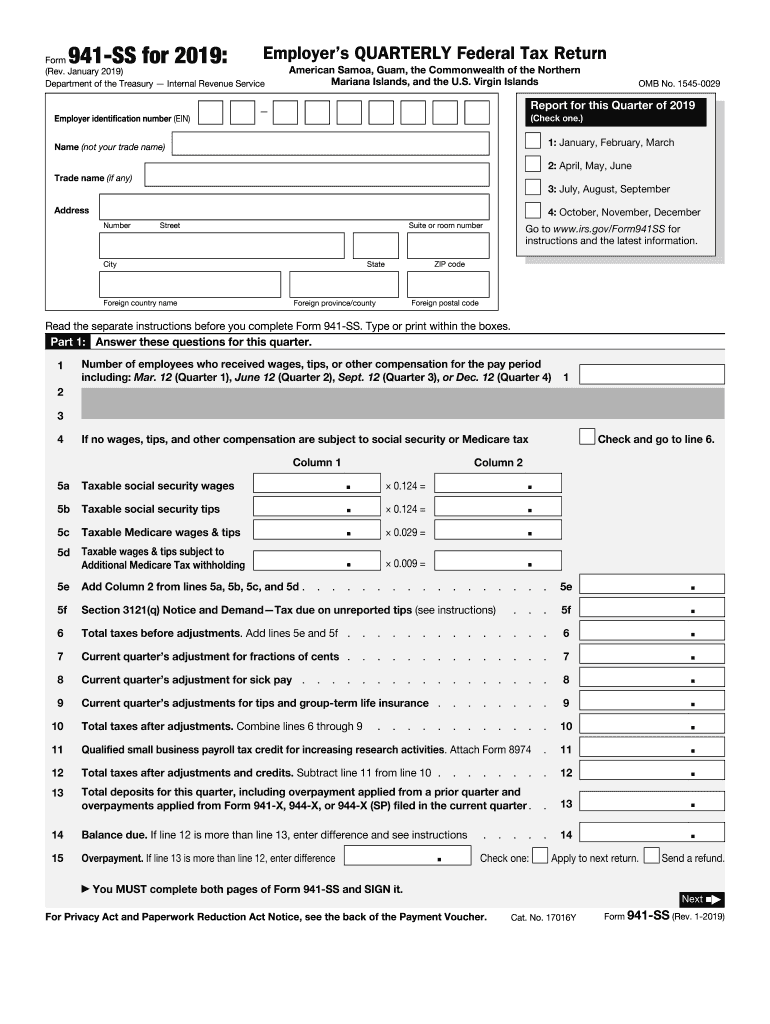

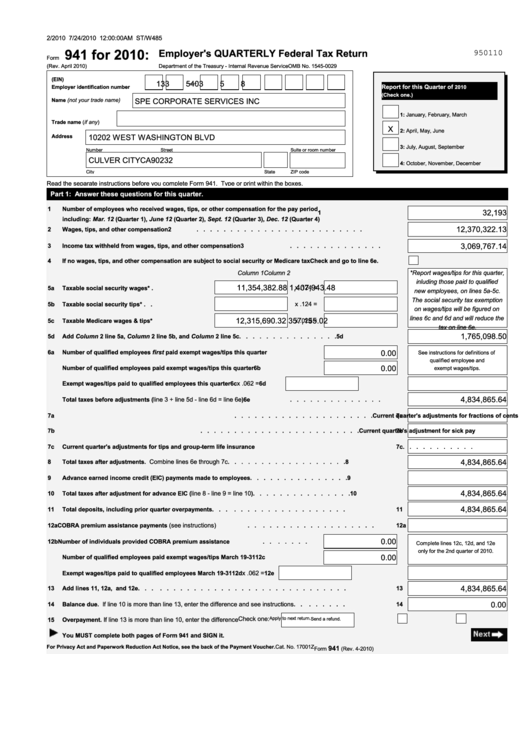

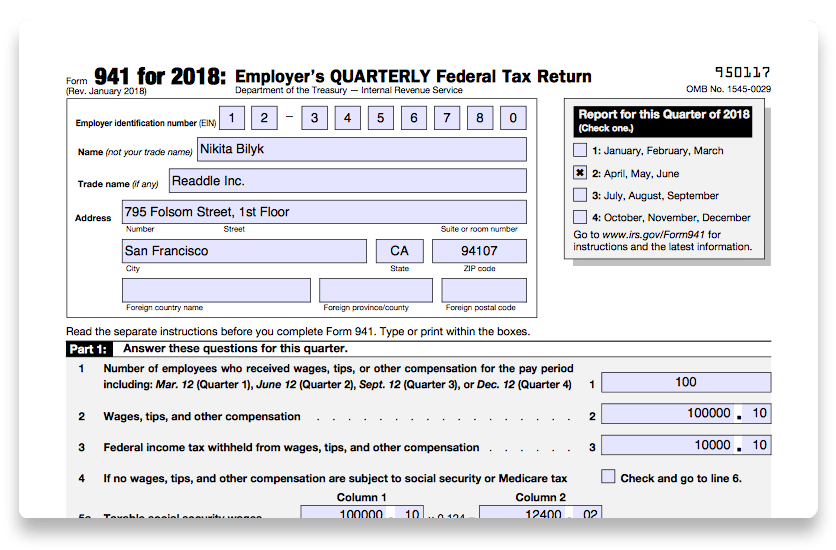

P2019 941 Printable Form Employer Quarterly Box 4 Name and address Enter your name and address as shown on Form 941 Enclose your check or money order made payable to United States Treasury Be sure to enter your EIN Form 941 and the tax period 1st Quarter 2019 2nd Quarter 2019 3rd Quarter 2019 or 4th Quarter 2019 on your check or money order

