Free Printable 1098 T Form Federal Student Aid Loading

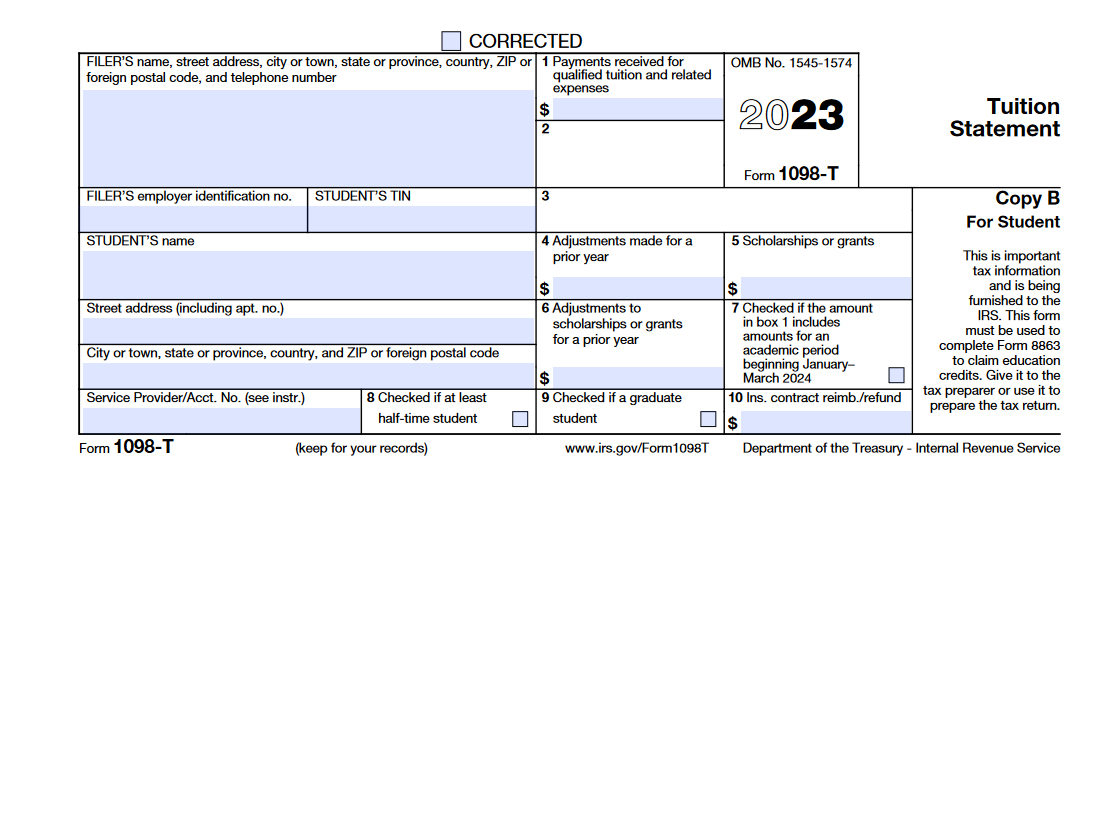

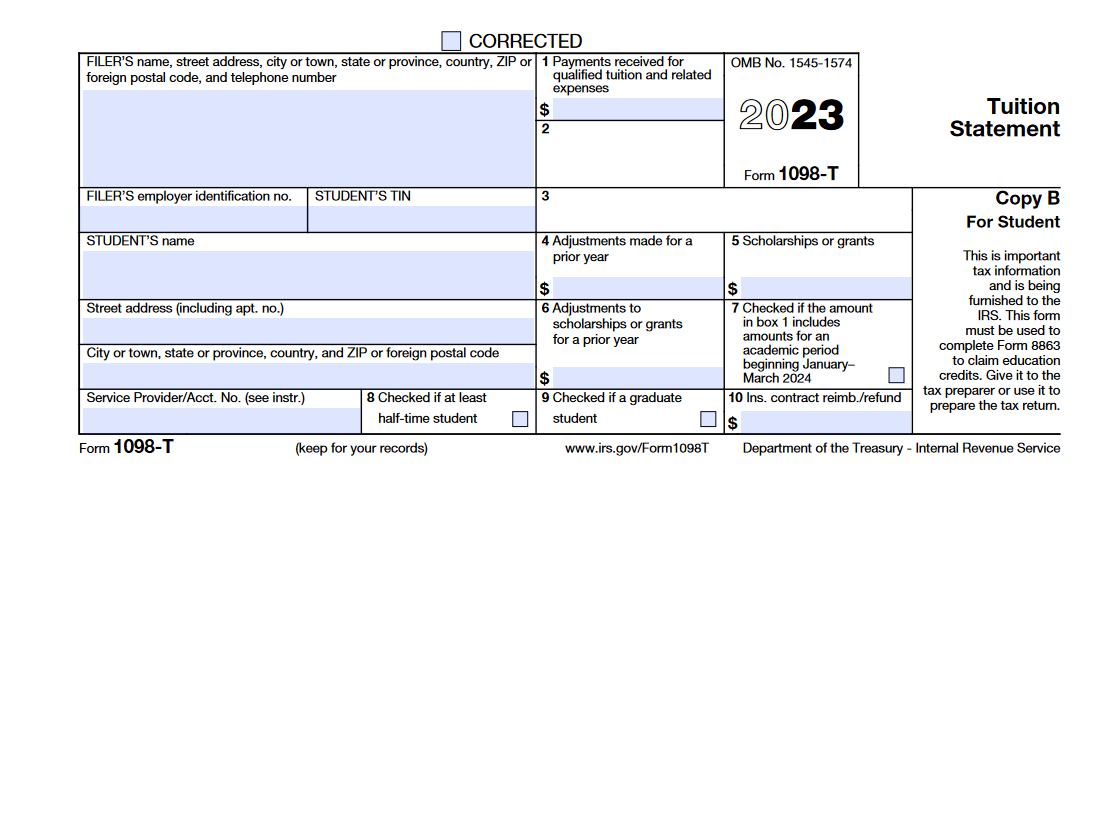

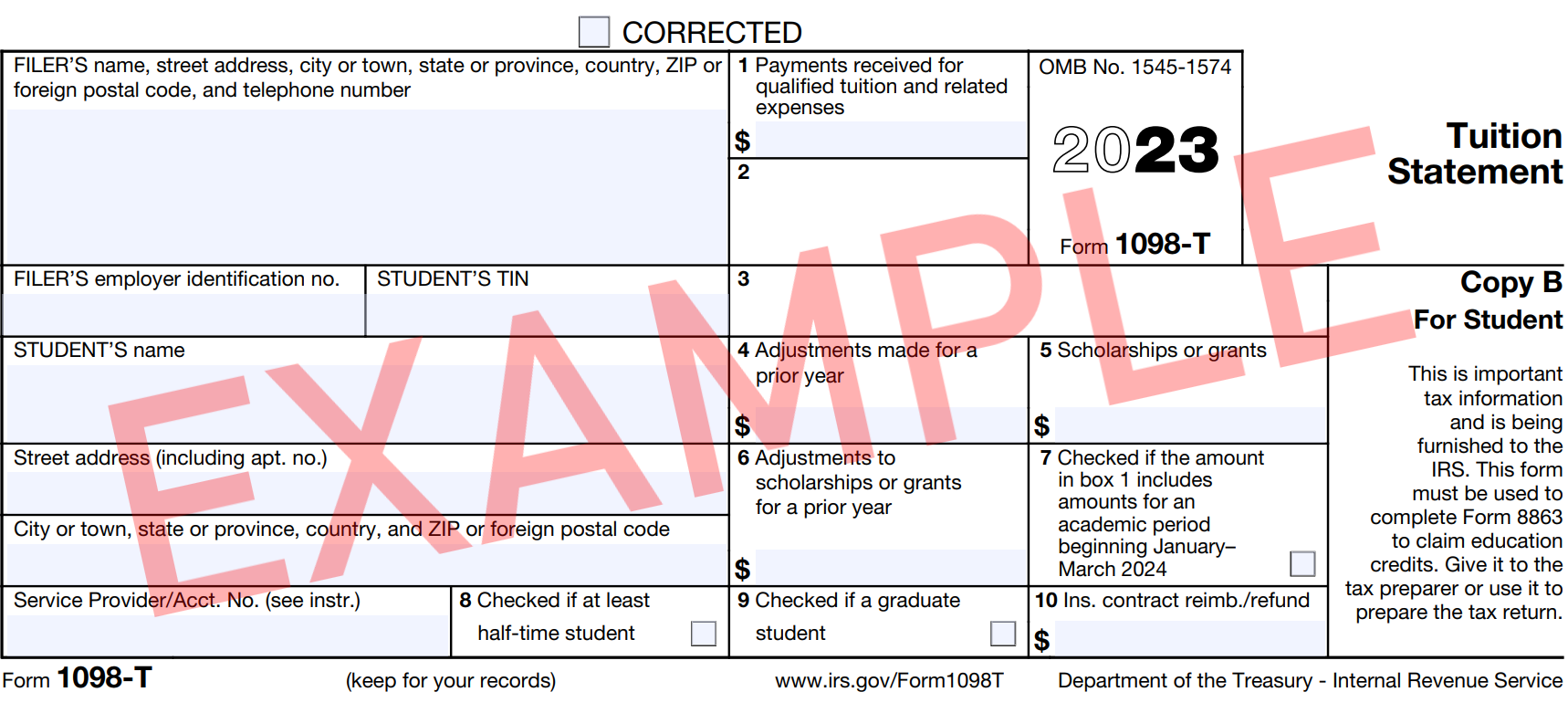

