Printable Homeowners Exemption Form Idaho Contact your county assessor s office or call us at 208 334 7736 if you need help Alternately you can fill out and mail a paper form to your county assessor Contact your assessor s office for the form or download it here Property Tax Reduction Application Property Tax Reduction Application Instruction Other forms

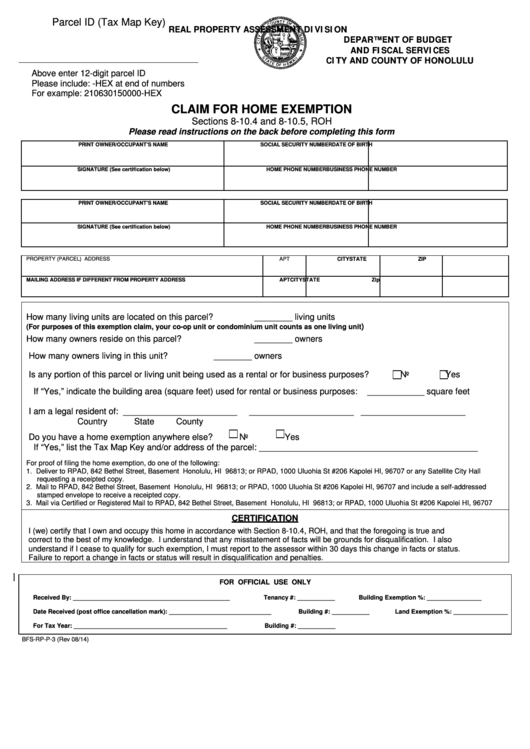

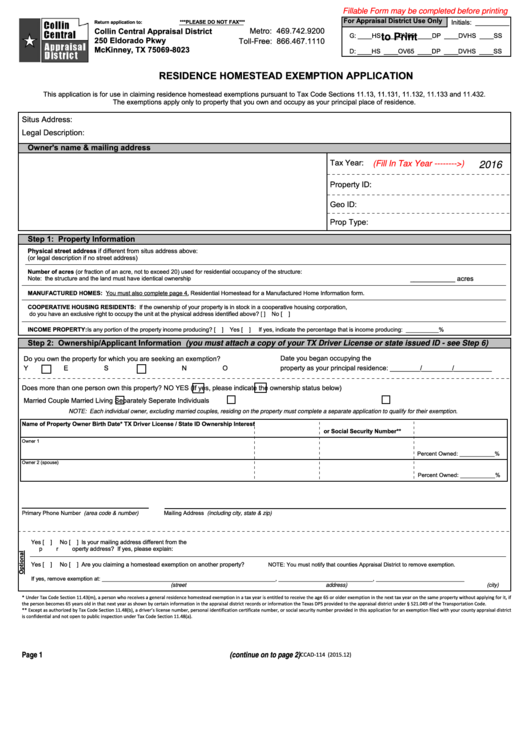

THIS APPLICATION MUST BE FILED WITH YOUR COUNTY ASSESSOR BY APRIL 18 2023 APPLICATION FOR PROPERTY TAX REDUCTION FOR 2023 ALL OF THE FOLLOWING QUESTIONS MUST BE COMPLETED ATTACH SUPPORTING DOCUMENTS County Code Area Parcel Number Section A 1 Ownership Information Name address and ZIP code 2 Social Security Number Claimant 3 If you own and occupy a home including manufactured homes as your primary residence you could qualify for a homeowner s exemption for that home and up to one acre of land Learn more on the Property Tax Homeowners Exemption page Property tax reduction program

