Printable Tax Form 1041 A Instructions for Form 1041 and Schedules A B G J and K 1 Introductory Material Future Developments What s New Instructions for Form 1041 and Schedules A B G J and K 1 2022 Internal Revenue Service Skip to main content An official website of the United States Government English Espa ol Ti ng Vi t

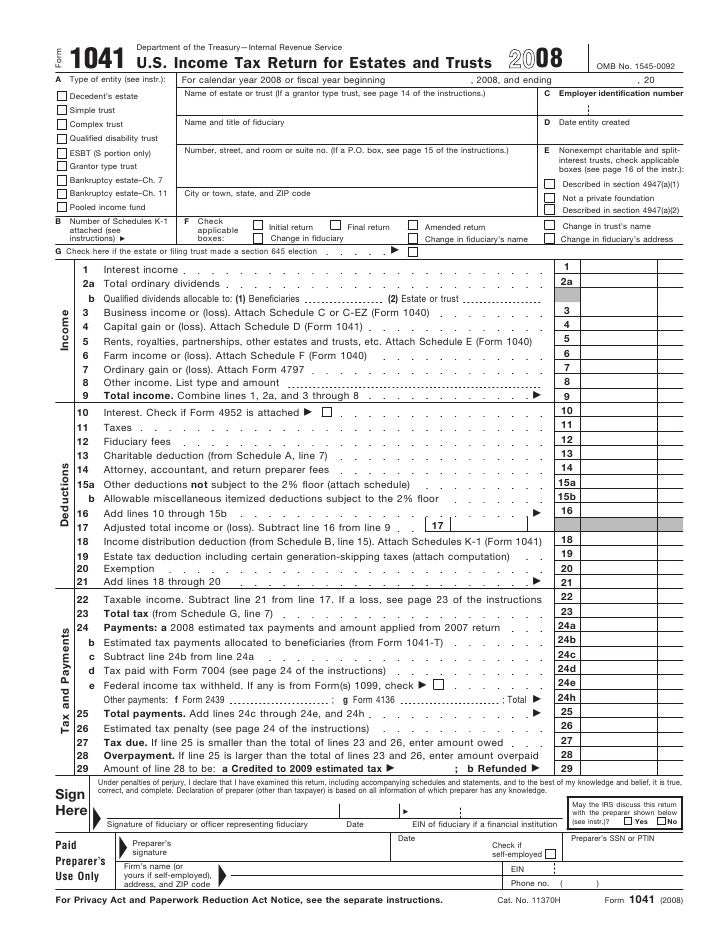

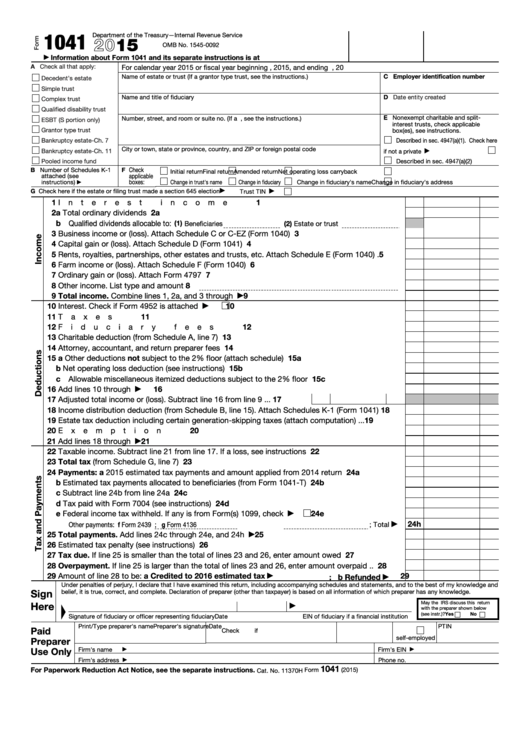

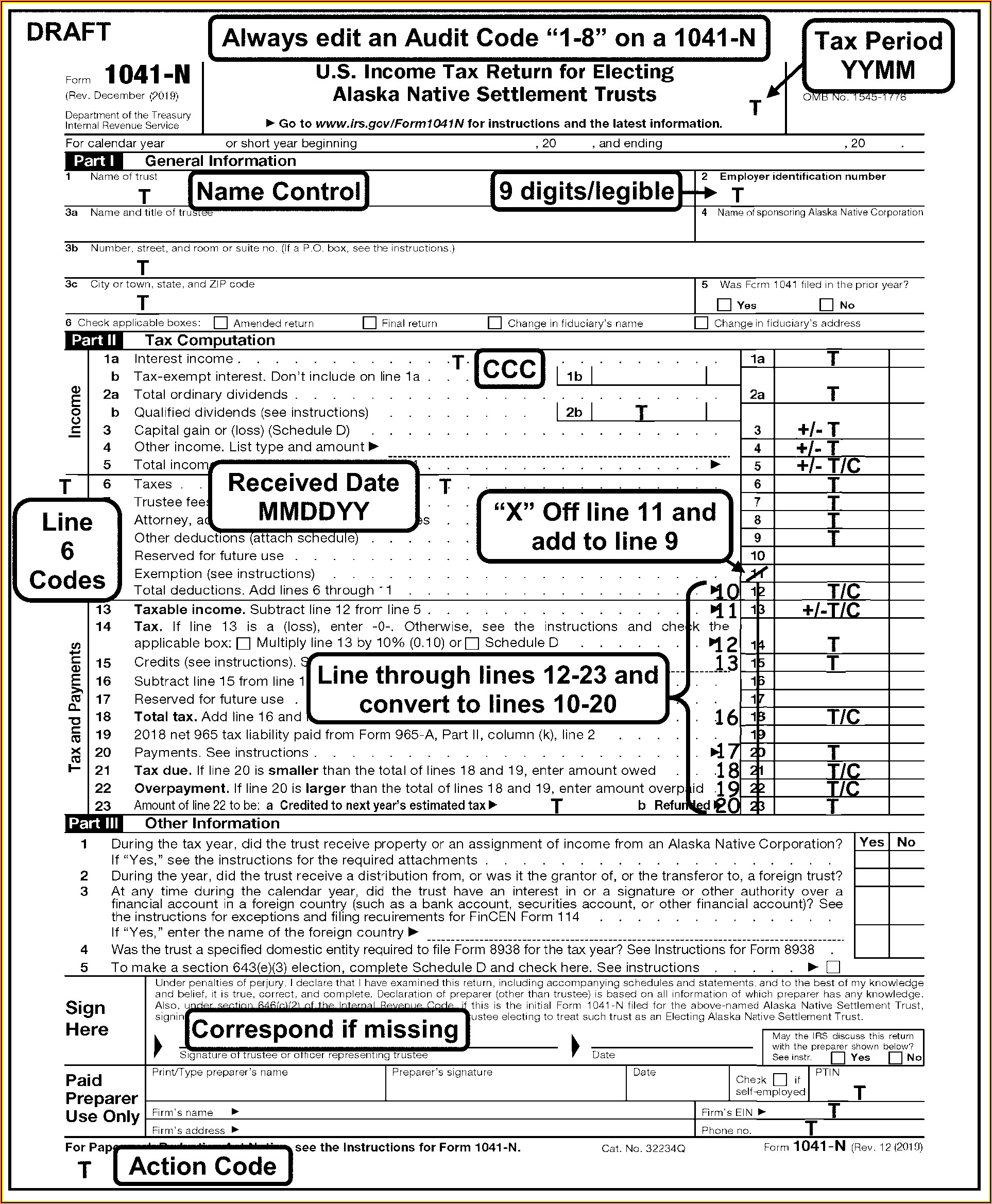

Form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries The executor Estate income tax is documented on IRS Form 1041 This form reports any income the estate earned after the date of death This includes income earned from bank accounts or stock while the estate is being managed through a process called probate Is An EIN Necessary for Filing Form 1041

Printable Tax Form 1041 A

Printable Tax Form 1041 A

https://image.slidesharecdn.com/1272386/95/form-1041-us-income-tax-return-for-estates-and-trusts-form-1041-us-income-tax-return-for-estates-and-trusts-1-728.jpg?cb=1239353922

