Printable W Form For Business In Louisiana LaTAP Online Payment Vouchers Online Taxpayer Education Tax Calendar Tax Clearances What to Bring When Visiting LDR Income Tax Extension Payments Businesses LaTAP Access your account online File returns and make payments

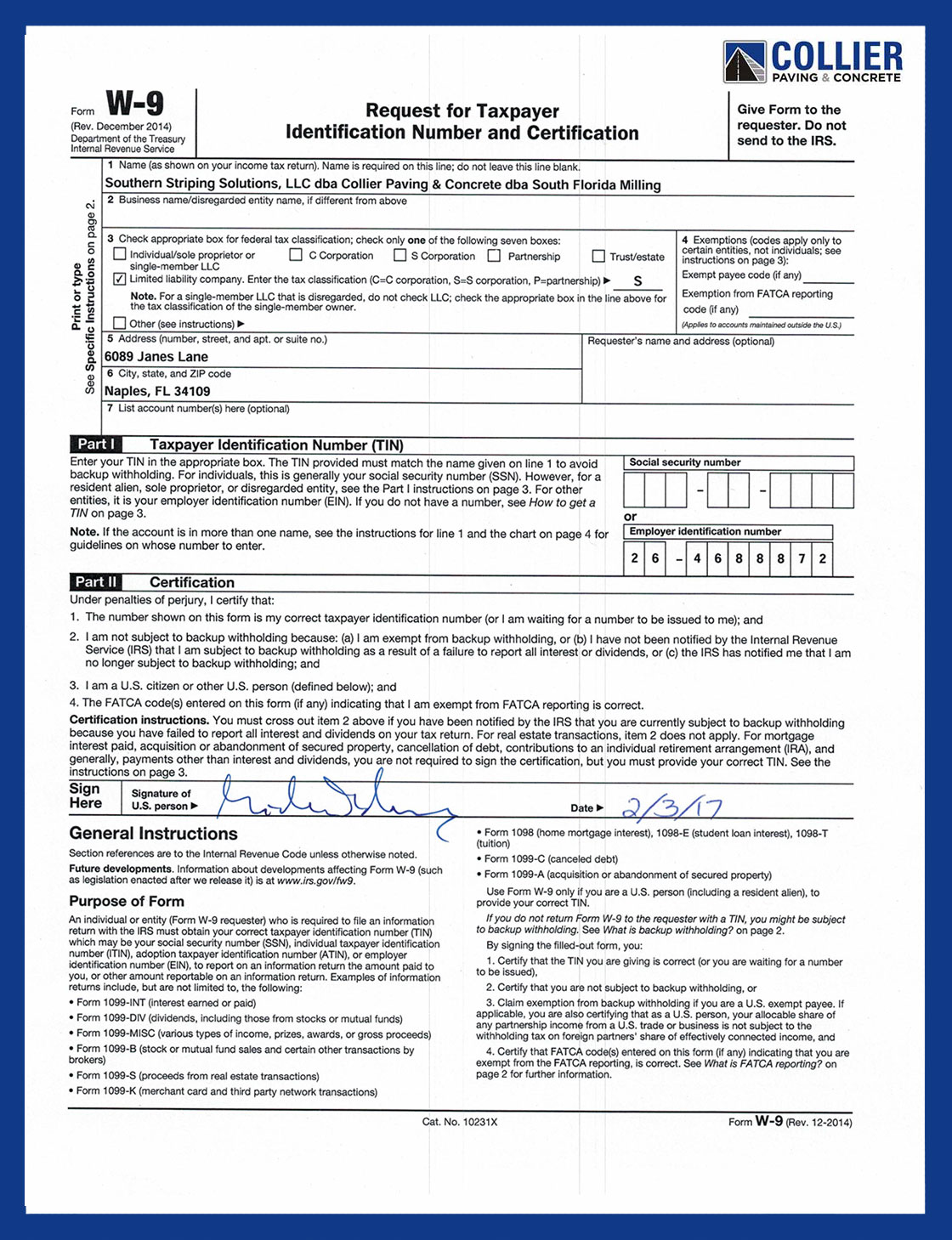

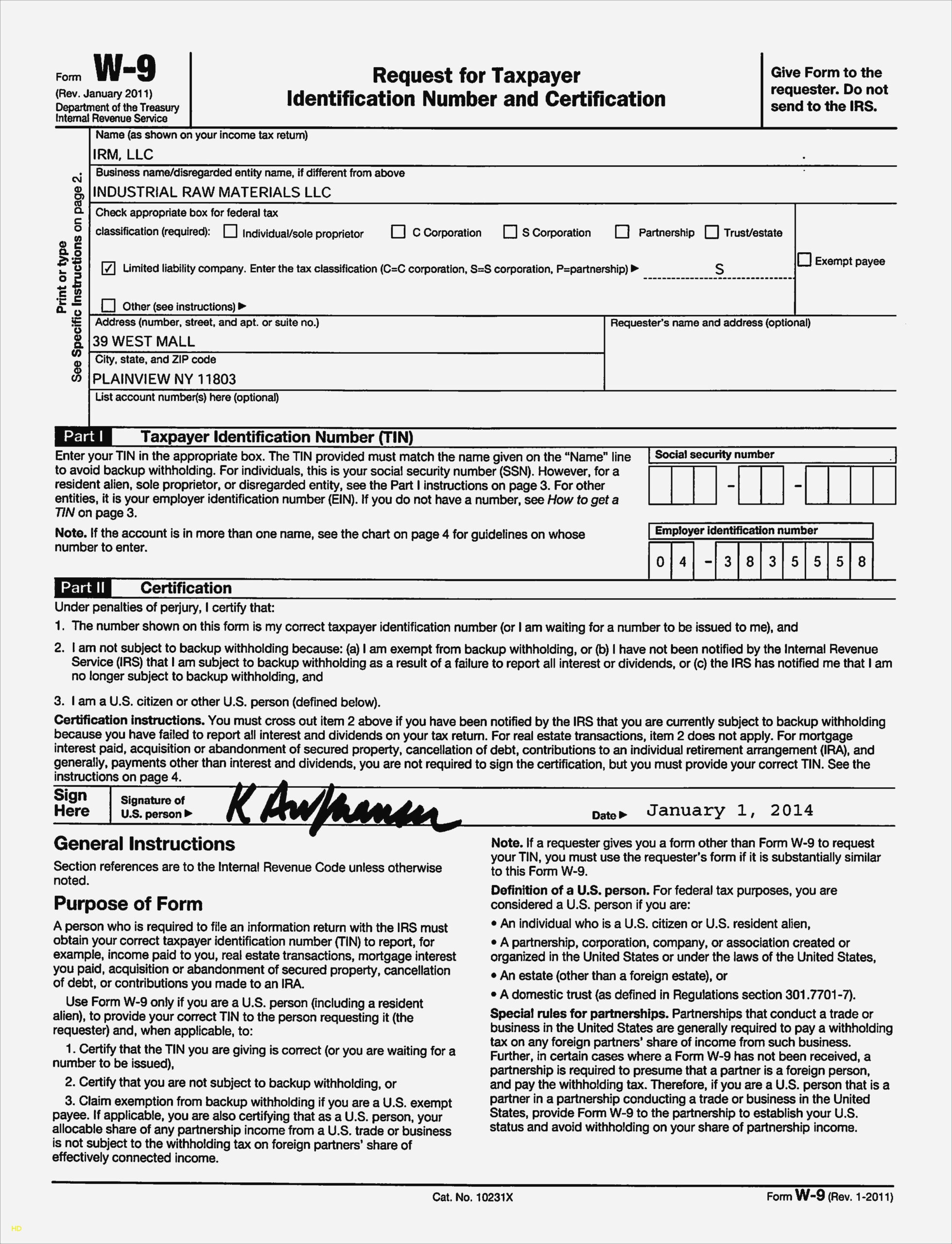

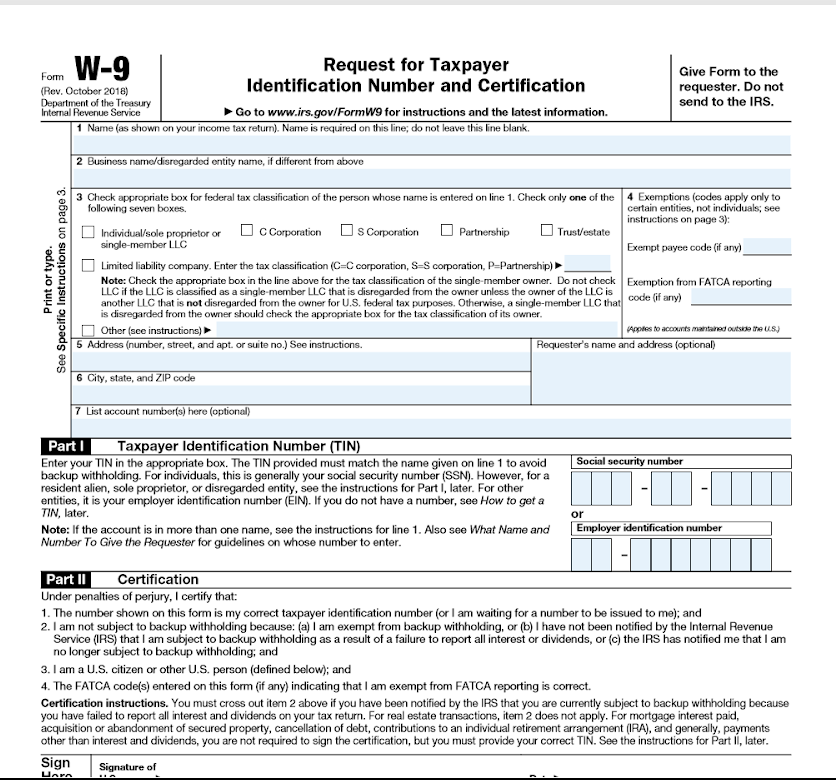

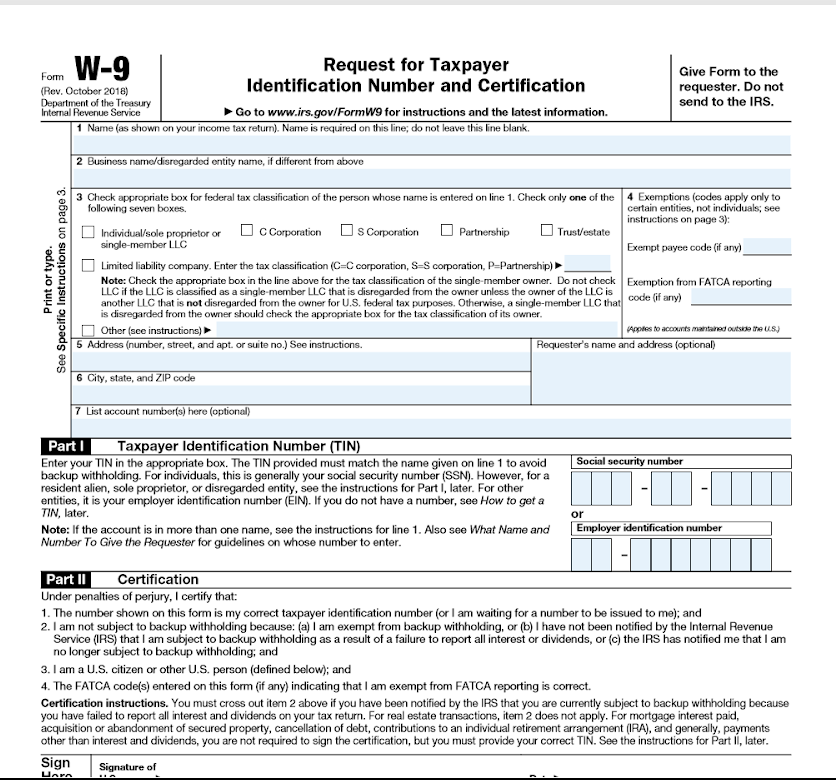

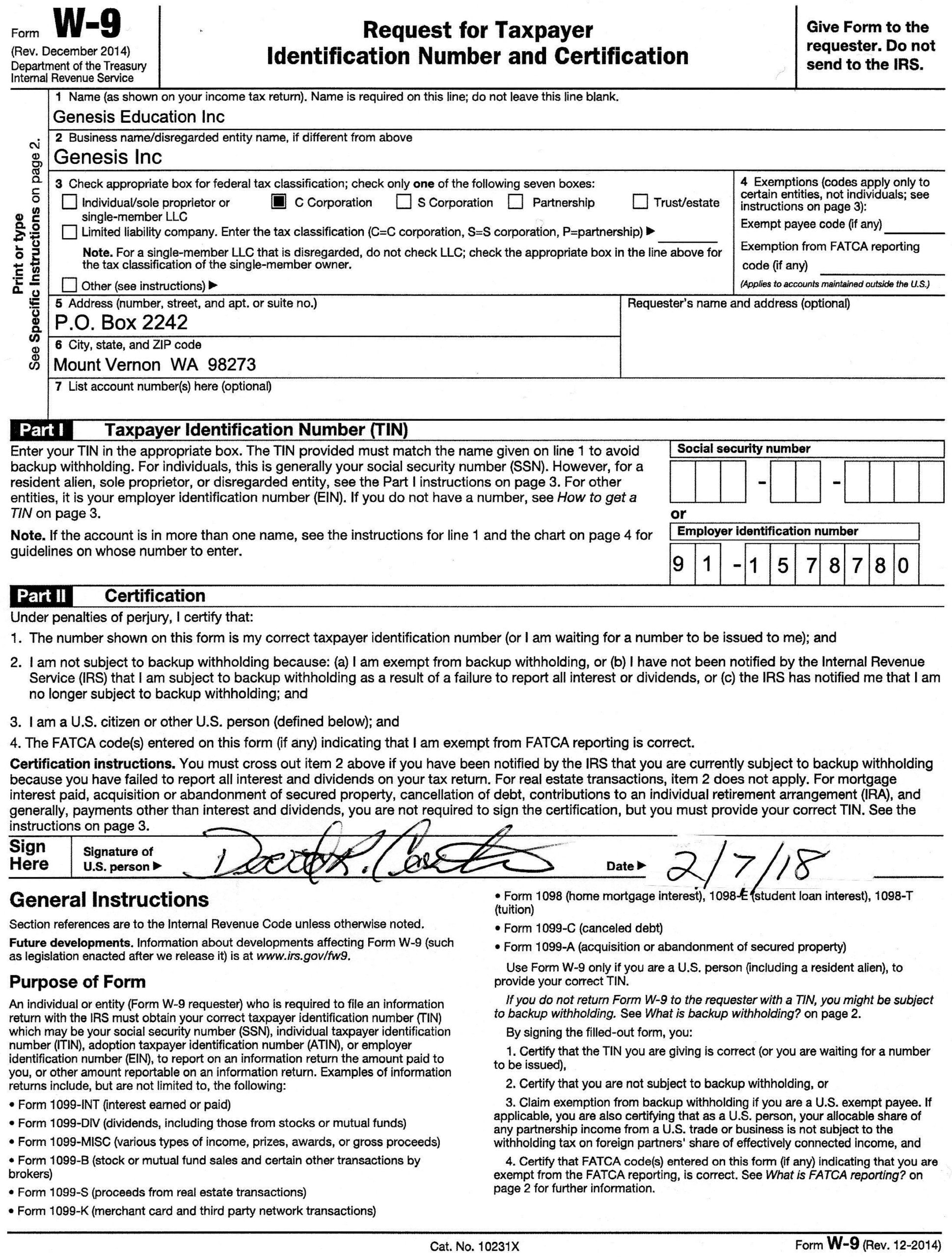

Do not send to the IRS 4 Exemptions codes apply only to certain entities not individuals see instructions on page 3 Exempt payee code if any Limited liability company Enter the tax classification C C corporation S S corporation P Partnership Louisiana Stadium and Exhibition District Ernest N Morial Exhibition Hall Authority Hotel Motel Sales Tax Instructions 07 01 2022 present Form R 1029DSEi R 1029DSOi Business Taxes Address Change Form 12 01 2015 present Form R 6450 R 68001 Installment Request from Business Taxes Bank Debit Application

Printable W Form For Business In Louisiana

Printable W Form For Business In Louisiana

https://printablew9.com/wp-content/uploads/2022/09/blank-printable-w-9-2022.png

Form Louisiana Department Of Revenue Louisiana Gov Revenue Louisiana Fill Out And Sign

https://www.signnow.com/preview/50/351/50351798/large.png

Free Printable W 4 Form For Employees Printable Templates

https://storage.store2phone.com/industriesData/307/ScreenShots/LiveApp/f8b733a0-1a21-4927-9429-4ddb781b6ab0.PNG