Printable Homeowners Exemption Form Idaho

Printable Homeowners Exemption Form Idaho

https://data.formsbank.com/pdf_docs_html/43/437/43784/page_1_thumb_big.png

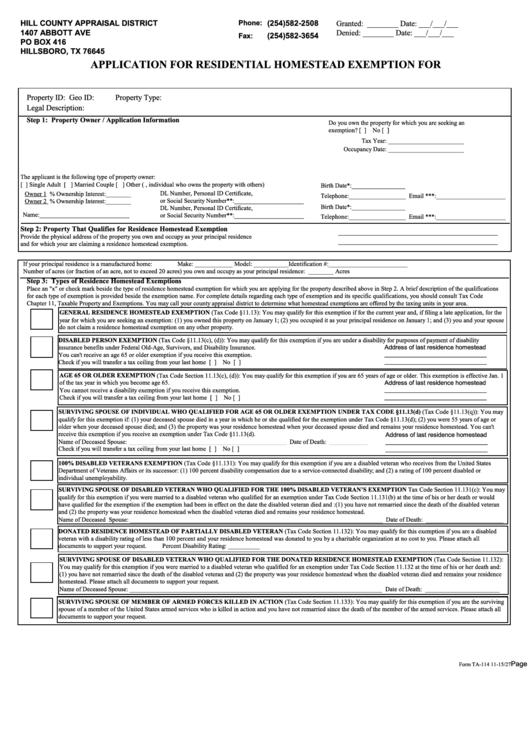

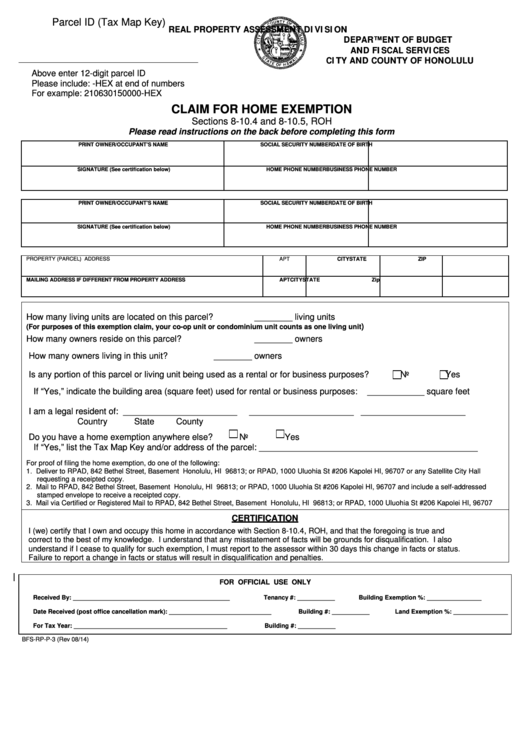

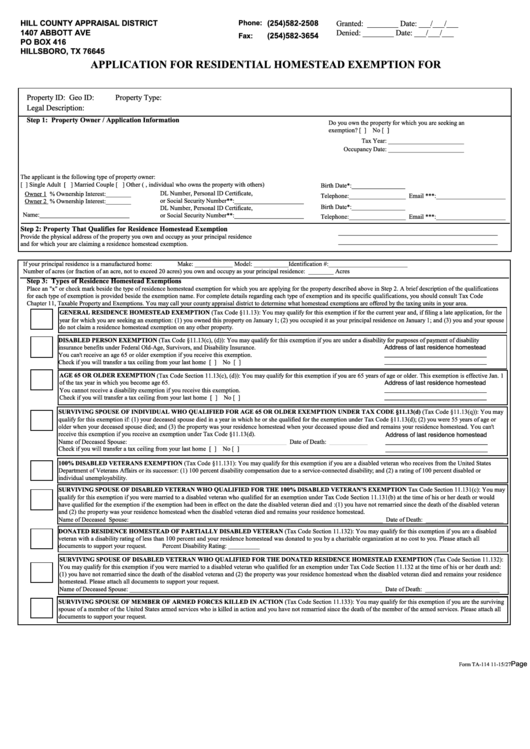

Orange County Homeowners Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-claim-for-home-exemption-printable-pdf-download.png

