Printable Tax Excempt Certification Form IR 2024 39 Feb 13 2024 With a key March deadline quickly approaching the Internal Revenue Service today highlighted special warning signs that an Employee Retention Credit claim may be questionable to help small businesses that may need to resolve incorrect claims

How they work You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for United States Tax Exemption Form Title United States Tax Exemption Form Form SF1094 Current Revision Date 04 2015 Authority or Regulation GSA FAR 48 CFR 53 229 PDF versions of forms use Adobe Reader Download Adobe Reader

Printable Tax Excempt Certification Form

Printable Tax Excempt Certification Form

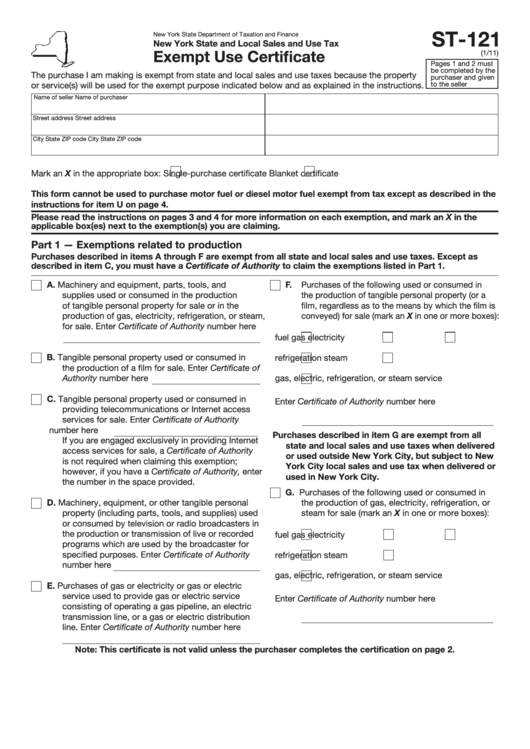

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-form-st-121-exempt-use-certificate-printable-pdf-download-2.png

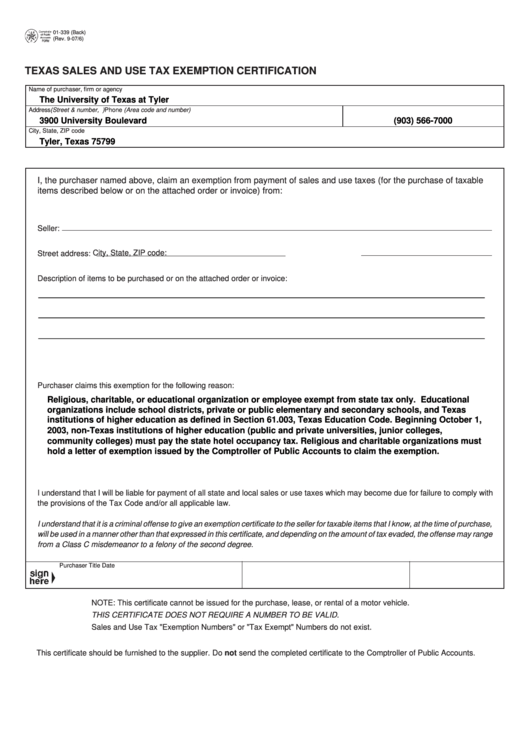

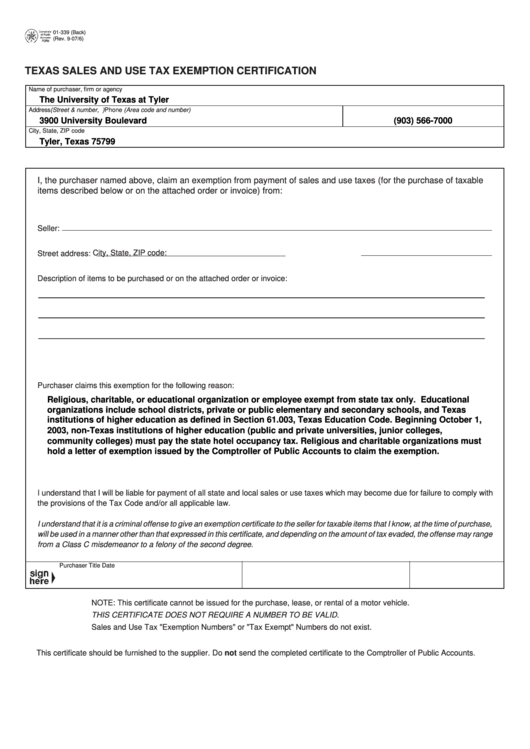

Fillable Form 01 339 Back Texas Sales And Use Tax Exemption Certification Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/132/1328/132868/page_1_thumb_big.png

