Printable Sub Contractor Tax Form The SSA shares the information with the Internal Revenue Service Payers use Form 1099 MISC Miscellaneous Information and or Form 1099 NEC Nonemployee Compensation to Report any amount of federal income tax withheld under the backup withholding rules Form 1099 MISC or Form 1099 NEC Report payments of 10 or more made in the course of a

Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN However the payer has reported your complete TIN 1099 Subcontractor Agreement Updated September 01 2023 A 1099 subcontractor agreement is utilized when a subcontractor has been hired to complete a service for more than 600 The contractor must then provide the 1099 MISC form to the subcontractor by January 31 st of the following year in which the payment was provided

Printable Sub Contractor Tax Form

Printable Sub Contractor Tax Form

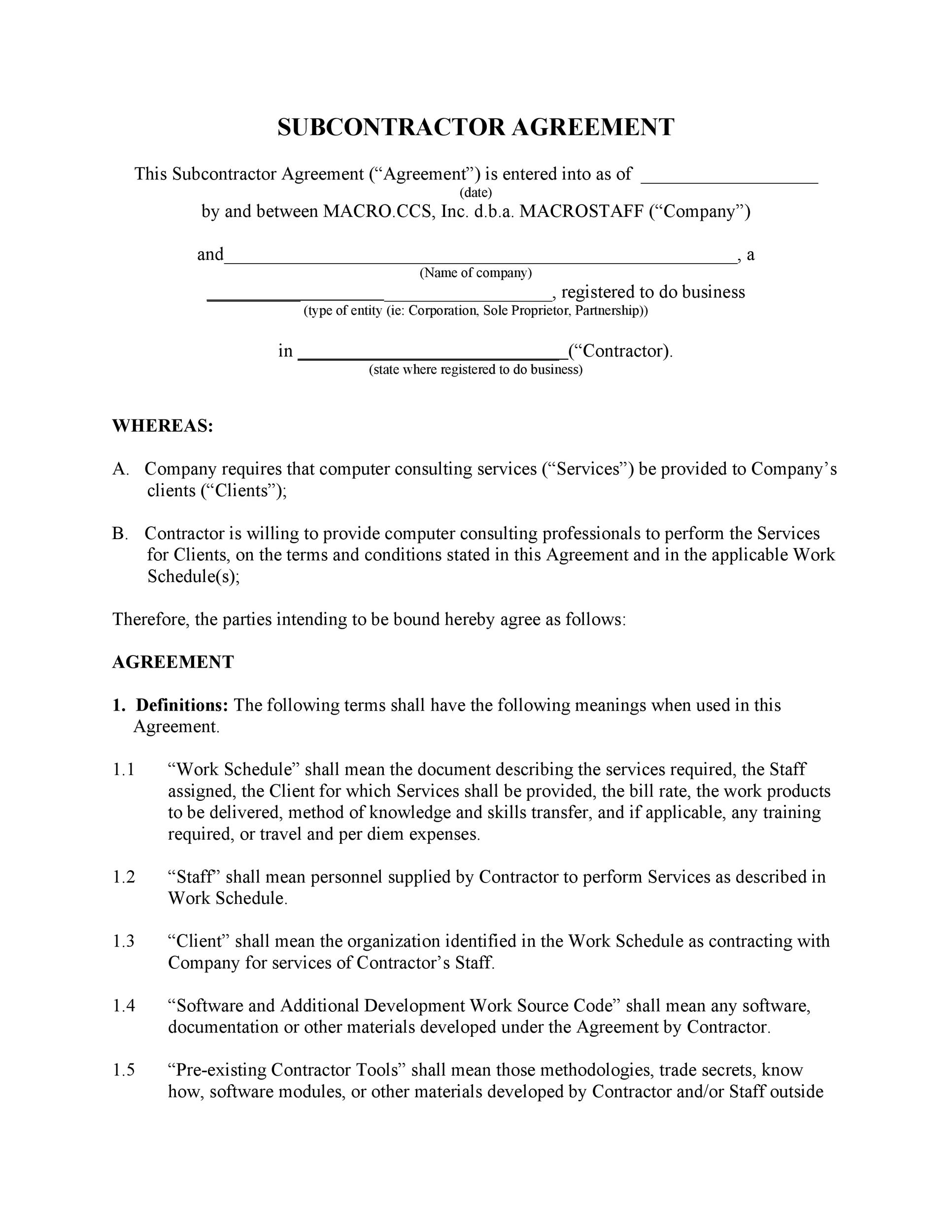

https://templatelab.com/wp-content/uploads/2017/04/Subcontractor-Agreement-03.jpg

