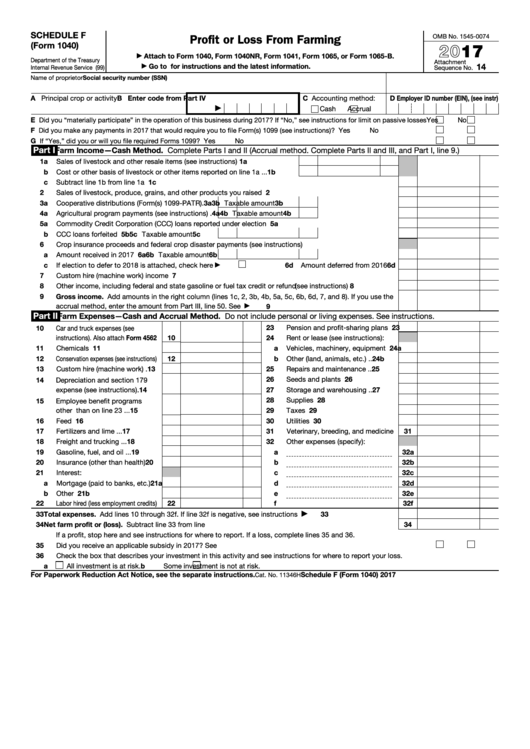

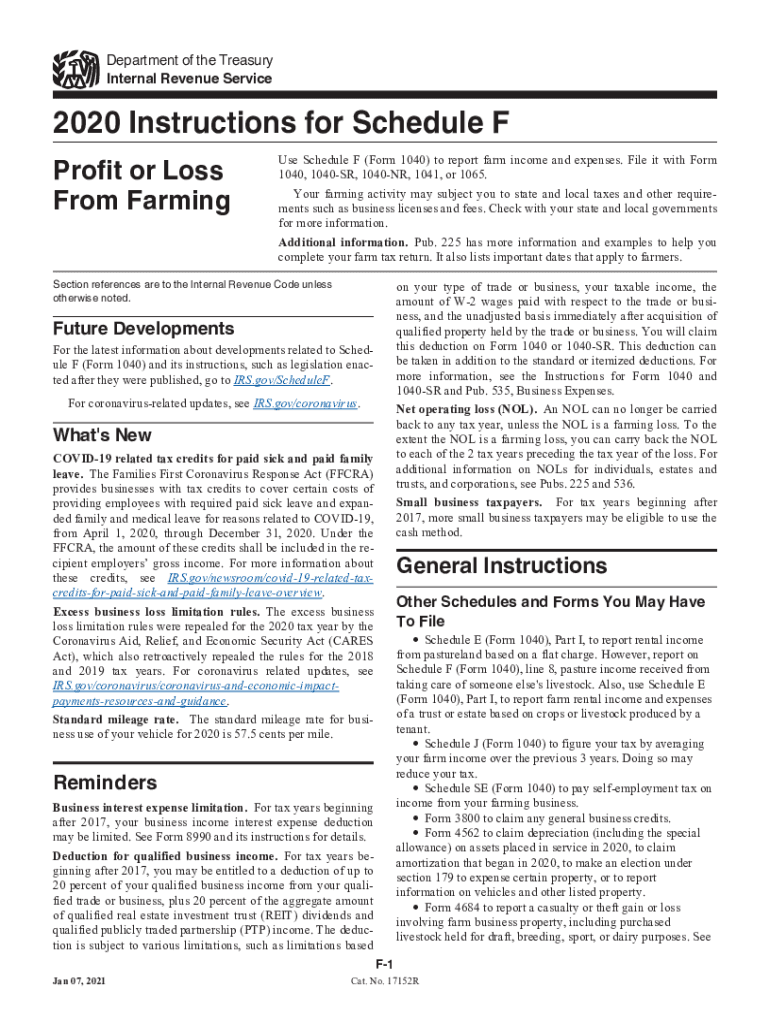

Schedule F Form Irs Printable 2023 Instructions for Schedule F 2023 Profit or Loss From Farming Introduction Additional information Future Developments What s New Standard mileage rate Business meals deduction Form 1040 SS Part III has been replaced Farmers and ranchers affected by drought may be eligible for extension of tax relief Reminders

Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF TRAVERSE CITY MI US January 9 2024 EINPresswire The Internal Revenue Service IRS has released Schedule F tax form instructions and printable forms for 2023 and 2024

