Printable Tax Form 501 Cs Forms currently required by the IRS are Form 1023 Application for Recognition of Ex emption Under Section 501 c 3 of the Internal Revenue Code Form 1023 EZ Streamlined Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code Form 1024 Application for Recognition of Exemption Under Section 501 a o

Instructions for Form 1024 PDF Form 1024 A Application for Recognition of Exemption Under Section 501 c 4 Instructions for Form 1024 A PDF Form 1041 A U S Information Return Trust Accumulation of Charitable Amounts PDF Form 1098 C Contributions of Motor Vehicles Boats and Airplanes PDF Instructions for Form 1098 C PDF File Charities and Nonprofits How to apply for 501 c 3 status How to apply for 501 c 3 status To apply for recognition by the IRS of exempt status under IRC Section 501 c 3 you must use either Form 1023 or Form 1023 EZ

Printable Tax Form 501 Cs

Printable Tax Form 501 Cs

https://www.501c.com/wp-content/uploads/2016/05/IRS-Form-990.png

Watchtower Stock Investments Irs Tax Forms 501 C Organization

https://imgv2-1-f.scribdassets.com/img/document/375671347/original/cbf1820624/1583321605?v=1

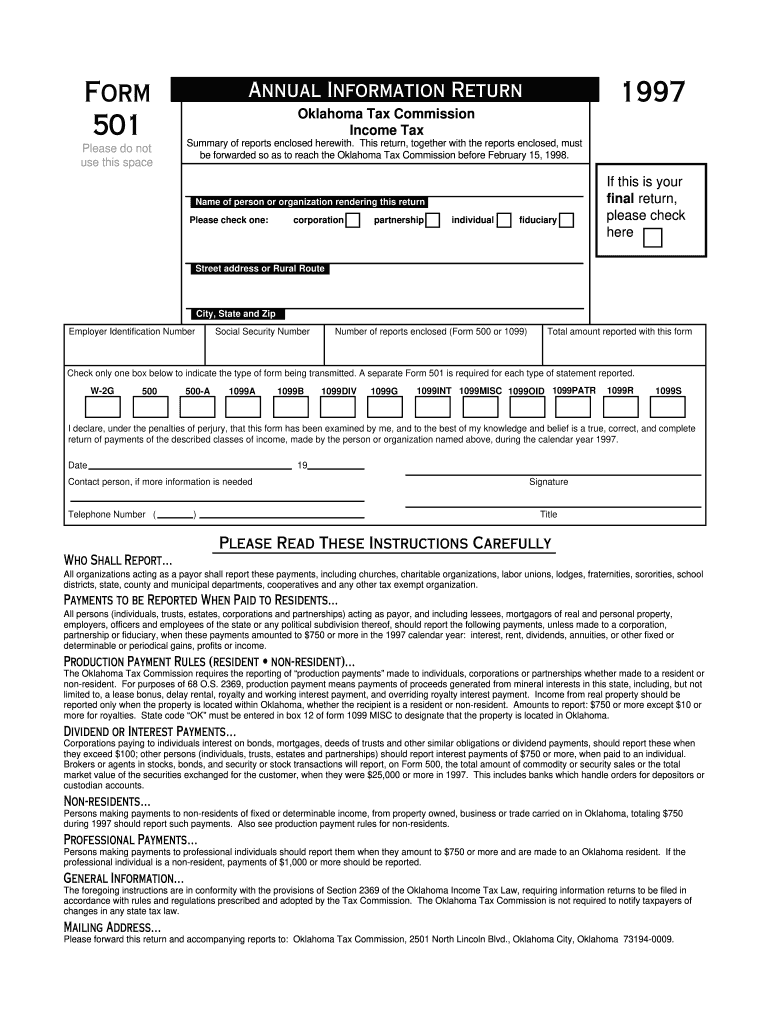

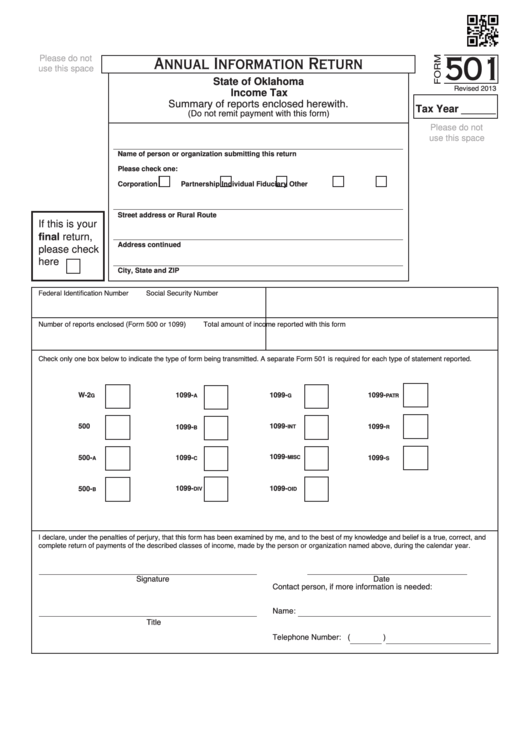

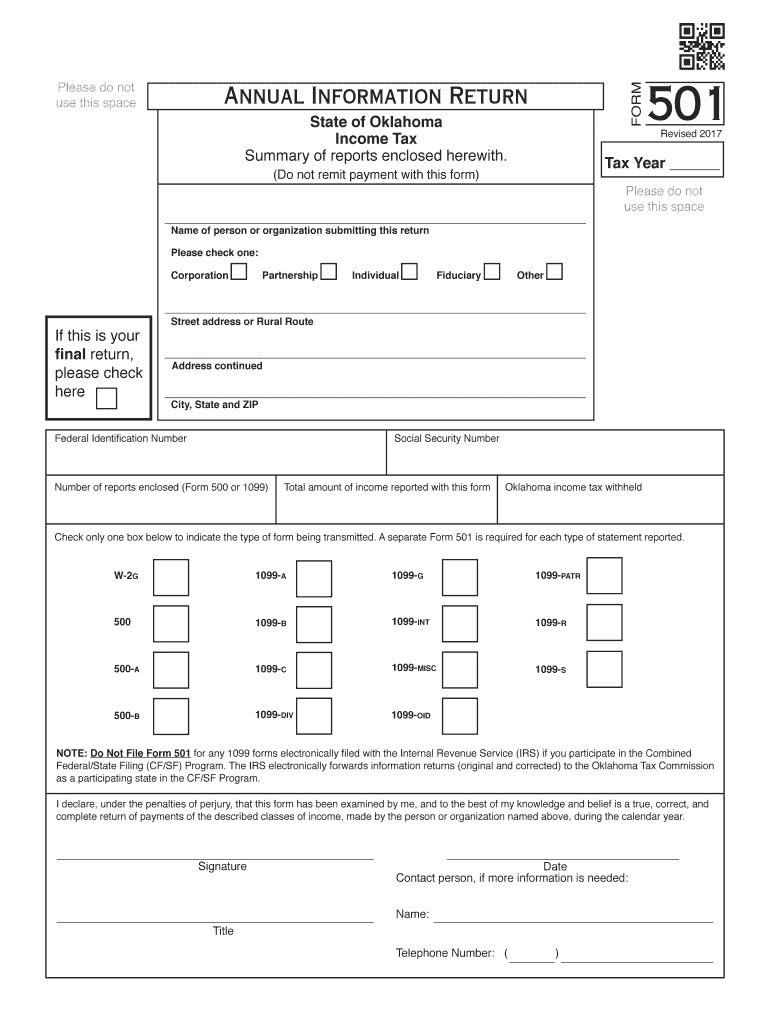

OK Form 501 1997 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/0/132/132795/large.png

Information about Form 1023 Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code including recent updates related forms and instructions on how to file Form 1023 is used to apply for recognition as a tax exempt organization To be tax exempt under section 501 c 3 of the Internal Revenue Code an organization must be organized and operated exclusively for exempt purposes set forth in section 501 c 3 and none of its earnings may inure to any private shareholder or individual

