Printable California W 2 Form Complete this form so that your employer can withhold the correct California state income tax from your paycheck Use Worksheet A for Regular Withholding allowances Use other worksheets on the following pages as applicable 1a Number of Regular Withholding Allowances Worksheet A 1b

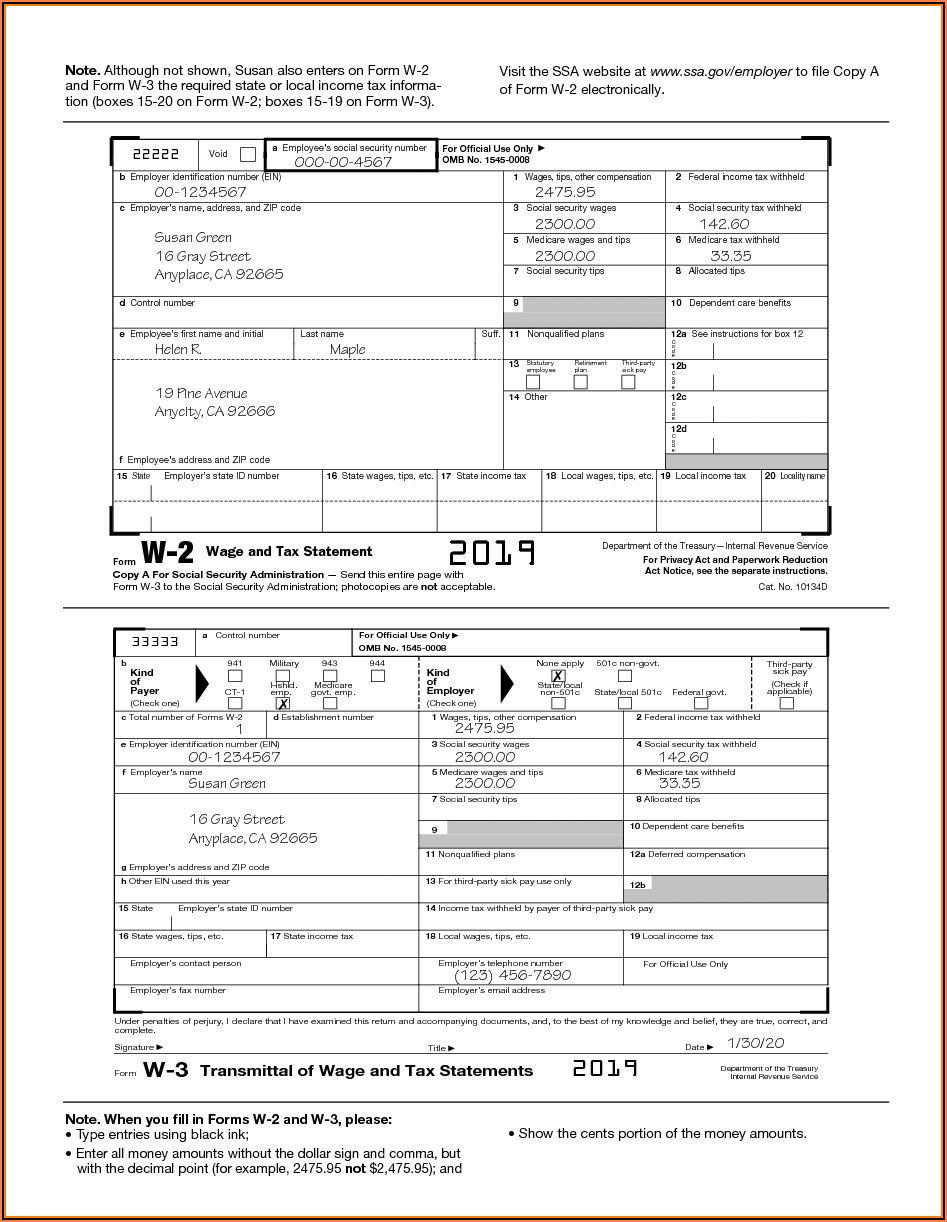

