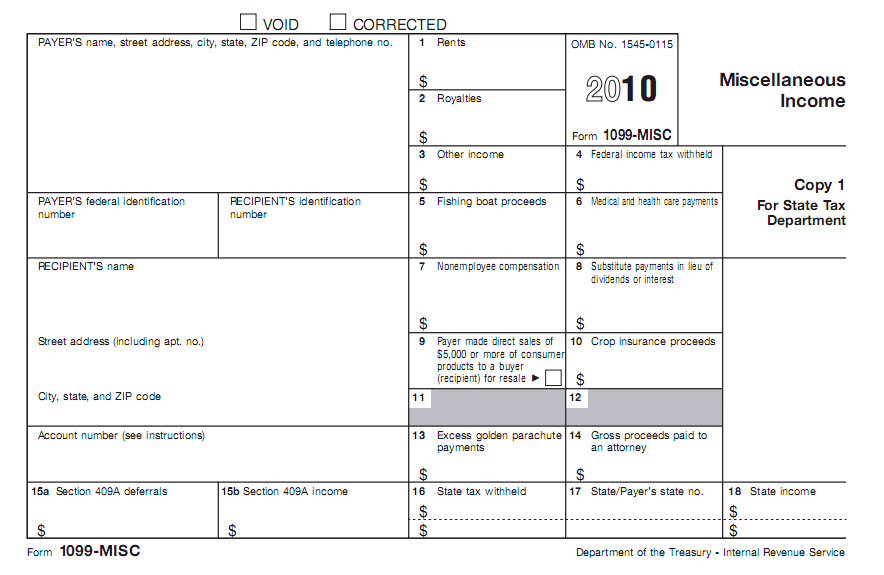

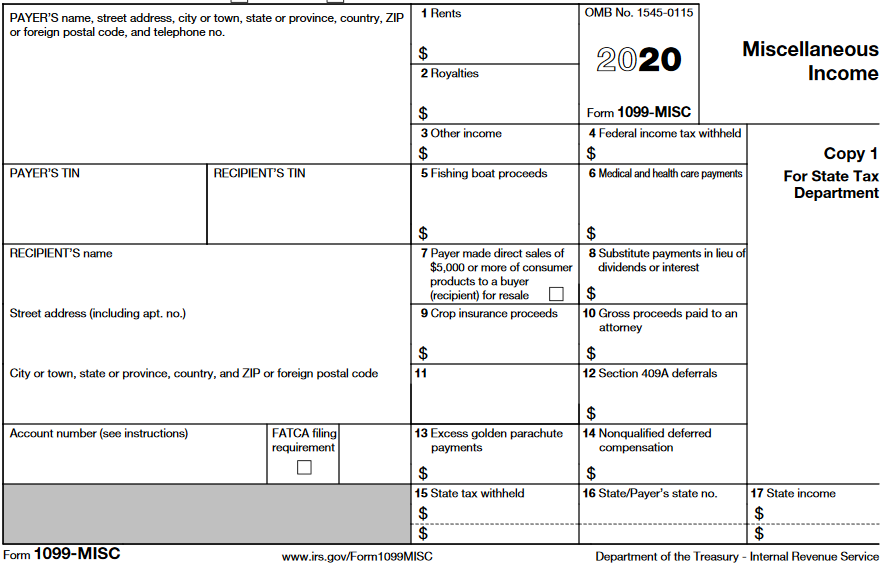

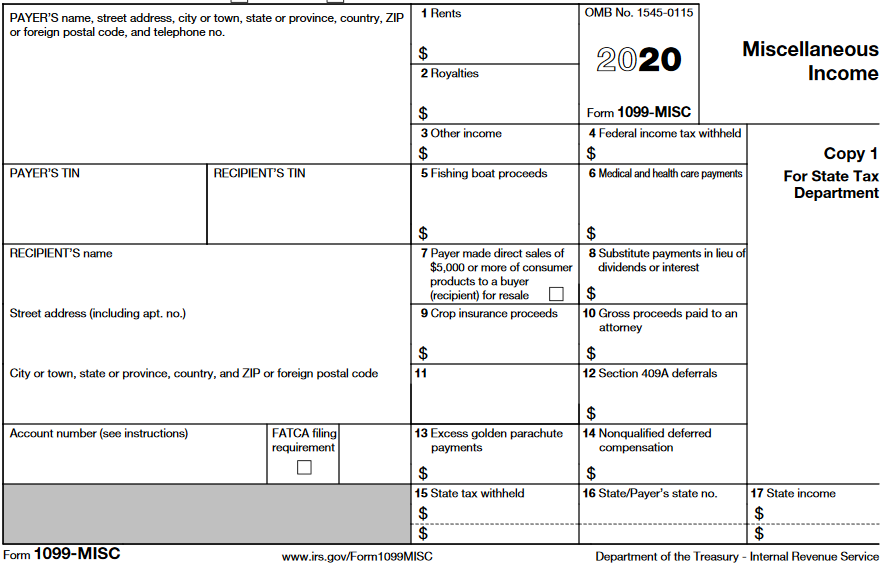

Printable W2 And 1099 Forms When a taxpayer files both a Form W 2 and Form 1099 MISC for a worker for the same year and payments reported on each information return were made during the same period of time the taxpayer may argue that the worker was performing two separate and distinct services one as an employee and one as an independent contractor