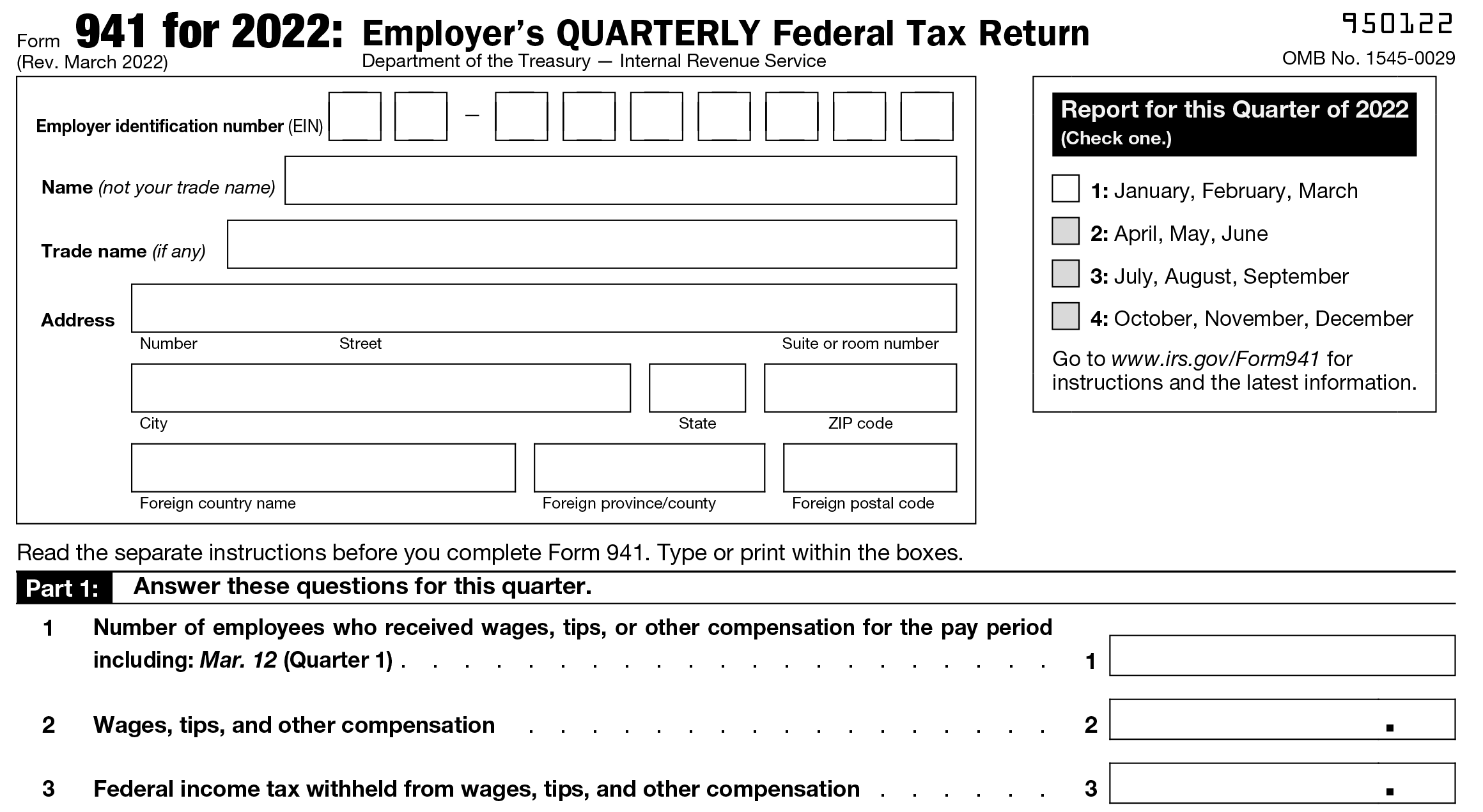

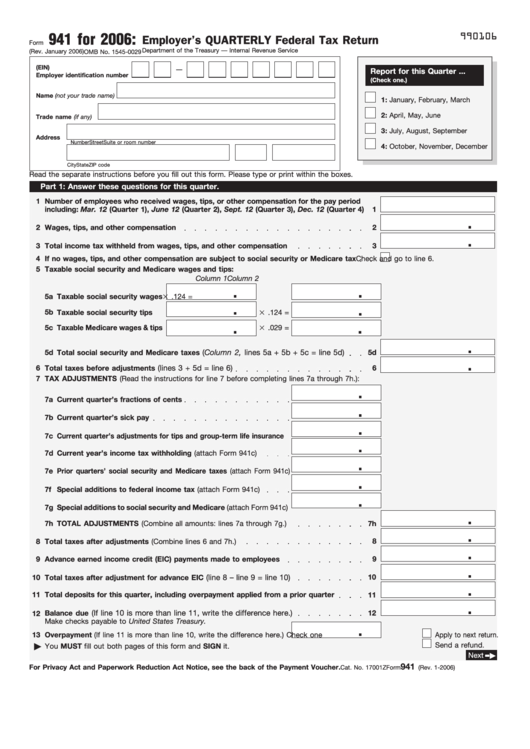

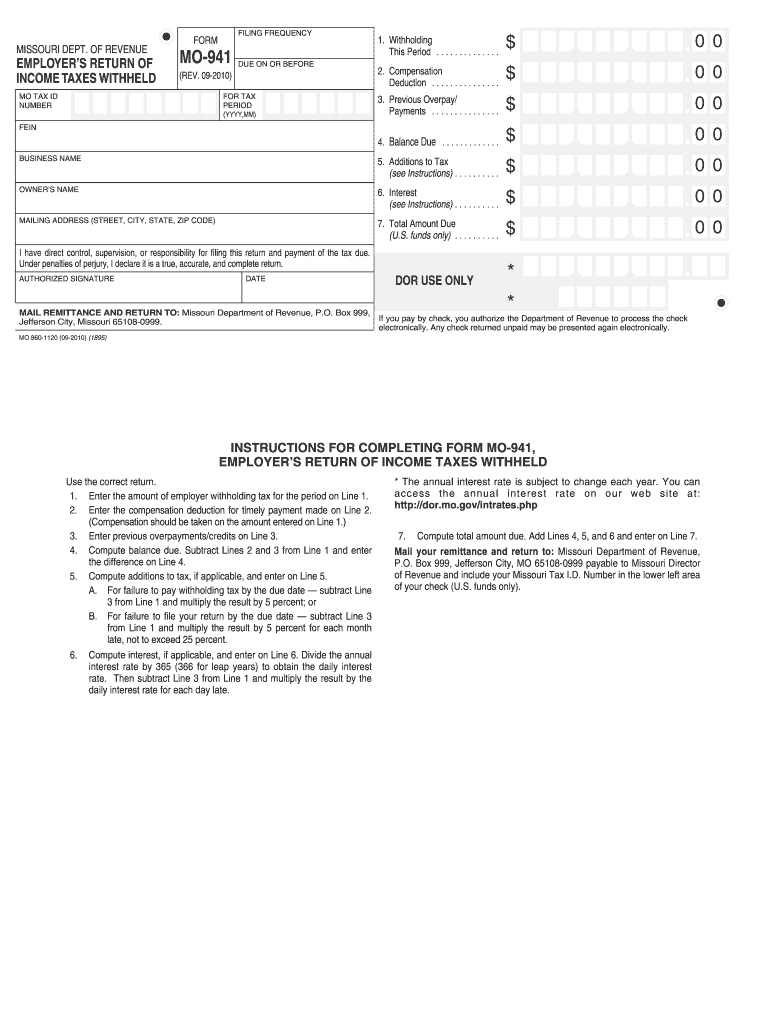

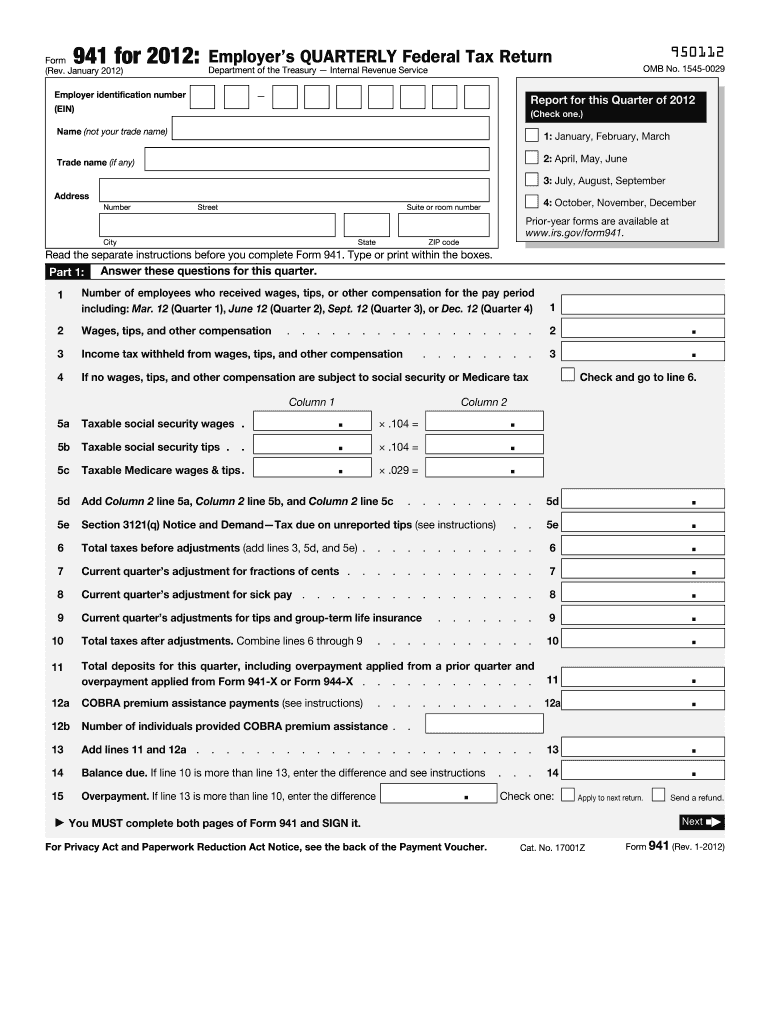

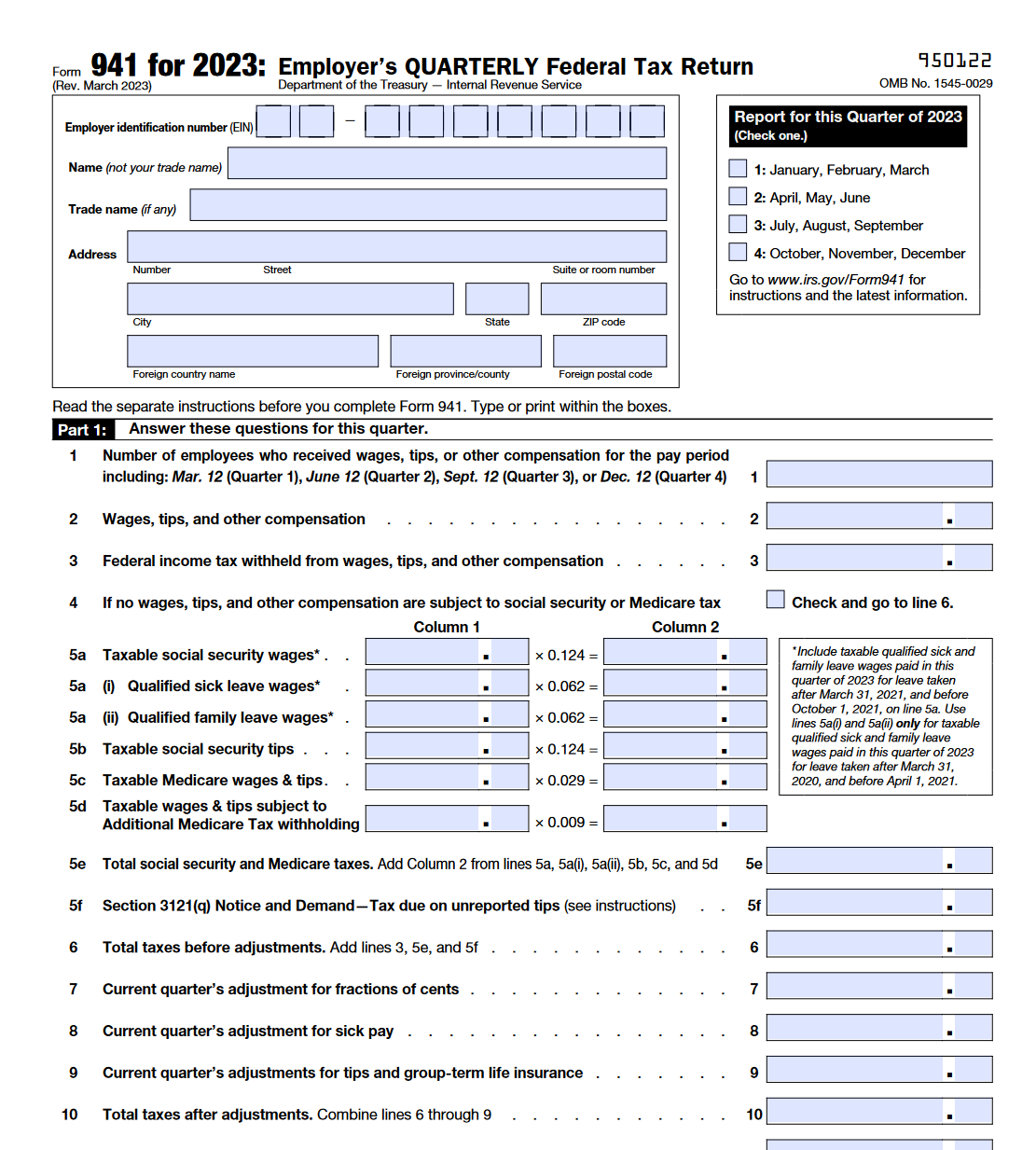