A Quick Guide To Contractor Tax Forms

https://lh6.googleusercontent.com/k7gS4KBVAF2N6UIMreAVUTQduu1jMWUIOSvcn3uImarQbrcQn43EuyyrBBVVJ7H0ZNNQOKpQliDlGQev4YG9jH5PA_sWdK1u24EXchulhCiSLkhGzbk0iZczWp5cXe9kwcZv19mx

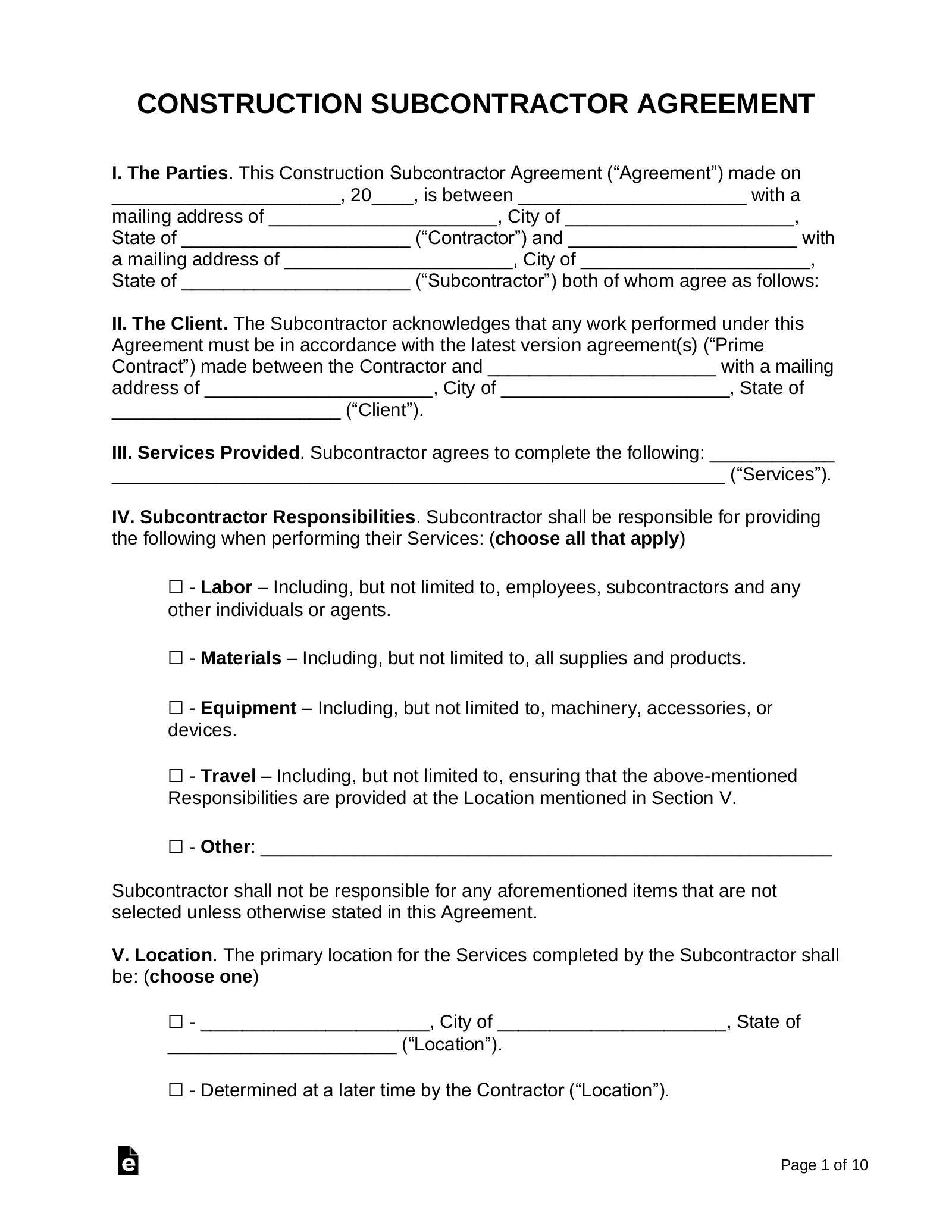

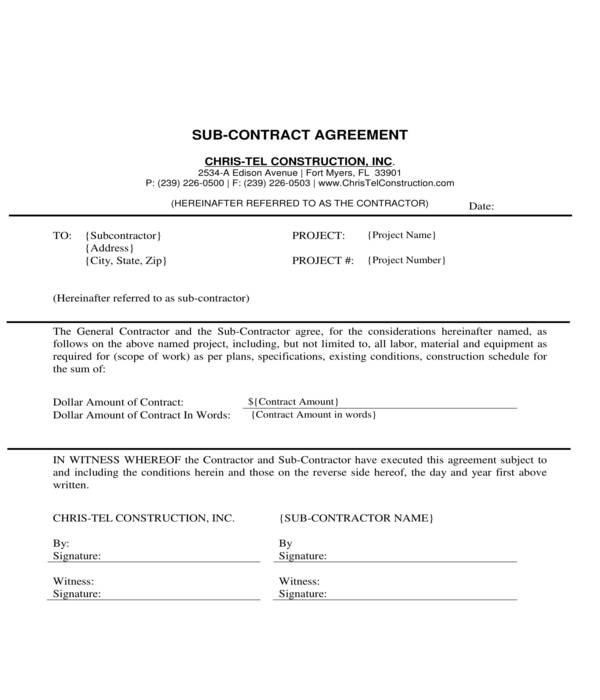

Construction Free Printable Subcontractor Agreement Free Printable Templates

https://eforms.com/images/2018/10/Construction-Subcontractor-Agreement.png

For tax year 2023 independent contractors contribute 12 4 to Social Security on the first 168 600 of their income and 2 9 to Medicare on all of their income In addition they are liable for an additional 0 9 in Medicare taxes if their wages compensation or self employment income exceeds specific thresholds When you re looking for unique skills or trying to fill gaps in job responsibilities without hiring a full time employee independent contractors may meet your needs Employers that outsource some of their functions must know how to file tax forms for independent contractors If your business uses the services of this type of worker you should be familiar with independent contractor tax forms

Filing Taxes Form 1099 NEC IRS Form 1099 MISC is required to be completed by the contractor if there were payments made to the subcontractor in excess of 600 during the fiscal year The contractor must provide this form to the subcontractor and the IRS by Jan 31 of the following year The subcontractor is responsible for withholding and or Legal Help Getting Legal Help Understanding your liability when using subcontractors for construction projects Hiring subcontractors may be standard practice in the construction industry but before you hire out you should study up on subcontractor taxes insurance and contract provisions so you can get the job done without any unnecessary financial risk