Schedule F Form Irs Printable

Schedule F Form Irs Printable

https://data.formsbank.com/pdf_docs_html/296/2968/296812/page_1_thumb_big.png

Form 1040 Schedule F Profit Or Loss From Farming 2014 Free Download

https://www.formsbirds.com/formimg/individual-income-tax/8083/form-1040-schedule-f-profit-or-loss-from-farming-2014-l1.png

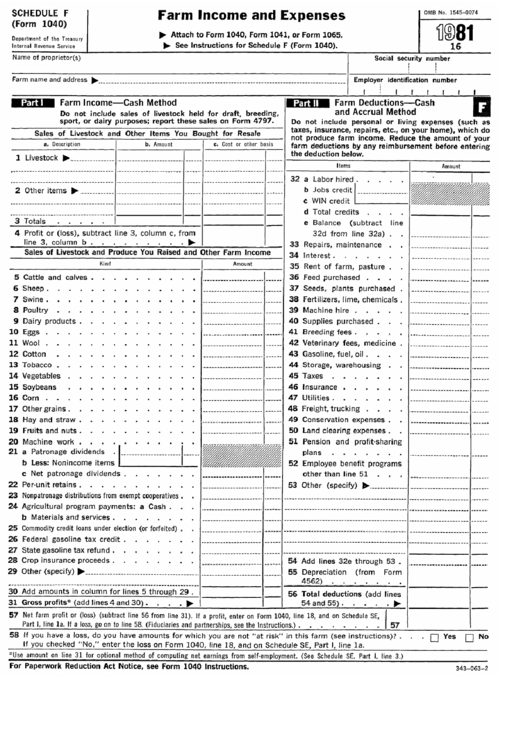

Schedule F Form 1040 Farm Income Tax Expenses 1981 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/280/2805/280536/page_1_thumb_big.png