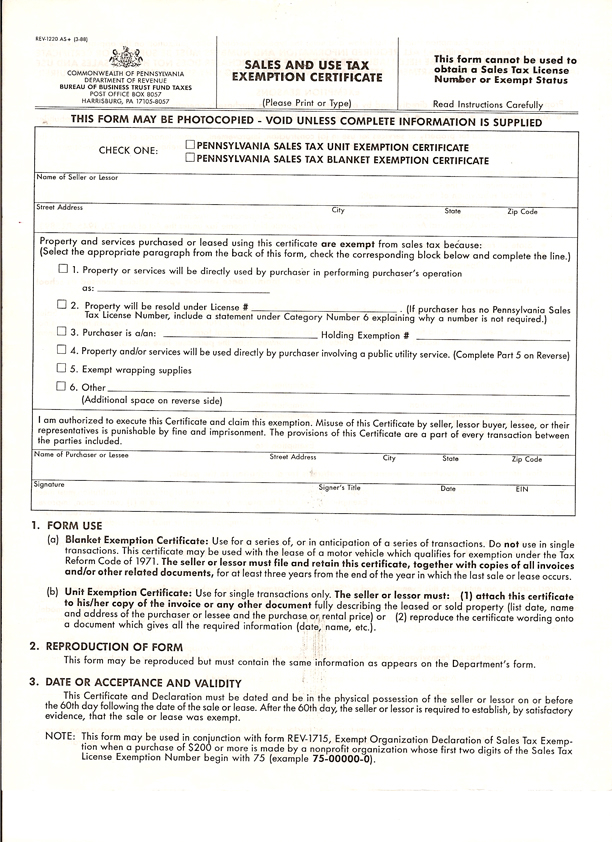

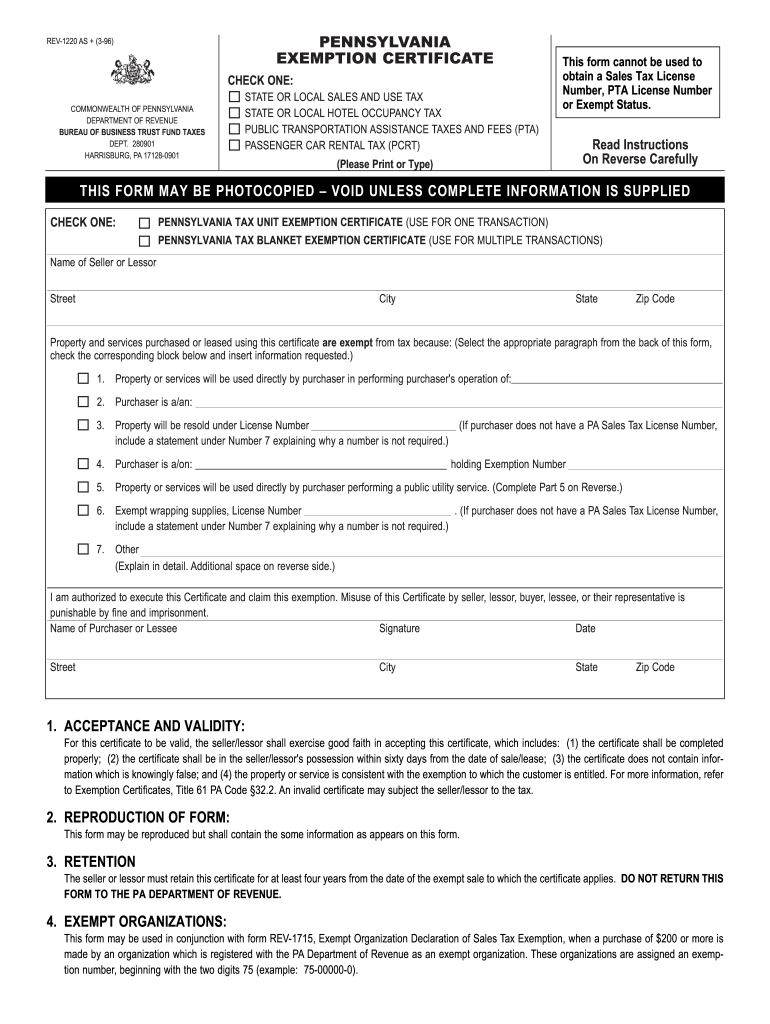

Pa Exemption Certificate Fill Out And Sign Printable PDF Template ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/pennsylvania-tax-exempt-1.jpg

Texas Sales and Use Tax Exemption Certification This certificate does not require a number to be valid understand that I will be liable for payment of all state and local sales or use taxes which may become due for failure to comply with the provisions of the Tax Code and or all applicable law understand that it is a criminal offense to give Texas Sales and Use Tax Exemption Certification This certificate does not require a number to be valid understand that I will be liable for payment of all state and local sales or use taxes which may become due for failure to comply with the provisions of the Tax Code and or all applicable law understand that it is a criminal offense to give