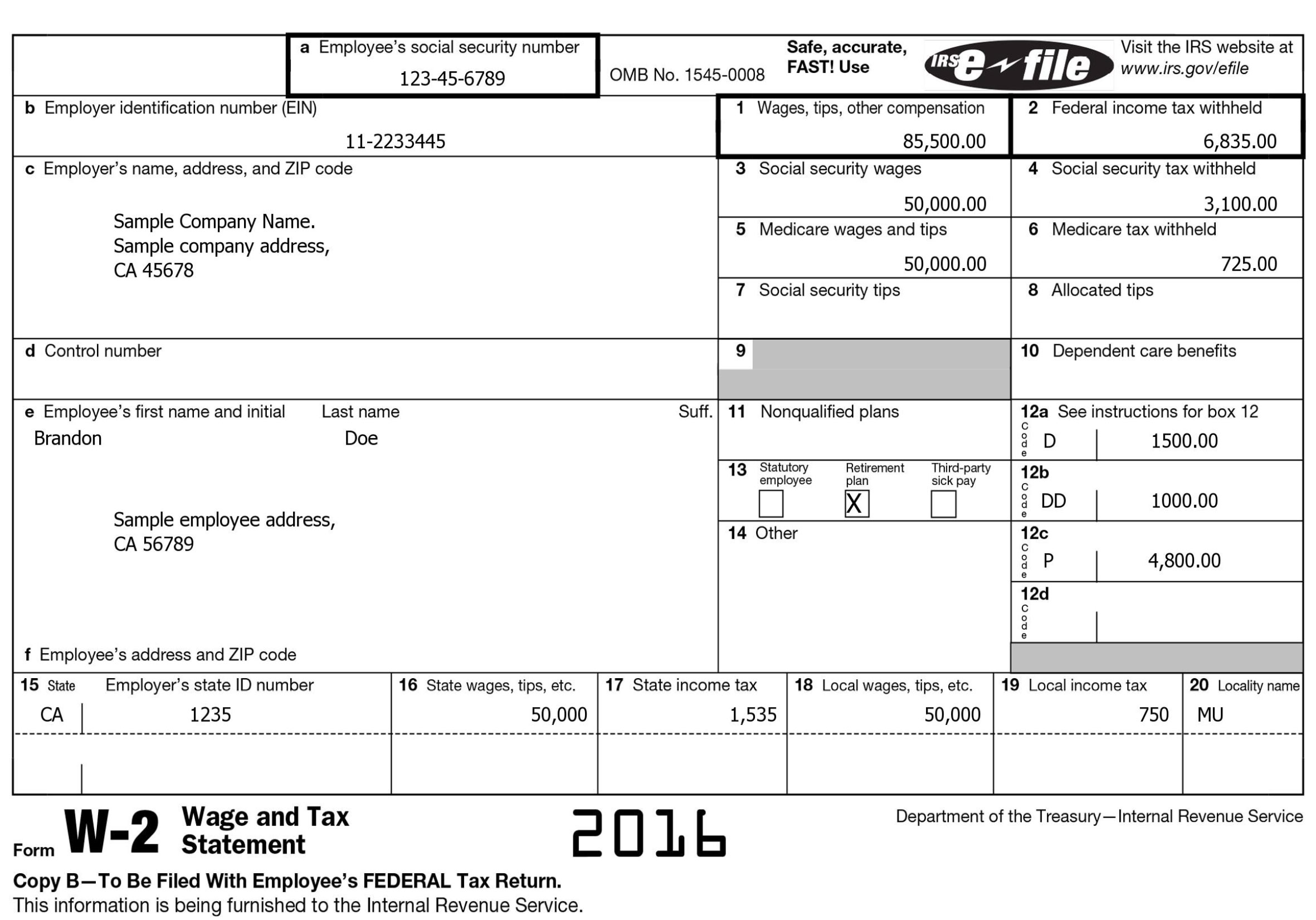

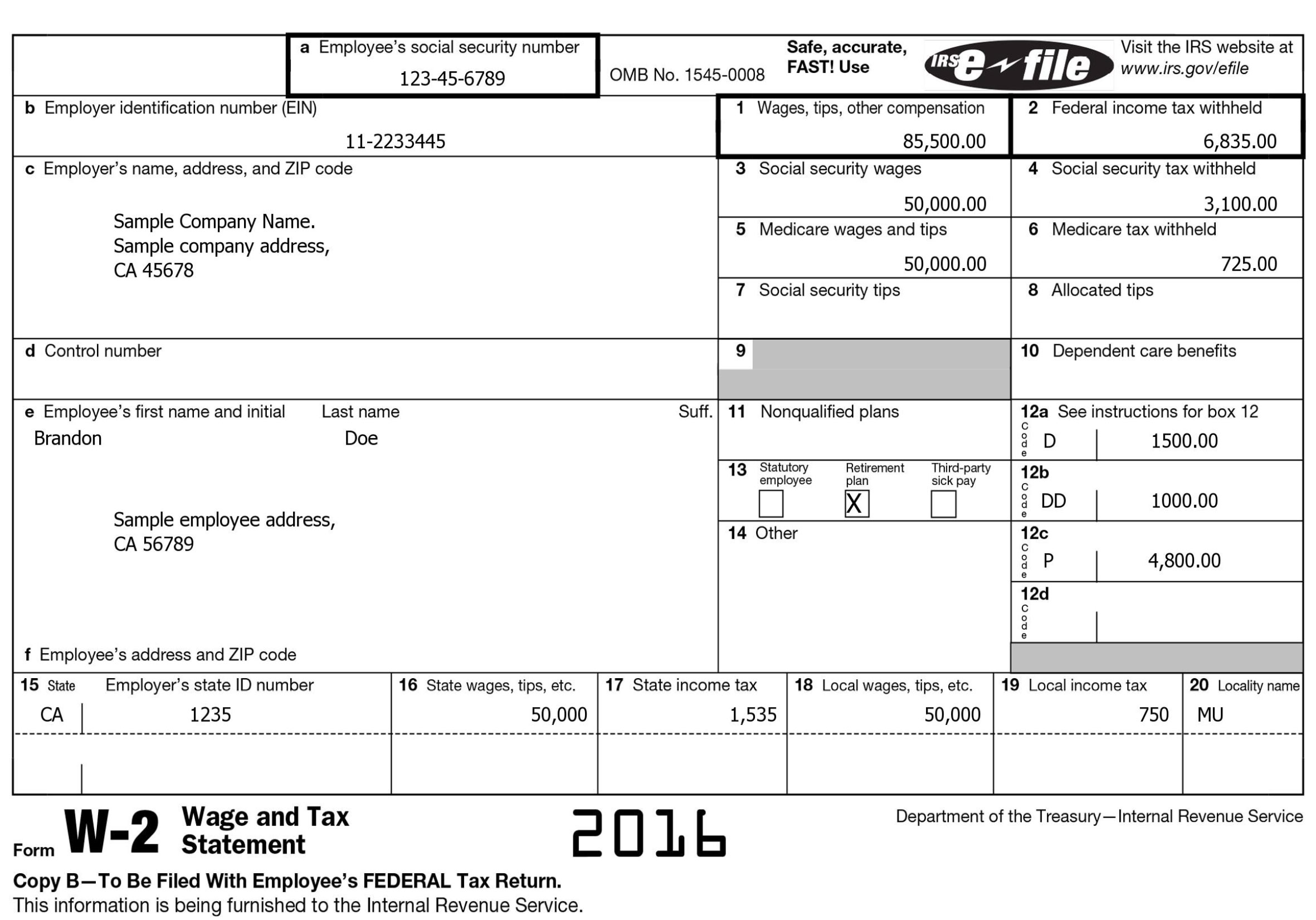

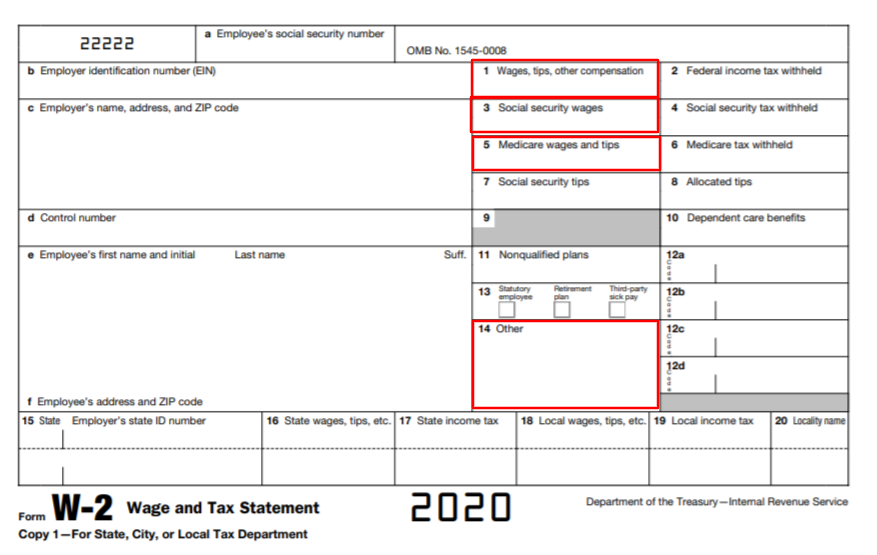

A W 2 Form also known as a Wage and Tax Statement is a form that an employer completes and provides to the employee to complete their tax return Form W 2 must contain certain information including wages earned and state federal and other taxes withheld from an employee s earnings The Form W 2 must be provided to employees by January 31 Form W 2 Wage and Tax Statements are mailed to your home address or routed to your department for distribution This normally occurs by January 31st of each year If you do not receive your Form W 2 by the end of January you should contact your Personnel Payroll Office