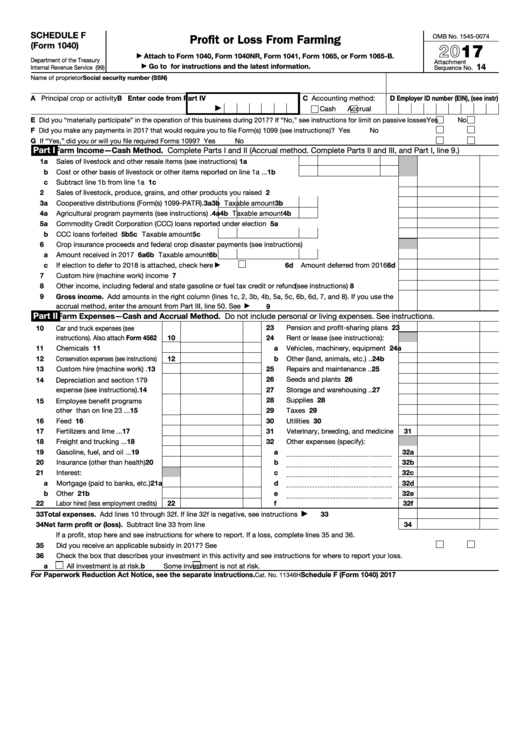

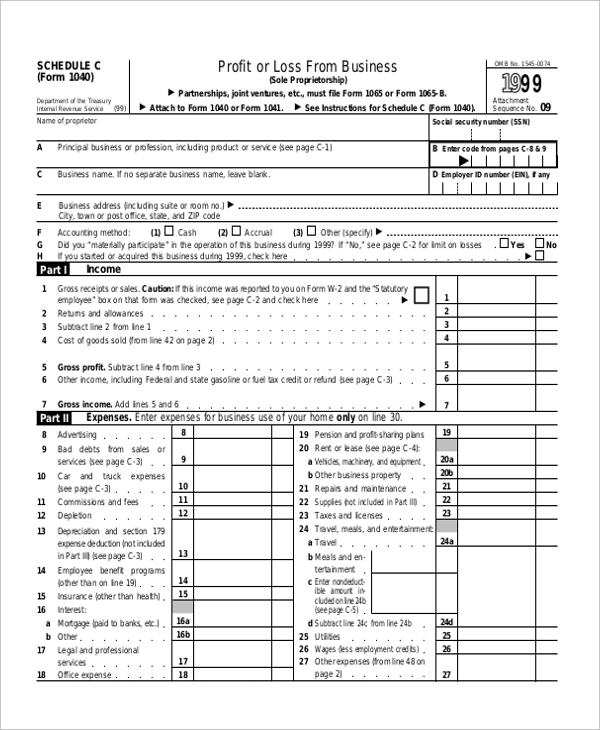

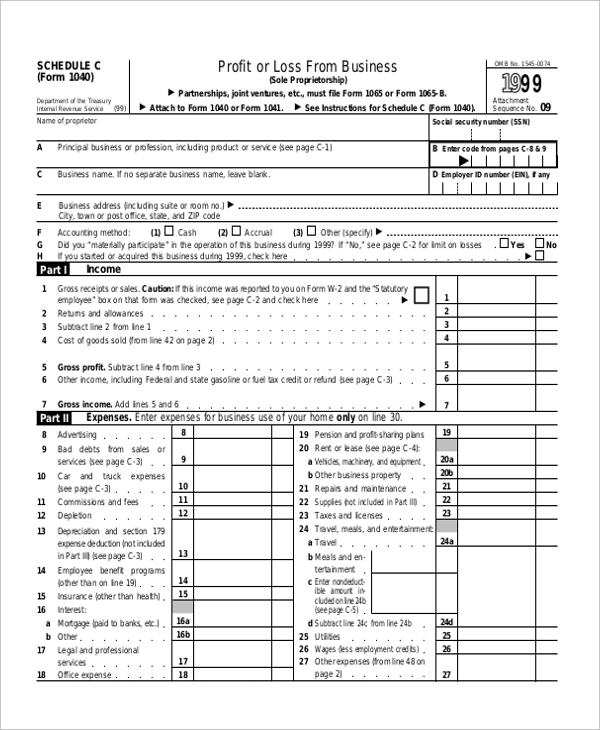

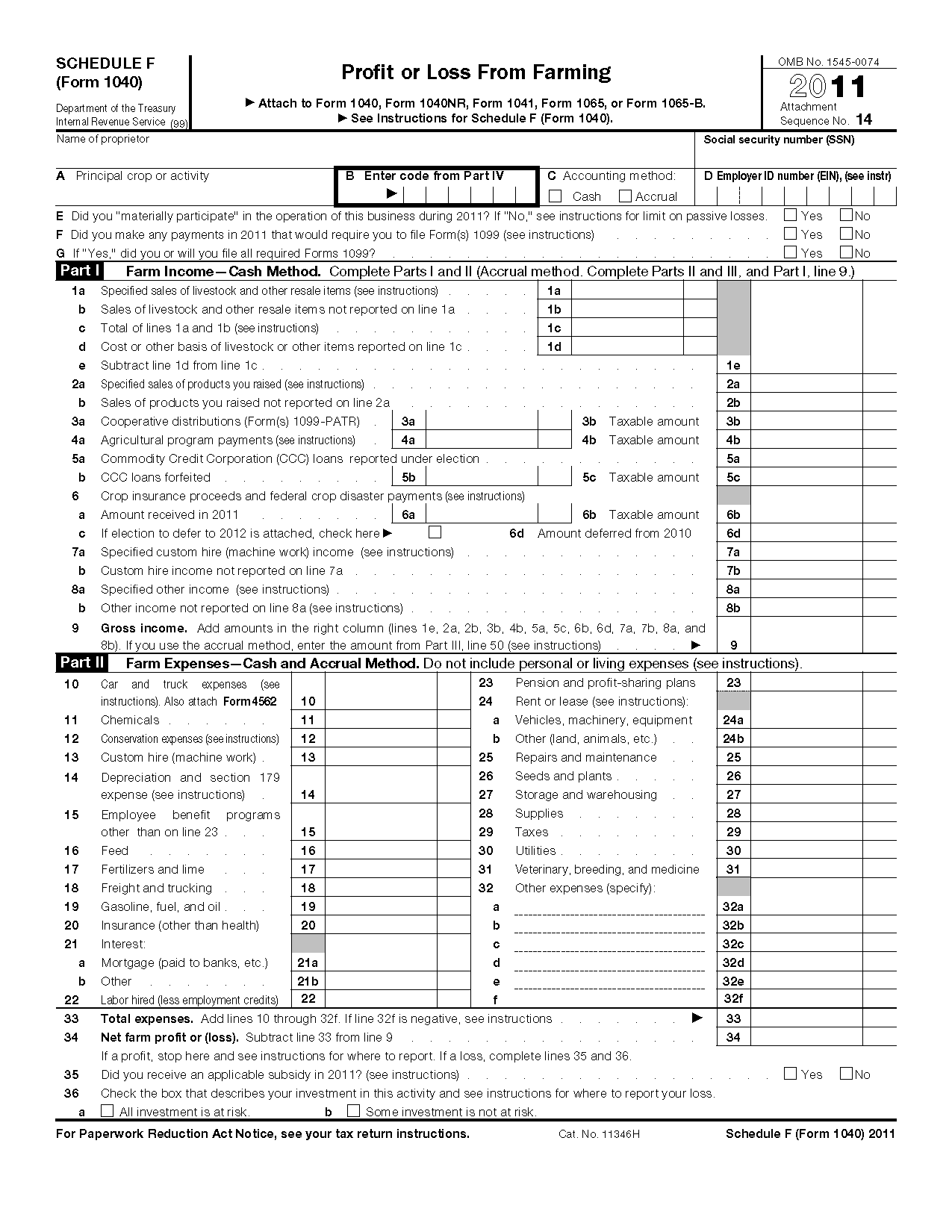

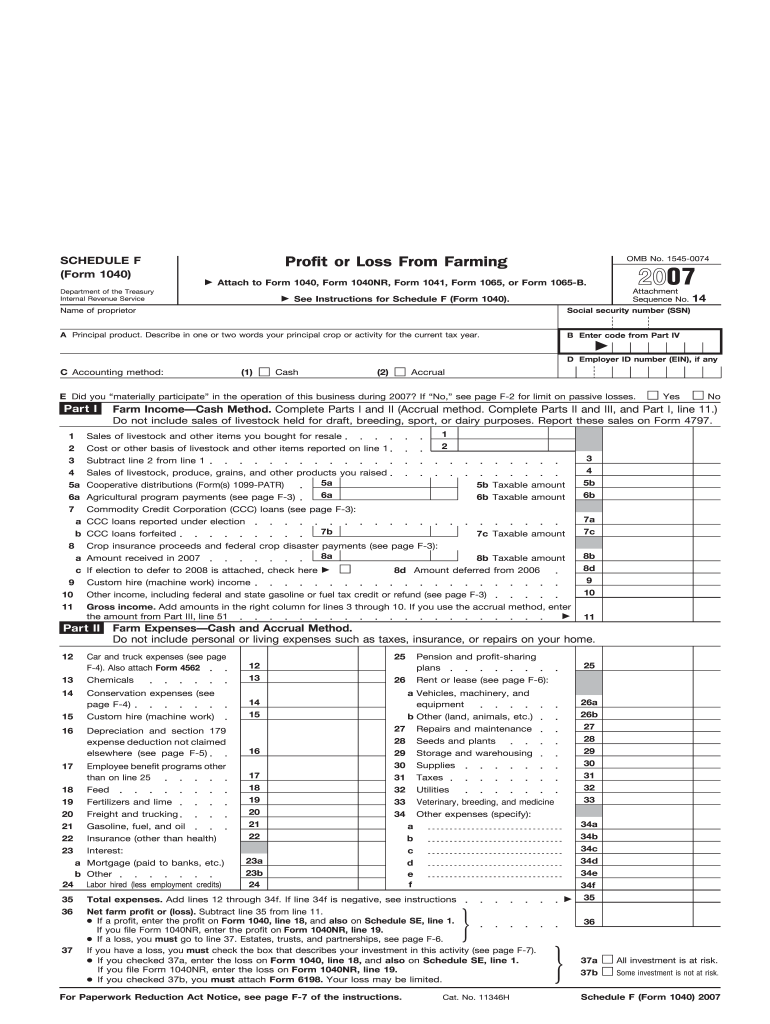

Use Schedule F Form 1040 to report farm income and expenses About Schedule H Form 1040 Household Employment Taxes Information about Schedule H Form 1040 Household Employment Taxes including recent updates related forms and instructions on how to file Schedule H is used by household employers to report household employment taxes Schedule F is a two page tax form which lists the major sources of farm income and farm expense The end result is the net farm profit or loss amount transferred to Form 1040 Who Must File Form 1040 Schedule F You own or operate a farm livestock produce grains greenhouse nursery floriculture dairy aquaculture etc