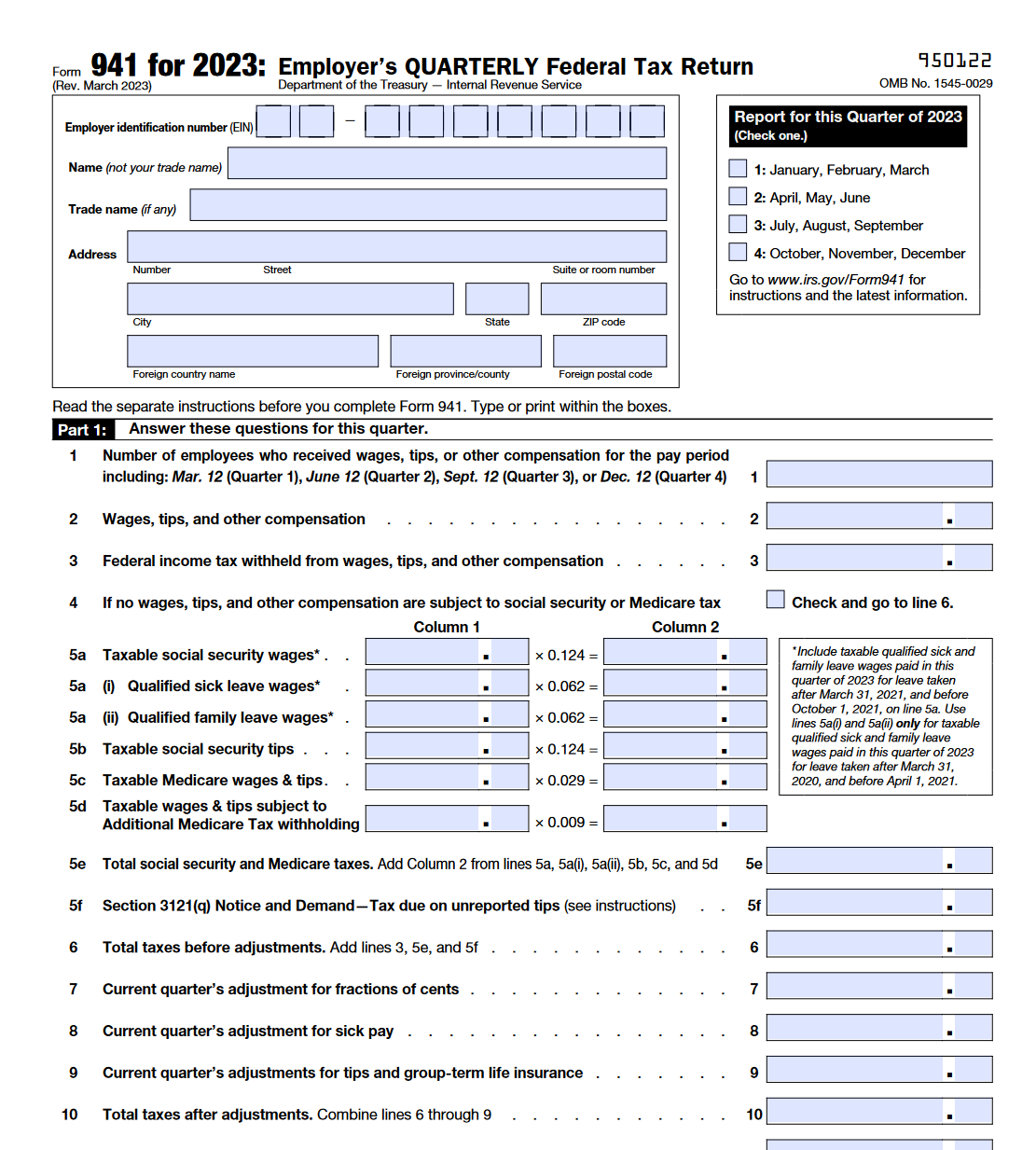

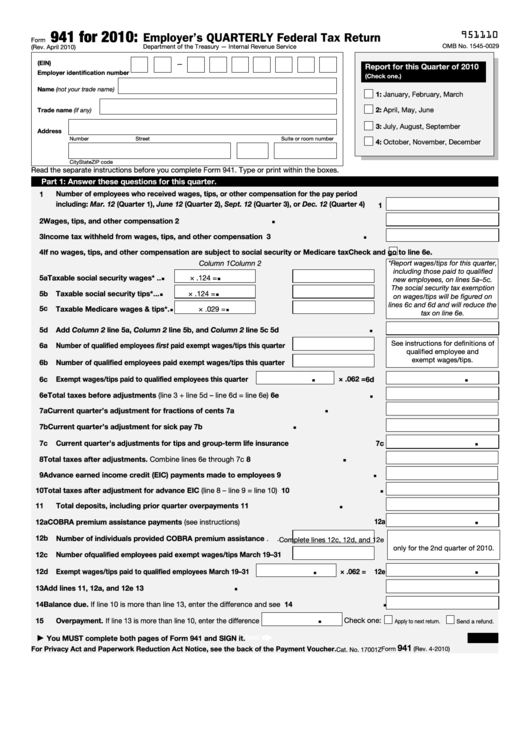

What is Form 941 IRS Form 941 also known as the Employer s Quarterly Federal Tax Return is where businesses report the income taxes and payroll taxes that they withheld from their Form 941 is a required IRS document that businesses must file every three months to report and calculate the federal income tax withheld from employees paychecks It also includes the amount of Social Security and Medicare taxes owed to the IRS by both the employer and the employees The following information is reported quarterly 1