2019 Form IRS 1041 Schedule K 1 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/489/187/489187937/large.png

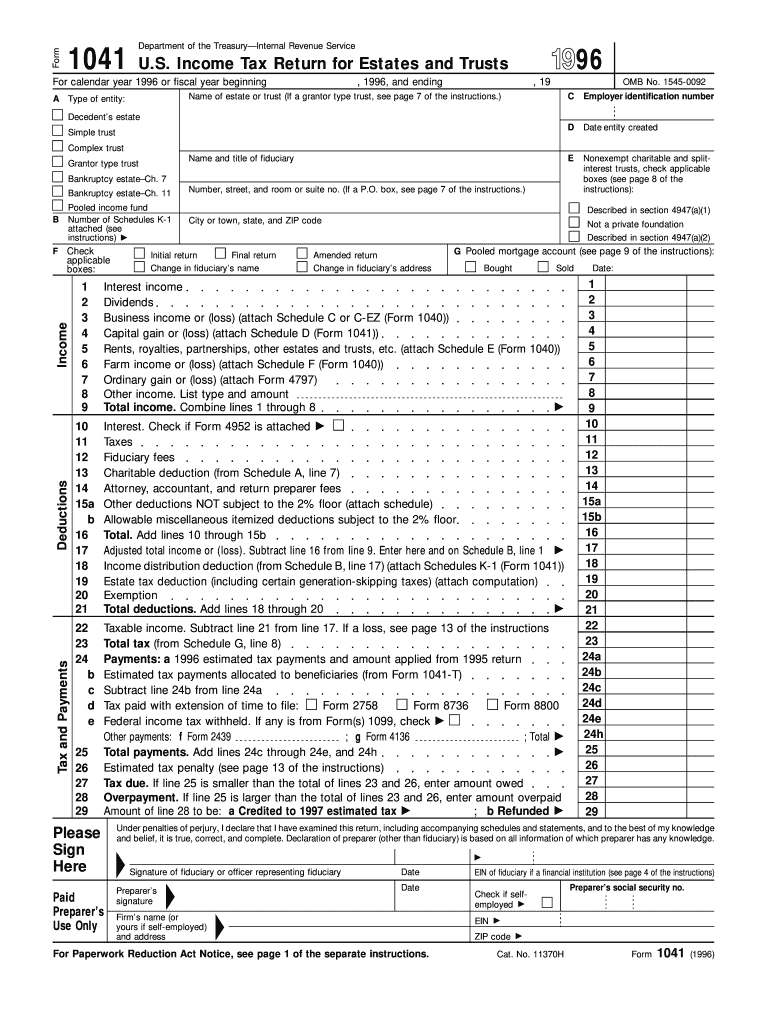

Irs Form 1041 For 1996 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/1/670/1670352/large.png

Form 1041 is a Federal Estate Tax form The IRS and most states will grant an automatic 6 month extension of time to file income tax and other types of tax returns which can be obtained by filing the proper extension request form Obtaining an extension will prevent you from being subject to often very large failure to file penalties Financial Advisors All About IRS Form 1041 Tax Return for Estates and Trusts If you re designated the executor of someone s estate you may need to file to declare the income from that person s estate or hire someone to fill out the form for you Form 1041 isn t a substitute for Form 1040 though Confused We don t blame you