The integrator also provides feed and veterinary supplies Al is paid on a piglet delivered basis with possibilities for premiums based on feed conversion and number of live pigs per sow delivered above the contracted target Al is paid every two weeks based on piglets Al receives a 1099 NEC for 425 000 Schedule F is used to report taxable income earned from farming or agricultural activities This schedule must be included on a Form 1040 tax return regardless of the type of farm income

More picture related to Schedule F Form Irs Printable

Irs Fillable Form 1040 Irs 1040 Schedule F 2019 2021 Fill And Sign Printable Template Online

https://www.pdffiller.com/preview/100/24/100024174/large.png

IRS Releases Draft Form 1040 Here s What s New For 2020

https://specials-images.forbesimg.com/imageserve/5f3ed50b6c322baa3b67a319/960x0.jpg?fit=scale

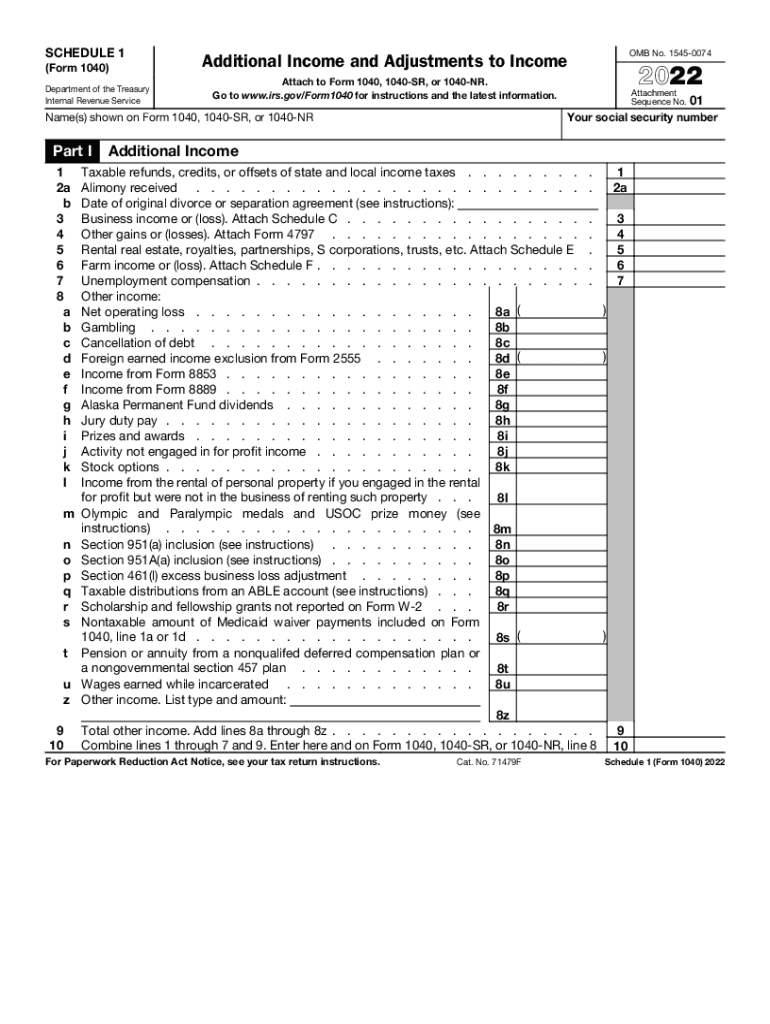

2022 Form IRS 1040 Schedule 1 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/624/654/624654308/large.png

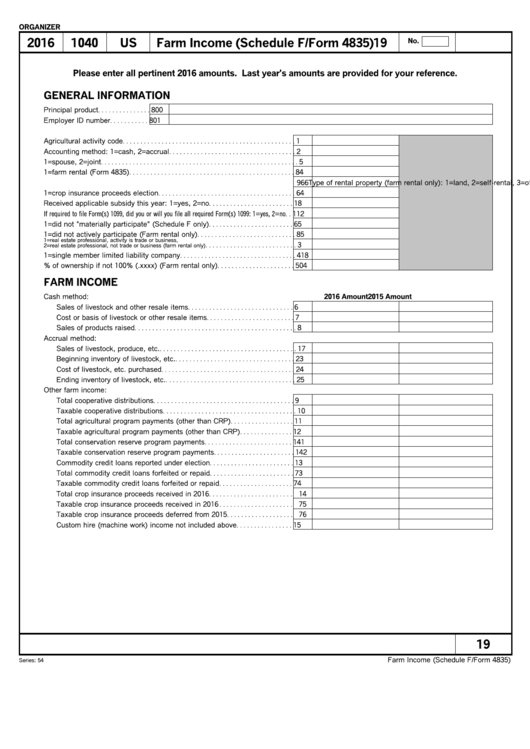

Schedule F Worksheet Farm and or Farm Rental Provide all 1099 s MISC NEC received and issued and Cooperative Distributions received Type of Product Main Activity Total Rent Received in 2020 Total Income Received in 2020 Raised Livestock Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state s revenue department which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer s entire liability

