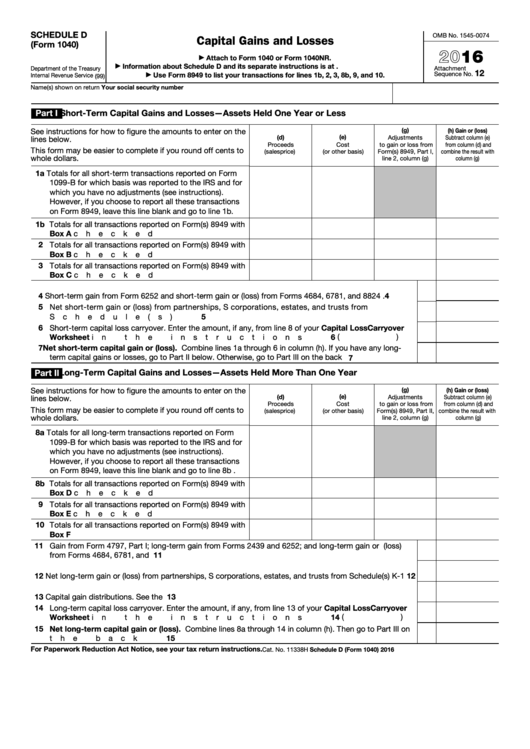

Fillable Schedule D Form 1040 Capital Gains And Losses 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/fillable-schedule-d-form-1040-capital-gains-and-losses-3.png

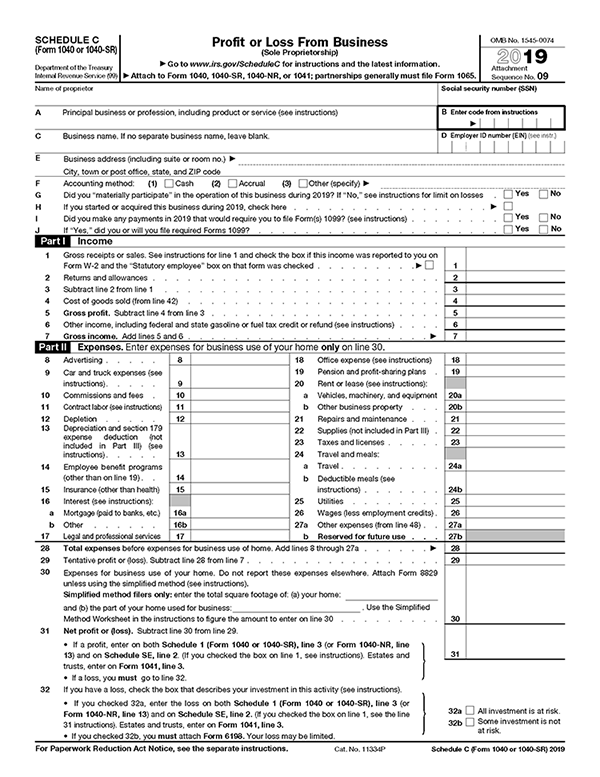

Gambling Taxes Complete 2023 Guide To Online Betting

https://www.onlineunitedstatescasinos.com/app/uploads/2019/03/IRS-Form-1040-Schedule-C.jpg

To enter gambling winnings Form IRS W 2G Gambling Winnings In Boxes 30 through 131 Gambling Winnings enter all applicable information Form 5754 Statement by Person s Receiving Gambling Winnings Wagering tickets cancelled checks substi tute checks credit records bank withdraw als and statements of actual winnings or payment slips provided by the gambling establishment Court Case The taxpayers had gambling win nings of 45 634 and claimed an itemized deduc tion for

Amount of your gambling winnings and losses Any information provided to you on a Form W 2G The tool is designed for taxpayers who were U S citizens or resident aliens for the entire tax year for which they re inquiring If married the spouse must also have been a U S citizen or resident alien for the entire tax year Use PA 40 Schedule T to report gambling and lottery win nings as well as the costs for any gambling and lottery wa gering of the taxpayer and or spouse Gambling and lottery winnings from any source except non cash prizes from playing the Pennsylvania Lottery must be reported Pennsylvania residents must include all gambling and lottery