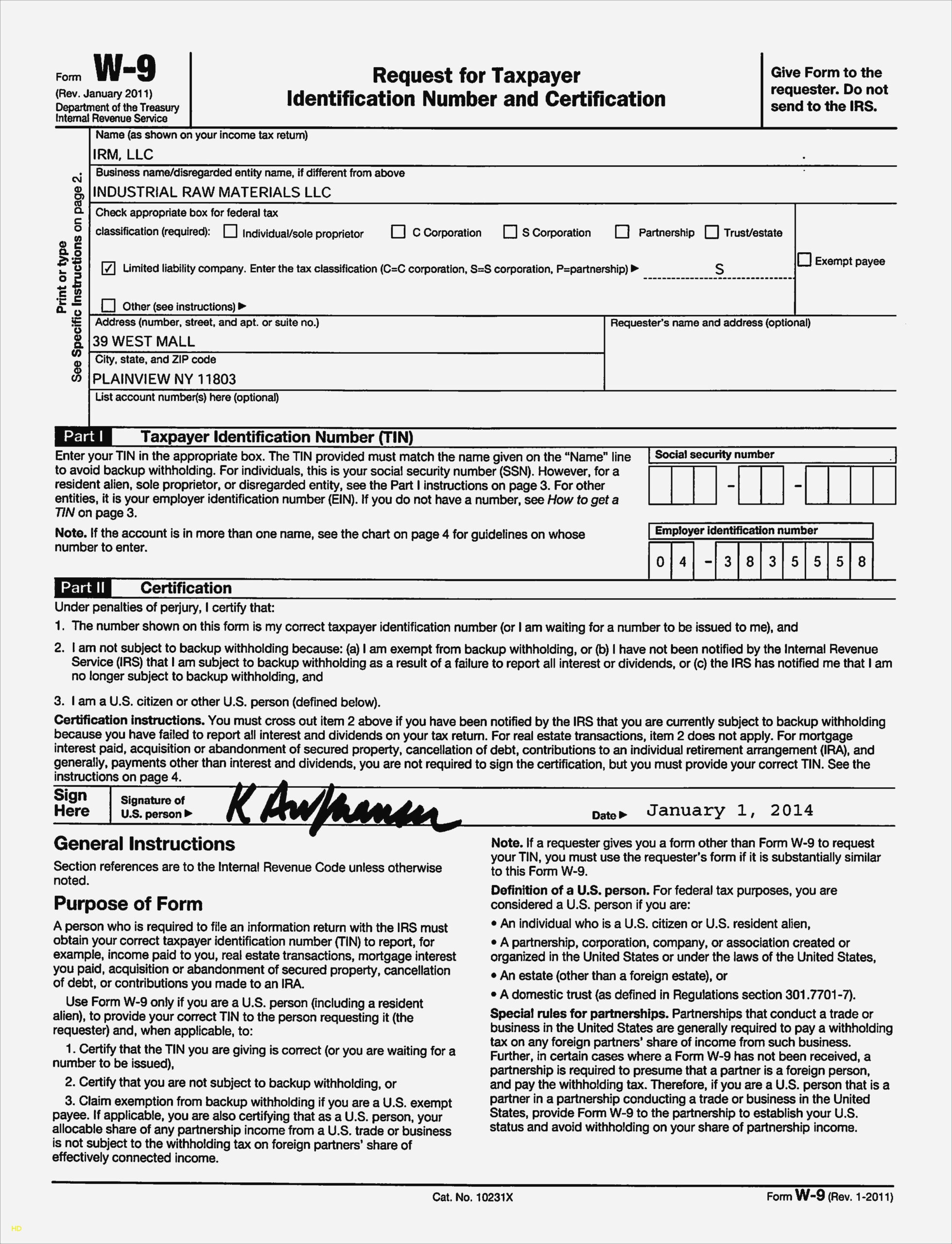

Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS to report for example Income paid to you Real estate transactions Mortgage interest you paid Acquisition or abandonment of secured property Cancellation of debt Contributions you made to an IRA The Treasury Internal Revenue Service Number and Certification Name as shown on your income tax return Give Form to the requester Do not send to the IRS Business name disregarded entity name if different from above Check appropriate box for federal tax classification required Individual sole proprietor C Corporation Corporation

Give Form to the requester Do not send to the IRS 4 Exemptions codes apply only to certain entities not individuals see instructions on page 3 Exempt payee code if any Limited liability company Enter the tax classification C C corporation S S corporation P Partnership Note Check the appropriate box in the line above for the tax Print Start a Business An important step in forming a new business is to determine the type of business structure that you will use There are several business structures to choose from including sole proprietorship partnership corporation limited liability company and limited liability partnership

More picture related to Printable W Form For Business In Louisiana

Form W 2 2023 Printable Forms Free Online

https://digitalasset.intuit.com/IMAGE/A7WppZmhG/2022-w-2-form.jpg

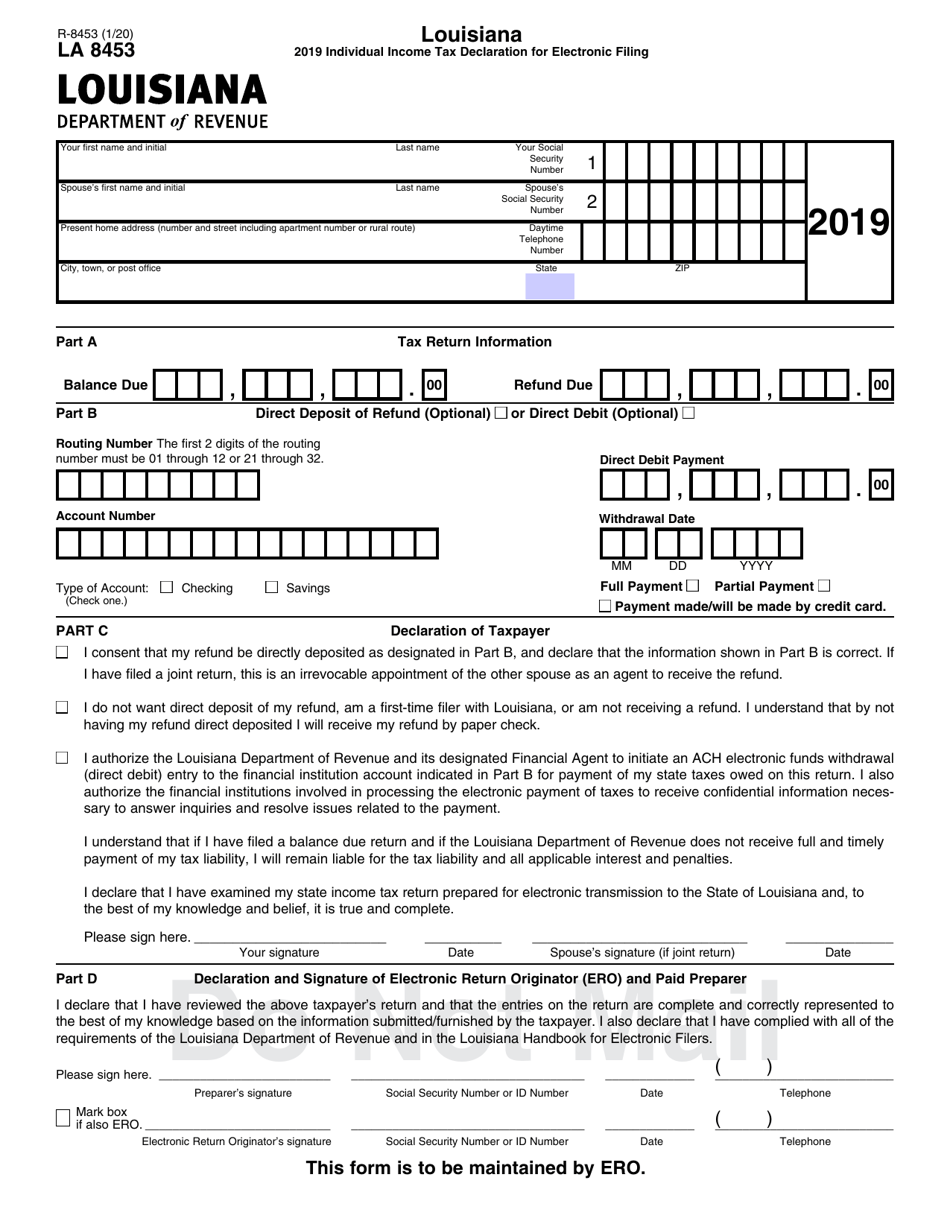

Form R 8453 Download Fillable PDF Or Fill Online Louisiana Individual Income Tax Declaration For

https://data.templateroller.com/pdf_docs_html/2060/20606/2060680/form-r-8453-louisiana-individual-income-tax-declaration-for-electronic-filing-louisiana_print_big.png