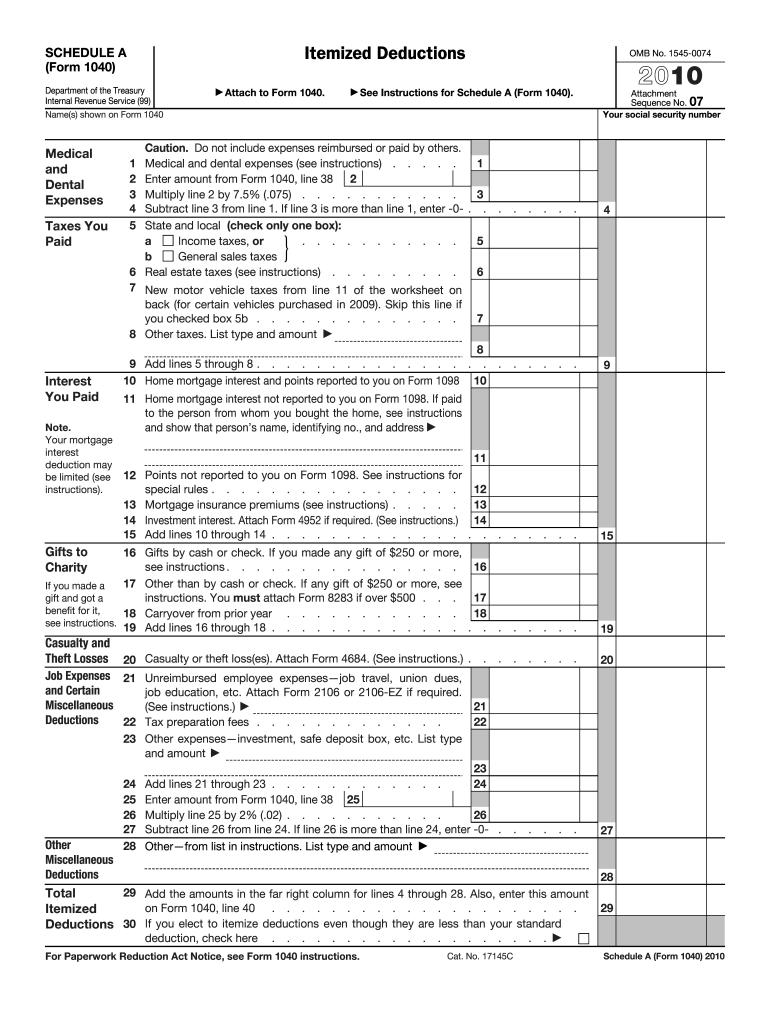

Schedule F ultimately computes the net farming profit or loss that gets reported on the designated line of your 1040 If you have a profit or a loss it gets combined with the other non farming income reported on your return and increases or reduces your taxable income When you suffer a net operating loss meaning you paid more in expenses New 1040 form for older adults The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart The form is optional and uses the same schedules instructions and attachments as the regular 1040