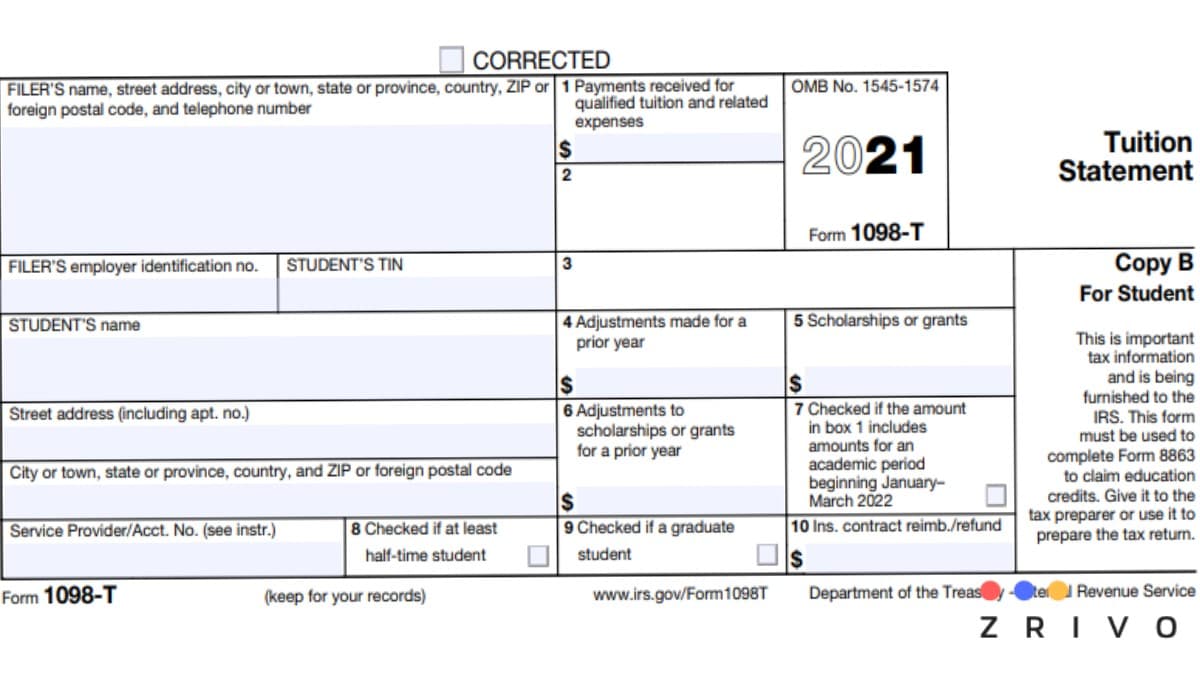

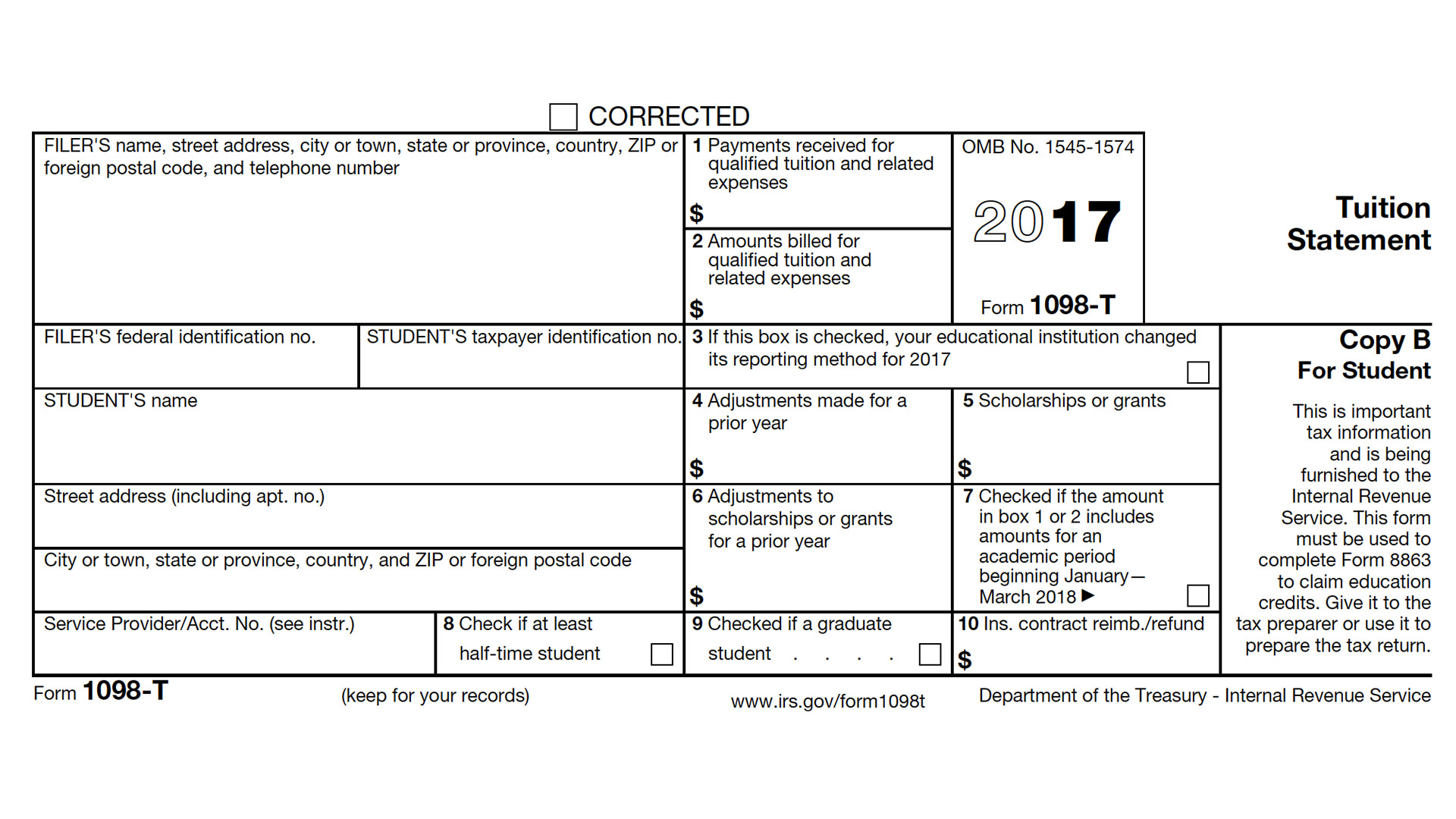

Key Takeaways Eligible post secondary institutions are required to send Form 1098 T to tuition paying students by January 31 and file a copy with the IRS by February 28 Schools use Box 1 of the form to report the payments received With a 1098 T the business your college reports how much qualified tuition and expenses you or your parents paid it during the tax year The IRS uses these forms to match data from information returns to income deductions and credits reported on individual income tax returns