P2019 941 Printable Form Employer Quarterly

P2019 941 Printable Form Employer Quarterly

https://www.pdffiller.com/preview/467/842/467842248/large.png

Printable 941 Form 2019 PrintableTemplates

https://www.printabletemplates.download/wp-content/uploads/4Gae0R/941.jpg

Fillable 941 Quarterly Form 2022 Printable Form Templates And Letter

https://www.taxbandits.com/content/images/form941-article-mail.png

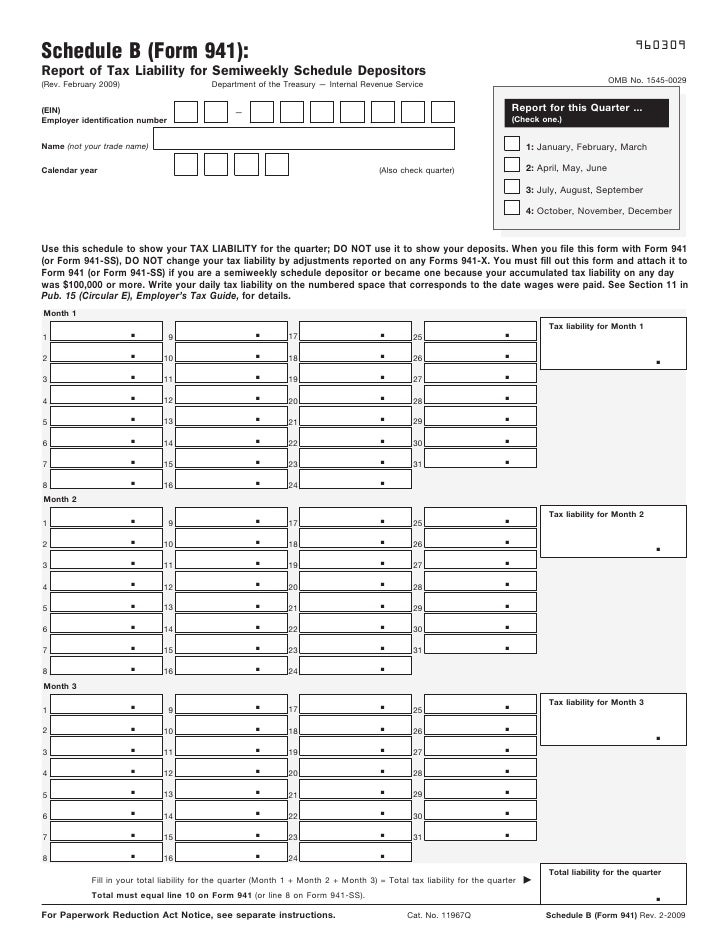

Tax year 2023 guide to the employer s quarterly federal tax Form 941 Learn filing essentials get instructions deadlines mailing info and more Employers transfer withheld taxes to the IRS monthly or semiweekly reporting quarterly on Form 941 with details on staff compensation and taxes owed or overpaid Form 941 has five parts

IRS Form 941 Employer s Quarterly Federal Tax Return is a form used by employers to report income taxes social security taxes or Medicare taxes withholding from employee s paychecks This form is also necessary to pay the employer s share of social security or Medicare tax Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF

More picture related to P2019 941 Printable Form Employer Quarterly

Fed Tax Form 941 Fillable And Printable Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/99/999/99964/page_1_thumb_big.png

