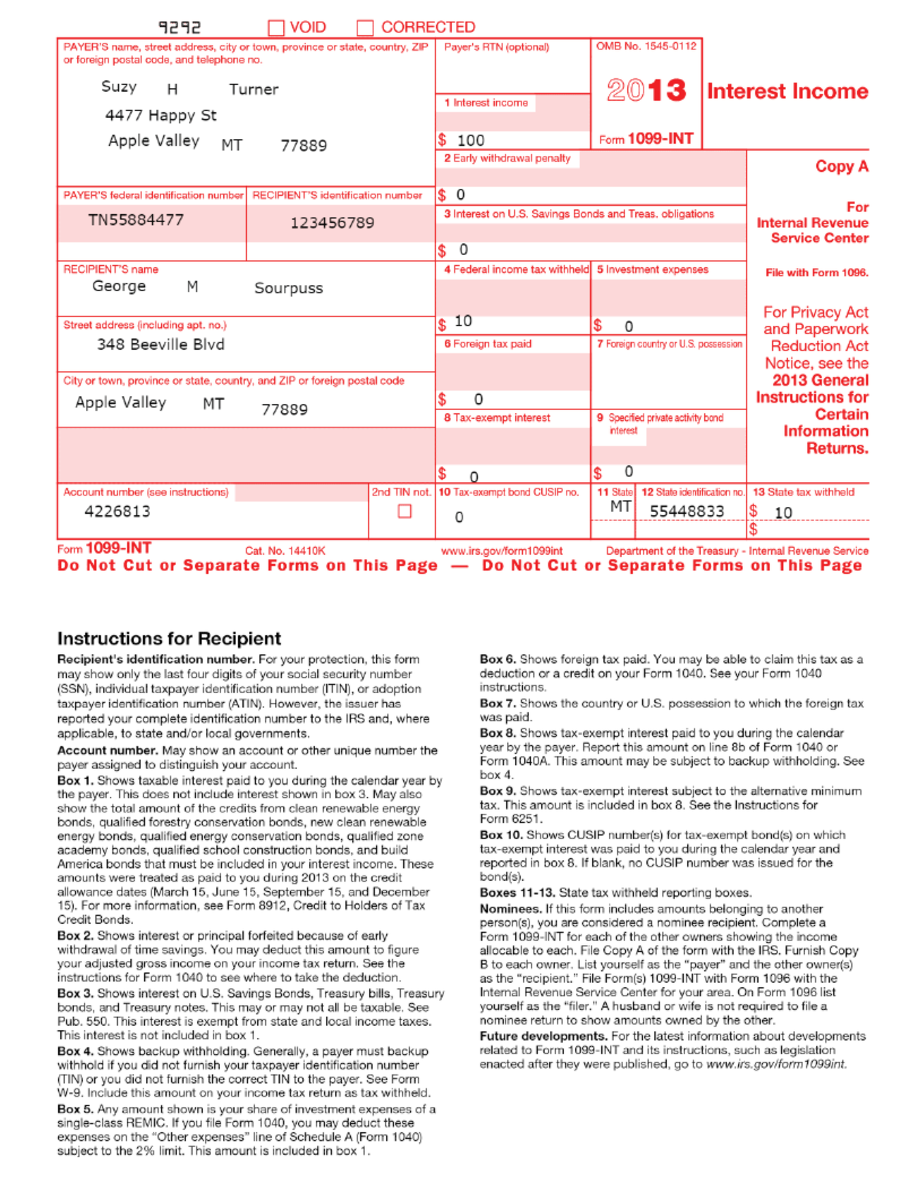

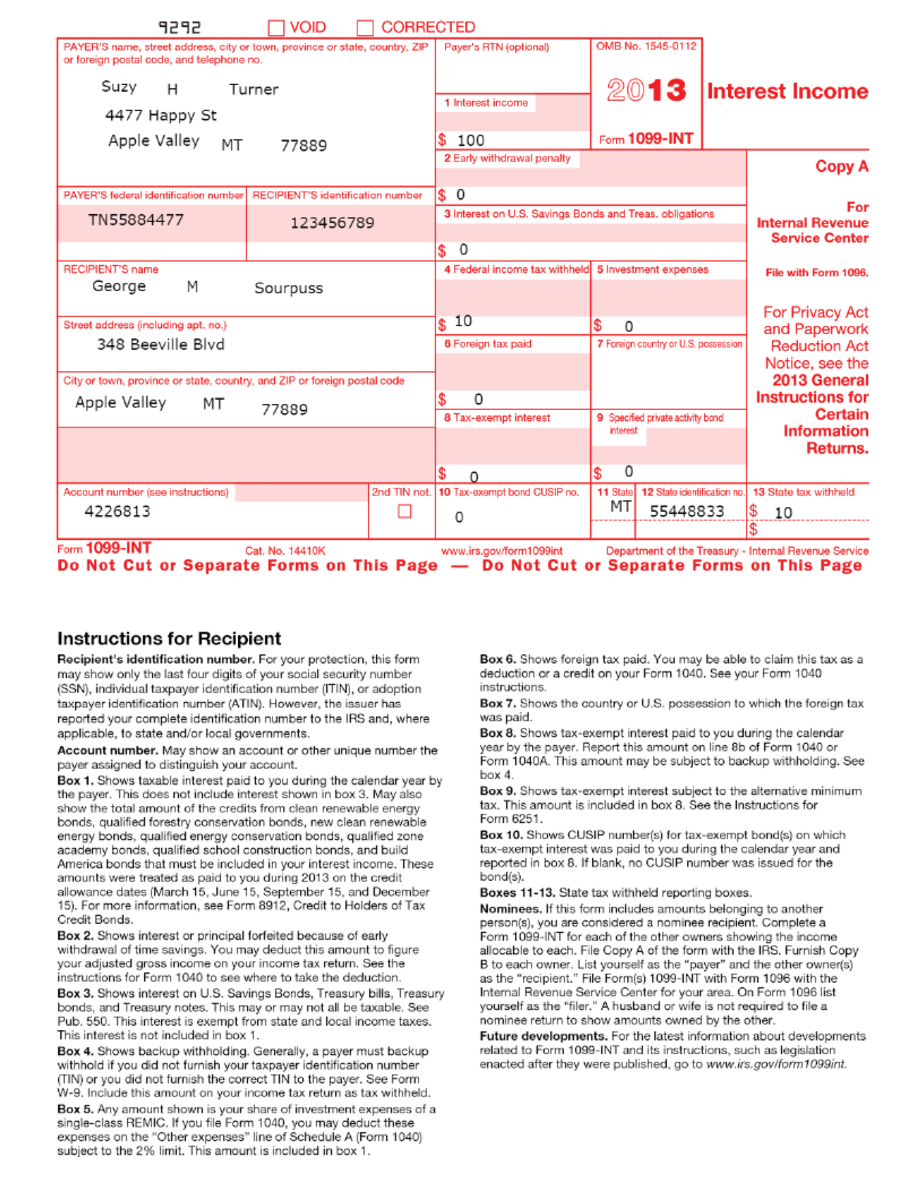

Free Printable 1099 Int Form Updated January 08 2024 IRS Form 1099 INT is a tax form used to report more than 10 worth of interest paid to an individual or more than 600 worth of interest paid to a trade or business in a year The government agency bank or financial institution that paid the interest files the 1099 INT with the IRS and issues a copy to the taxpayer