Form W 9 2020 Printable 354

https://oyungurup.com/wp-content/uploads/2019/09/printable-w-9-form-basecampjonkoping-se-blank-w-9-form-2020-printable.jpg

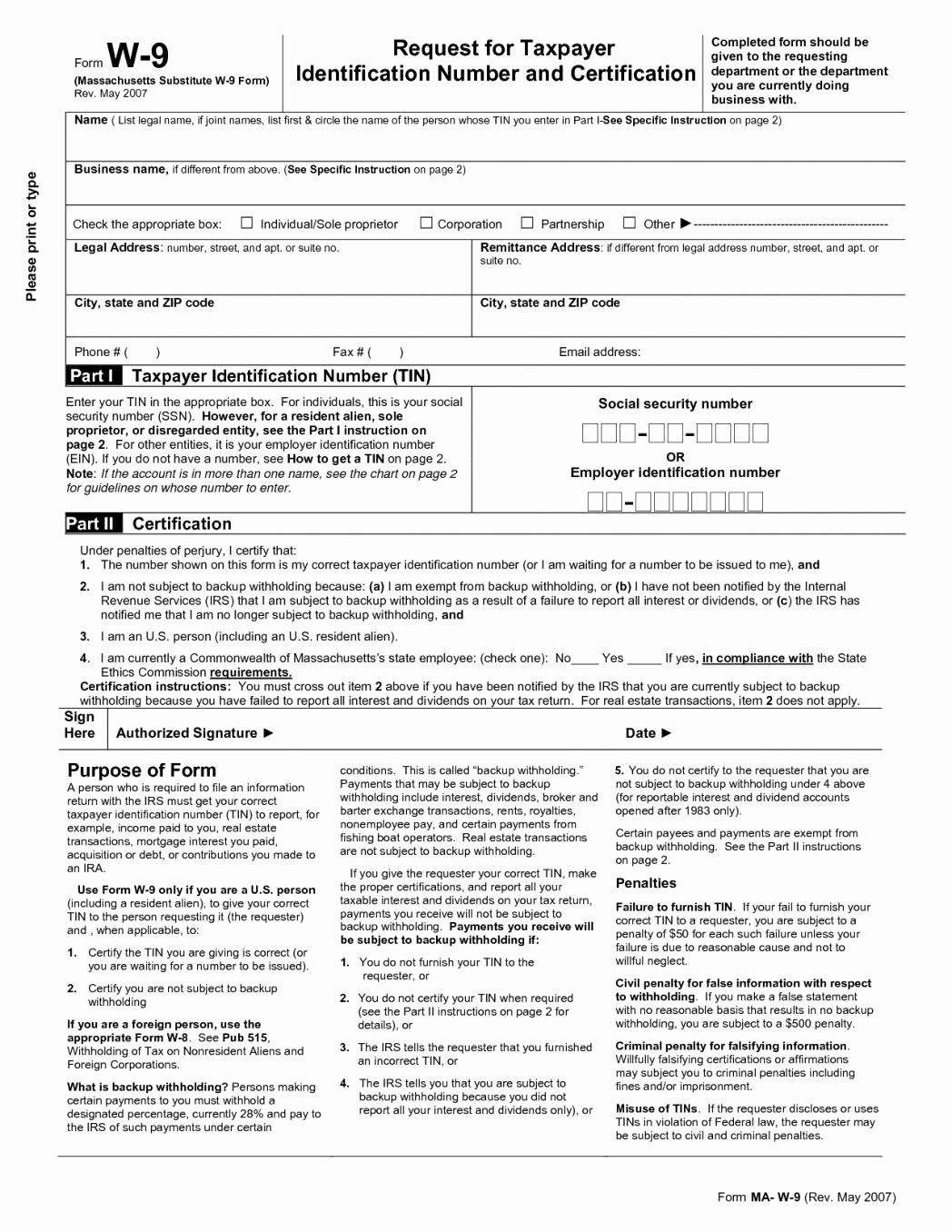

Purpose of Form An individual or entity Form W g requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number TIN which may be your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identif Print Get Forms Fee Schedule Effective January 1 2018 business owners in the following parishes will be required to file all available business documents online through geauxBIZ Ascension Bossier Caddo Calcasieu East Baton Rouge Jefferson Lafayette Livingston Orleans Ouachita Rapides St Tammany Tangipahoa and Terrebonne

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject to review by the IRS 2022 Step 1 Enter Personal Information First name and middle initial First name and middle initial Do not send to the IRS Name as shown on your income tax return Business name if different from above Check appropriate box Individual Sole proprietor Corporation Partnership Other Exempt from backup withholding Address number street and apt or suite no City state and ZIP code Requester s name and address optional

Printable W Form For Business In Louisiana Printable Forms Free Online

https://oyungurup.com/wp-content/uploads/2021/05/sample-w-9-form-example-calendar-printable-irs-w-9-form-2021-printable.jpg