More picture related to Printable Sub Contractor Tax Form

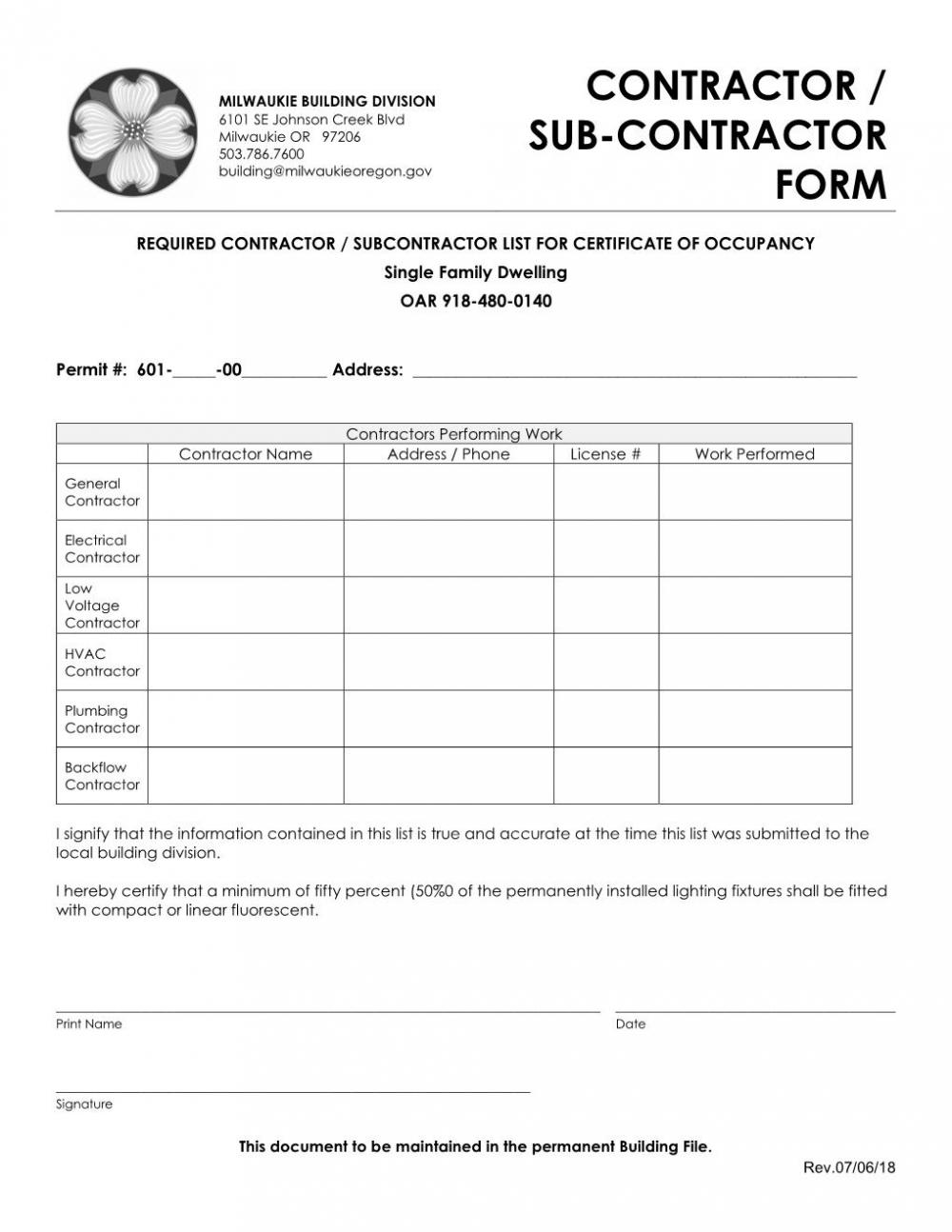

Sub Contractor Form City Of Milwaukie Oregon Official Website

https://www.milwaukieoregon.gov/sites/default/files/styles/gallery500/public/imageattachments/building/page/79101/sub-contractor_form_image.jpg?itok=1UR-6E4o

Free Printable Irs Tax Forms Printable Templates

https://allfreeprintable4u.com/wp-content/uploads/2019/03/free-fillable-1040-tax-form-free-file-fillable-formspng-forms-form-free-printable-irs-1040-forms.jpg