Free Printable 1098 T Form

Free Printable 1098 T Form

https://blanker.org/files/images/form-1098t.png

Form 1098 T Information Student Portal

https://portal.mtec.edu/Portal/Resources/ex1098t.png

2020 Form IRS 1098 T Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/487/372/487372991/large.png

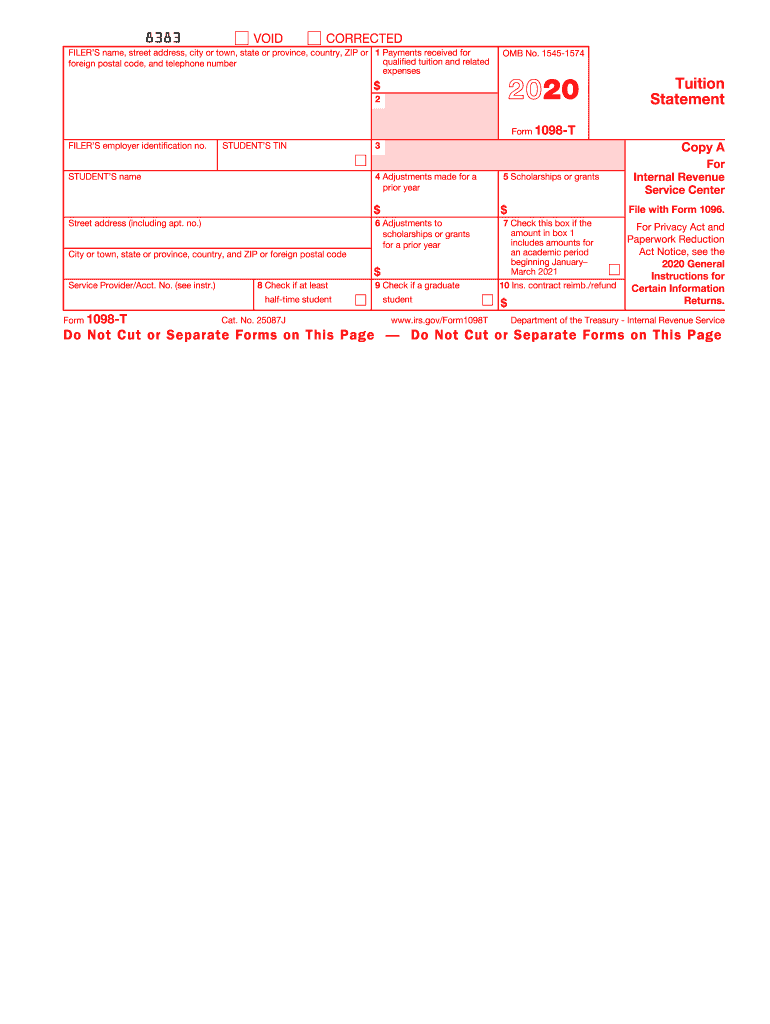

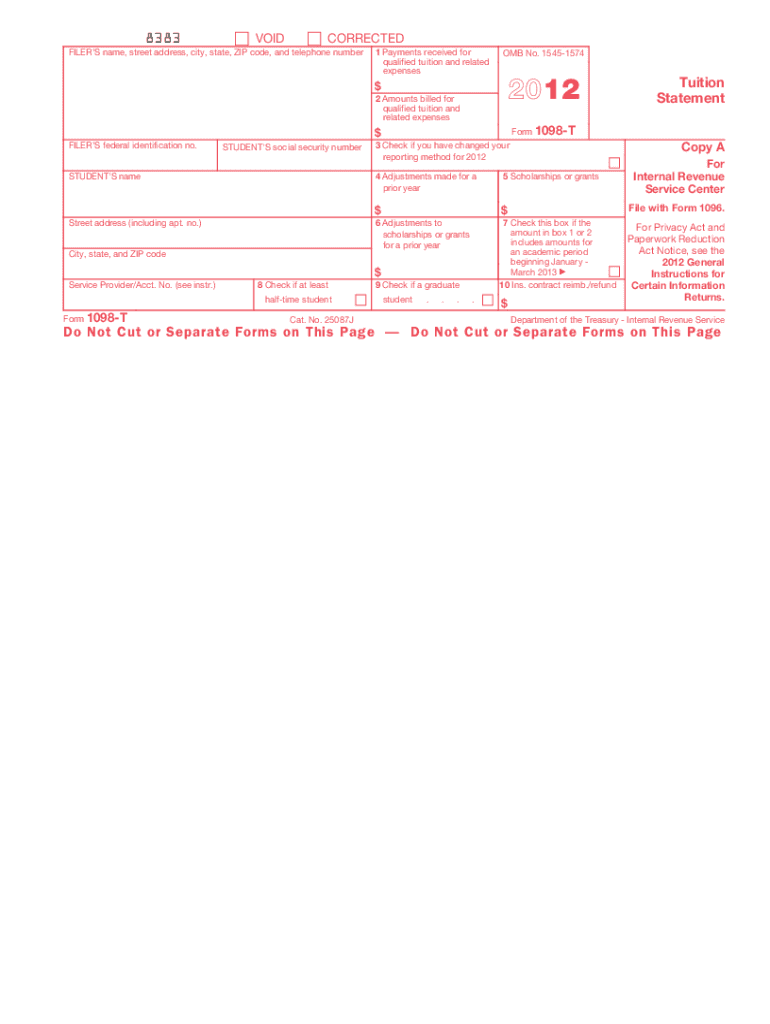

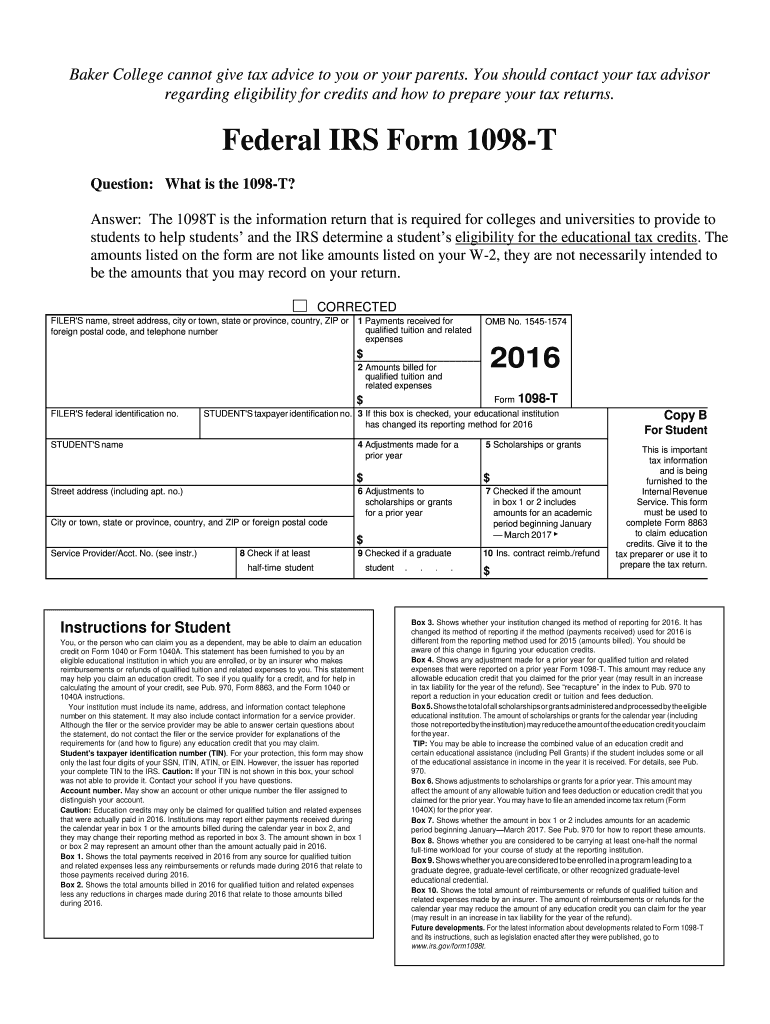

1098 T Form A form 1098 T provides the amount of tuition spent by a student during the previous tax year It documents qualified tuition fees and other related course materials The educational institution generates this form and mails it to the students by January 31 The students who receive a 1098 T must report it on their income tax forms IRS Form 1098 is a tax form used to report mortgage interest received in the course of a trade or business within a year Lenders file a copy with the IRS and send another copy to the payer of the interest A separate Form 1098 which is also known as a Mortgage Interest Statement should be filed for each mortgage on which interest was paid

The 1098 T tuition statement is a tax form that helps you capture one of those great tax perks you don t want to miss out on So take note students you ll get a 1098 T form a tuition statement sent from your college or university by January 31 To help you understand what the 1098 T is all about we ve outlined what this IRS tax form Form 1098 T Tuition Statement is an American IRS tax form filed by eligible education institutions or those filing on the institution s behalf to report payments received and payments due from the paying student The institution has to report a form for every student that is currently enrolled and paying qualifying tuition and related expenses