IRS Form 1041 reports only income earned by an estate from the time of the decedent s death until the estate closes That income can be offset by deductions and capital losses Income received before the decedent s date of death is reported on the decedent s final tax return a separate document that must also be filed by the estate s executor How do I file Form 1041 for an estate or trust SOLVED by TurboTax 2494 Updated 2 weeks ago You ll need TurboTax Business to file Form 1041 as the personal versions of TurboTax don t support this form After you install TurboTax Business and begin working on your return you ll be asked which type of return you need to prepare

More picture related to Printable Tax Form 1041 A

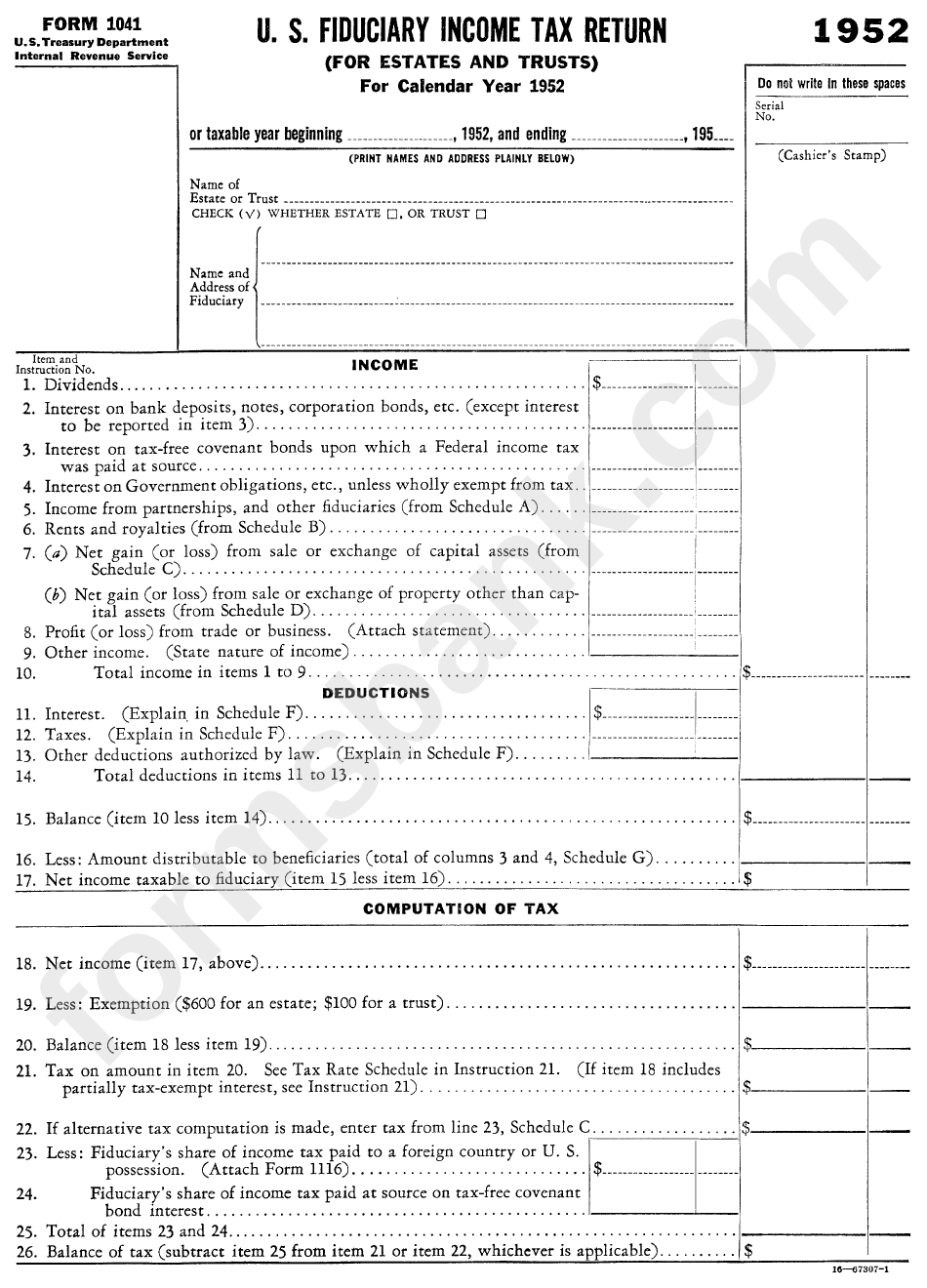

Form 1041 U s Fiduciary Income Tax Return For Estates And Trusts 1952 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/282/2826/282652/page_1_bg.png