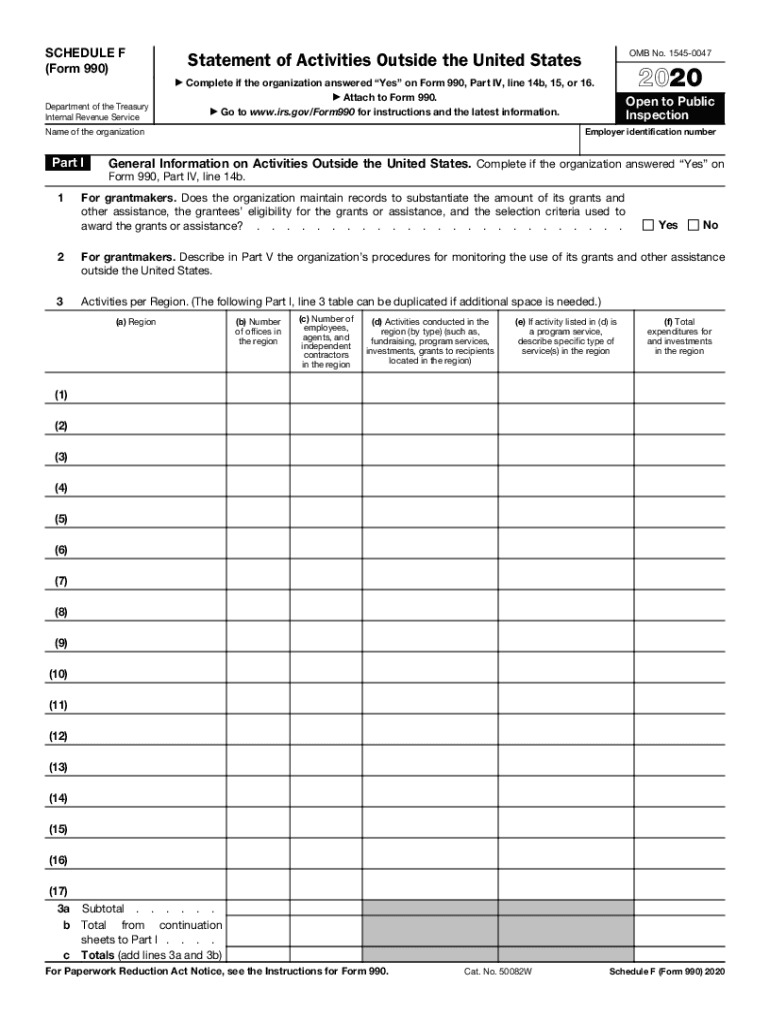

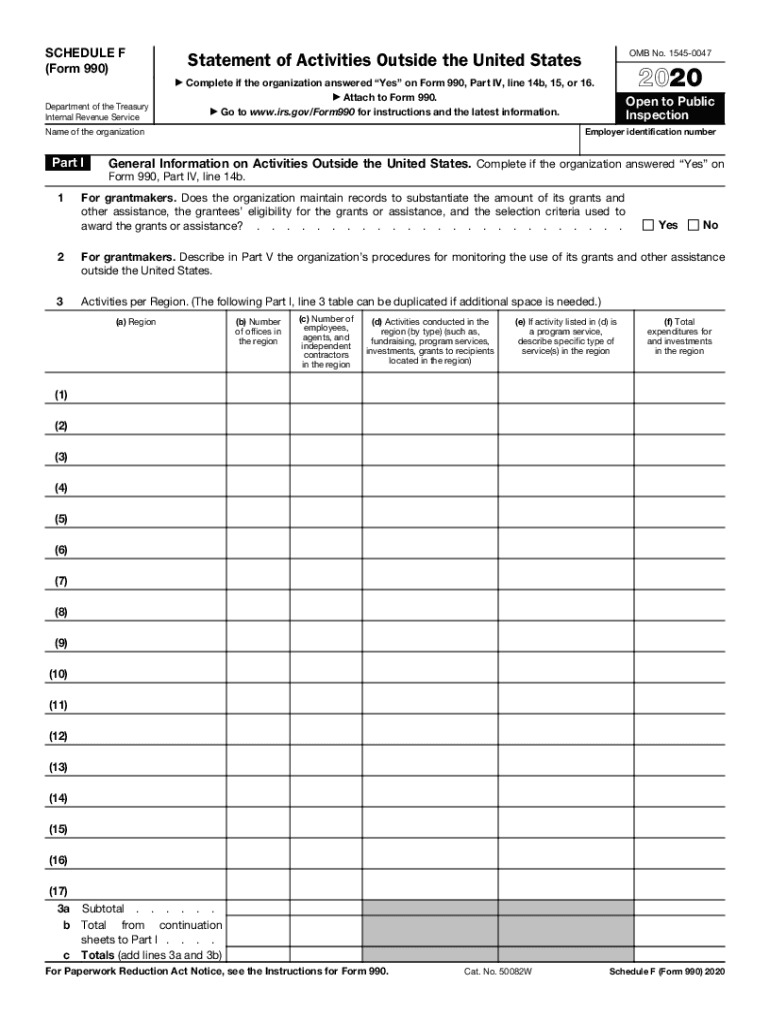

2020 Form IRS 990 Schedule F Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/535/781/535781072/large.png

2020 Form IRS 1040 Schedule F Instructions Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/545/950/545950447/large.png