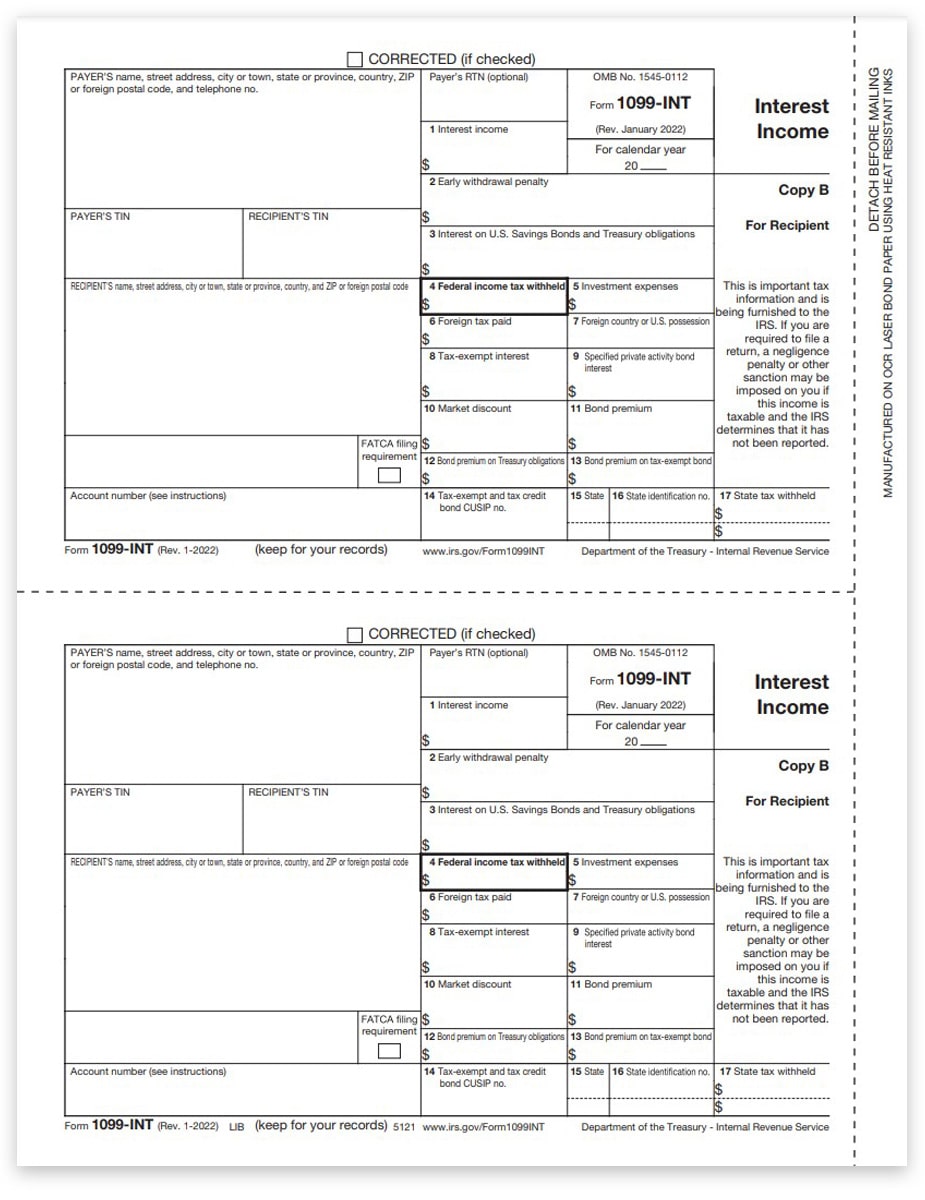

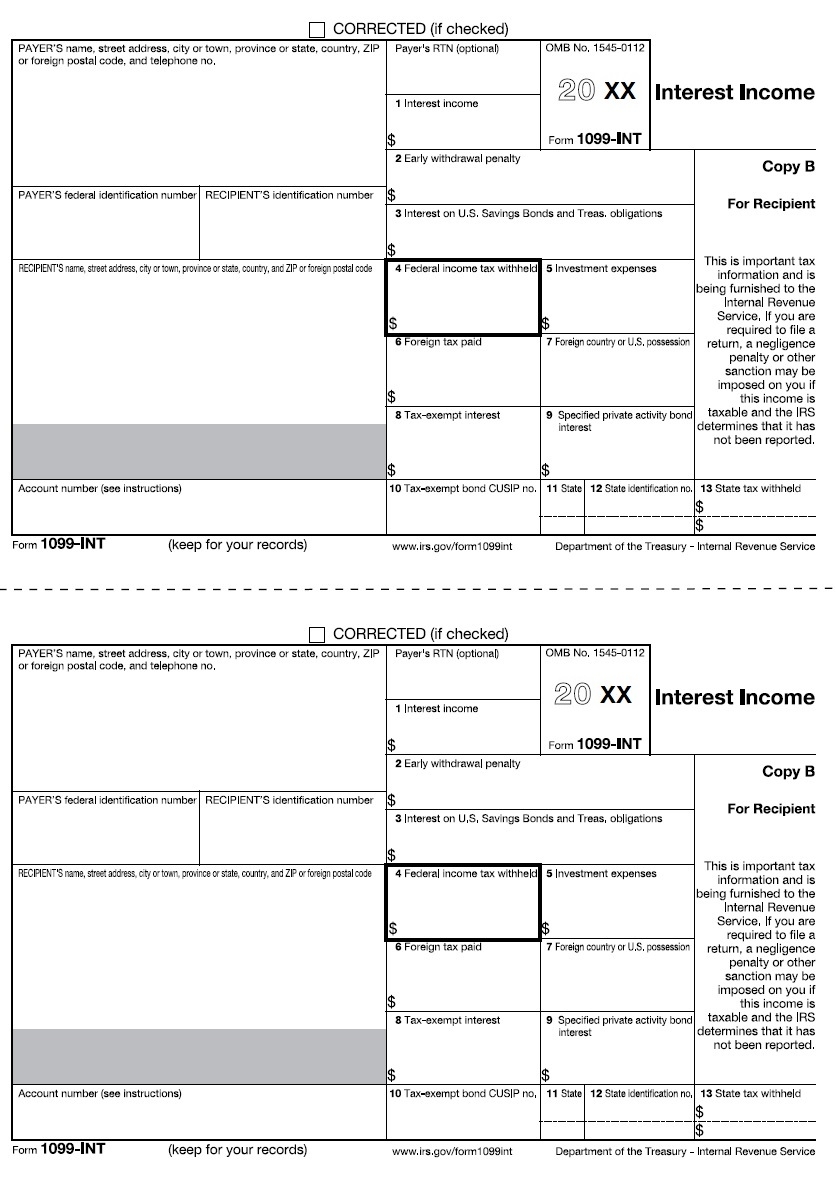

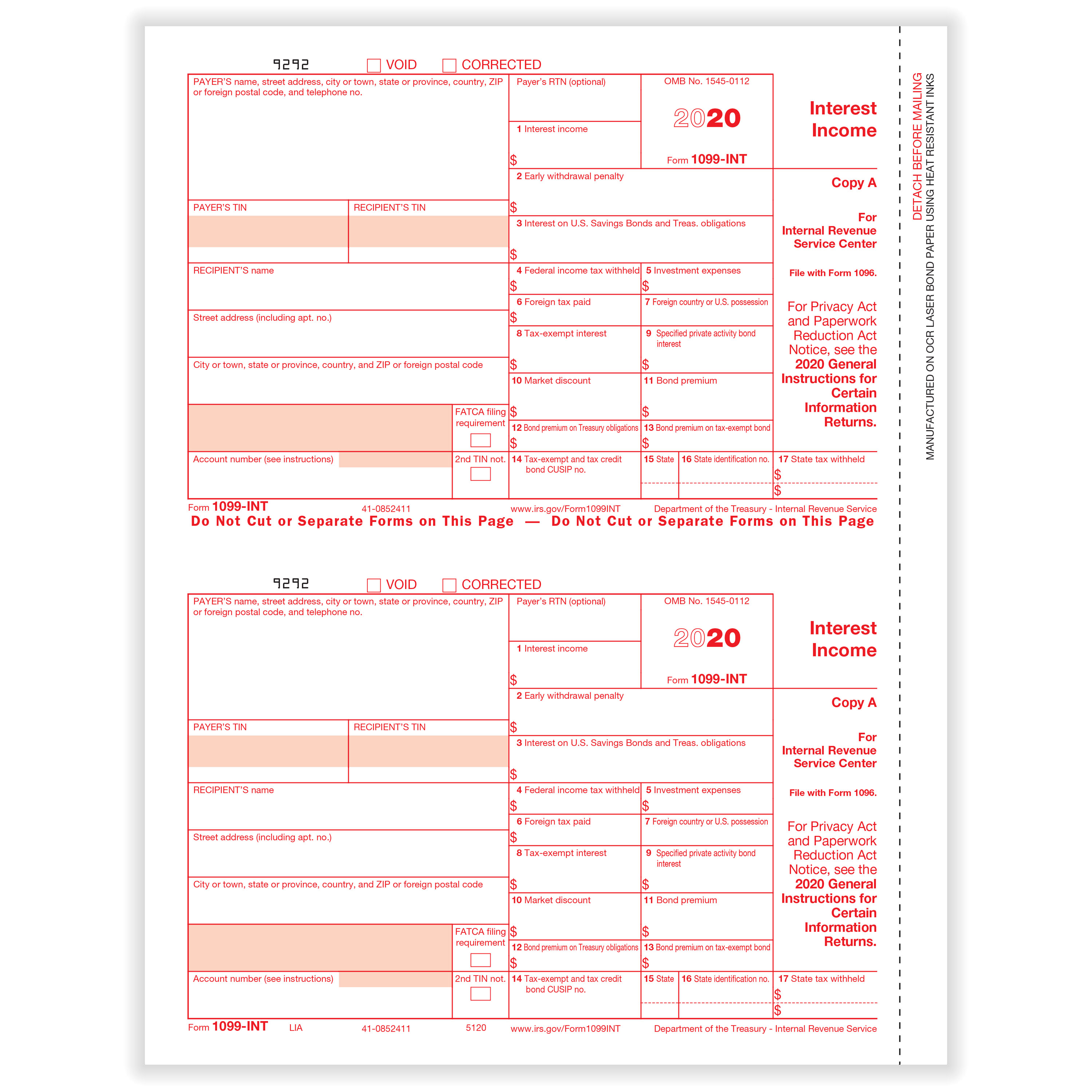

About Form 1099 INT Interest Income File Form 1099 INT for each person To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10 For whom you withheld and paid any foreign tax on interest From whom you withheld and did not refund any federal income tax under the backup withholding rules regardless of the amount of the payment Form 1099 INT is used by taxpayers to report interest income to the IRS Any payer of interest income should issue a 1099 INT Form by January 31st of the following year to any party paid at least 10 of interest The form details interest payments related expenses and taxes owed 1099 INT for 2022 2021 2020

Free Printable 1099 Int Form

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)

Free Printable 1099 Int Form

https://www.investopedia.com/thmb/OGUDDvaXzzUl5Mccne0mYit28VM=/1668x1103/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png

1099 Int Template Create A Free 1099 Int Form

https://d1qmdf3vop2l07.cloudfront.net/big-tiger1.cloudvent.net/compressed/5dfd15c0d94b65cc4e7c2552768efb21.png

Form 1099 Int Rev 10 2013 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/21/158/21158127/large.png

Key Takeaways If a bank financial institution or other entity pays you at least 10 of interest during the year it is required to prepare a Form 1099 INT send you a copy by January 31 and file a copy with the IRS If you receive a Form 1099 INT you ll need to include the amount shown in Box 1 on the taxable interest line 1099 NEC You ll receive a 1099 NEC nonemployee compensation for income you receive for contract labor or self employment of more than 600 Note Prior to tax year 2020 this information was reported on Form 1099 MISC If you work for more than one company you ll receive a 1099 NEC tax form from each company

