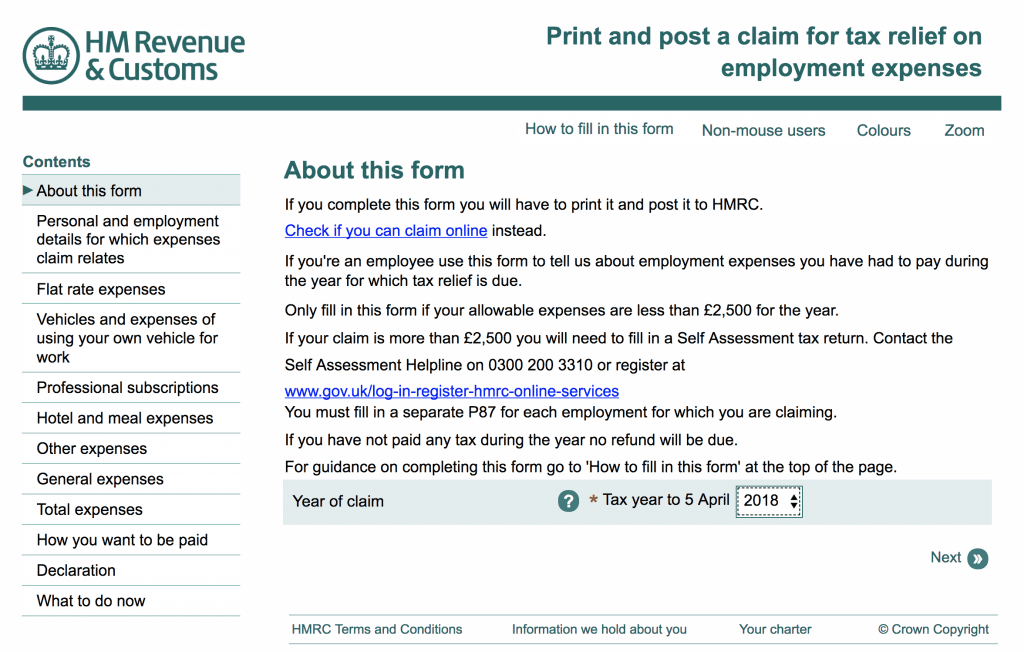

P87 Tax Relief Form Printable About this form Before you fill in this form read the guidance in P87 Notes If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due These may relate to professional subscriptions professional fees mileage laundry or working from home

Form P87 tax relief for employment expenses From 6 January 2024 the rate of class 1 National Insurance contributions NIC deducted from employees wages is reduced from 12 to 10 From 6 April 2024 self employed class 4 NIC will reduce from 9 to 8 and class 2 NIC will no longer be due HM Revenue and Customs HMRC has issued the new P87 form and guidance notes Individuals in paid employment needing to claim tax relief on job expenses by post are required to use the P87 form However from 21 December 2022 the new Tax relief for expenses of employment P87 form and guidance notes will need to be used

P87 Tax Relief Form Printable

P87 Tax Relief Form Printable

https://uploads-ssl.webflow.com/6187dc9778a578119292ebca/64392654b156576166bf0935_P87ClaimForm.png

P87 Printable Form Printable Forms Free Online

https://goselfemployed.co/wp-content/uploads/2019/02/p87-form-online-1024x652.png