Organizations file this form to apply for recognition of exemption from federal income tax under Section 501 a other than Sections 501 c 3 or 501 c 4 or Section 521 See the Instructions for Form 1024 for help in completing this application In addition Publication 4220 Applying for 501 c 3 Tax Exempt Status PDF is designed to help prospective charities apply for tax exemption under the tax law Learn more about the benefits limitations and expectations of tax exempt organizations by attending 10 courses at the online Small to Mid Size Tax Exempt Organization Workshop

More picture related to Printable Tax Form 501 Cs

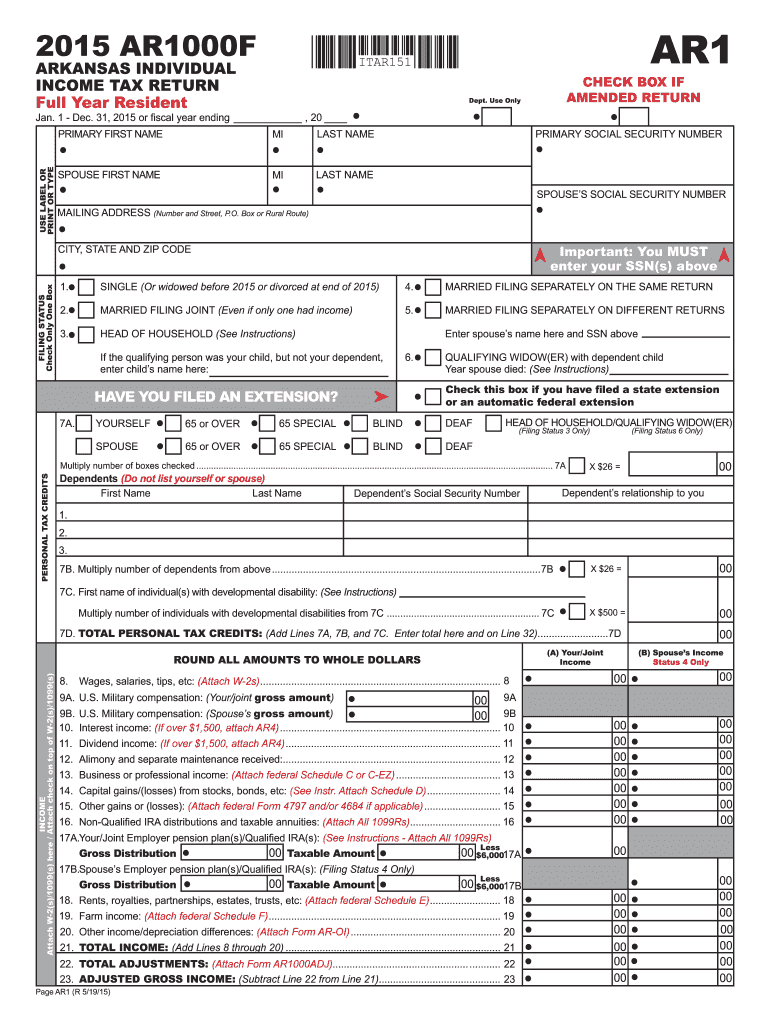

Arkansas Individual Income Tax Forms Free Fillable Printable Forms Free Online

https://www.signnow.com/preview/6/964/6964212/large.png

Printable 501C3 Form

https://syncronizer.com/wp-content/uploads/2018/08/501-c-3-tax-exempt-form.jpg

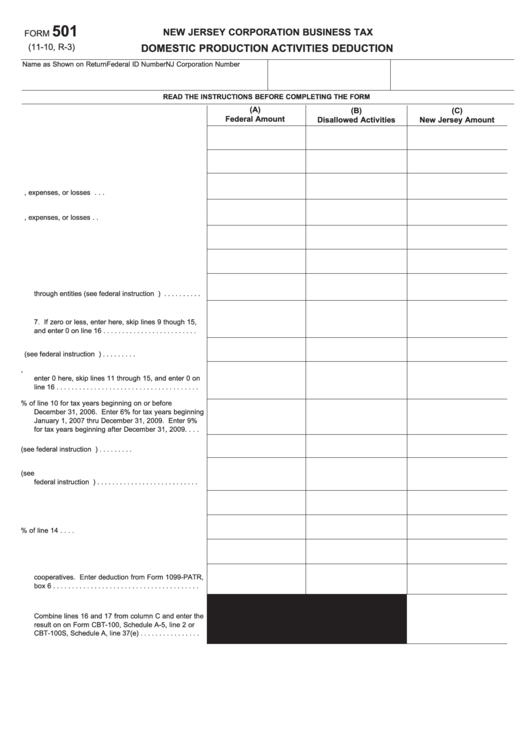

Fillable Form 501 New Jersey Corporation Business Tax Domestic Production Activities Deduction