Fillable 941 Quarterly Form 2022 Printable Form Templates And Letter

https://www.pdffiller.com/preview/24/469/24469452/large.png

941 Irs Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/0/55/55587/large.png

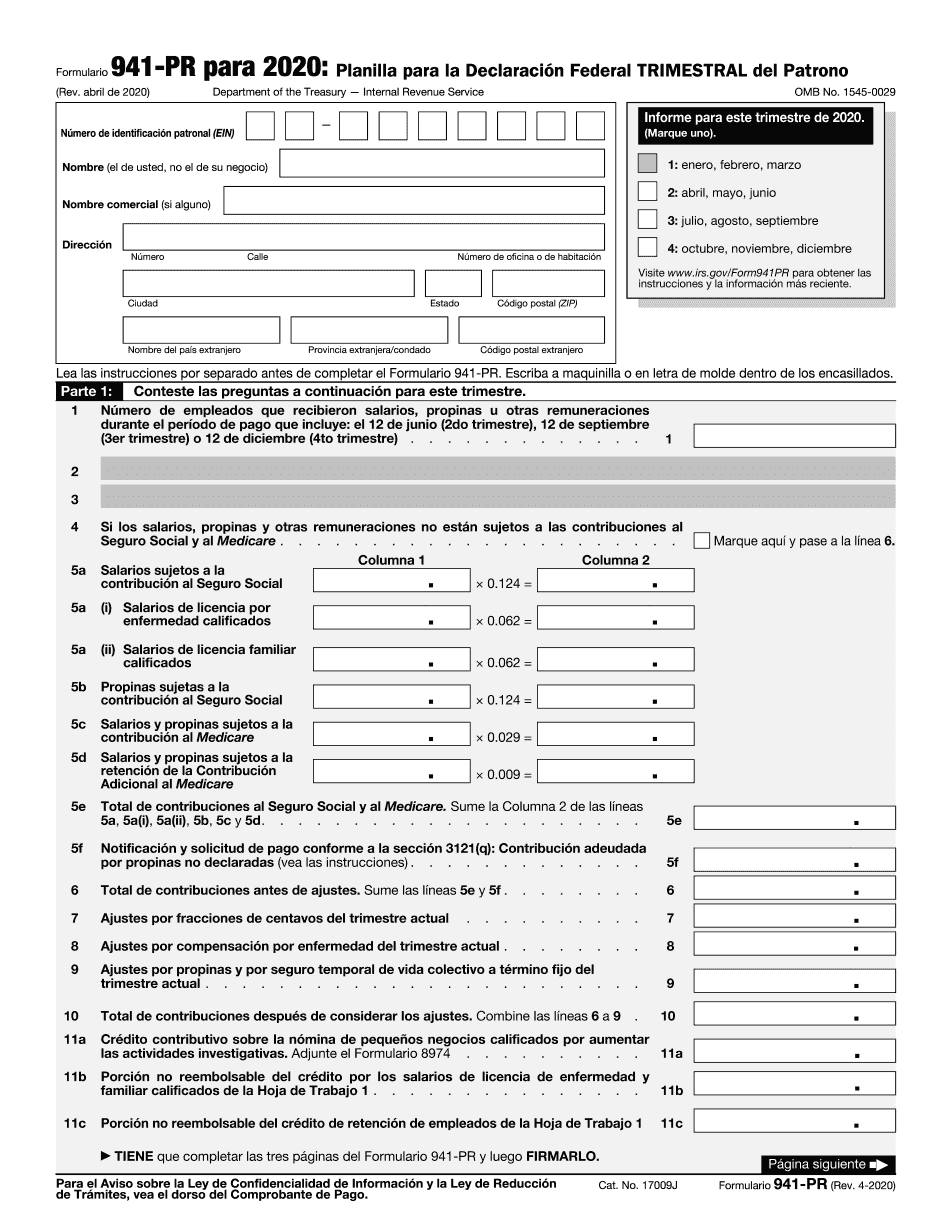

Form 941 SS Employer s QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of the Northern Mariana Islands and the U S Virgin Islands and Form 941 PR Planilla para la Declaraci n Federal TRIMESTRAL del Patrono will no longer be available after the fourth quarter of 2023 The IRS revised Form 941 Employer s Quarterly Federal Tax Return for new and expanded employment tax credits for the second third and fourth quarters of 2021 Employers use Form 941 Worksheet 4 to claim the new ERC for wages paid after June 30 2021 The nonrefundable portion of the credit is credited against the employer s share

Form 941 provides a summary of all federal income Social Security and Medicare taxes withheld and paid each quarter It must be filed by the last day of the month following the end of each quarter April 30th July 31st October 31st January 31st Failure to file Form 941 timely can result in penalties Foreign postal code 950122 OMB No 1545 0029 Report for this Quarter of 2023 Check one 1 January February March 2 April May June 3 July August September 4 October November December Go to www irs gov Form941 for instructions and the latest information Read the separate instructions before you complete Form 941

IRS Form 941 Employer s QUARTERLY Federal Tax Return Forms Docs 2023

https://blanker.org/files/images/form-941.png