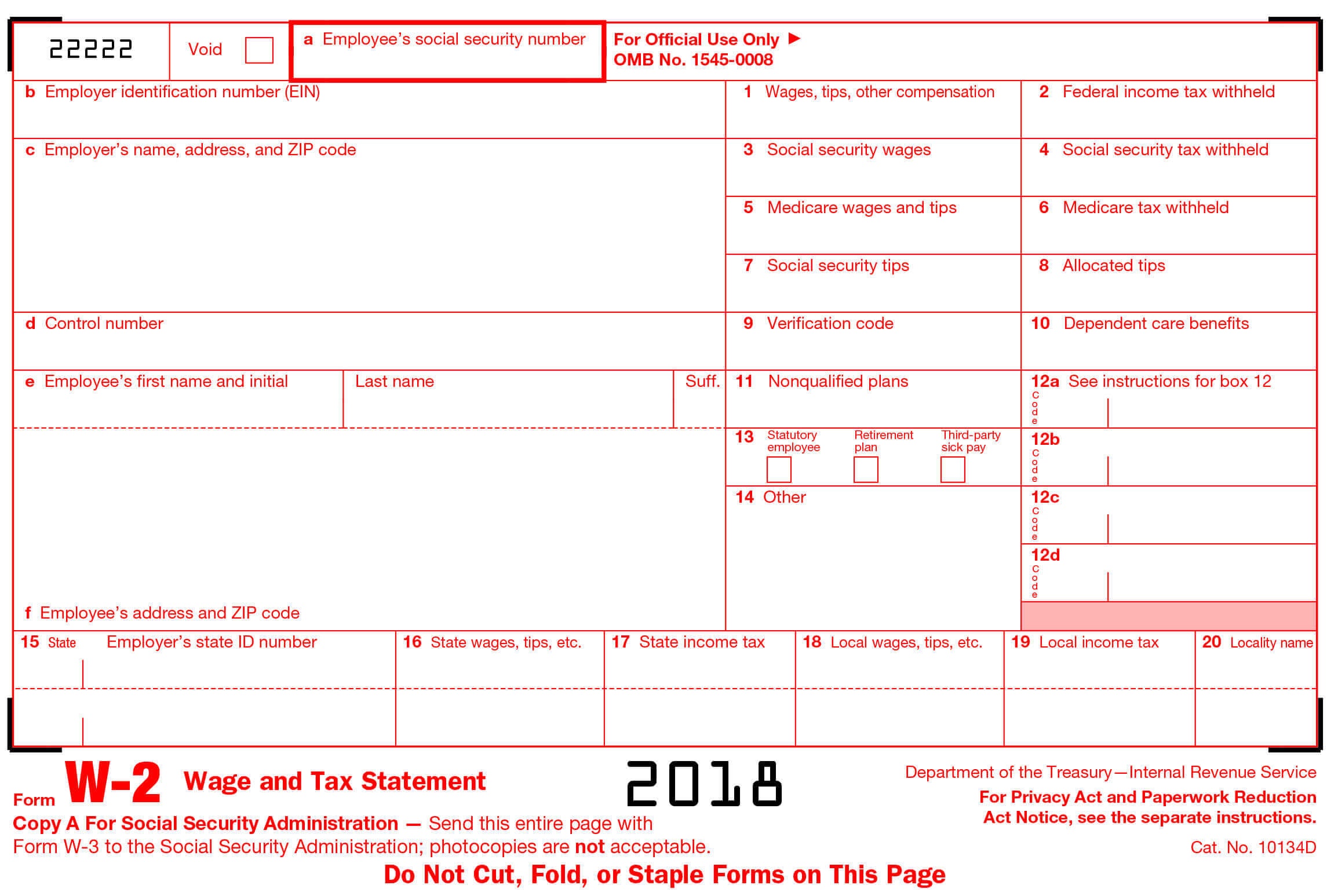

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN IRS Form W 2 Wage and Tax Statement Updated December 15 2023 A W 2 form also known as a Wage and Tax Statement is an IRS document used by an employer to report an employee s annual wages in a calendar year and the amount of taxes withheld from their paycheck

Printable W2 And 1099 Forms

Printable W2 And 1099 Forms

https://www.taxuni.com/wp-content/uploads/2020/08/W2-Form-2021.jpg

Form 1099 Vs W 2 For Workers What You Need To Know

https://www.patriotsoftware.com/wp-content/uploads/2018/07/Form-1099-vs.-W-2-1.png

Understanding Your Tax Forms The W 2

https://blogs-images.forbes.com/kellyphillipserb/files/2014/02/W2.png

If you re a business owner you may need to create W 2 and 1099 forms including 1099 NEC and 1099 MISC for your employees or contractors Select your product and follow the instructions to create W 2s and 1099s using Quick Employer Forms Form W 2 and Form 1099 Guide for Employees ADP is here to help as much as we can but for most questions regarding Form W 2 Form 1099 and other tax issues we recommend you speak with your payroll or benefits department What to Expect View your W 2 Online How to Keep Your W2 Secure FAQs

How To Get W 2 and 1099 Forms By Jean Murray Updated on January 12 2022 In This Article Forms for Types of Payments Where To Get W 2 and 1099 Forms Filing W 2 and 1099 MISC Forms Filing W 2 and 1099 Forms Online Frequently Asked Questions FAQs Photo BartekSzewczyk Getty Images Easily print W 2 information directly from QuickBooks Desktop onto the correct blank section of each tax form Specifically designed for small businesses available in quantities as low as 10 so you don t buy forms you don t need Each kit contains 2023 W 2 forms two tax forms per page four free pre printed W 3 forms