https://data.formsbank.com/pdf_docs_html/328/3280/328086/page_1_thumb_big.png

A publication describing in question and answer format the federal tax rules that apply to group rulings of exemption under Internal Revenue Code section 501 The Restriction of Political Campaign Intervention by Section 501 c 3 Tax Exempt Organizations Political Campaign Activity by section 501 c 3 tax exempt organizations About this form Organizations file this form to apply for recognition of exemption from federal income tax under Section 501 c 3 NOTICE You may experience issues with saving a form and accessing it later If this occurs you will need to complete the form again We apologize for this inconvenience

Getty A 501 c 3 is a corporation that receives tax exempt status from the Internal Revenue Service IRS To get the 501 c 3 status a corporation must file for a Recognition of Exemption Form 1024 Rev January 2018 Department of the Treasury Internal Revenue Service Application for Recognition of Exemption Under Section 501 a Go to www irs gov Form1024 for instructions and the latest information OMB No 1545 0057 If exempt status is approved this application will be open for public inspection

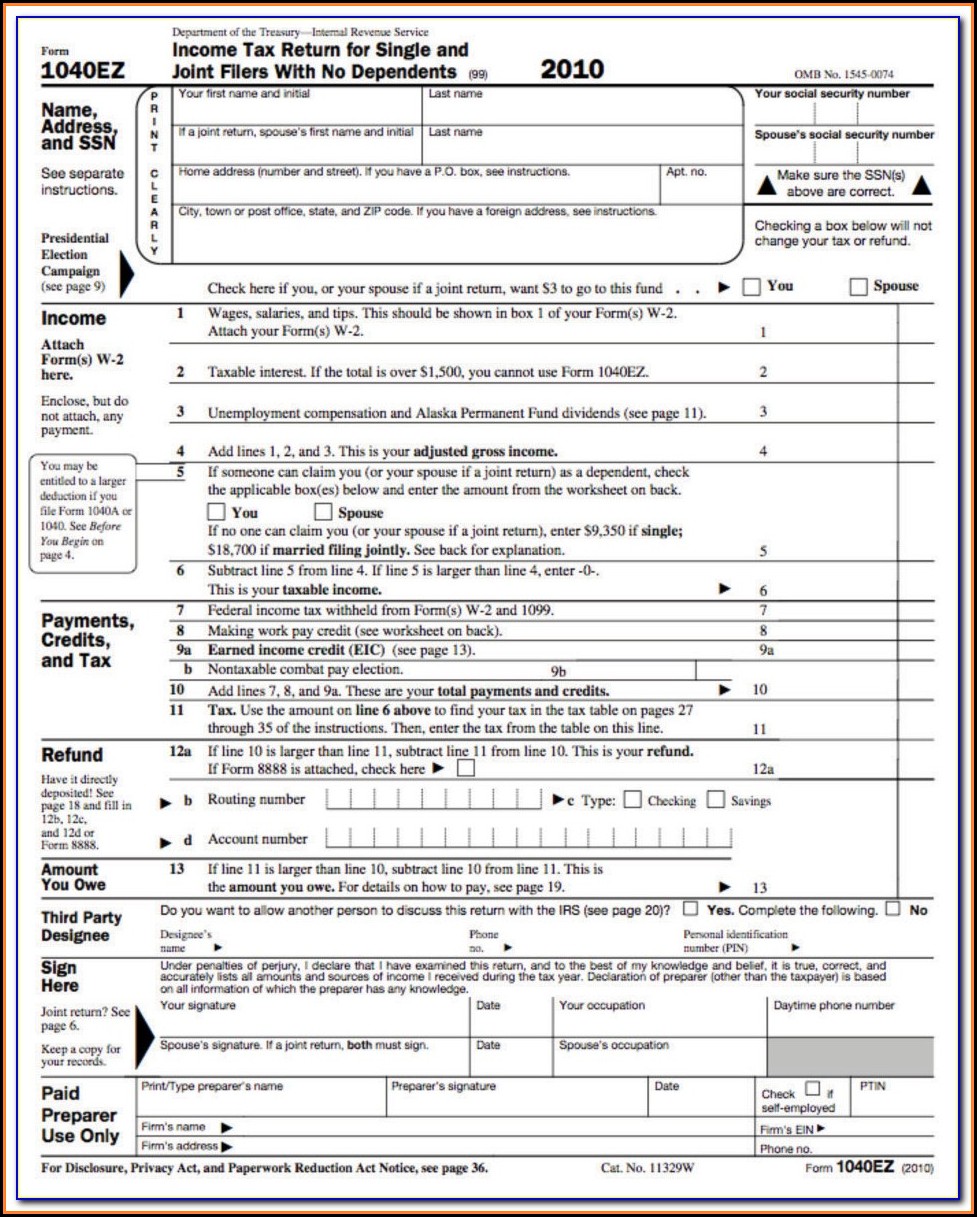

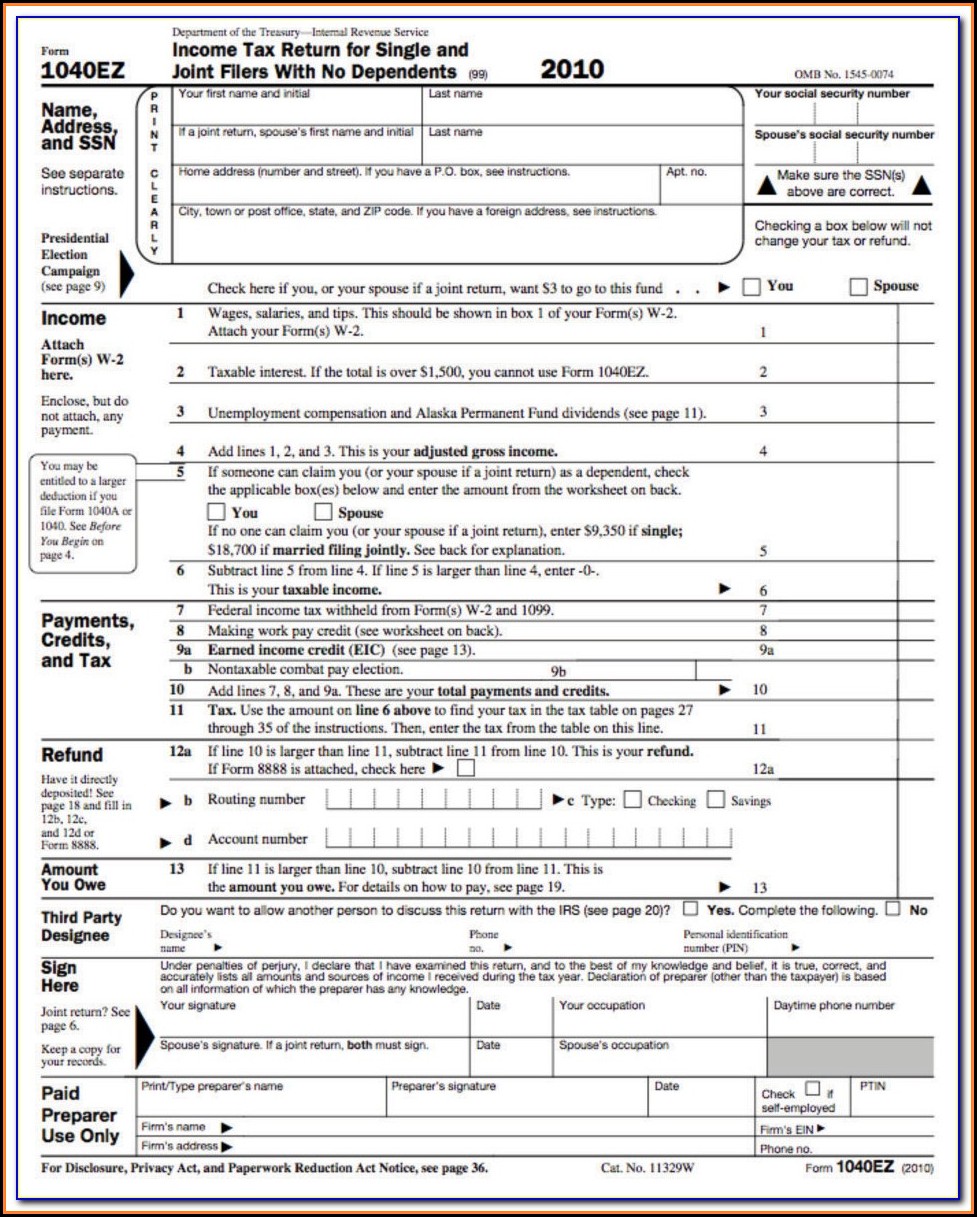

Federal Tax Forms 2023 Printable Printable Forms Free Online

https://www.contrapositionmagazine.com/wp-content/uploads/2019/12/printable-federal-tax-forms-1040ez.jpg

Fillable Form 501 Annual Information Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/323/3230/323040/page_1_thumb_big.png

https://www.irs.gov/charities-non-profits/other-non-profits/exempt-organizations-application-forms

Forms currently required by the IRS are Form 1023 Application for Recognition of Ex emption Under Section 501 c 3 of the Internal Revenue Code Form 1023 EZ Streamlined Application for Recognition of Exemption Under Section 501 c 3 of the Internal Revenue Code Form 1024 Application for Recognition of Exemption Under Section 501 a o

https://www.irs.gov/charities-non-profits/exempt-organizations-forms-and-instructions

Instructions for Form 1024 PDF Form 1024 A Application for Recognition of Exemption Under Section 501 c 4 Instructions for Form 1024 A PDF Form 1041 A U S Information Return Trust Accumulation of Charitable Amounts PDF Form 1098 C Contributions of Motor Vehicles Boats and Airplanes PDF Instructions for Form 1098 C PDF