Tax Relief P87 Tax Relief Form

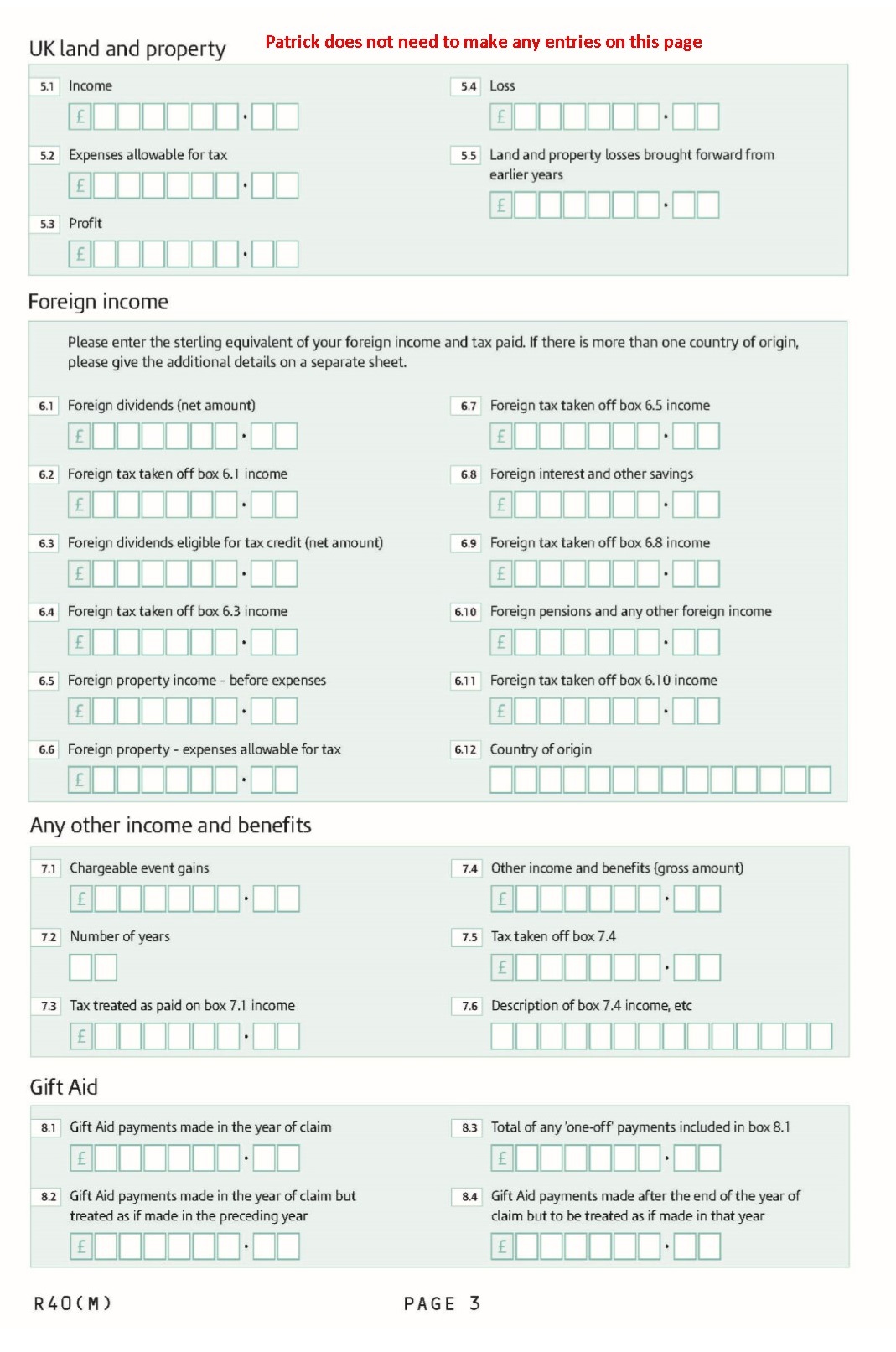