Printable California W 2 Form

Printable California W 2 Form

https://gusto.com/wp-content/uploads/2019/12/Form-W-2-Box-14.jpg

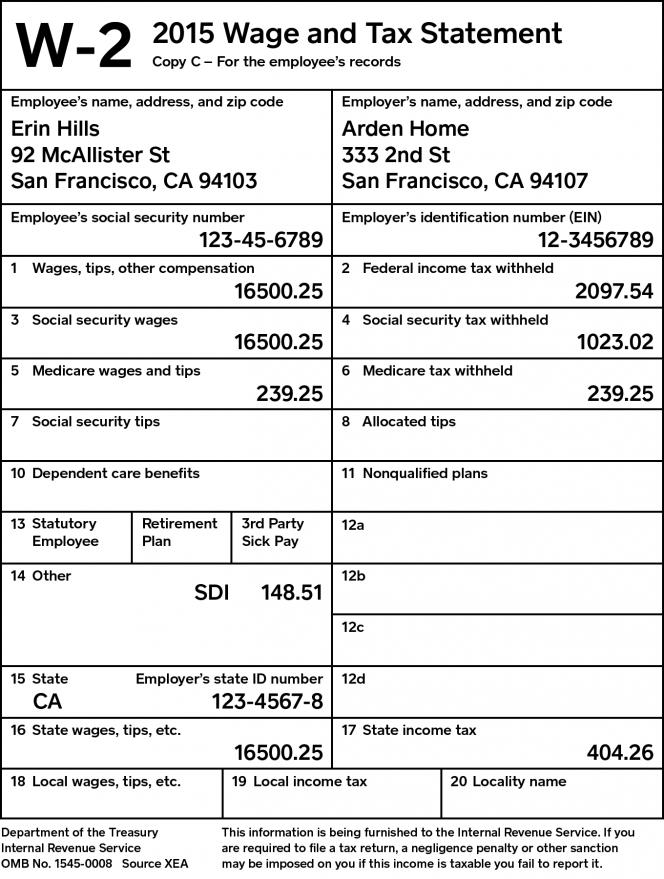

California W2 Form 2015 Amulette

https://www.amulettejewelry.com/wp-content/uploads/2018/09/california-w2-form-2015-w2-example-1455840596416.jpg