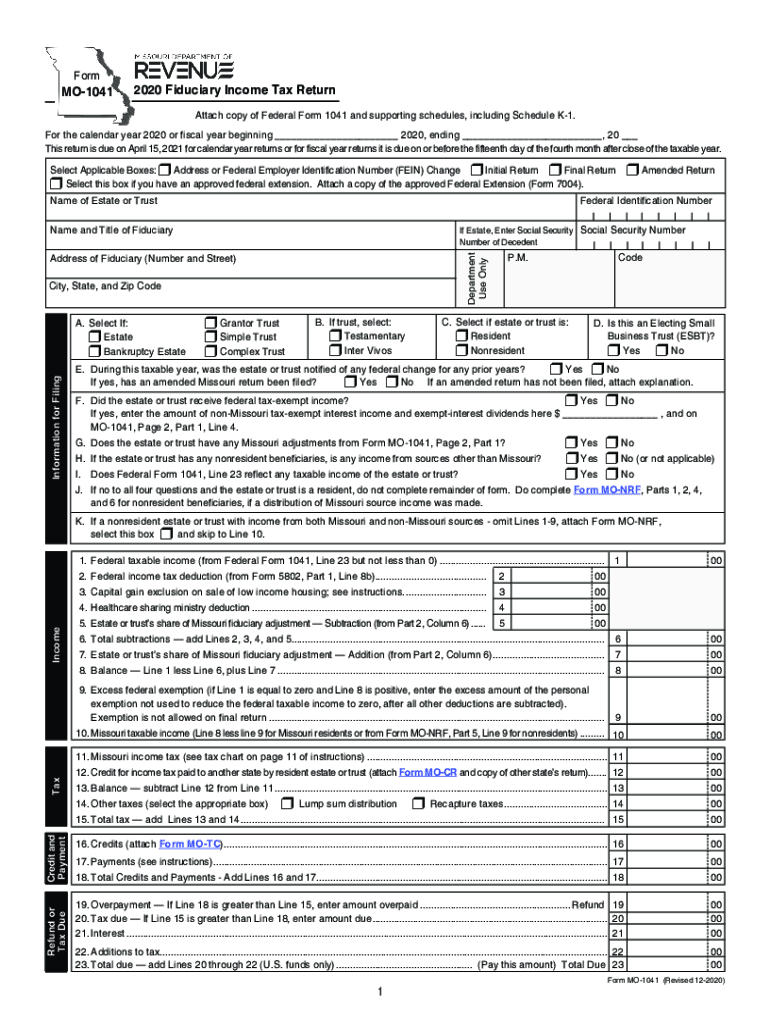

Mo 1041 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/536/240/536240662/large.png

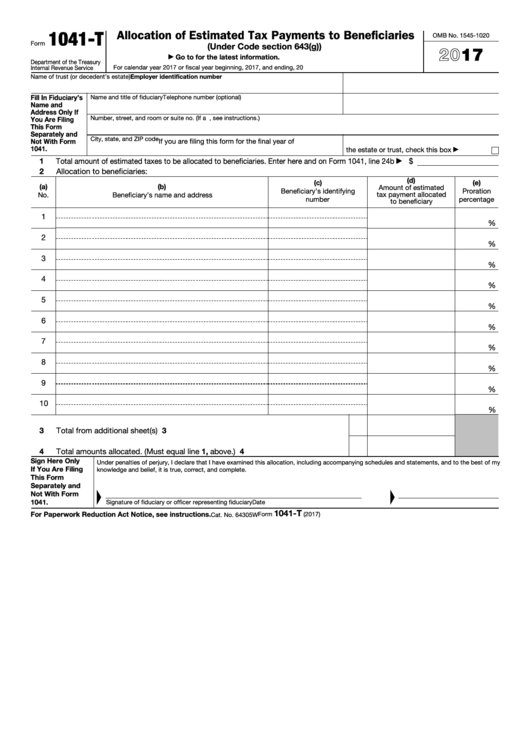

Fillable Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries 2017 Printable

https://data.formsbank.com/pdf_docs_html/296/2968/296842/page_1_thumb_big.png

The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart The form is optional and uses the same schedules instructions and attachments as the regular 1040 Accessible federal tax forms Form 1041 allows estates and trusts to reduce the amount of income that can be taxed by deducting expenses associated with income generation These expenses may include professional attorney and accountant fees fees paid to the trustee or executor local and state tax payments distributed trust income qualified business income mortgage

Schedule K 1 and Form 1041 If beneficiaries receive the income established from a trust or estate they must pay income tax on it An estate or trust that generates income of 600 or more and estates with nonresident alien beneficiaries must file a Form 1041 Income received from the trust or estate and deductions and credits is reported to An estate or trust can generate income that gets reported on Form 1041 United States Income Tax Return for Estates and Trusts However if trust and estate beneficiaries are entitled to receive the income the beneficiaries pay the income tax rather than the trust or estate At the end of the year all income distributions made to beneficiaries are reported on a Schedule K 1

1041 I Form 2017 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/428/795/428795277/large.png

Online IRS Form 1041 2019 Fillable And Editable PDF Template

https://www.pdffiller.com/preview/489/187/489187942/big.png

https://www.irs.gov/instructions/i1041

Instructions for Form 1041 and Schedules A B G J and K 1 Introductory Material Future Developments What s New Instructions for Form 1041 and Schedules A B G J and K 1 2022 Internal Revenue Service Skip to main content An official website of the United States Government English Espa ol Ti ng Vi t

https://www.investopedia.com/tax-form-1041-estates-and-trusts-5211109

Form 1041 is a tax return filed by estates or trusts that generated income after the decedent passed away and before the designated assets were transferred to beneficiaries The executor