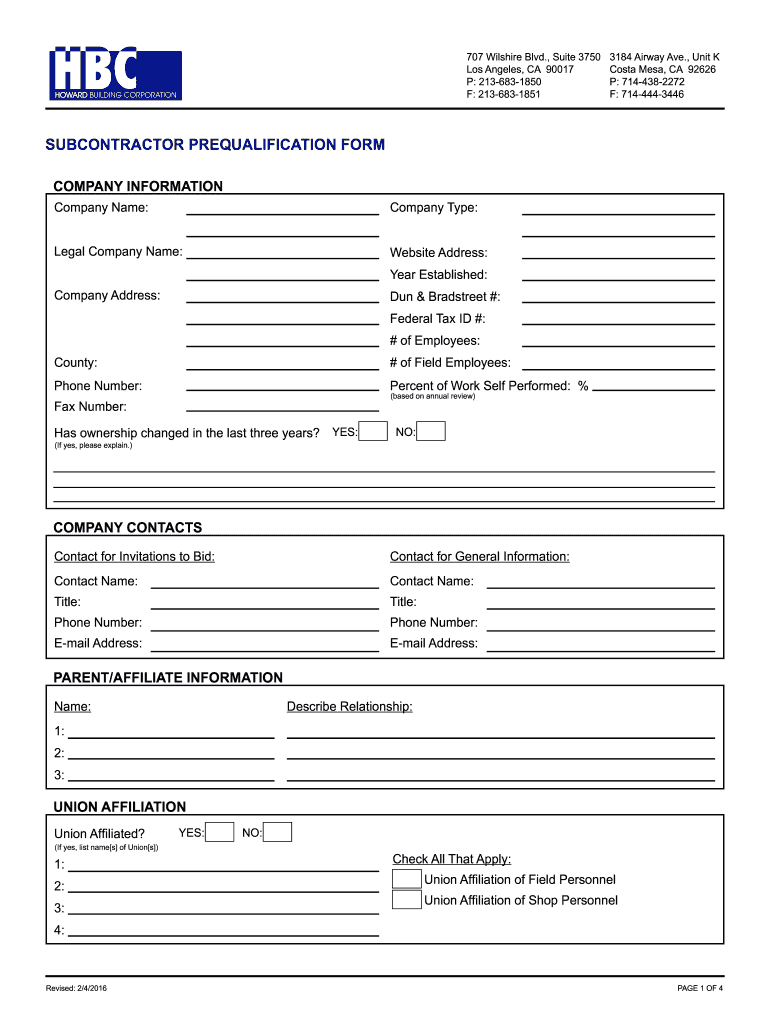

SUBCONTRACTOR PREQUALIFICATION FORM Corporation Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/257/813/257813898/large.png

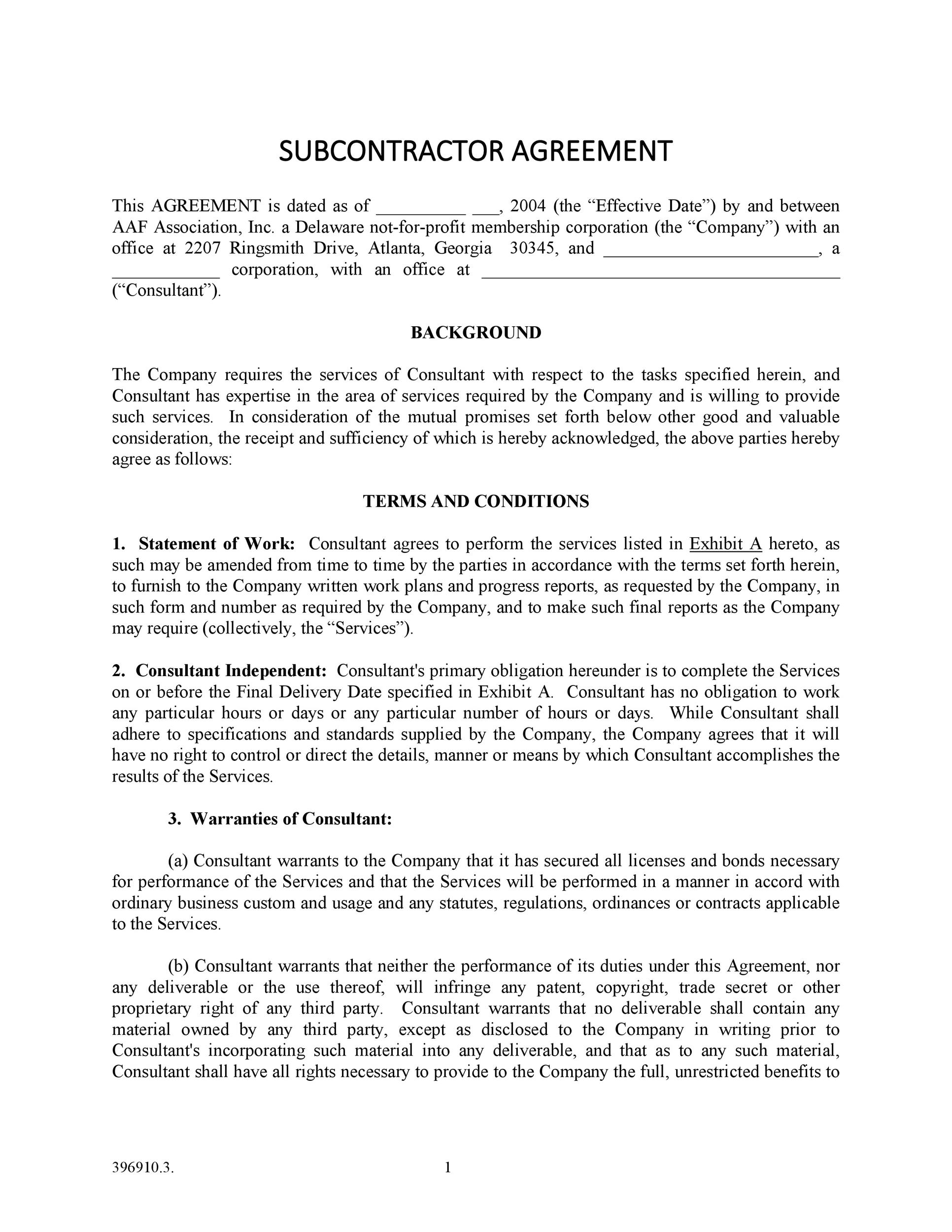

Updated January 18 2024 An independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment Also known as a 1099 agreement due to the contractor not being an employee of the client A contractor is commonly hired on a short term or intermittent basis unlike an employee 1 State the location Specify the region your company operates in and LawDepot will customize your Independent Contractor Agreement to meet your state s laws 2 Describe the type of service required Include an accurate description of the contractor s services in your agreement