What Form Do I Use To Claim Gambling Losses

https://images.ctfassets.net/ifu905unnj2g/1TZflfgxvLyVDN0wF52pwZ/b11378a3897f6885db64eab44bafc01f/Schedule_A_-_Form_1040.png

Irs Form 1040 Printable

https://www.printableform.net/wp-content/uploads/2021/07/1040-form-2021-federal-income-tax-return-768x512.jpg

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-f619eccef6a84e3ab500003fcc088ce8.png?w=186)

https://www.irs.gov/taxtopics/tc419

You may deduct gambling losses only if you itemize your deductions on Schedule A Form 1040 and kept a record of your winnings and losses The amount of losses you deduct can t be more than the amount of gambling income you reported on your return Claim your gambling losses up to the amount of winnings as Other Itemized Deductions

https://www.irs.gov/instructions/iw2g

You must provide a statement to the winner Copies B and C of Form W 2G The types of gambling are discussed in these instructions under the following four headings 1 Horse Racing Dog Racing Jai Alai and Other Wagering Transactions Not Discussed Later 2 Sweepstakes Wagering Pools and Lotteries 3

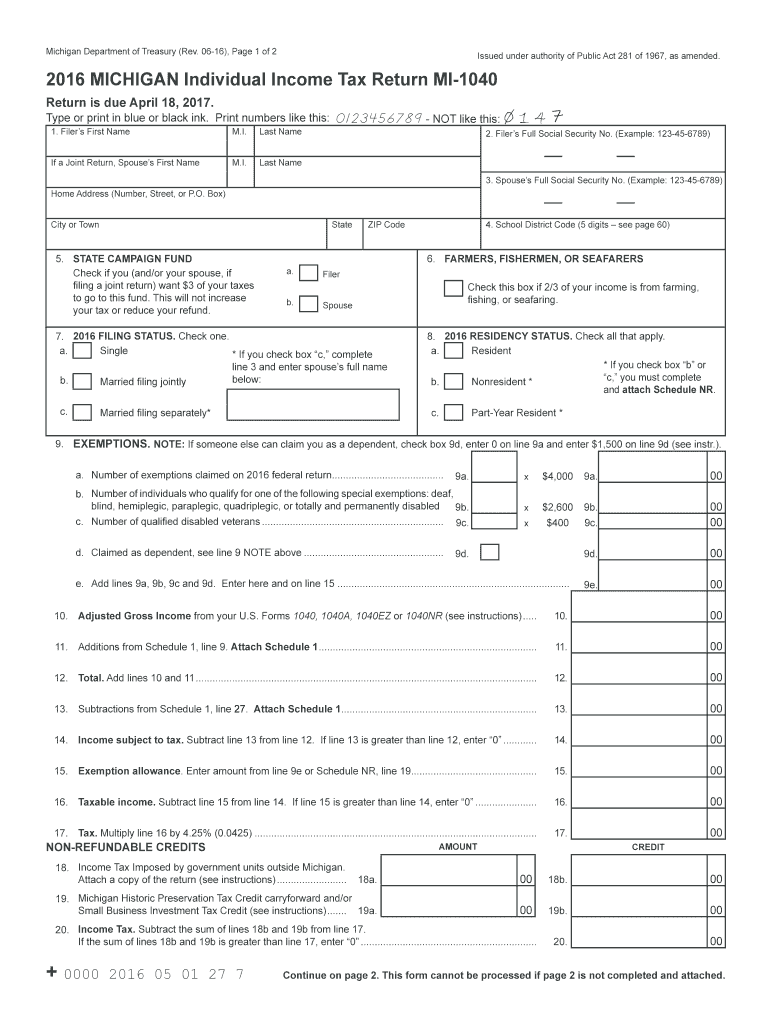