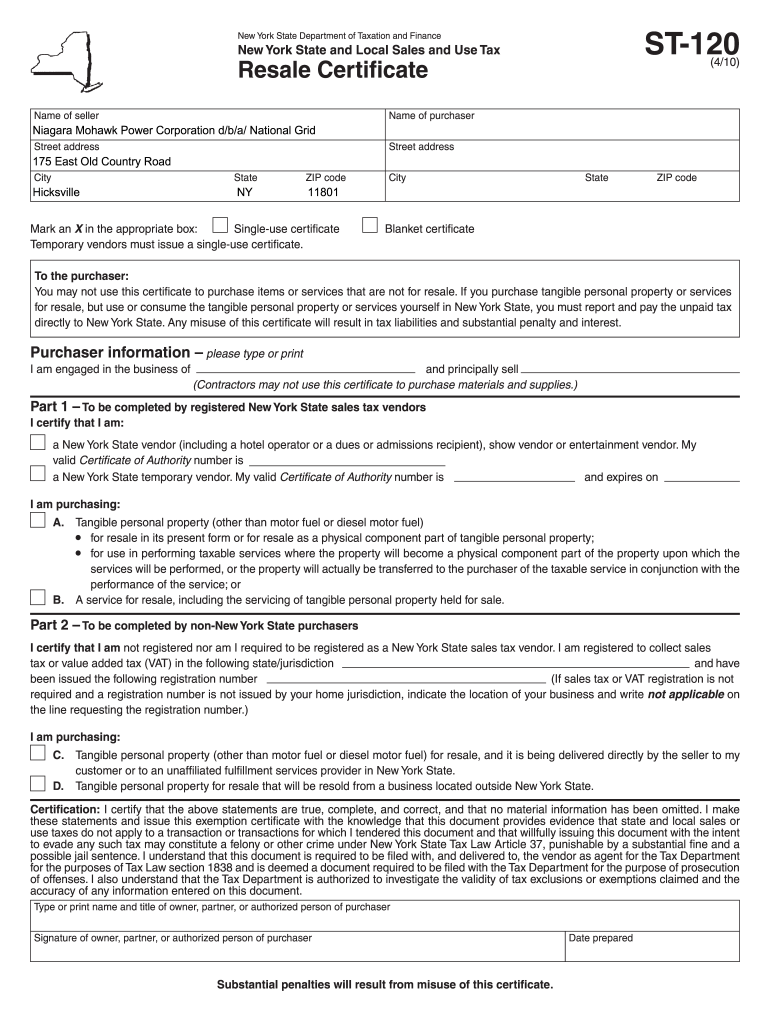

Page 2 of 4 ST 121 1 11 Part 2 Services exempt from tax exempt from all state and local sales and use taxes Enter Certificate of Authority number here if applicable H Installing repairing maintaining or servicing qualifying property listed in Part 1 items A through D Please indicate the type of qualifying property being serviced by marking an X in the applicable box es Withholding Tax Forms for 2024 Filing Season Tax Year 2023 2024 File the FR 900A if you are an annual wage filer whose threshold is less than 200 per year Note The 2023 FR 900A is due January 31 2024 Deposits are due by January 20 2024 for the preceding calendar year File the FR 900Q if you are required to pay monthly or quarterly