http://www.litrg.org.uk/sites/default/files/files/R40 3.5.jpg

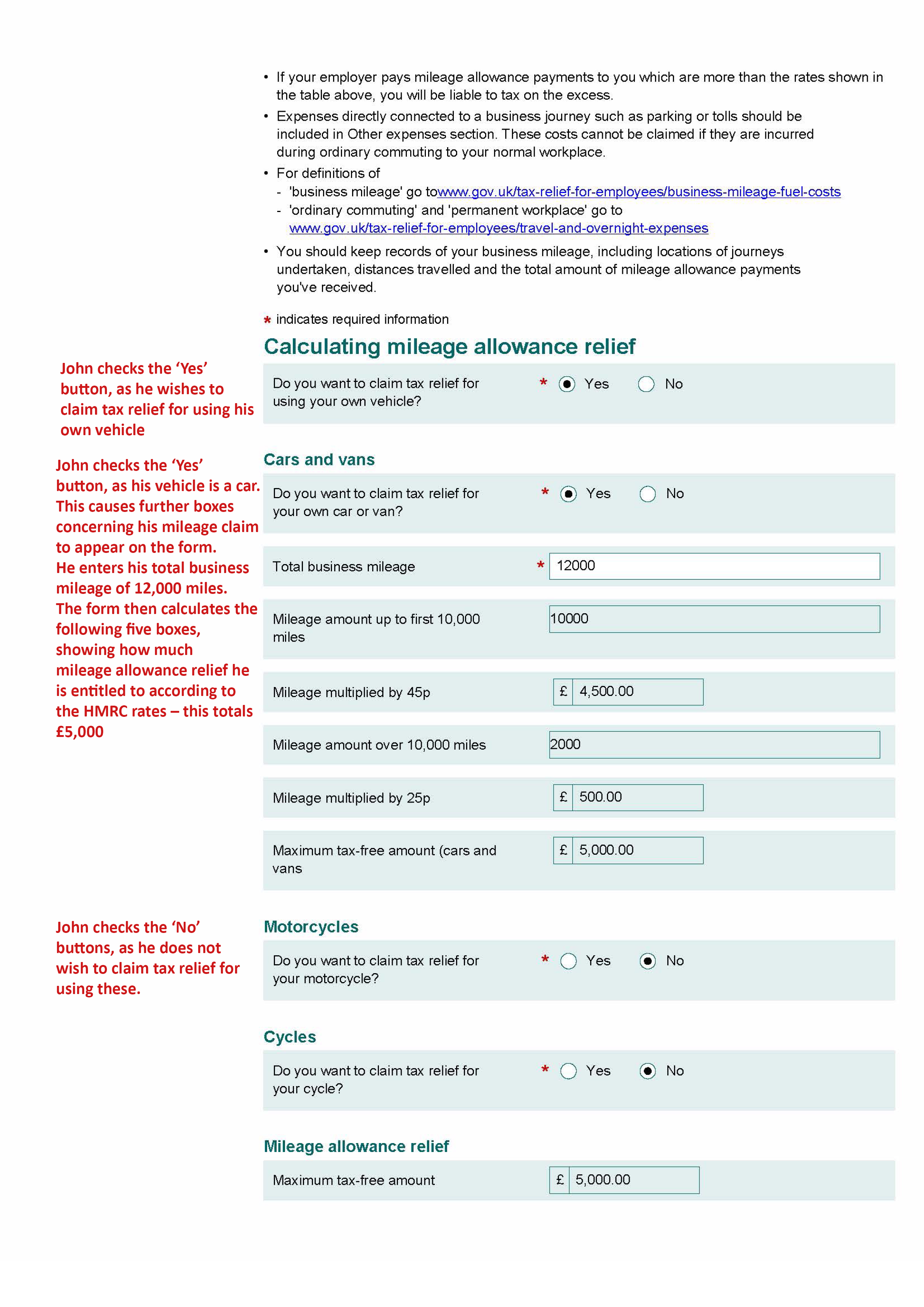

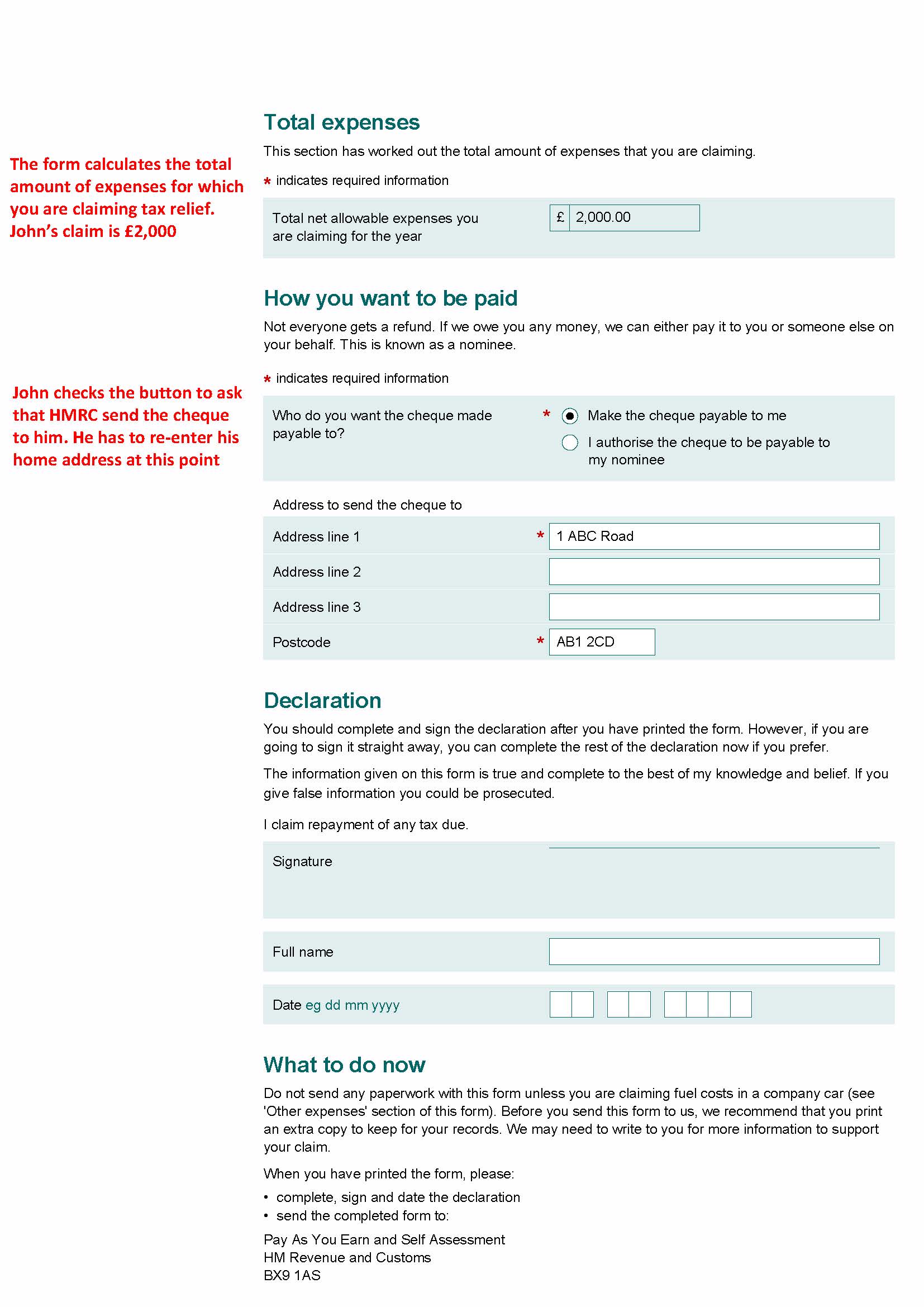