Mi 1040 2016 Form Fill Out Sign Online DocHub

What Form Do I Use To Claim Gambling Losses

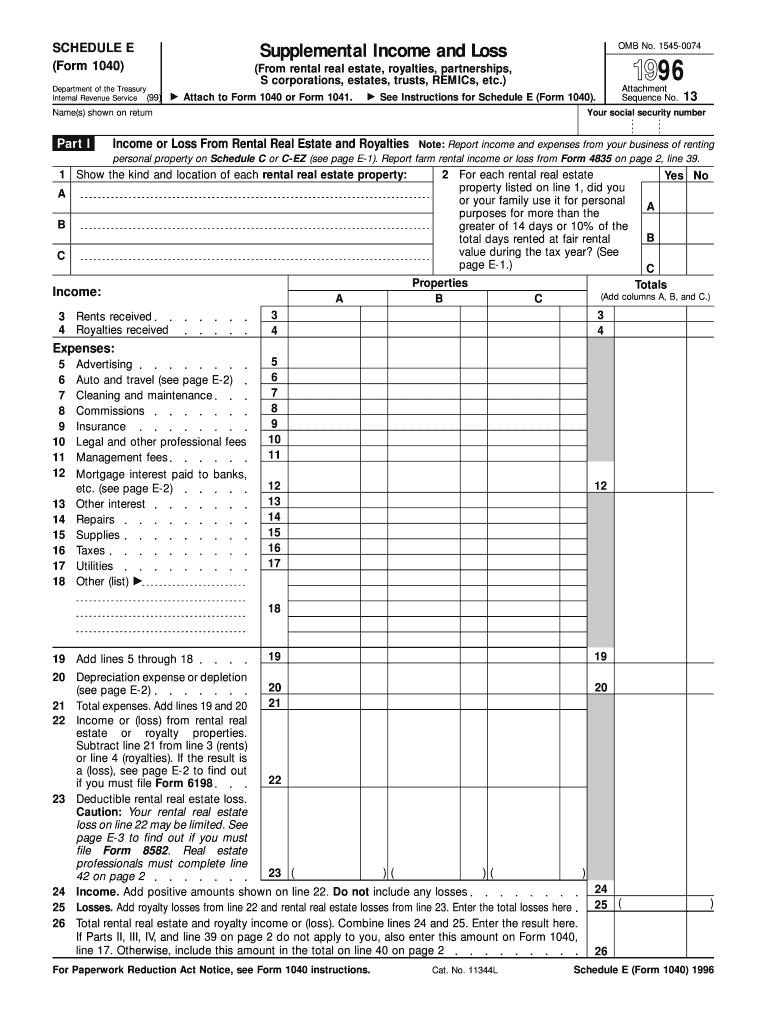

1996 Form IRS 1040 Schedule E Fill Online Printable Fillable Blank PdfFiller

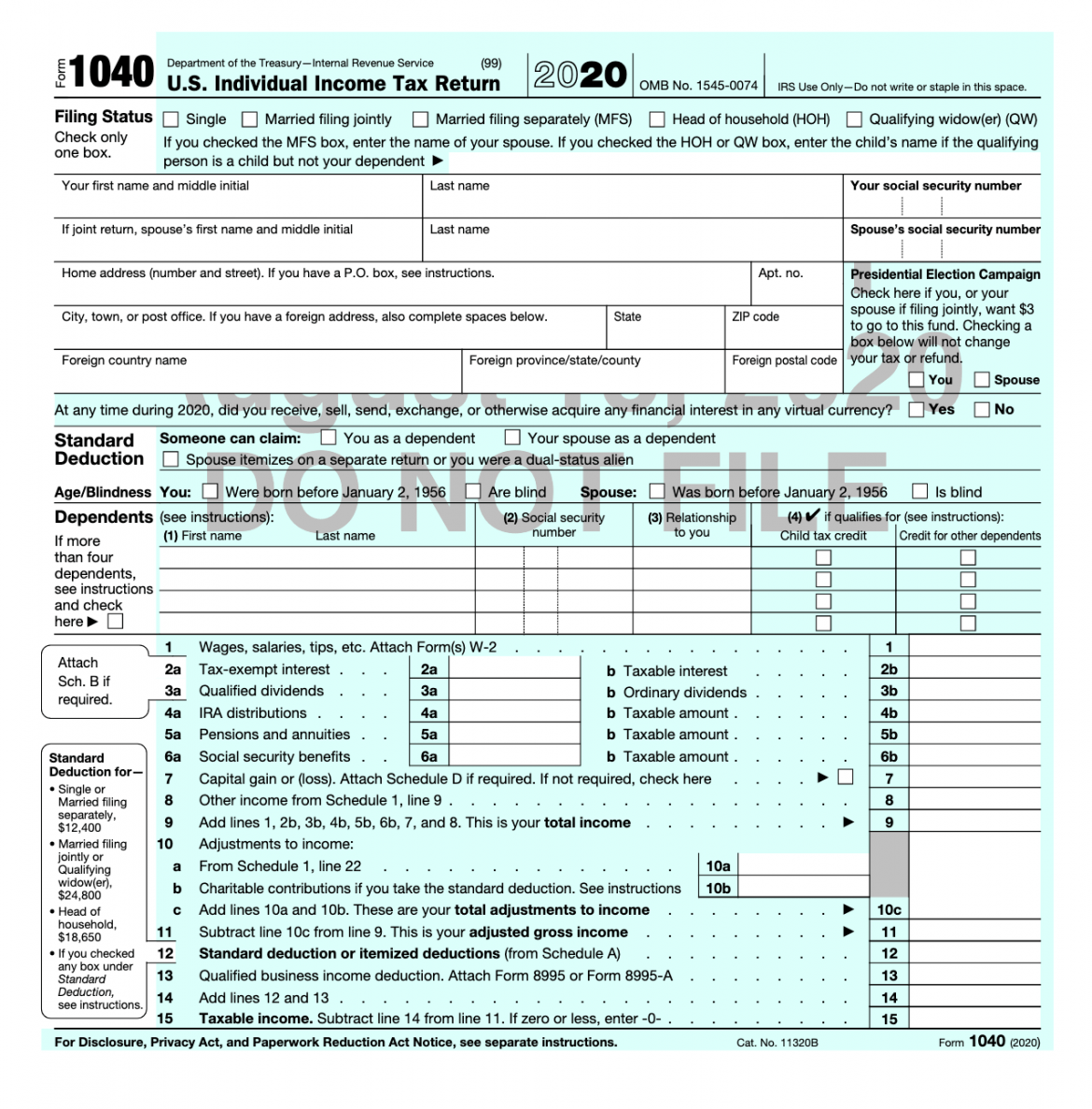

What s New On Form 1040 For 2020 Taxgirl

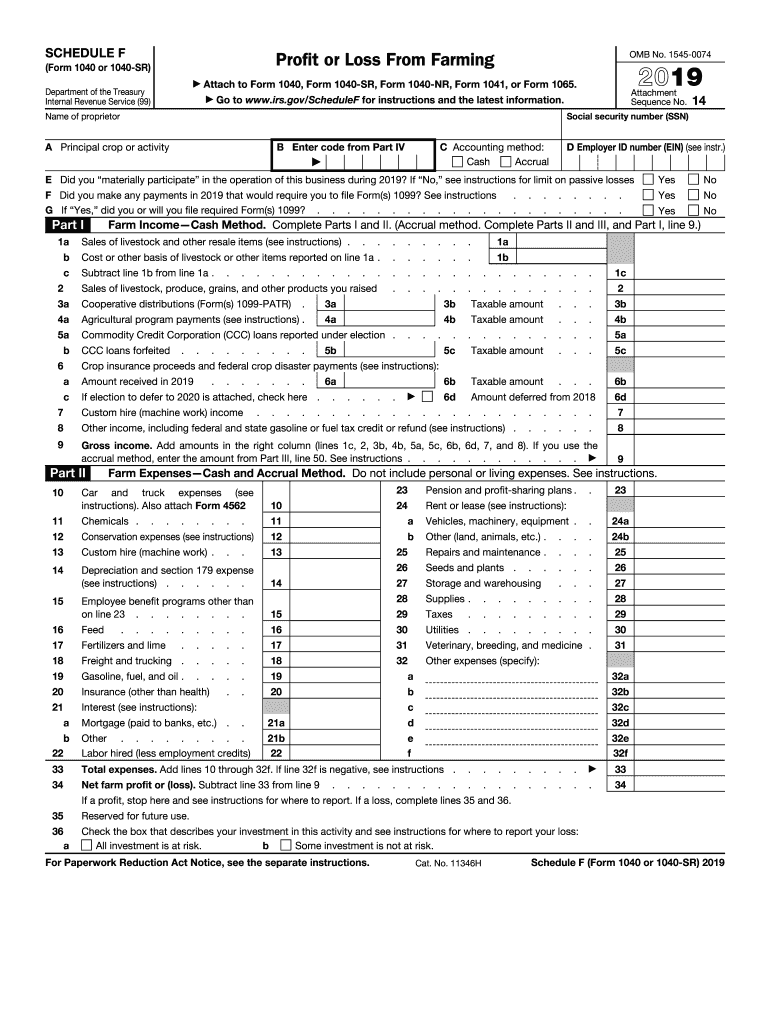

Irs 1040 Form Example 1040 Ez Nr Form Example 1040 Form Printable Schedule Eic form 1040

What Do I Do With IRS Form W 2G

What Do I Do With IRS Form W 2G

Printable IRS Form 1040 For Tax Year 2021 CPA Practice Advisor