Irs Form 1041 For 2023 Printable Forms Free Online

1041 I Form 2017 Fill Out Sign Online DocHub

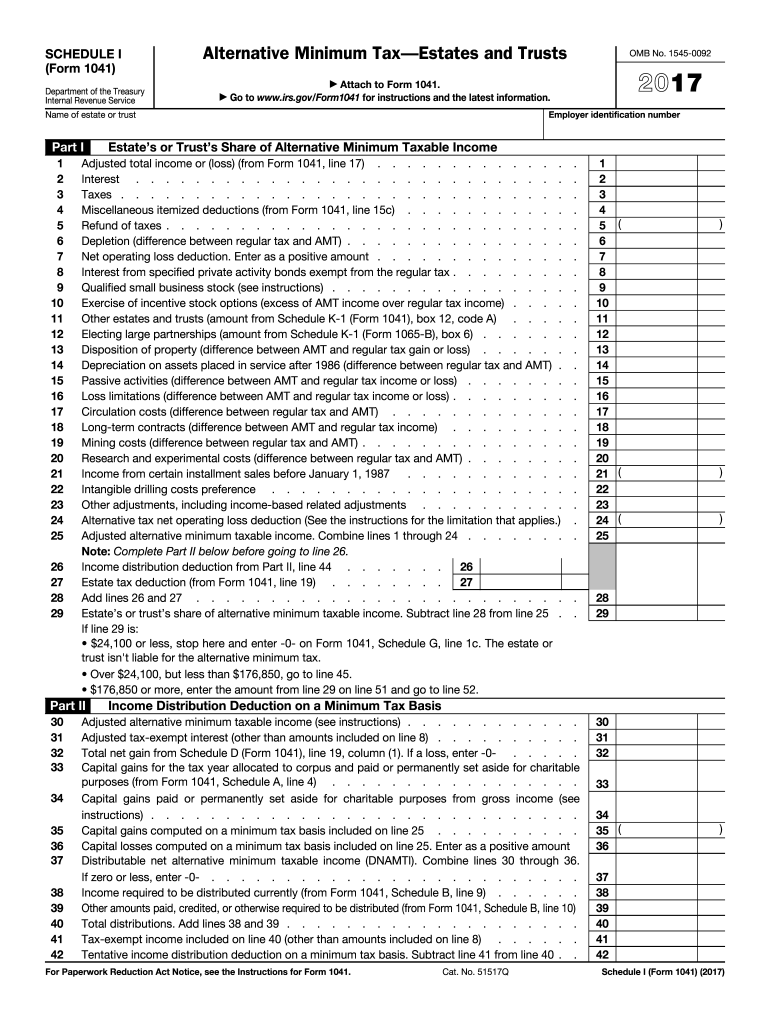

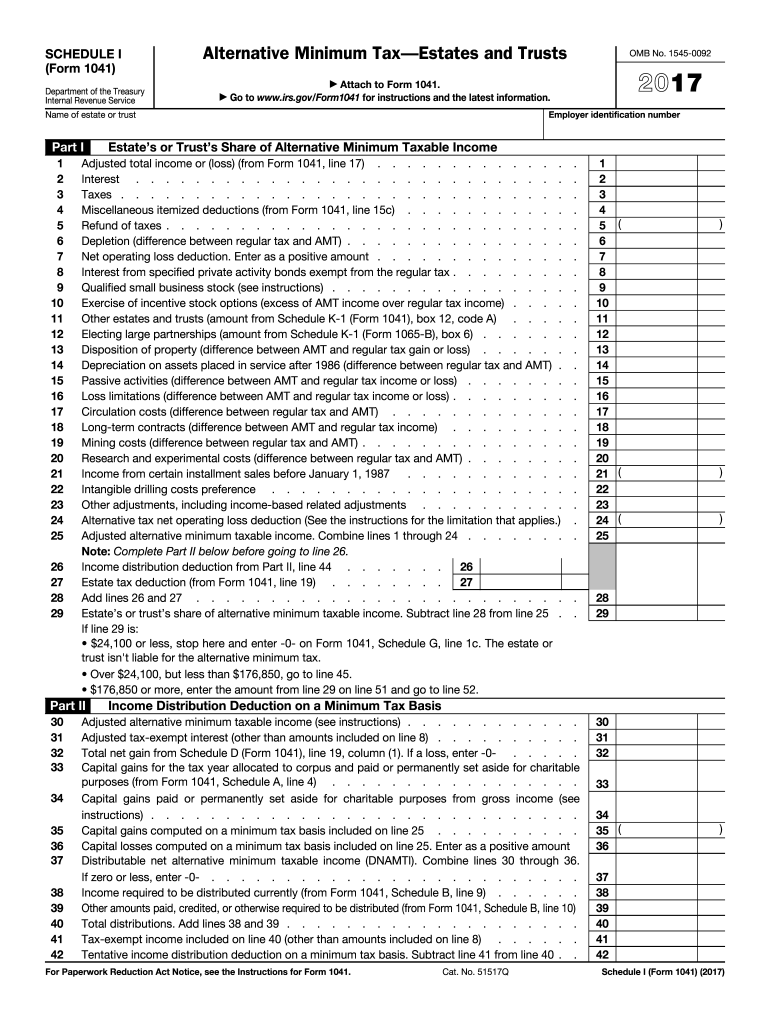

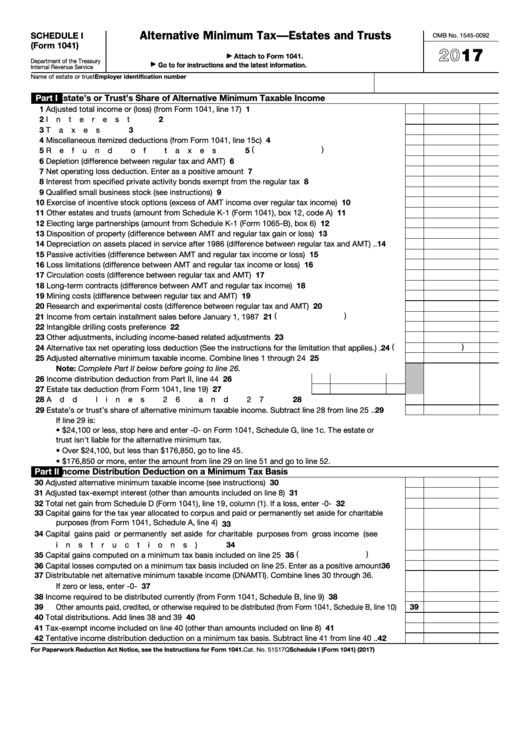

Fillable Schedule I Form 1041 Alternative Minimum Tax Estates And Trusts 2016 Printable