DonorsTrust522166327 2011 08d29028Searchable Irs Tax Forms 501 C Organization

Federal Tax Forms 2023 Printable Printable Forms Free Online

Free Printable Irs Tax Forms Printable Templates

Tax Forms For 501c3 Organizations Form Resume Examples lV8NeRg30o

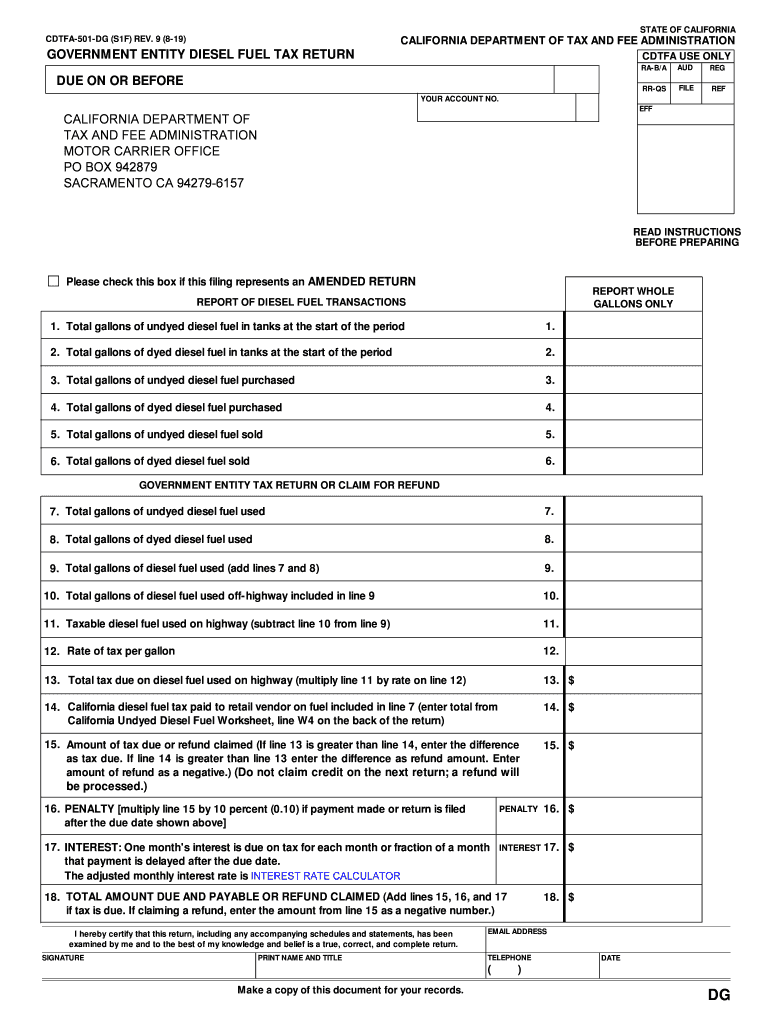

CA CDTFA 501 DG formerly BOE 501 DG 2019 2022 Fill Out Tax Template Online US Legal Forms

Irs 501c3 Form 1023 Form Resume Examples EvkBMrPO2d

Irs 501c3 Form 1023 Form Resume Examples EvkBMrPO2d

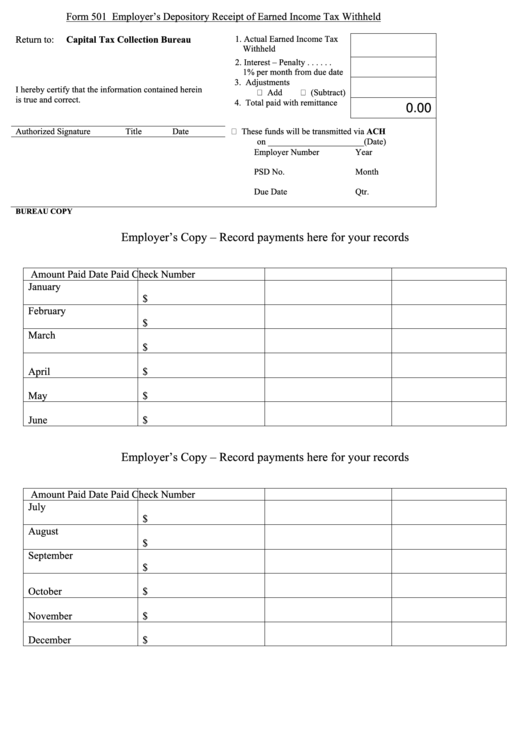

Fillable Form 501 Employer S Depository Receipt Of Earned Income Tax Withheld Printable Pdf