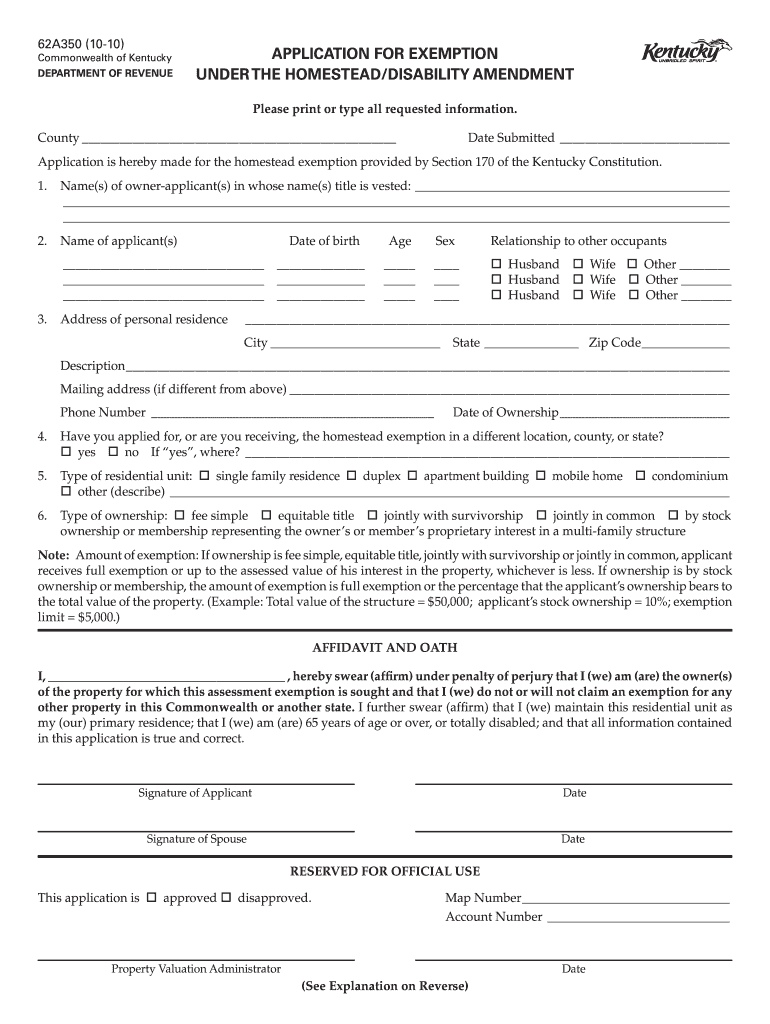

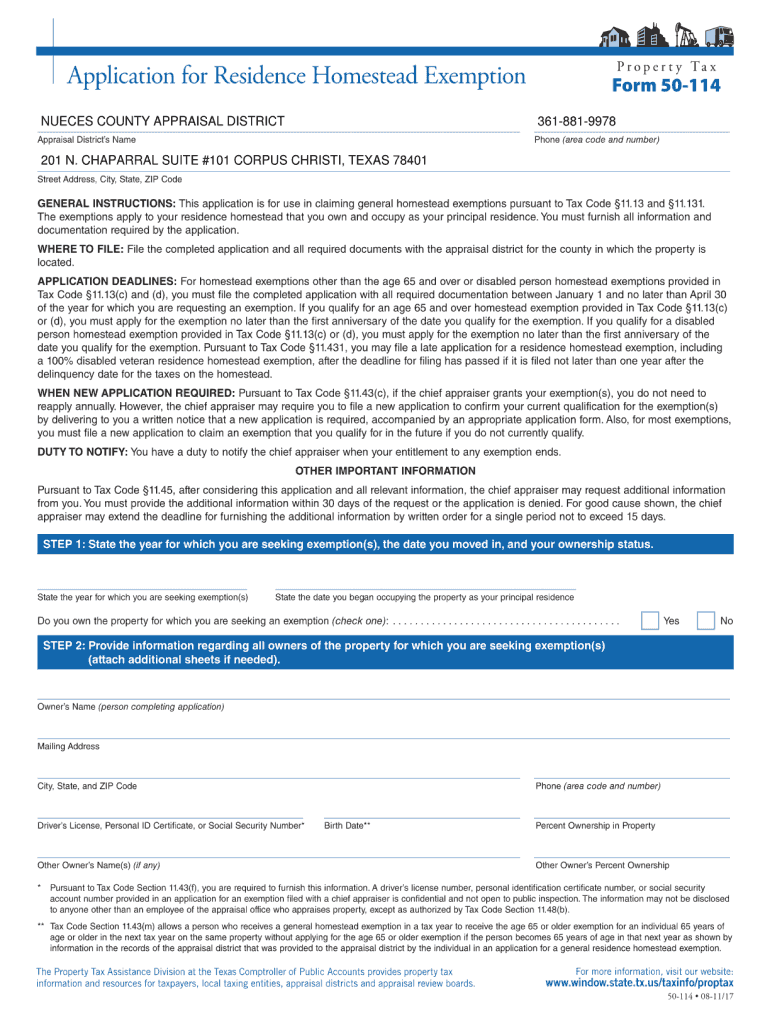

Homestead Application Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/1/115/1115331/large.png