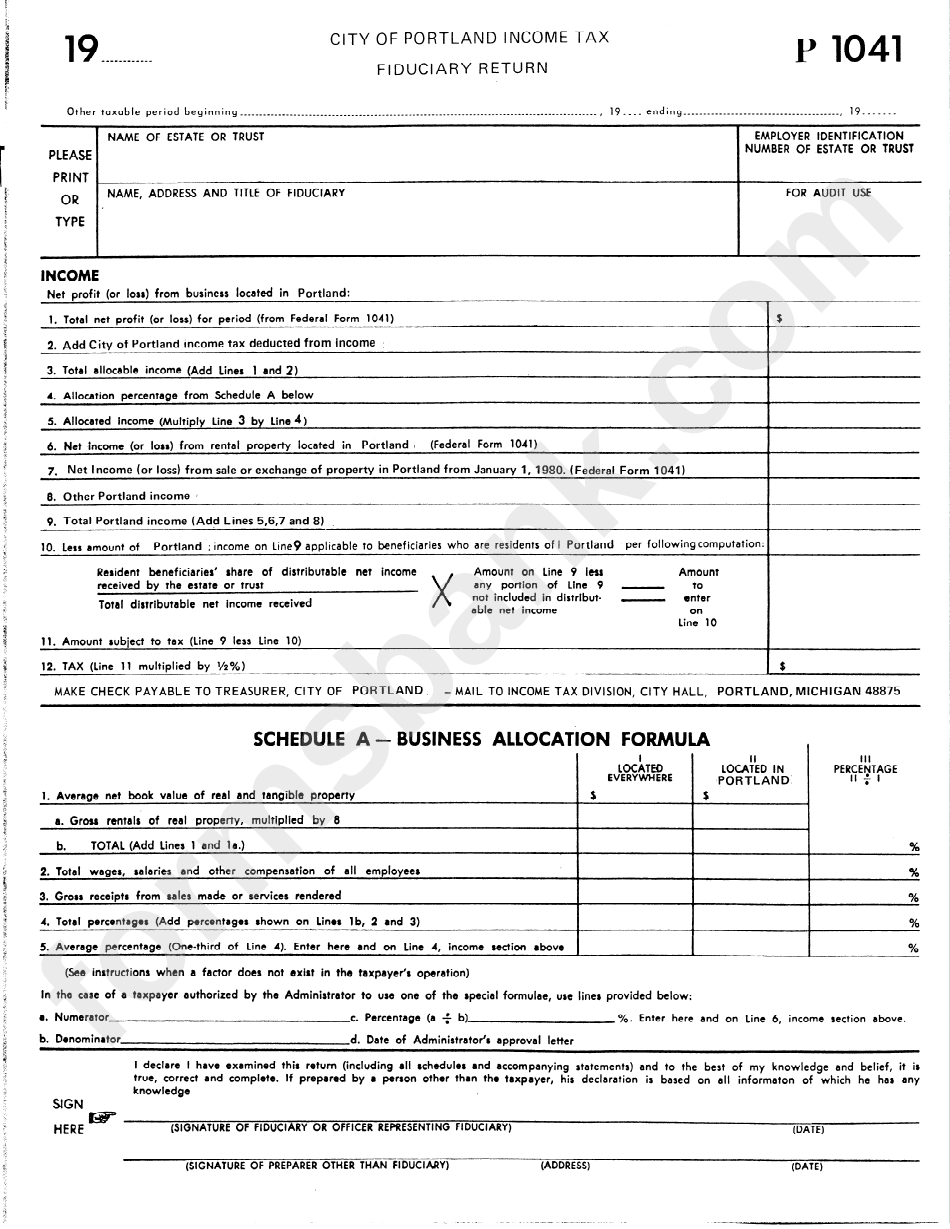

Form P 1041 Income Tax Fiduciary Return Printable Pdf Download

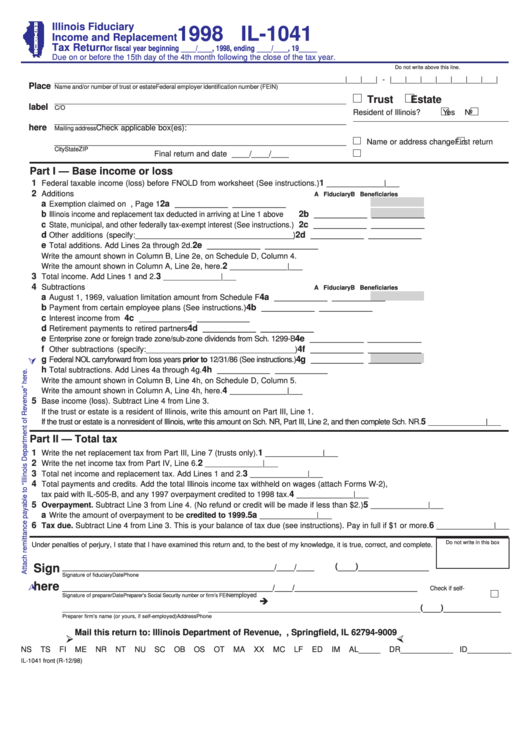