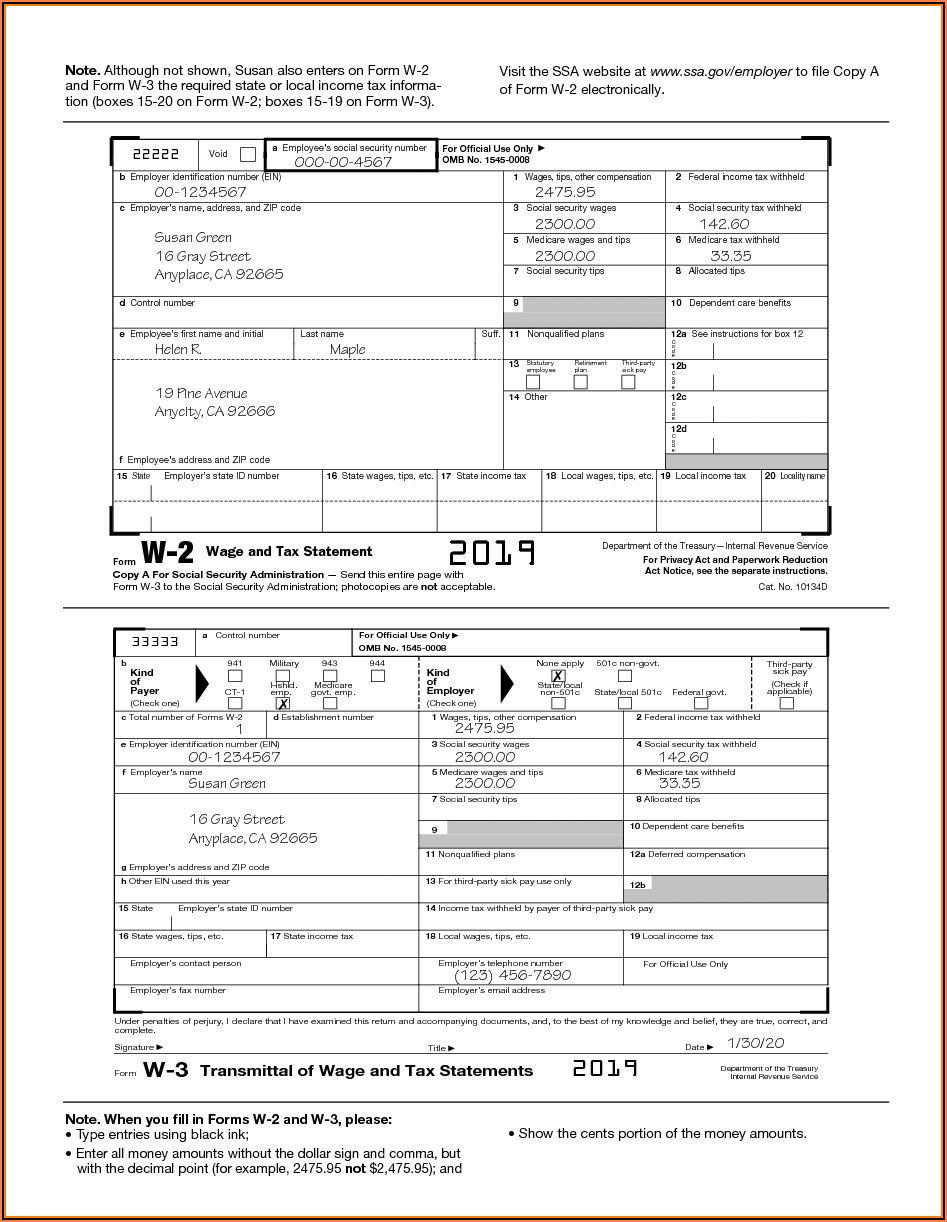

Employer Identification Number W2 Form Universal Network

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/w2-form-employer-state-id-number.jpg

California form must be used If there is no difference between California and federal amounts you may use a copy of the federal form If there is a difference between California and federal amounts use the California form Form W 2 PDF Instructions for Forms W 2 and W 3 Print Version PDF Including Forms W 2AS W 2CM W 2GU W 2VI W 3SS W 2c and W 3c Recent Developments SECURE 2 0 Act changes affecting amounts reported on the 2023 Forms W 2 W 2AS W 2GU and W 2VI 29 JAN 2024

Cal Employee Connect CEC View and print your Form W 2 Form W 2 vs Pay Stub FAQs Form W 2 Wage And Tax Statement FAQs Form