Exempt Buyers Purchases made directly by the entities listed below are exempt Check the box that applies Each owner occupied primary residence house or manufactured home and up to one acre of land is eligible for a homeowner s exemption You must own and occupy your home before April 15th and you must file an application with your county assessor s office by April 15th of the tax year

Homestead Exemption Each owner occupied primary residence house or manufactured home and up to one acre of land is eligible for a Homestead Exemption This exemption allows the value of your residence and land up to one acre be exempted at 50 of the assessed value up to a maximum of 125 000 whichever is less Homeowner s Exemption is a program that reduces property taxes for individuals who own and occupy their home as their primary residence The following application should be completed only after the transfer of ownership has been completed and the applicant has moved into the home and made it their primary residence

More picture related to Printable Homeowners Exemption Form Idaho

Homeowners Exemption Form Riverside County ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/application-for-nueces-residence-homestead-exemption-fill-online.png

2009 Form IL Disabled Veterans Standard Homeowner Exemption Cook County Fill Online Printable

https://www.pdffiller.com/preview/26/913/26913050/large.png

Tax Exemption Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/11/44/11044386/large.png

Homeowner s Exemption Form Print Fill Out No items found Contact Information 208 529 1320 To qualify for a HOMEOWNER S EXEMPTION Idaho Code 63 602G you must be the owner and occupy this property as your primary place of residence To receive the Homeowner s Exemption for the current year you must have owned and occupied a The homeowner s exemption is a program that reduces property taxes for individuals who own and occupy their home as their primary residence This is done by reducing the net taxable value of the home and up to one acre of land by half or up to 125 000 worth of exemption whichever is less Beginning in 2021 the maximum homeowner s

Homeowners Exemption forms can be obtained through the Assessor s Office click here Application Worksheets 2024 Property Tax Exemption Short Form 2024 Property Tax Exemption Long Form 63 602B Religious Corporations or Societies pdf 63 602C Fraternal Benevolent Or Charitable Societies pdf 12 28 2023 Affidavit Regarding Limited Partnership Limited Liability Company or Corporation form 01 07 2021 Instructions for Completing the Property Tax Reduction PTR Application 01 01 2014 Application for Property Tax Deferral

2015 2023 Form VA DoT ST 14 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/467/177/467177625/large.png

Top 24 Idaho Tax Exempt Form Templates Free To Download In PDF Format ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/top-24-idaho-tax-exempt-form-templates-free-to-download-in-pdf-format-1.png

https://tax.idaho.gov/taxes/property/homeowners/reduction/

Contact your county assessor s office or call us at 208 334 7736 if you need help Alternately you can fill out and mail a paper form to your county assessor Contact your assessor s office for the form or download it here Property Tax Reduction Application Property Tax Reduction Application Instruction Other forms

https://tax.idaho.gov/wp-content/uploads/forms/efo00002/efo00002_12-29-2022.pdf

THIS APPLICATION MUST BE FILED WITH YOUR COUNTY ASSESSOR BY APRIL 18 2023 APPLICATION FOR PROPERTY TAX REDUCTION FOR 2023 ALL OF THE FOLLOWING QUESTIONS MUST BE COMPLETED ATTACH SUPPORTING DOCUMENTS County Code Area Parcel Number Section A 1 Ownership Information Name address and ZIP code 2 Social Security Number Claimant 3