Fillable Il 1041 Form Printable Forms Free Online

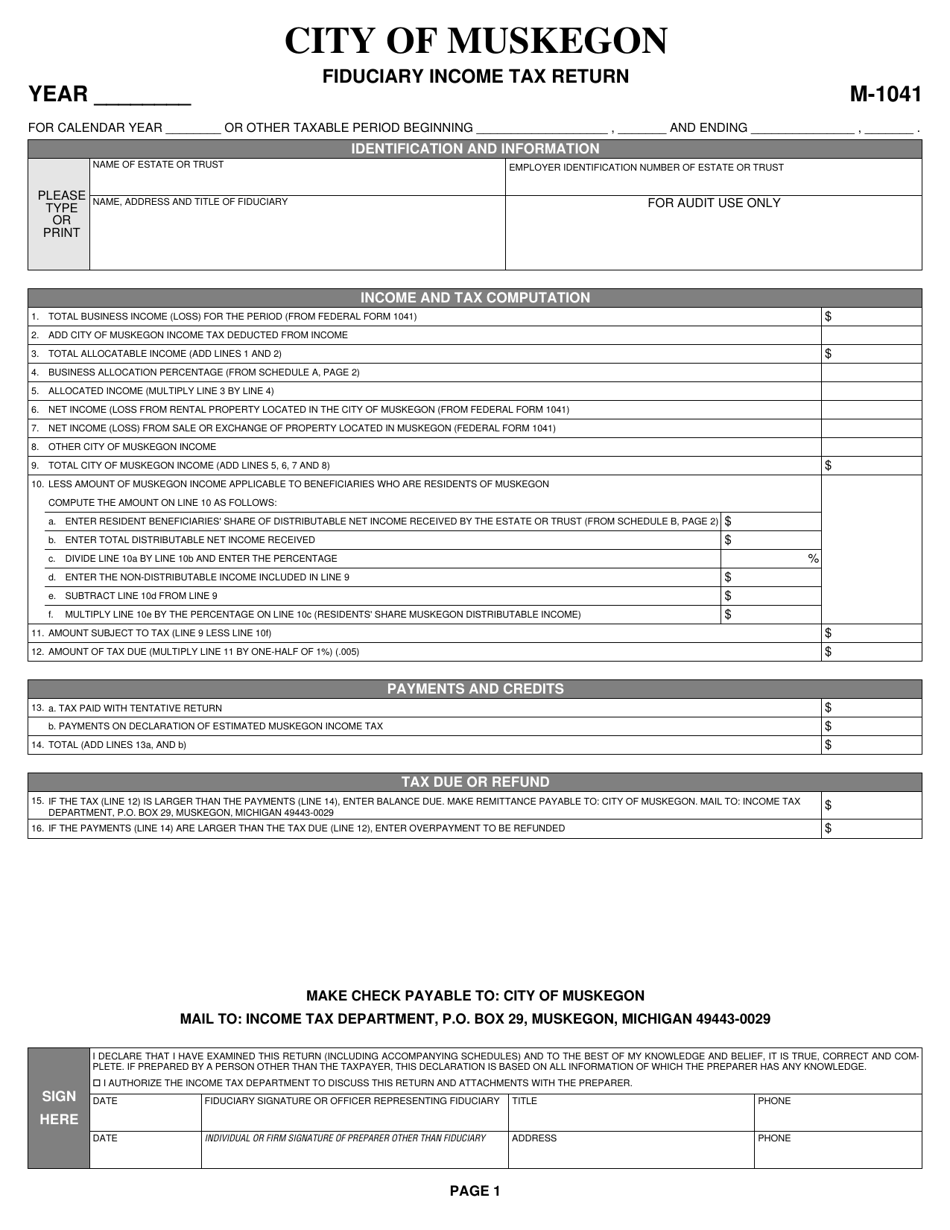

Form M 1041 Download Printable PDF Or Fill Online Fiduciary Income Tax Return City Of Muskegon