More picture related to Printable Tax Excempt Certification Form

Texas Fillable Tax Exemption Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/313/100313563/large.png

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/form-rev-1220-pennsylvania-exemption-certificate-printable-pdf-download-1.png?w=950&ssl=1

Pa Tax Exempt Form Rev 1220 ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/fillable-form-rev-1220-pennsylvania-exemption-certificate-printable-2.png

Millions of Canadians file an income tax and benefit return every year For the 2023 tax filing season Canadians filed more than 32 million tax returns and more than 92 of them were filed electronically There were also more than 18 million refunds processed and Canadians who had a tax refund received an average of 2 262 01 339 Texas Sales and Use Tax Resale Certificate Exemption Certification PDF 12 302 Texas Hotel Occupancy Tax Exemption Certification PDF 50 299 Primarily Charitable Organization Property Tax Exemption PDF Forms for applying for tax exemption with the Texas Comptroller of Public Accounts

Certificate Of Sales Tax Exemption For Diplomatic Missions And Personnel Single Purchase Certificate FT 123 Fill in Instructions on form IDA Agent or Project Operator Exempt Purchase Certificate for Fuel ST 119 1 Instructions on form Exempt Organization Exempt Purchase Certificate is available by calling 518 485 2889 Vendor s license number if any Vendors of motor vehicles titled watercraft and titled outboard motors may use this certificate to purchase these items under the resale exception Otherwise purchaser must comply with either rule 5703 9 10 or 5703 9 25 of the Admin istrative Code This certificate cannot be used by construction