W 2C Corrected Form W 2 FAQs Request A Duplicate Form W 2 Civil Service Tax Sheltered Annuity 403b Plans Important Information And Guidance For Determining Your Tax Withholdings Wage and Tax Statement Form W 2 Federal Earned Income Tax Credit Information Return Form 1099 Review the list of tax forms and notifications employers must provide to employees at year end such as Form W 2 Federal Earned Income Tax Credit EITC notification and Form 1099

More picture related to Printable California W 2 Form

How To Fill Out A W 2 Form Everything Else Employers Need To Know

https://fitsmallbusiness.com/wp-content/uploads/2022/07/Screenshot_of_W2_Form_2022.jpg

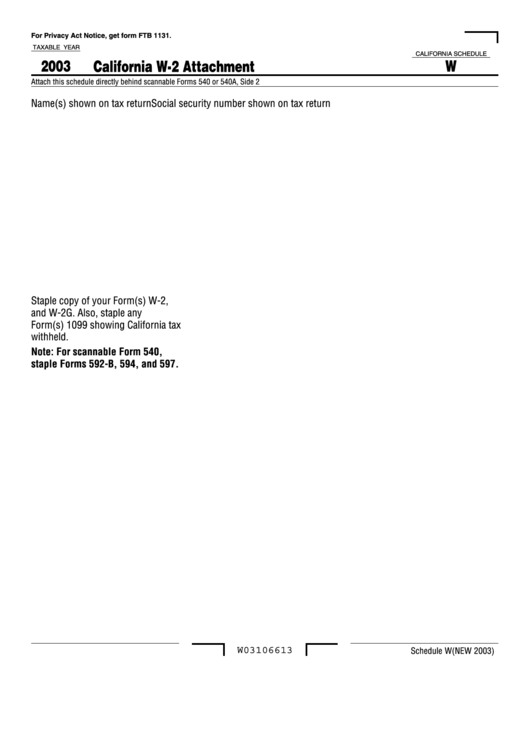

Fillable California W 2 Attachment Schedule W California Franchise Tax Board 2003