Cat No 10231X Form W 9 Rev 10 2018 By signing the filled out form you Certify that the TIN you are giving is correct or you are waiting for a number to be issued Certify that you are not subject to backup withholding or Claim exemption from backup withholding if you are a U S exempt payee Federal and State Payroll Tax Forms Download Ensuring that you have the most up to date state or federal forms can be a challenge often requiring a significant investment of time and effort Find copies of current unemployment withholding IRS ADP and other forms using this extensive repository of tax and compliance related forms and

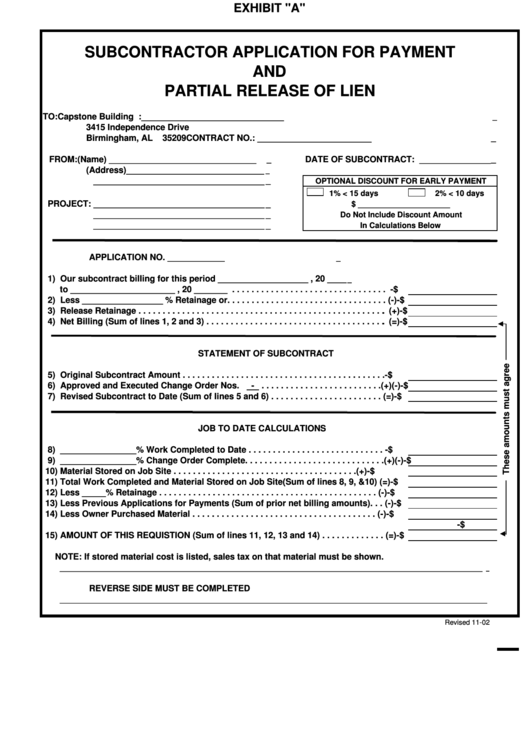

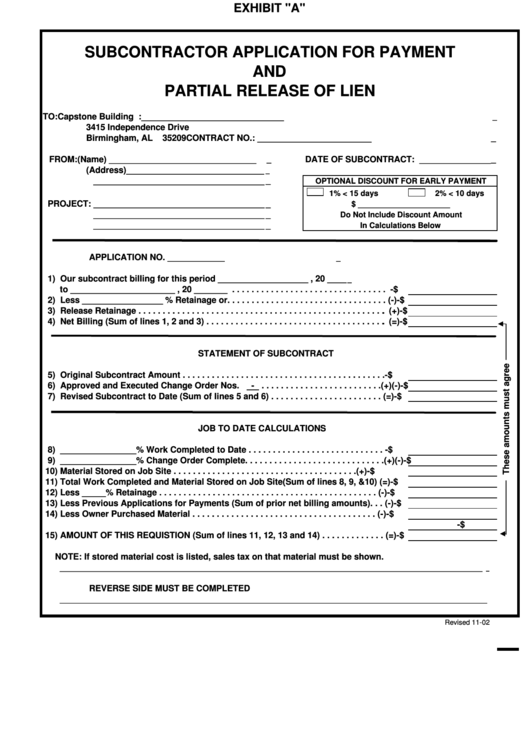

Subcontractor Application For Payment Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/62/624/62431/page_1_thumb_big.png