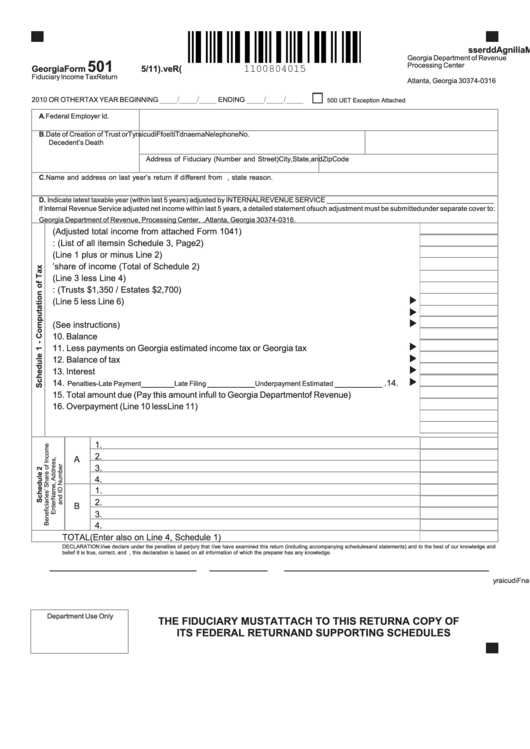

Fillable Form 501 Fiduciary Income Tax Return 2011 Printable Pdf Download

Oklahoma 501 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

Printable Tax Form 501 Cs - About this form Eligible organizations file this form to apply for recognition of exemption from federal income tax under Section 501 c 3 Note You must complete the Form 1023 EZ Eligibility Worksheet in the Instructions for Form 1023 EZ to determine if you are eligible to file Form 1023 EZ If you are not eligible to file Form 1023 EZ