Form 941 Employer s Quarterly Federal Tax Return

https://image.slidesharecdn.com/1272521/95/form-941-employers-quarterly-federal-tax-return-1-728.jpg?cb=1239357209

https://www.irs.gov/pub/irs-prior/f941--2019.pdf

Box 4 Name and address Enter your name and address as shown on Form 941 Enclose your check or money order made payable to United States Treasury Be sure to enter your EIN Form 941 and the tax period 1st Quarter 2019 2nd Quarter 2019 3rd Quarter 2019 or 4th Quarter 2019 on your check or money order

https://www.nerdwallet.com/article/small-business/irs-form-941-instructions

What is Form 941 IRS Form 941 also known as the Employer s Quarterly Federal Tax Return is where businesses report the income taxes and payroll taxes that they withheld from their

Free Printable Irs Form 941 Printable Forms Free Online

IRS Form 941 Employer s QUARTERLY Federal Tax Return Forms Docs 2023

Form 941 Employers Quarterly Federal Tax Return Form 941 Employer 19 Printable 941 Schedule B

Printable Form 941

Form 941 2023 Fillable Printable Forms Free Online

2022 Form IRS 941 X Fill Online Printable Fillable Blank PdfFiller

2022 Form IRS 941 X Fill Online Printable Fillable Blank PdfFiller

Printable 941 Form 2019 PrintableTemplates

What Employers Need To Know About 941 Quarterly Tax Return

Printable Form 941 Printable Forms Free Online

P2019 941 Printable Form Employer Quarterly - Tax year 2023 guide to the employer s quarterly federal tax Form 941 Learn filing essentials get instructions deadlines mailing info and more