https://www.irs.gov/instructions/i1040sf

2023 Instructions for Schedule F 2023 Profit or Loss From Farming Introduction Additional information Future Developments What s New Standard mileage rate Business meals deduction Form 1040 SS Part III has been replaced Farmers and ranchers affected by drought may be eligible for extension of tax relief Reminders

https://www.irs.gov/forms-instructions

Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF

Farm Income Schedule F Form 4835 Printable Pdf Download

2020 Form IRS 990 Schedule F Fill Online Printable Fillable Blank PdfFiller

Irs Printable Form 1040

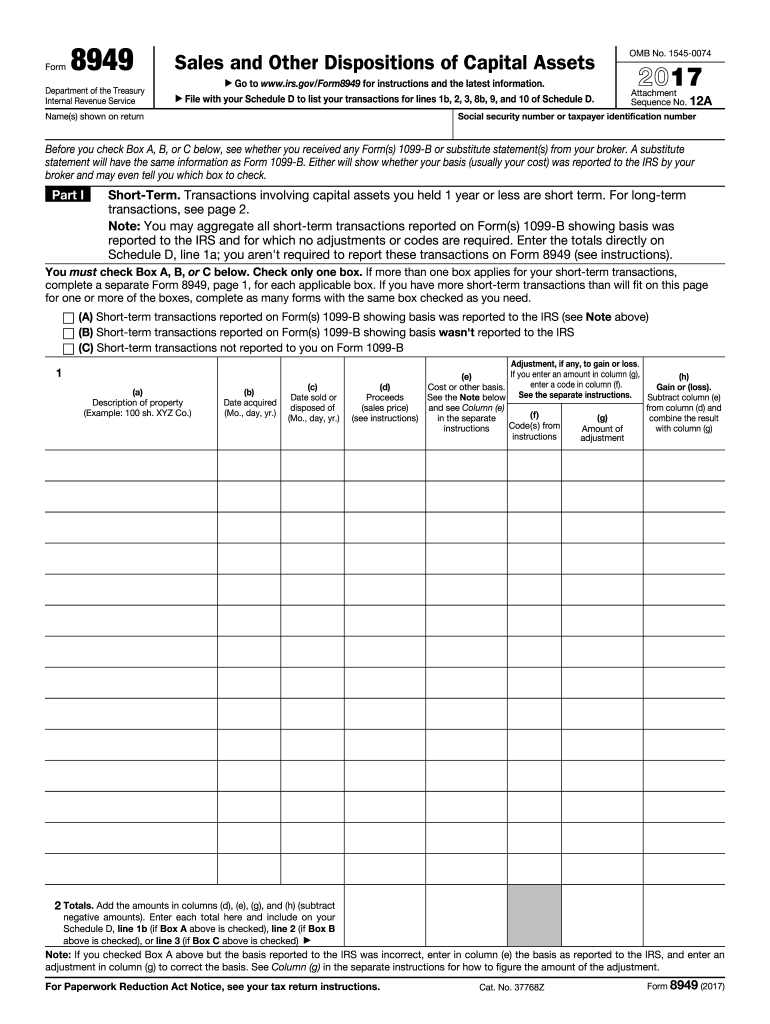

Form 8949 2017 Fill Out Sign Online DocHub

2023 Federal Tax Form 1040 Printable Forms Free Online

Irs 1040 Form 2020 Pdf 1040ez Form Fill Out And Sign Printable Pdf Template Signnow

Irs 1040 Form 2020 Pdf 1040ez Form Fill Out And Sign Printable Pdf Template Signnow

Form 1040 Schedule F Profit Or Loss From Farming 1040 Form Printable

Form 1040 Schedule F Edit Fill Sign Online Handypdf

Form 1040 Schedule F Fill In Capable Profit Or Loss From Farming Fill Out And Sign Printable

Schedule F Form Irs Printable - SCHEDULE F Form 1040 Department of the Treasury Internal Revenue Service Profit or Loss From Farming Attach to Form 1040 Form 1040 SR Form 1040 NR Form 1041 or Form 1065 Go to www irs gov ScheduleF for instructions and the latest information OMB No 1545 0074 2022 Attachment Sequence No 14 Name of proprietor