https://data.formsbank.com/pdf_docs_html/242/2421/242164/page_1_thumb_big.png

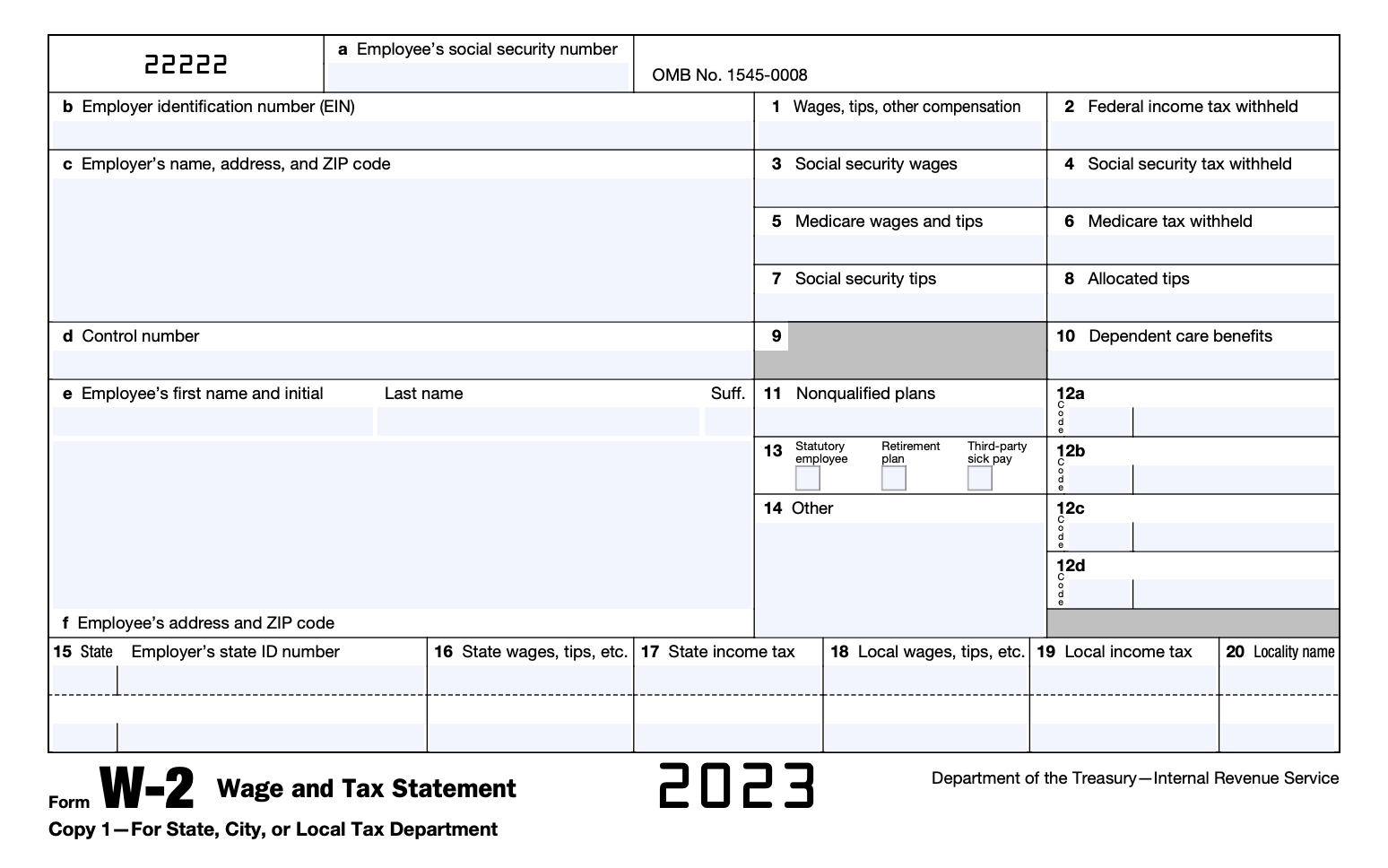

W 2 Form Legal Templates

https://legaltemplates.net/wp-content/uploads/Form-W-2-for-2023.png

2024 Form W 2 Attention You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA By January 31 the previous year s W 2 should be in the hands of all employees With the ability to either send a PDF form or post W 2s on a secure website this deadline should be easy to reach for most The IRS wants any employee who does not receive their W 2 form by February 15 th to contact them and fill them in on their employer s

