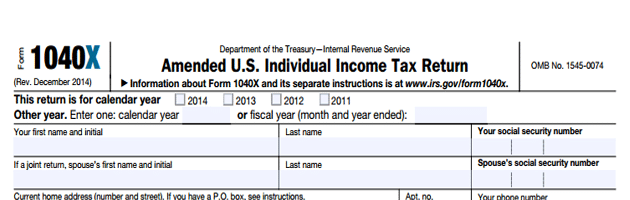

Who Should File An Amended Tax Return Form 1040 X available on the IRS website is the form for filing amended returns Changes in filing status changes in the

An amended tax return is filed when a taxpayer realizes a mistake was made on the initial return and needs to correct it says Nell Curtis an accounting instructor at Milwaukee Area You need to add or remove a dependent You forgot to claim taxable income on your tax return You realize you claimed an expense deduction or credit that you

Who Should File An Amended Tax Return

Who Should File An Amended Tax Return

https://optimataxrelief.com/wp-content/uploads/2023/03/2023-optima-amended-tax-return-now-what.jpg

Filing An Amended Tax Return Wheeler Accountants

https://wheelercpa.com/wp-content/uploads/blog3.jpg

5 Stocks That Turned 100 000 Into 3 Million or More In 1 Year The

https://g.foolcdn.com/editorial/images/616344/stack-of-one-hundred-dollar-bills-cash-money-stimulus-invest-retire-getty.jpg

IRS Form 1040 X also known as an amended tax return is a form that taxpayers can file with the IRS to correct mistakes made on a federal tax return In most cases if you originally filed IRS Form 1040 you should use Form 1040 X to file your amendment Follow along as we outline more details about filing amended tax returns along with the amended tax return

Generally in order for IRS to be able to issue a refund you must amend your return within three years including extensions after the date you filed your original April 17 2018 Under what circumstances would you need to file an amended tax return The IRS says you should file an amended return Form 1040X if you discover mistakes in any of the

More picture related to Who Should File An Amended Tax Return

A Guide To Amended Returns US Tax Filing

https://www.ustaxfiling.in/wp-content/uploads/2020/09/Amended-Returns.jpg

Should You File An Amended Tax Return Here s What To Know Consider

https://i0.wp.com/considertheconsumer.com/wp-content/uploads/2018/04/Should-You-File-An-Amended-Tax-Return-Consider-The-Consumer.jpg?fit=800%2C532&ssl=1

How To Know If You Need To File An Amended Tax Return

https://www.nationaldebtrelief.com/wp-content/uploads/2018/02/filing-amended-tax-return-1024x683.jpeg

Overview of Amended Tax Returns Understanding Form 1040 X Criteria for Filing an Amended Tax Return Process for Filing an Amended Tax Return An amended tax form formally called Form 1040 X Amended US Individual Income Tax Return is used to correct tax forms 1040 1040 A 1040 EZ 1040 NR or

In connection with an ERC refund for 2020 or 2021 the company and in some cases its owners is required to amend corporate and individual income tax In order to file a Form 1040 X Amended U S Individual Income Tax Return you will need to either print and sign the return and then mail it or you may be

How To File An Amended Tax Return WTOP News

https://wtop.com/wp-content/uploads/2020/07/GettyImages-897291366.jpg

Must Know Tips For Filing Amended Tax Returns Clean Slate Tax

https://cleanslatetax.com/wp-content/uploads/amended-tax-return.png

https://www.investopedia.com/terms/a/…

Form 1040 X available on the IRS website is the form for filing amended returns Changes in filing status changes in the

https://www.forbes.com/advisor/taxes/…

An amended tax return is filed when a taxpayer realizes a mistake was made on the initial return and needs to correct it says Nell Curtis an accounting instructor at Milwaukee Area

Amended Tax Returns You Don t Always Need To File One Cambaliza McGee LLP

How To File An Amended Tax Return WTOP News

When You Can File An Amended Tax Return And It s Way

Where s My Amended Return Easy Ways To File Form 1040X The Handy

Use Form 1040X To Fix And Amend Your Just Filed Tax Return

How To File An Amended Tax Return The Motley Fool

How To File An Amended Tax Return The Motley Fool

How To Amend An Incorrect Tax Return You Already Filed Trader

Tax News Tax Credits IRS Policies State Federal Taxes Filing Taxes

How Do You File An Amended Tax Return Account Abilities LLC

Who Should File An Amended Tax Return - April 17 2018 Under what circumstances would you need to file an amended tax return The IRS says you should file an amended return Form 1040X if you discover mistakes in any of the