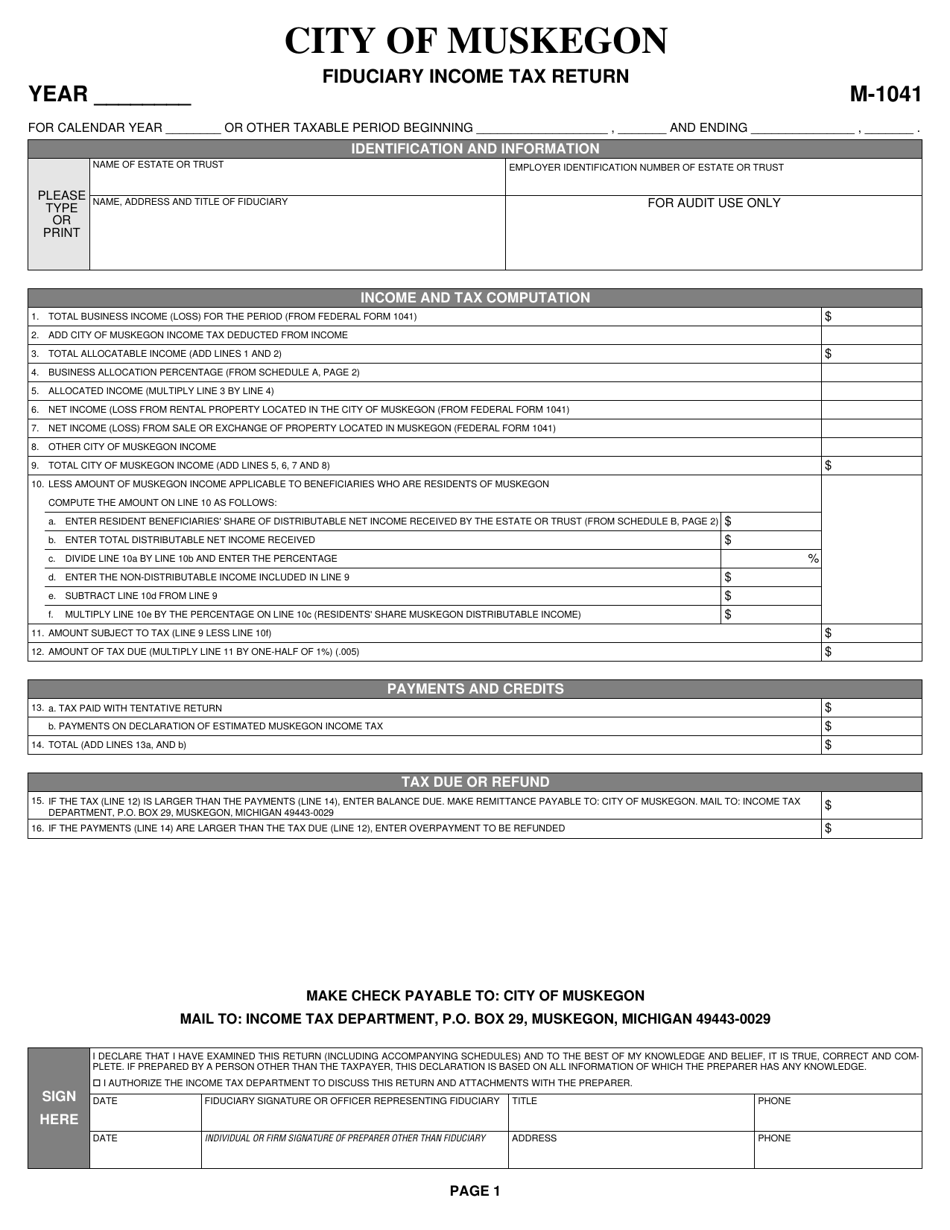

Form M 1041 Download Printable PDF Or Fill Online Fiduciary Income Tax Return City Of Muskegon

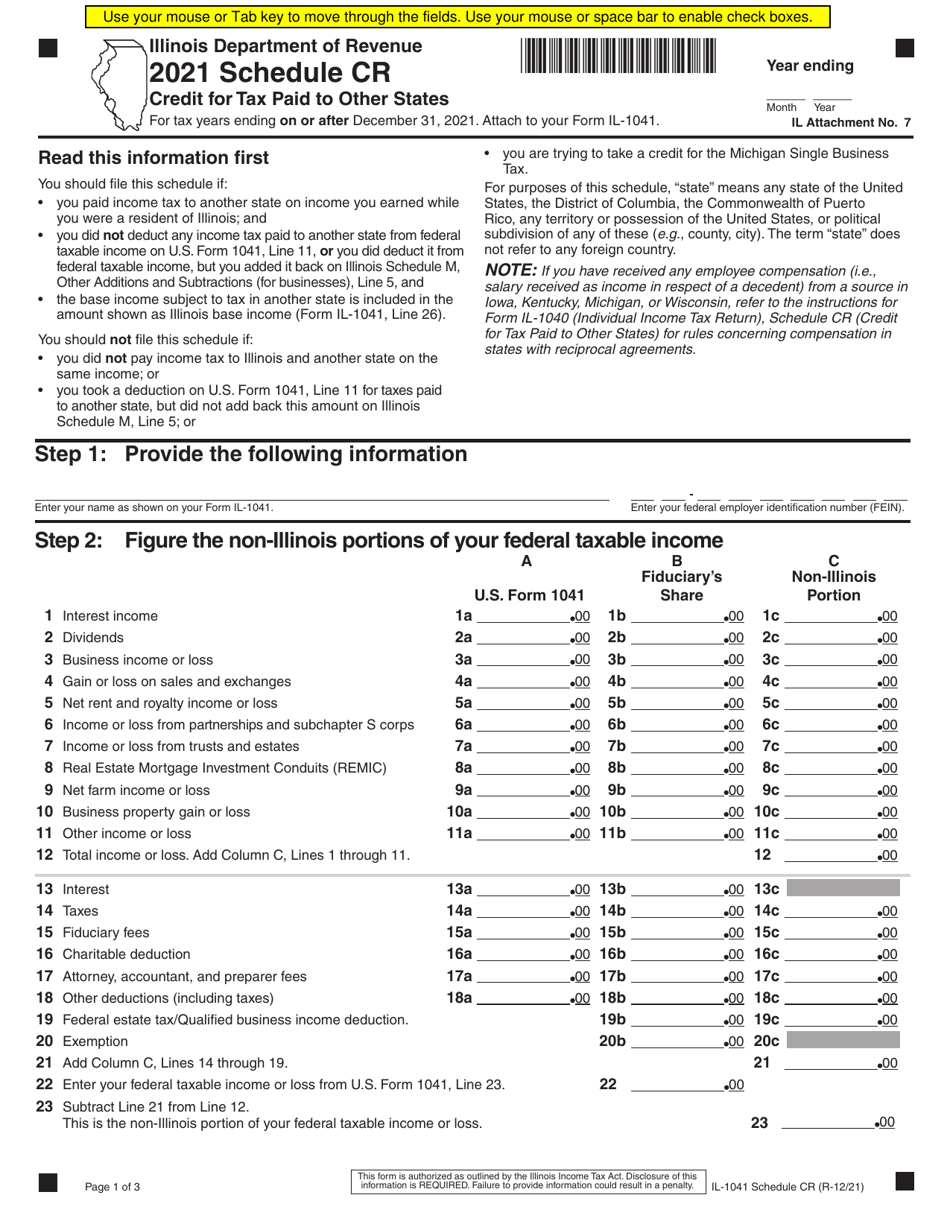

Form IL 1041 Schedule CR 2021 Fill Out Sign Online And Download Fillable PDF Illinois

Form 1041 Fillable Form Printable Forms Free Online

Irs Forms 1041 Instructions Form Resume Examples Kw9kwxQ9JN

Printable Tax Form 1041 A - Form 1041 is a Federal Estate Tax form The IRS and most states will grant an automatic 6 month extension of time to file income tax and other types of tax returns which can be obtained by filing the proper extension request form Obtaining an extension will prevent you from being subject to often very large failure to file penalties