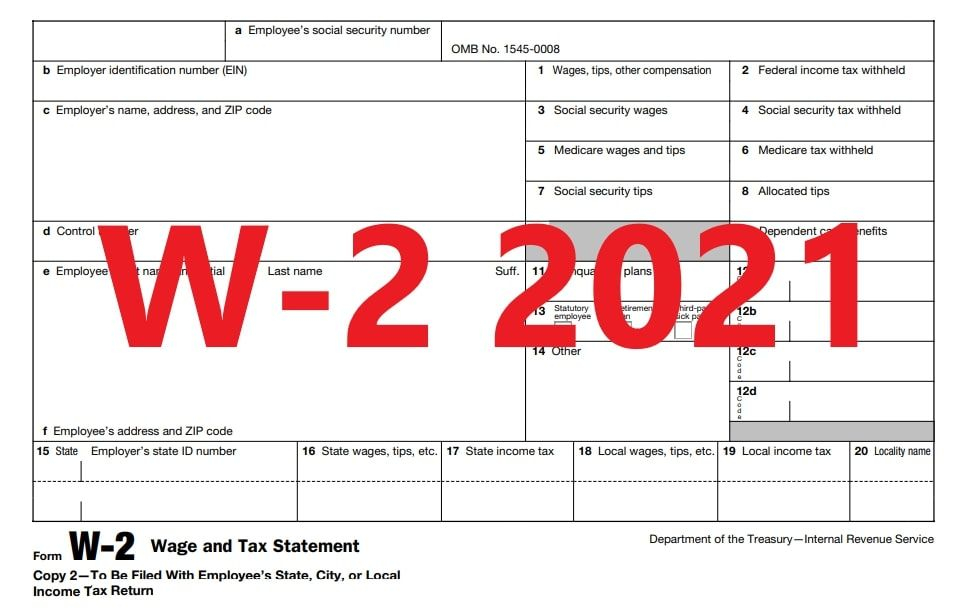

2021 Form W 2 Attention You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA There s a reason why a W 2 is referred to as a wage and tax statement Put simply it s a form that shows how much money an employee has earned for the year and the amount of taxes that employers have already handed over to the IRS Not everyone needs a W 2 form Independent contractors and folks who are self employed need a 1099 form instead

W2 Form California Form Resume Examples 4x2vRz825l

https://www.contrapositionmagazine.com/wp-content/uploads/2020/07/printable-w2-form-california.jpg

Understanding Your Tax Forms The W 2

https://blogs-images.forbes.com/kellyphillipserb/files/2014/02/W2.png

https://edd.ca.gov/siteassets/files/pdf_pub_ctr/de4.pdf

Complete this form so that your employer can withhold the correct California state income tax from your paycheck Use Worksheet A for Regular Withholding allowances Use other worksheets on the following pages as applicable 1a Number of Regular Withholding Allowances Worksheet A 1b

https://formswift.com/w2

A W 2 Form also known as a Wage and Tax Statement is a form that an employer completes and provides to the employee to complete their tax return Form W 2 must contain certain information including wages earned and state federal and other taxes withheld from an employee s earnings The Form W 2 must be provided to employees by January 31

California W2 Form 2015 Amulette

W2 Form California Form Resume Examples 4x2vRz825l

Printable Form W 2

Irs Form W 2 2021 Fillable Fill Out Sign Online DocHub

How To Fill Out And Print W2 Forms

W 2 Form Sample

W 2 Form Sample

Free Printable W2 Form 2021 Printable Form Templates And Letter

W 2 Reporting Requirements W 2 Changes For 2020 Forms

W 2 Form 2021 Printable Form 2021

Printable California W 2 Form - W 2 Printed Version If you did not select to have your W 2 sent to you electronically your statement will arrive by mail Printed W 2s are mailed by January 31 Sample W 2 Box b and c contain the Employer s federal identification number name and address Boxes a and e contain your Social Security number name and address