More picture related to Printable W2 And 1099 Forms

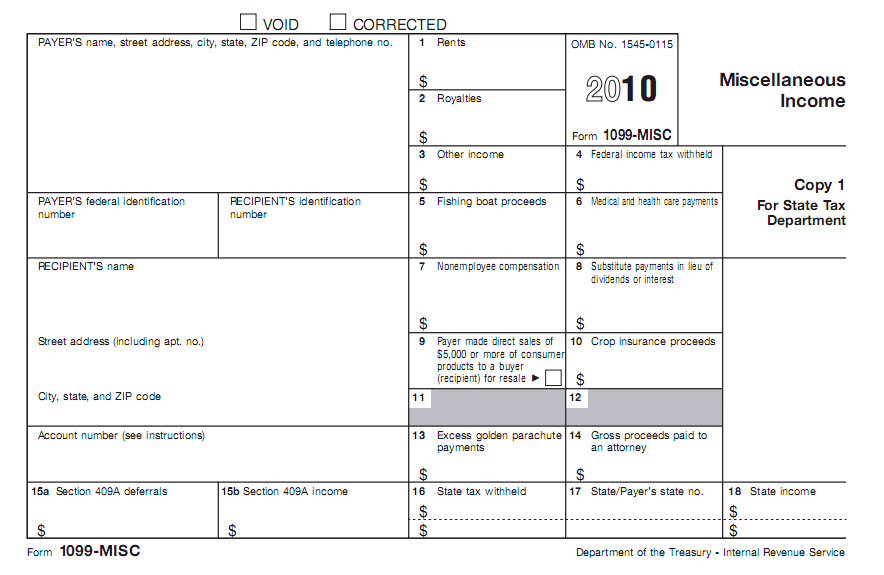

Free Printable 1099 Form 2018 Free Printable

https://printable-map-az.com/wp-content/uploads/2019/06/w2-form-generate-printable-w2-form-online-at-stubcreator-free-printable-1099-form-2018.jpg

Free Form 1099 MISC PDF Word

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

Difference Between W2 1099 And How To File For Both

https://unitedaccountingservices.com/wp-content/uploads/2020/01/difference_between_w2_and_1099__and_how_to_file_for_both.jpg

Step 1 Report your W 2 income The process for reporting your W 2 income is relatively straightforward On your Form 1040 or Individualized Income Tax Return these are the boxes worth paying the most attention to The income from box 1 of the W 2 will go on line 1 of the 1040 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more

Filing due dates for 1099 MISC forms have also been updated for the 2023 tax year The 1099 MISC must be sent To recipients by January 31 2024 To the IRS by February 28 2024 if filing by mail To the IRS by April 1 2024 if e filing The deadline for the 1099 MISC is different from the deadline for the 1099 NEC IMPORTANT DO THIS BEFORE YOU PRINT OR SHIP ANY YEAR END FORMS Verify that the information of every employee s W 2 and contractor s 1099 NEC using the W 2 Preview It s a single report that shows you the W 2 and 1099 information of every worker you paid during the year to make it easy for you to confirm or change this information before sending any forms

Everything You Need To Know About 1099 Misc Forms 1099 Mom

https://3.bp.blogspot.com/_UOC31v7C1xI/THspvMJZqyI/AAAAAAAADe0/Lfox9rw_ogU/s1600/1099.jpg

Printable 1099 Misc Tax Form Template Printable Templates

https://www.pandadoc.com/app/uploads/form-1099-misc.png

https://www.irs.gov/government-entities/form-w-2-and-form-1099-misc-filed-for-the-same-year

When a taxpayer files both a Form W 2 and Form 1099 MISC for a worker for the same year and payments reported on each information return were made during the same period of time the taxpayer may argue that the worker was performing two separate and distinct services one as an employee and one as an independent contractor

https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

Everything You Need To Know About 1099 Misc Forms 1099 Mom

Exact W2 Form Printable Blank PDF Online

Printable Form W 2

IRS Form 1099 Reporting For Small Business Owners

Microsoft Word 1099 Tax Form Printable Template Printable Templates

Microsoft Word 1099 Tax Form Printable Template Printable Templates

Printable IRS Form 1099 MISC For Tax Year 2017 For 2018 Income Tax Season CPA Practice Advisor

Filing Form W2 s And 1099 s Is Faster Than Ever With EzW2 s New Data Upload Feature

1099 Printable Template

Printable W2 And 1099 Forms - Form W 2 and Form 1099 Guide for Employees ADP is here to help as much as we can but for most questions regarding Form W 2 Form 1099 and other tax issues we recommend you speak with your payroll or benefits department What to Expect View your W 2 Online How to Keep Your W2 Secure FAQs