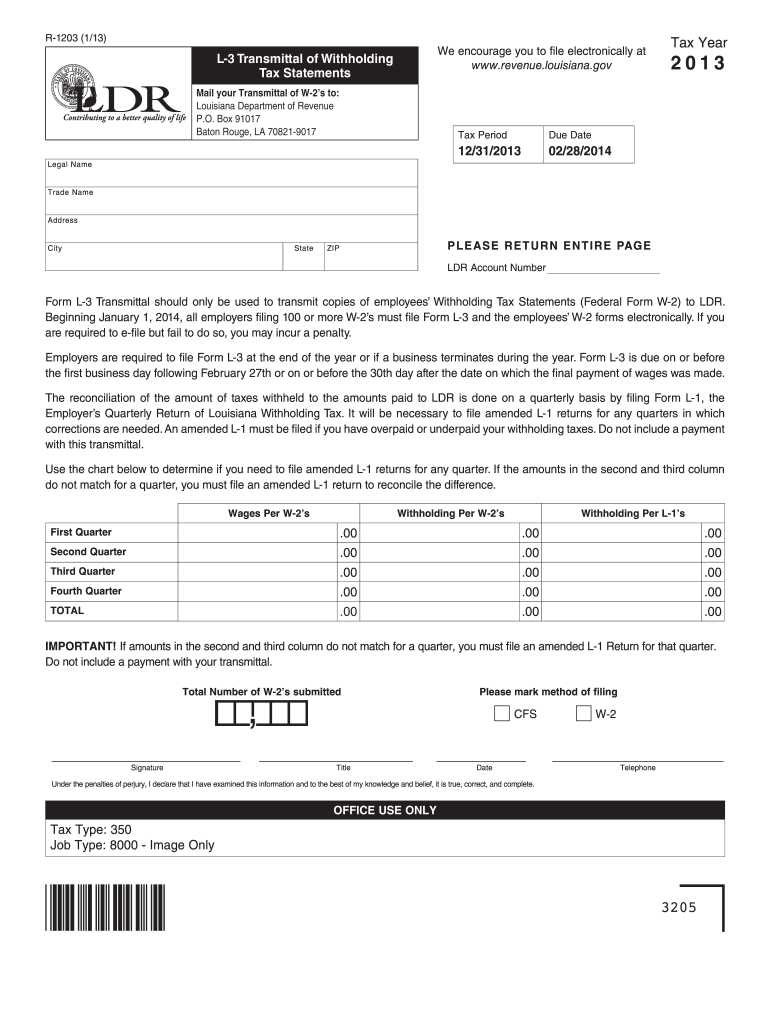

L4 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/0/114/114691/large.png

https://www.revenue.louisiana.gov/Forms

LaTAP Online Payment Vouchers Online Taxpayer Education Tax Calendar Tax Clearances What to Bring When Visiting LDR Income Tax Extension Payments Businesses LaTAP Access your account online File returns and make payments

https://www.irs.gov/pub/irs-pdf/fw9.pdf

Do not send to the IRS 4 Exemptions codes apply only to certain entities not individuals see instructions on page 3 Exempt payee code if any Limited liability company Enter the tax classification C C corporation S S corporation P Partnership