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/50/825/50825271/large.png

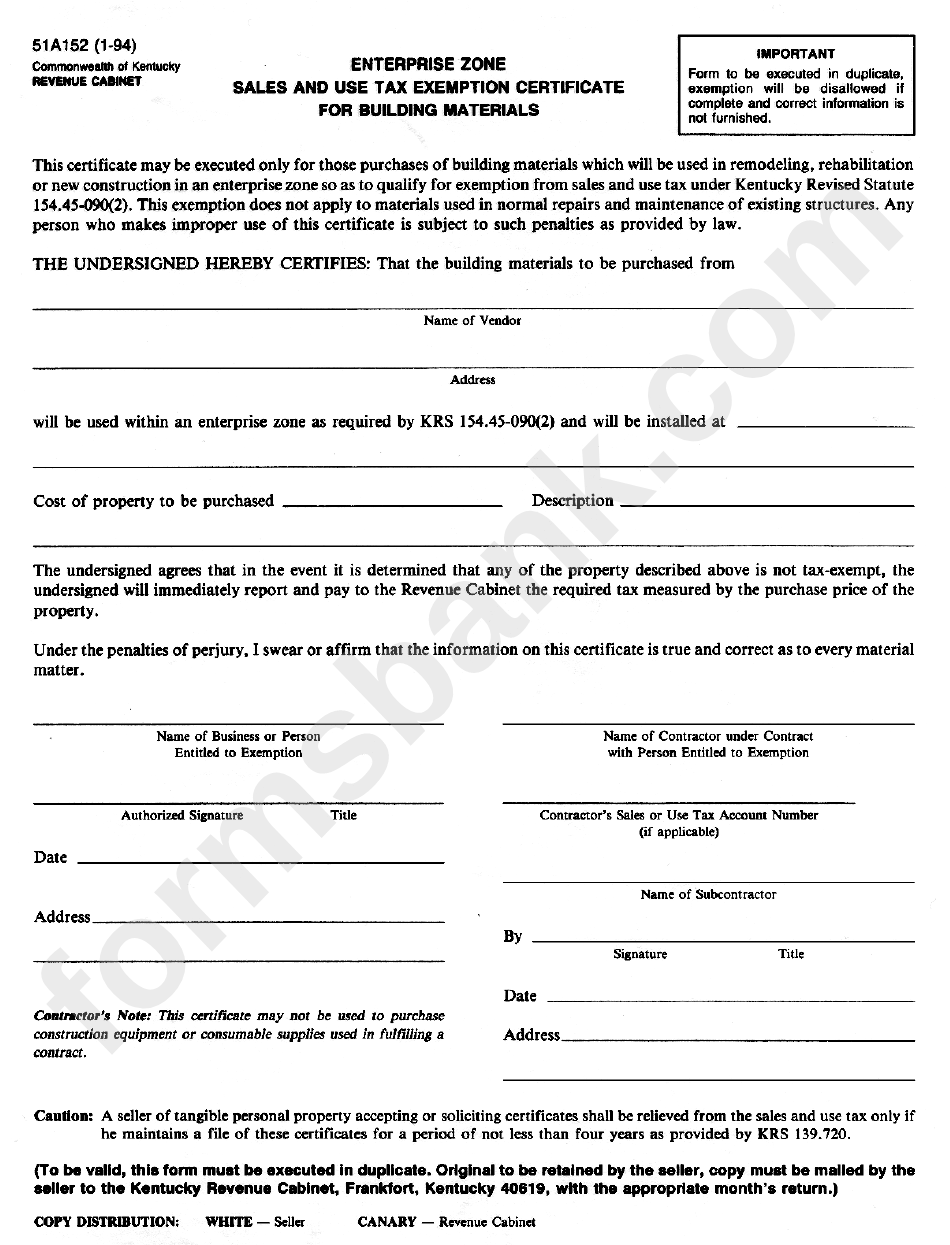

Form 51a152 Sales And Use Tax Exemption Certificate 1994 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/270/2706/270651/page_1_bg.png

https://www.irs.gov/newsroom/irs-shares-7-warning-signs-employee-retention-credit-claims-may-be-incorrect-urges-businesses-to-revisit-eligibility-resolve-issues-now-before-march-22

IR 2024 39 Feb 13 2024 With a key March deadline quickly approaching the Internal Revenue Service today highlighted special warning signs that an Employee Retention Credit claim may be questionable to help small businesses that may need to resolve incorrect claims