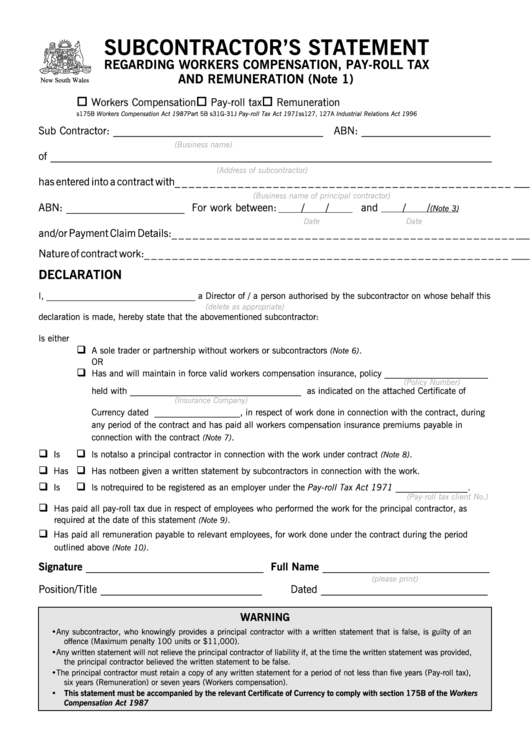

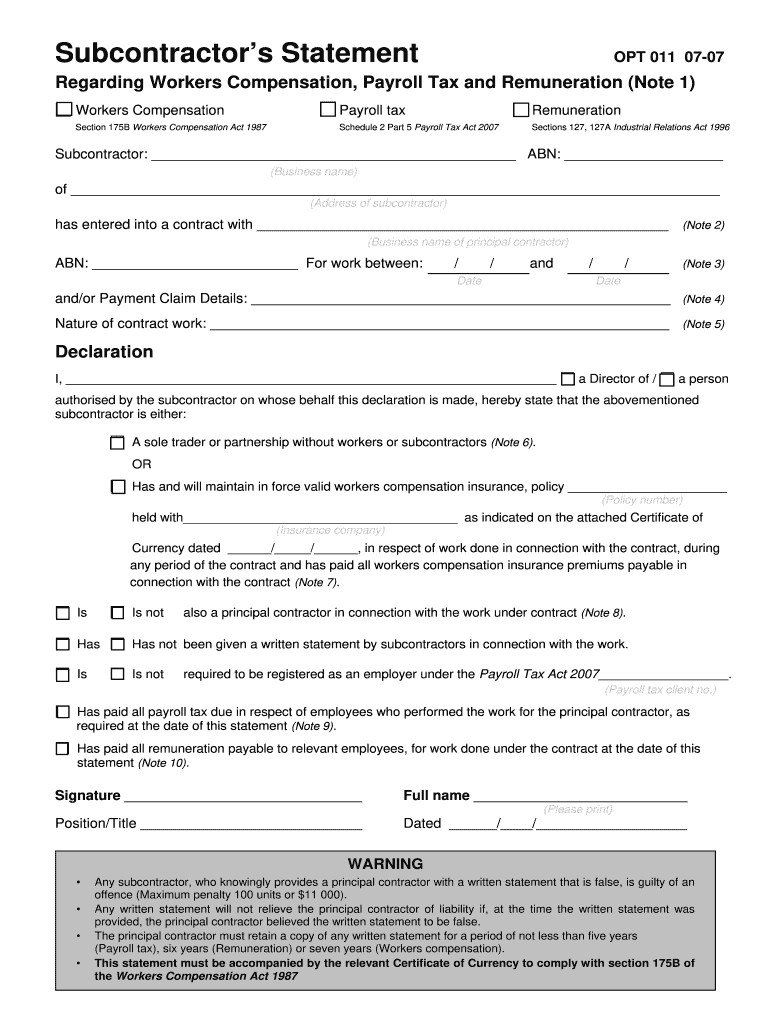

Subcontractor S Statement Regarding Workers Compensation Pay Roll Tax And Remuneration Form

https://data.formsbank.com/pdf_docs_html/217/2178/217822/page_1_thumb_big.png

https://www.irs.gov/faqs/small-business-self-employed-other-business/form-1099-nec-independent-contractors/form-1099-nec-independent-contractors

The SSA shares the information with the Internal Revenue Service Payers use Form 1099 MISC Miscellaneous Information and or Form 1099 NEC Nonemployee Compensation to Report any amount of federal income tax withheld under the backup withholding rules Form 1099 MISC or Form 1099 NEC Report payments of 10 or more made in the course of a

https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN However the payer has reported your complete TIN