2020 Form IRS 1040 Fill Online Printable Fillable Blank PdfFiller

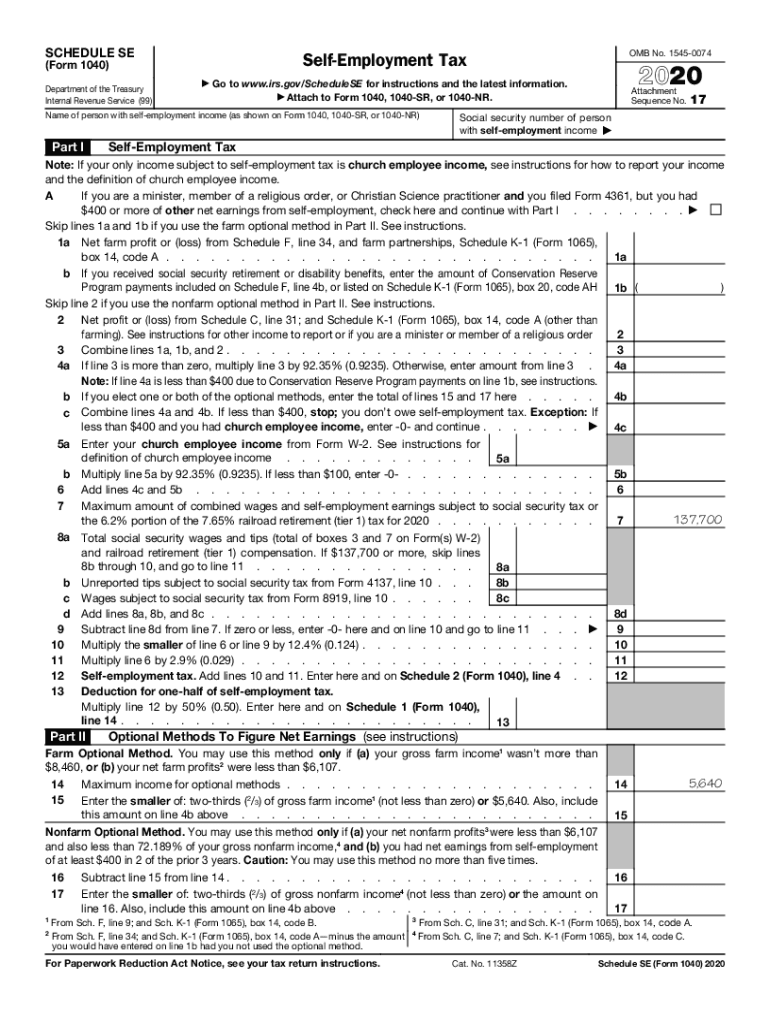

2020 Form IRS 1040 Schedule SE Fill Online Printable Fillable Blank PdfFiller

Printable Shedule 1040 A Gambling Losses Form - Instructions to Winner Box 1 The payer must furnish a Form W 2G to you if you receive 1 200 or more in gambling winnings from bingo or slot machines 1 500 or more in winnings reduced by the wager from keno More than 5 000 in winnings reduced by the wager or buy in from a poker tournament 600 or more in gambling winnings except