https://www.irs.gov/credits-and-deductions-for-individuals

How they work You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for

2009 Form SD Streamlined Sales And Use Tax Certificate Of Exemption Fill Online Printable

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank PdfFiller

Tax Exempt Form Fill Online Printable Fillable Blank PdfFiller

FREE 10 Sample Tax Exemption Forms In PDF

Pa Tax Exempt Form 2023 ExemptForm

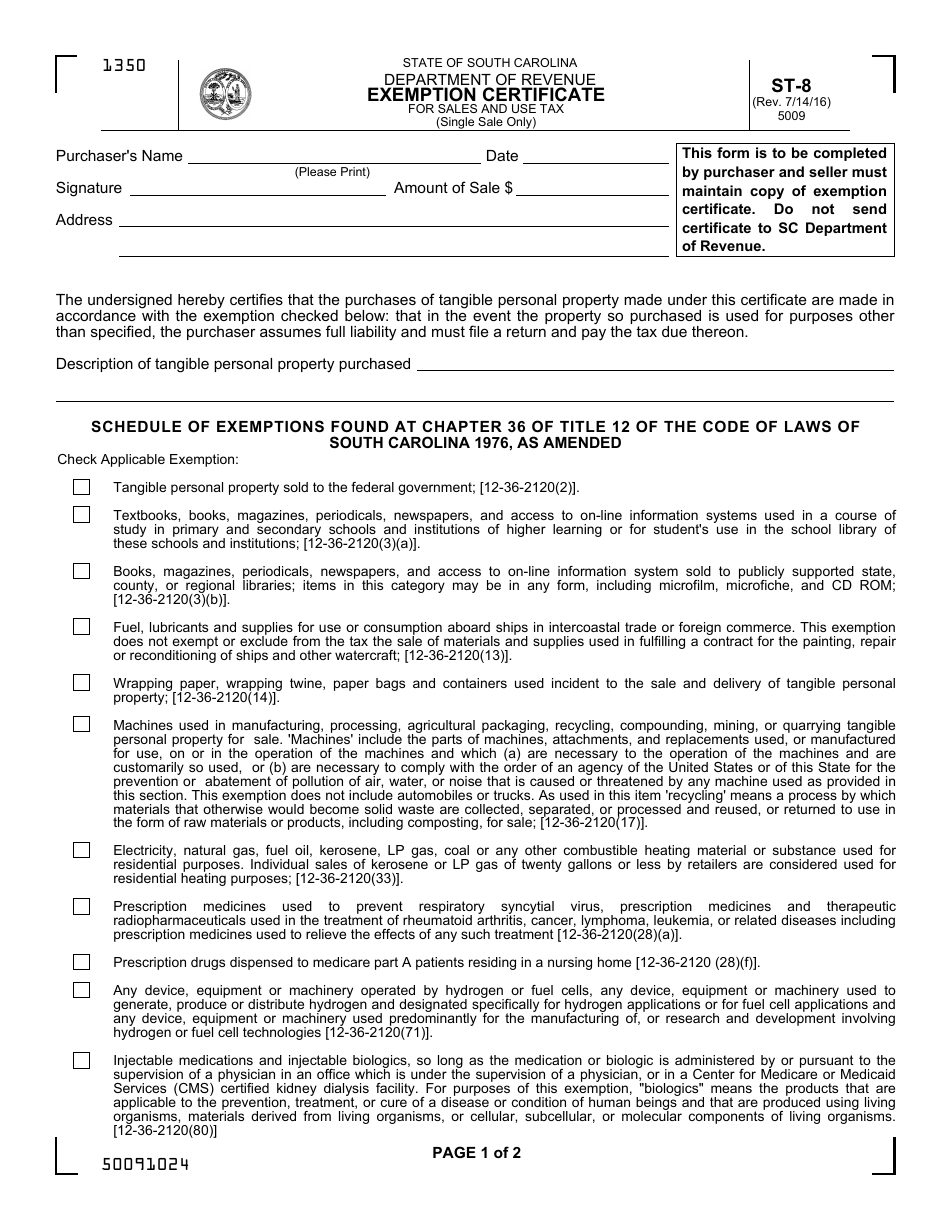

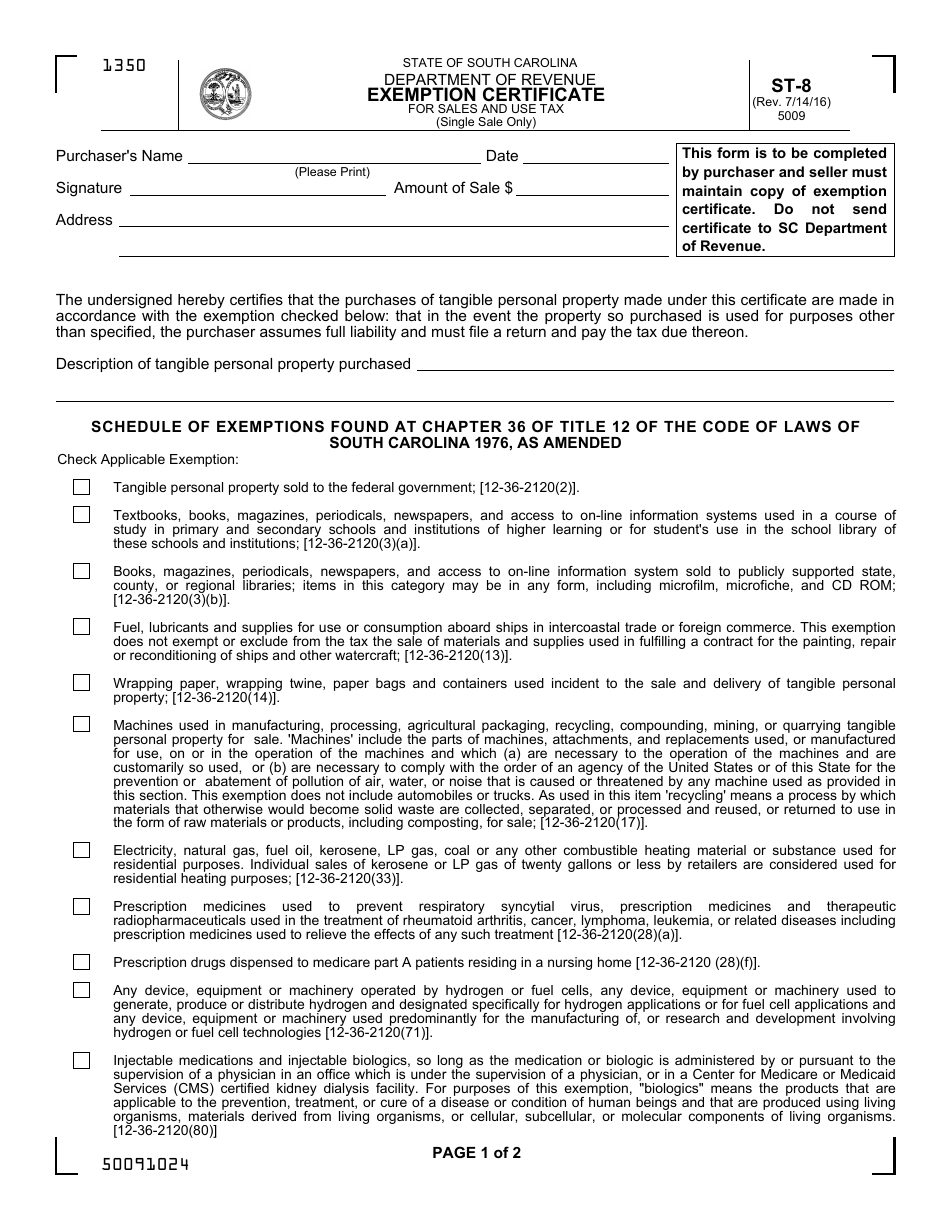

Form ST 8 Fill Out Sign Online And Download Fillable PDF South Carolina Templateroller