1099 Printable Forms

Subcontractor Application For Payment Printable Pdf Download

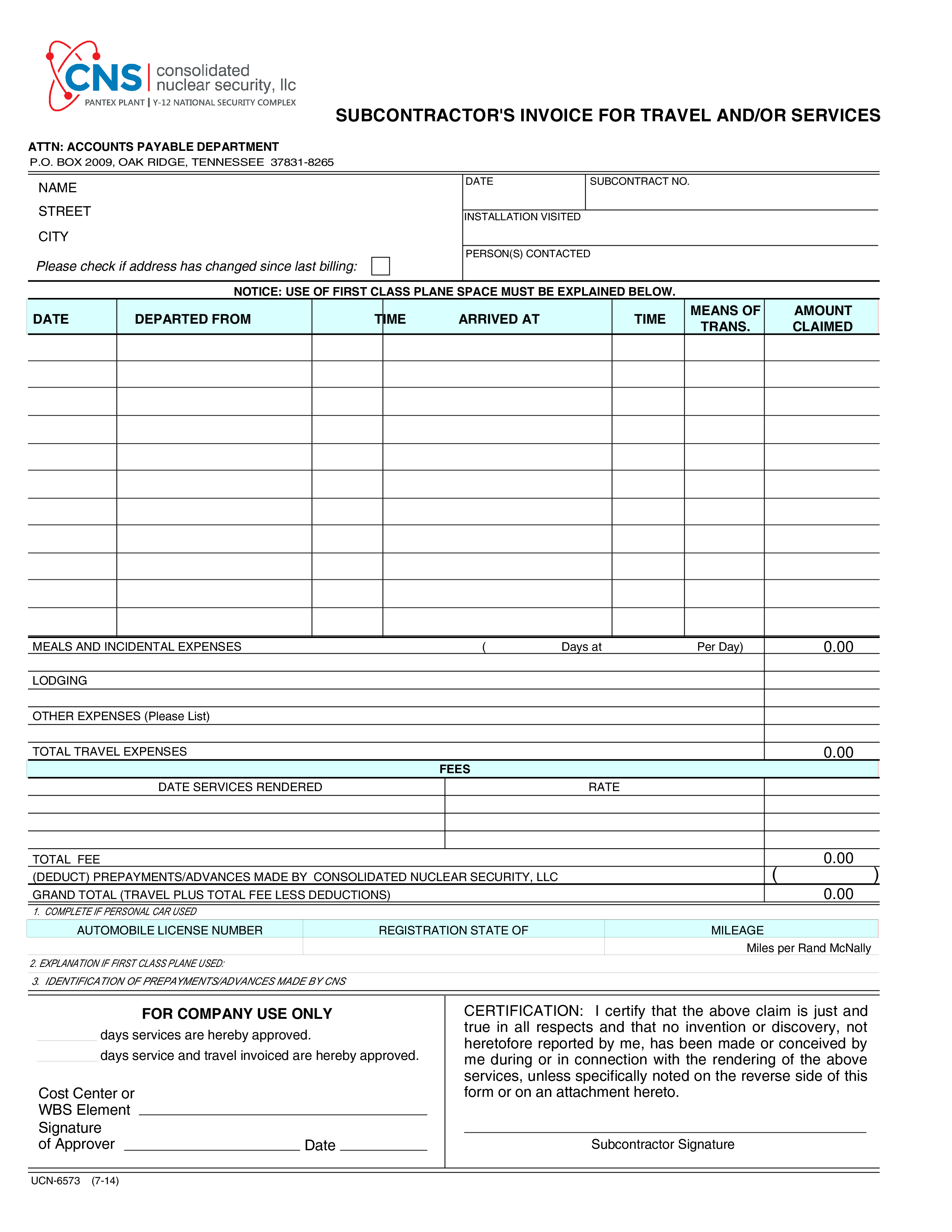

Kostenloses Subcontractor Invoice For Travel And Or Services

Subcontractor Statement Nsw Download 2020 2021 Fill And Sign Printable Template Online US

Subcontractor Agreement Form Free Printable Documents

IRS 1099 MISC 2023 Form Printable Blank PDF Online

IRS 1099 MISC 2023 Form Printable Blank PDF Online

Subcontractor Contract Agreement Template HQ Printable Documents

39 Free Subcontractor Agreement Templates Samples

Subcontractor Statement Template 2007 2023 Form Fill Out And Sign Printable PDF Template SignNow

Printable Sub Contractor Tax Form - Free Subcontrator Agreement Template for Download We ve worked closely with legal experts and proofreaders to design a simple subcontractor agreement PDF and Word so you can save money and time as you scale your operations Think of our document as a subcontractor agreement form where you merely fill it out and sign