Irs Printable W 9 Form 2023 Printable Cards

Printable W Form For Business In Louisiana Printable Forms Free Online

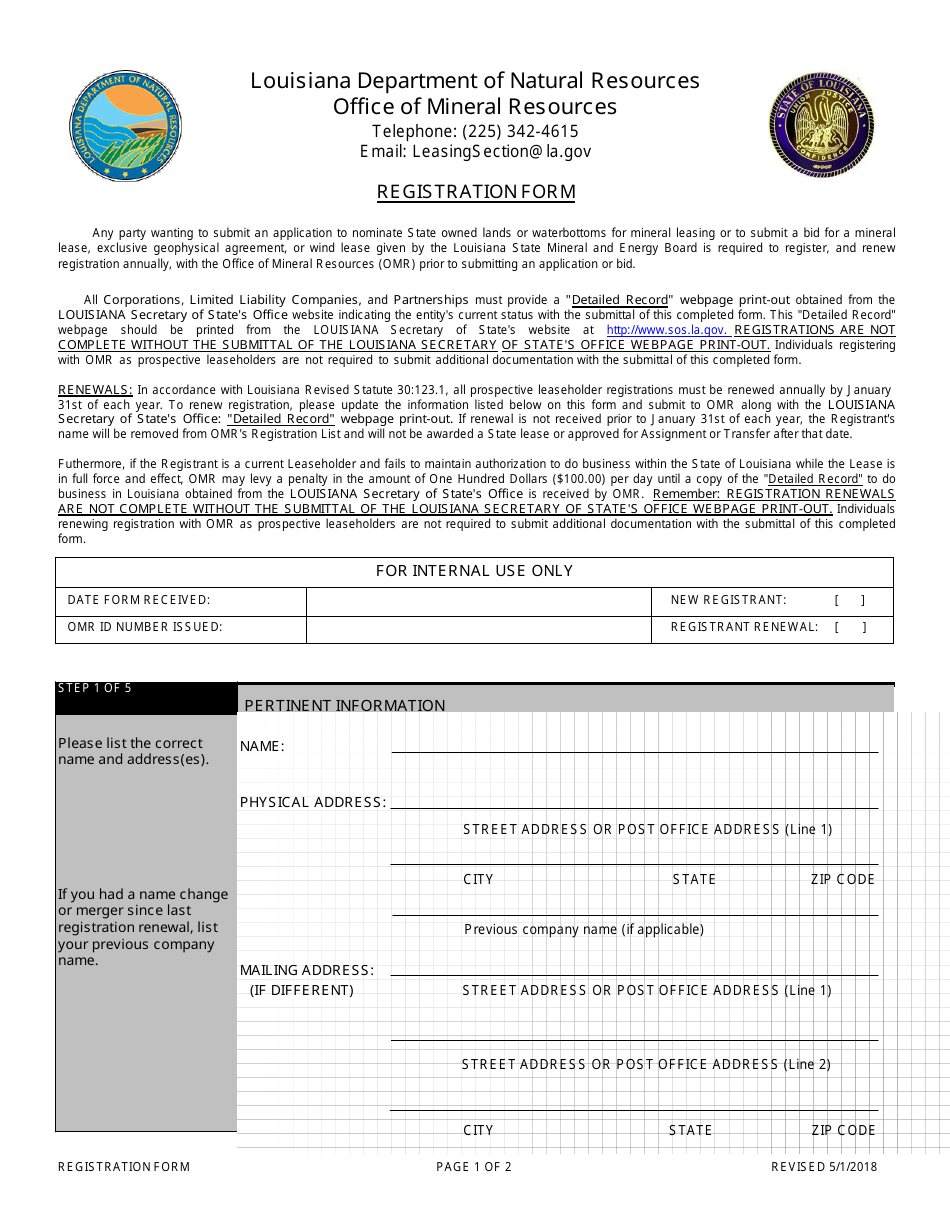

Louisiana Registration Form Fill Out Sign Online And Download PDF Templateroller

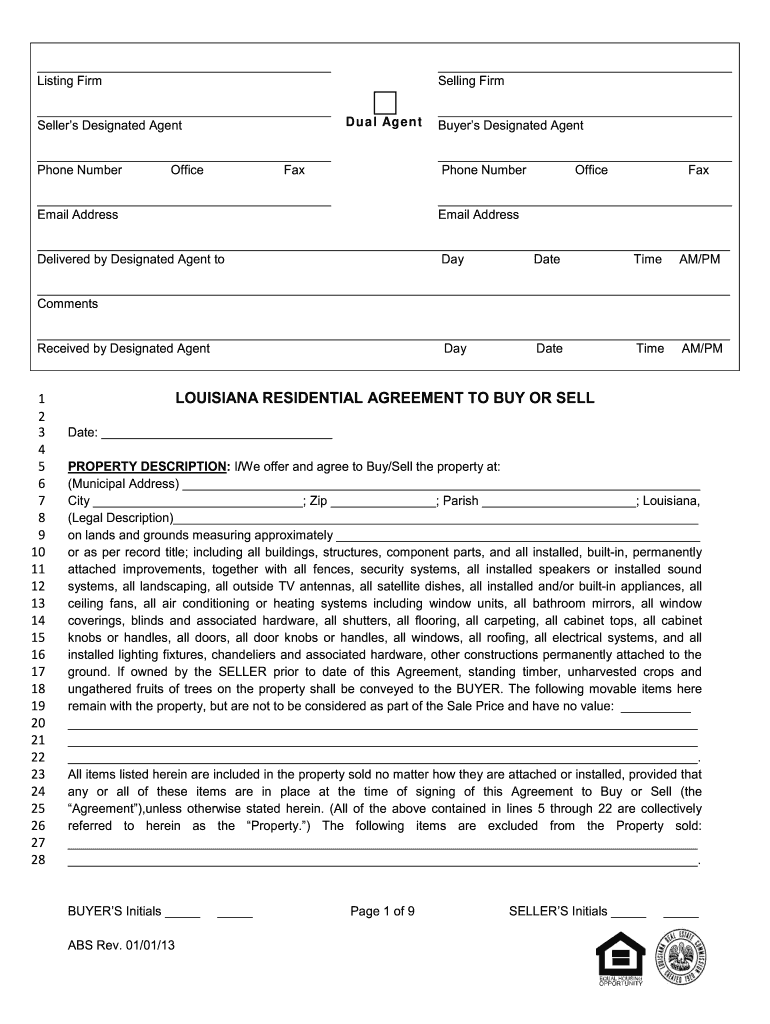

Louisiana Agreement Purchase 2013 Form Fill Out Sign Online DocHub

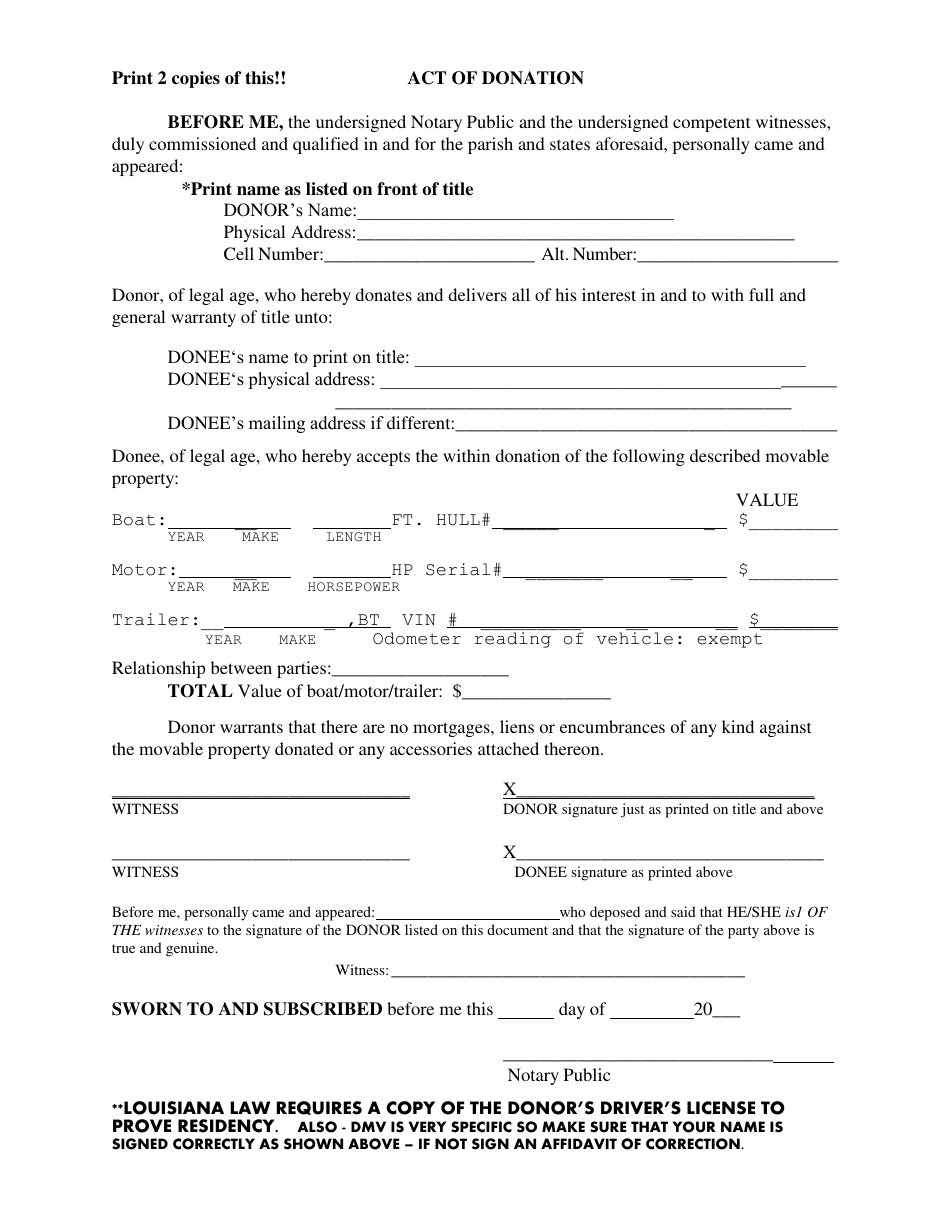

Free Printable Act Of Donation Form Louisiana Printable Templates

Printable W9 Form Louisiana Printable Forms Free Online

Printable W9 Form Louisiana Printable Forms Free Online

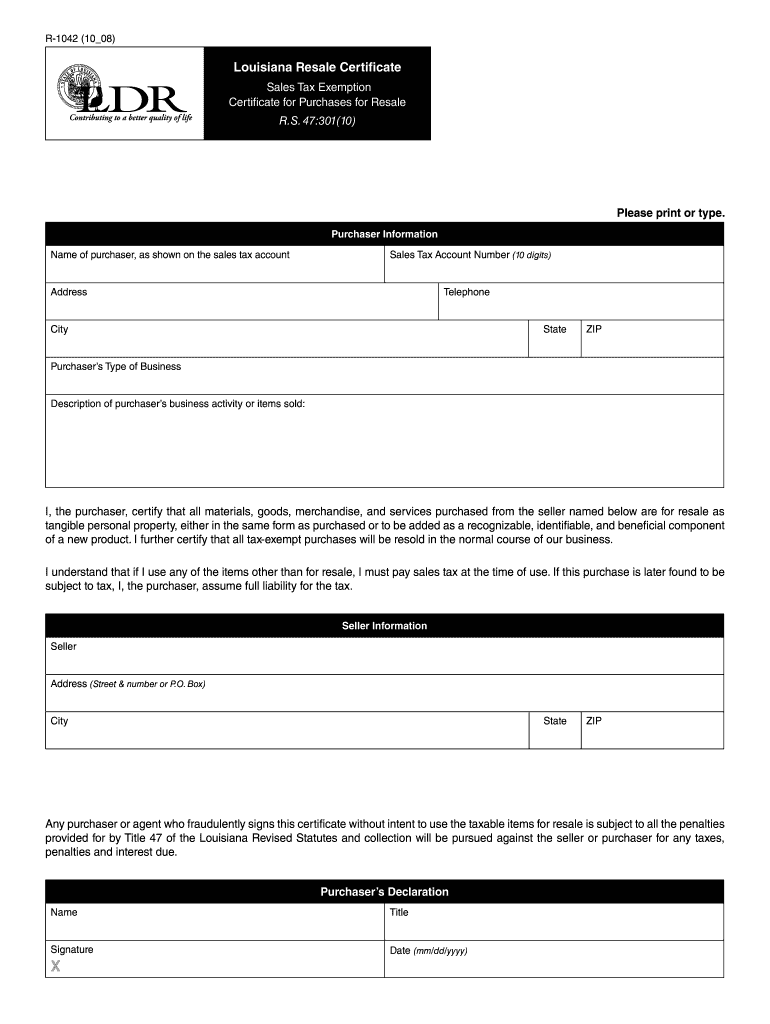