Form ST 8 Fill Out Sign Online And Download Fillable PDF South Carolina Templateroller

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable ExemptForm

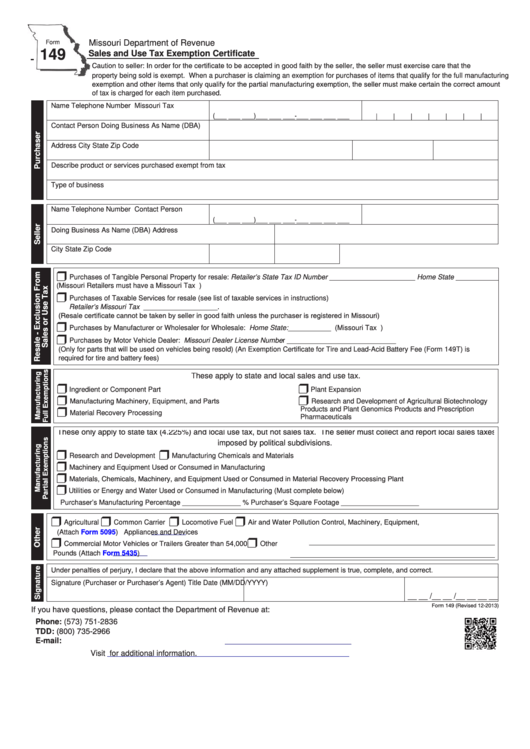

Fillable Form 149 Sales And Use Tax Exemption Certificate Printable Pdf Download

Tax Exempt Form 2020 2021 Fill And Sign Printable Template Online US Legal Forms

Printable Tax Excempt Certification Form - REV 1220 TR 07 23 FI PENNSYLVANIA EXEMPTION CERTIFICATE STATE AND LOCAL SALES AND USE TAX STATE 6 AND LOCAL 1 HOTEL OCCUPANCY TAX PUBLIC TRANSPORTATION ASSISTANCE TAXES AND FEES PTA VEHICLE RENTAL TAX VRT ADDITIONAL LOCAL CITY COUNTY HOTEL TAX PENNSYLVANIA EXEMPTION CERTIFICATE