Henry County Homestead Exemption Fill Online Printable Fillable Blank PdfFiller

2015 2023 Form VA DoT ST 14 Fill Online Printable Fillable Blank PdfFiller

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

Homestead Exemption Form

2012 Form PA REV 72 Fill Online Printable Fillable Blank PdfFiller

Harris County Homestead Exemption Form Fill Out Sign Online DocHub

Harris County Homestead Exemption Form Fill Out Sign Online DocHub

Fillable Residence Homestead Exemption Application Form Printable Pdf Download

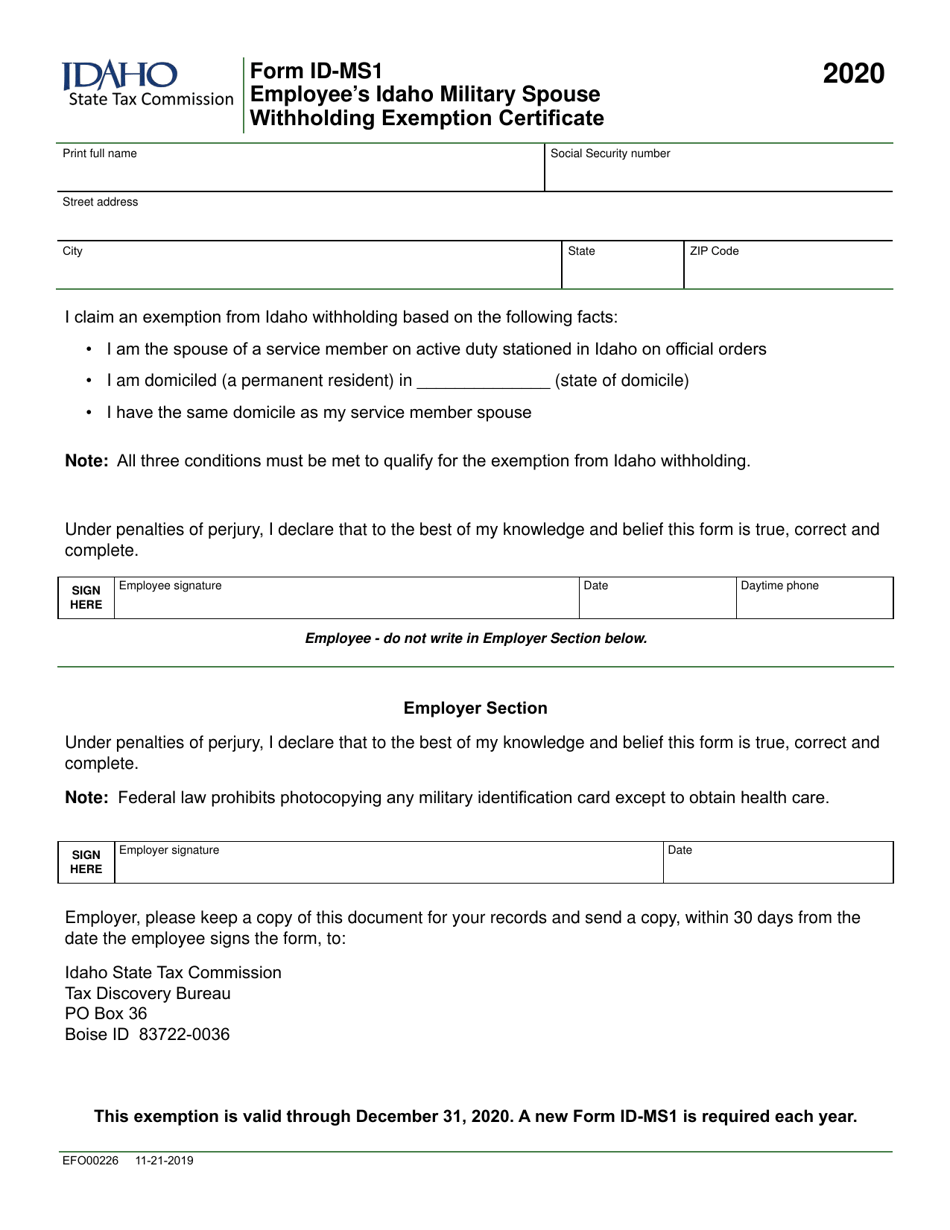

Form ID MS1 EFO00226 Download Fillable PDF Or Fill Online Employee s Idaho Military Spouse

FREE 8 Sample Tax Exemption Forms In PDF MS Word

Printable Homeowners Exemption Form Idaho - Homestead Exemption Each owner occupied primary residence house or manufactured home and up to one acre of land is eligible for a Homestead Exemption This exemption allows the value of your residence and land up to one acre be exempted at 50 of the assessed value up to a maximum of 125 000 whichever is less