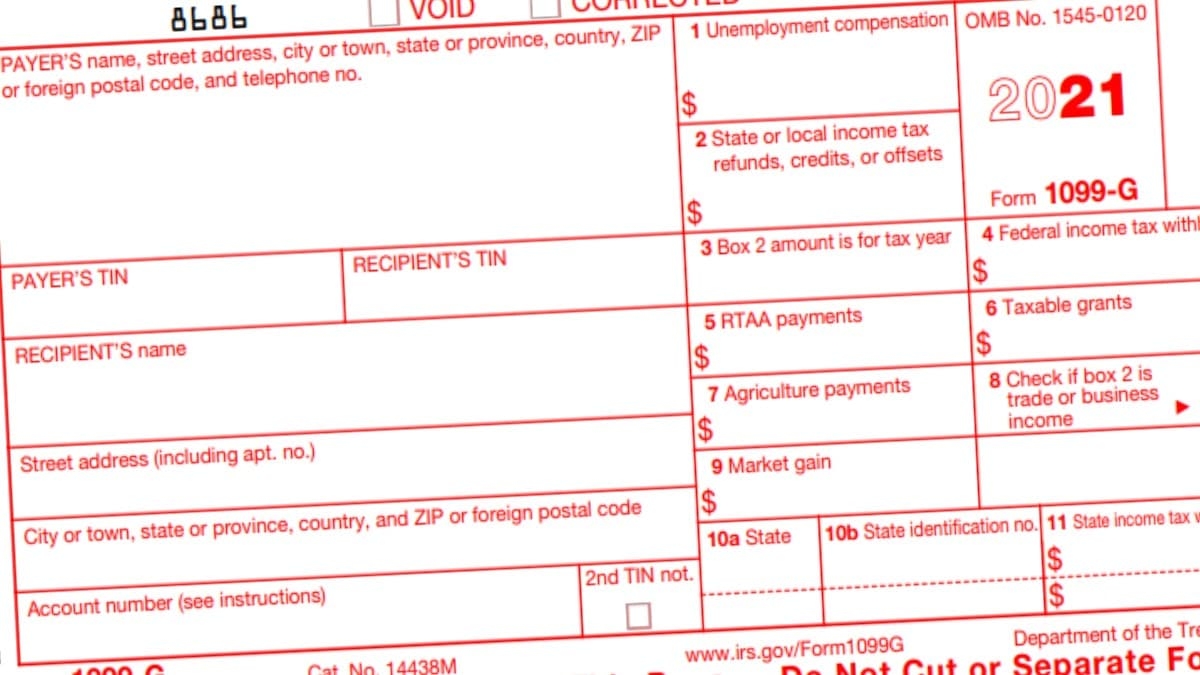

Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of 1099 forms used for various income types 1099s fall into a group of tax documents called information returns because they notify A 1099 INT tax form is a record that someone paid you interest Here s how the 1099 INT works and what you need to do with it Hassle free tax filing is 50 for all tax situations no

More picture related to Free Printable 1099 Int Form

E File 1099 File Form 1099 Online Form 1099 For 2020

https://www.expressirsforms.com/Content/Images/form-1099-int.jpg

1099INT Tax Forms For 2022 Copy B For Recipient ZBPforms

https://www.zbpforms.com/wp-content/uploads/2018/12/1099INT-Form-Copy-B-Recipient-LIB-FINAL-min.jpg

1099 INT Recipient Copy B

https://www.formsmall.com/media/catalog/product/cache/1/image/5e06319eda06f020e43594a9c230972d/1/0/1099-Int-3up-copy-B.jpg

Form 1099 INT The form issued by all payers of interest income to investors at year s end Form 1099 INT breaks down all types of interest income and related expenses Payers must issue Form 1099 From there Click Print 1099 NEC or Print 1099 MISC Select which date range you re looking for then click OK Select each contractor you want to print 1099s for Click Print 1099 or Print 1096 if you only want that form Make sure you ve got the right paper in your printer

As noted earlier in prior years contractor payments were included in Form 1099 MISC If you need to file a 1099 for nonemployee income paid in 2019 you would use the 2019 1099 MISC We cover 1099 MISC and other types of 1099 forms in more detail later in this article The due date for furnishing a copy to your contractors and vendors and filing a copy with the IRS is Jan 31 for most Account bonuses may also be reported on a 1099 INT form or separately on a 1099 MISC form 1099 MISC tax form You ll receive a 1099 MISC tax form if you re the primary account holder and received at least 600 00 in miscellaneous income for all of your deposit accounts including closed accounts during the relevant tax year

1099 INT A Quick Guide To This Key Tax Form The Motley Fool

https://g.foolcdn.com/editorial/images/472740/1099-int.PNG

1099 INT Forms Filing TaxFormExpress

https://www.taxformexpress.com/wp-content/uploads/2014/06/LIB-2022.jpg

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png?w=186)

https://eforms.com/irs/form-1099/int/

Updated January 08 2024 IRS Form 1099 INT is a tax form used to report more than 10 worth of interest paid to an individual or more than 600 worth of interest paid to a trade or business in a year The government agency bank or financial institution that paid the interest files the 1099 INT with the IRS and issues a copy to the taxpayer

https://www.irs.gov/forms-pubs/about-form-1099-int

About Form 1099 INT Interest Income File Form 1099 INT for each person To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10 For whom you withheld and paid any foreign tax on interest From whom you withheld and did not refund any federal income tax under the backup withholding rules regardless of the amount of the payment

1099 Int Federal Form 1099 INT Formstax

1099 INT A Quick Guide To This Key Tax Form The Motley Fool

IRS Form 1099 Reporting For Small Business Owners

Irs Printable 1099 Form Printable Form 2023

Free Form 1099 MISC PDF Word

Fillable 1099 Int Forms 2022 Fillable Form 2022

Fillable 1099 Int Forms 2022 Fillable Form 2022

Form 1099 INT Interest Income 2016 Free Download

Form 1099 INT IRS Copy A

Form 1099 INT Interest Income State Copy 1

Free Printable 1099 Int Form - A 1099 INT tax form is a record that someone paid you interest Here s how the 1099 INT works and what you need to do with it Hassle free tax filing is 50 for all tax situations no