Louisiana Resale Certificate Pdf Fill Online Printable Fillable Blank PdfFiller

Printable W9 Form 2022 Free Customize And Print

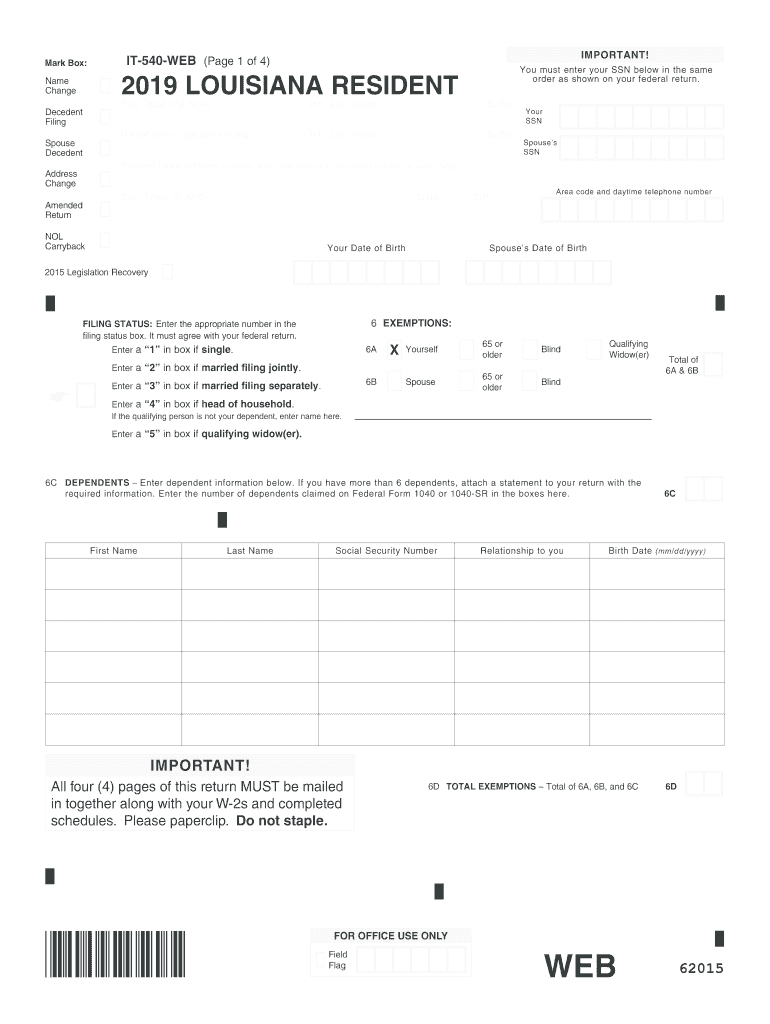

2019 Form LA IT 540 Fill Online Printable Fillable Blank PdfFiller

Printable W Form For Business In Louisiana - Give Form to the requester Do not send to the IRS 4 Exemptions codes apply only to certain entities not individuals see instructions on page 3 Exempt payee code if any Limited liability company Enter the tax classification C C corporation S S corporation P Partnership Note Check the appropriate box in the line above for the tax