More picture related to Free Printable 1098 T Form

1098 T IRS Tax Form Instructions 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-1200x523.png

Understanding Your IRS Form 1098 T Student Billing

https://studentbilling.berkeley.edu/sites/default/files/styles/openberkeley_image_full/public/1098t_sample_2020.jpg?itok=9ehuNdu-×tamp=1610405644

1098 T Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/0/55/55604/large.png

Leave blank boxes blank Don t enter 0 for any blank boxes on the form as this generates errors Parents If the student listed on the 1098 T is your dependent enter the 1098 T on your return even if your dependent paid the tuition This will allow you to see what is included in Box 1 and Box 5 For information on the box on the 1098T form please read the instructions from the IRS If you have any questions please feel free to contact us at 206 221 2609 send an email with your student to taxquest uw edu or review the FAQs below

If you purchased your home before Dec 16 2017 and are a single or joint filer you can deduct interest paid on the first 1 million of your mortgage If you are married and filing separately If you or your parents have paid tuition fee expenses to CIU for any previous year you will receive an email with a link to access your Form 1098 T online by January 31 of the next year The email will come from a third party company named Track 1099 and emailed to your personal email address To help determine the tax credit you may

OCCC 1098T Tuition Statement Information

http://www.occc.edu/images/bursar/2019 1098T Forms.jpg

Printable 1098 T Tax Form IRS 1098 T Form For 2022 Tuition Statement Instructions PDF

https://1098t-form-printable.us/images/uploads/blog/Temza-March23/1098t-fur-main4.jpg?1678366923145

https://studentaid.gov/help-center/answers/article/how-can-i-get-my-1098t-form

Federal Student Aid Loading

https://turbotax.intuit.com/tax-tips/college-and-education/guide-to-tax-form-1098-t-tuition-statement/L3SqH8fg0

Key Takeaways Eligible post secondary institutions are required to send Form 1098 T to tuition paying students by January 31 and file a copy with the IRS by February 28 Schools use Box 1 of the form to report the payments received

1098 T Form 2024

OCCC 1098T Tuition Statement Information

Form 1098 T Everything You Need To Know Go TJC

Bursar 1098 T Tuition Statement Reporting Hofstra University

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png)

Formulario 1098 T 2023

Form 1098 T TUITION STATEMENT IRS Copy A

Form 1098 T TUITION STATEMENT IRS Copy A

Baker 1098 T Fill Online Printable Fillable Blank PdfFiller

1098 T Form 2023 Printable Forms Free Online

How To File Your 1098 T Form Universal Network

Free Printable 1098 T Form - As part of the Student Account Agreement you consented to receive your form online in PDF format via your YES landing page Any request for a paper form must be submitted to the Office of Student Accounts at 1 800 288 1144 or student accounts vanderbilt edu