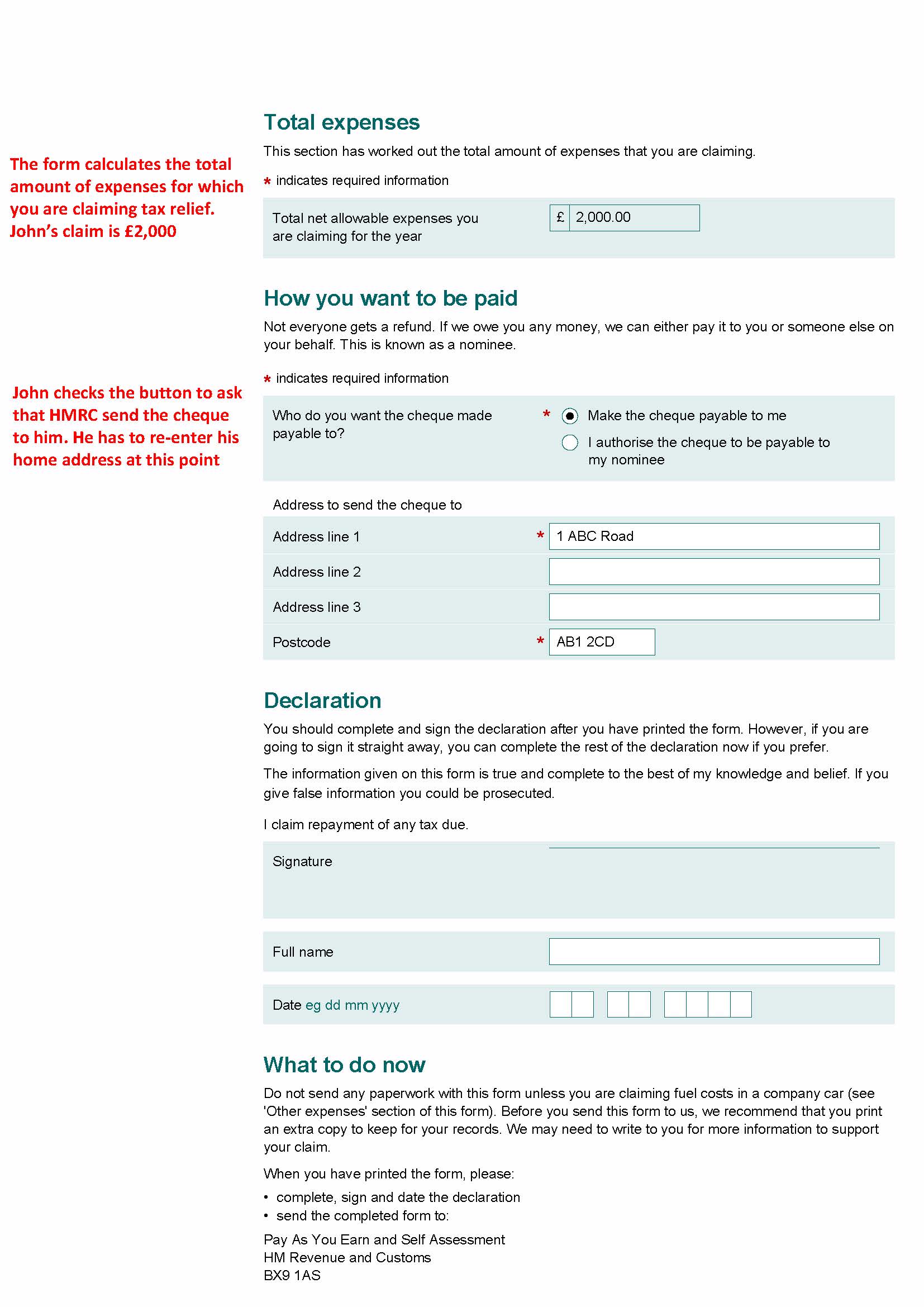

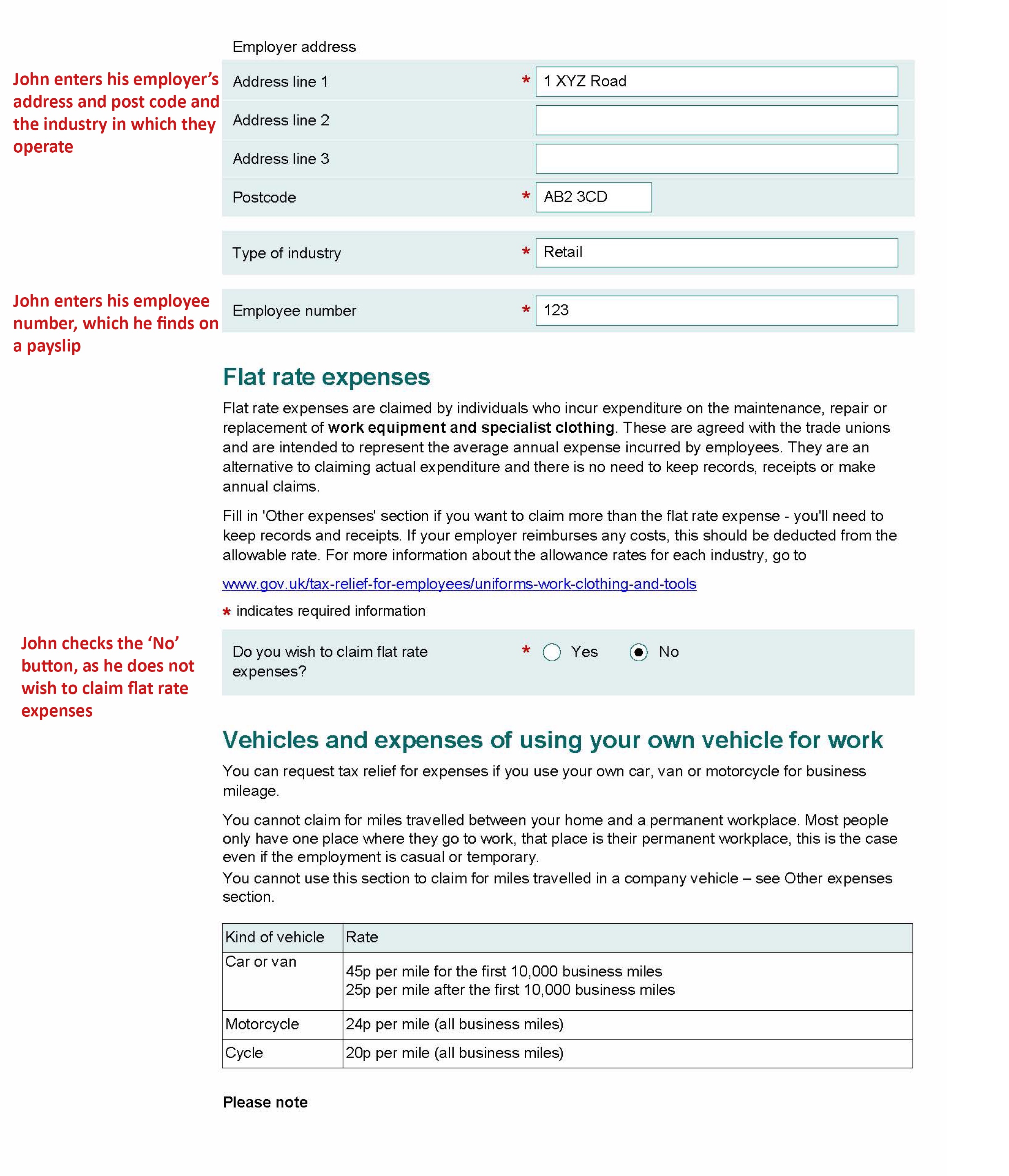

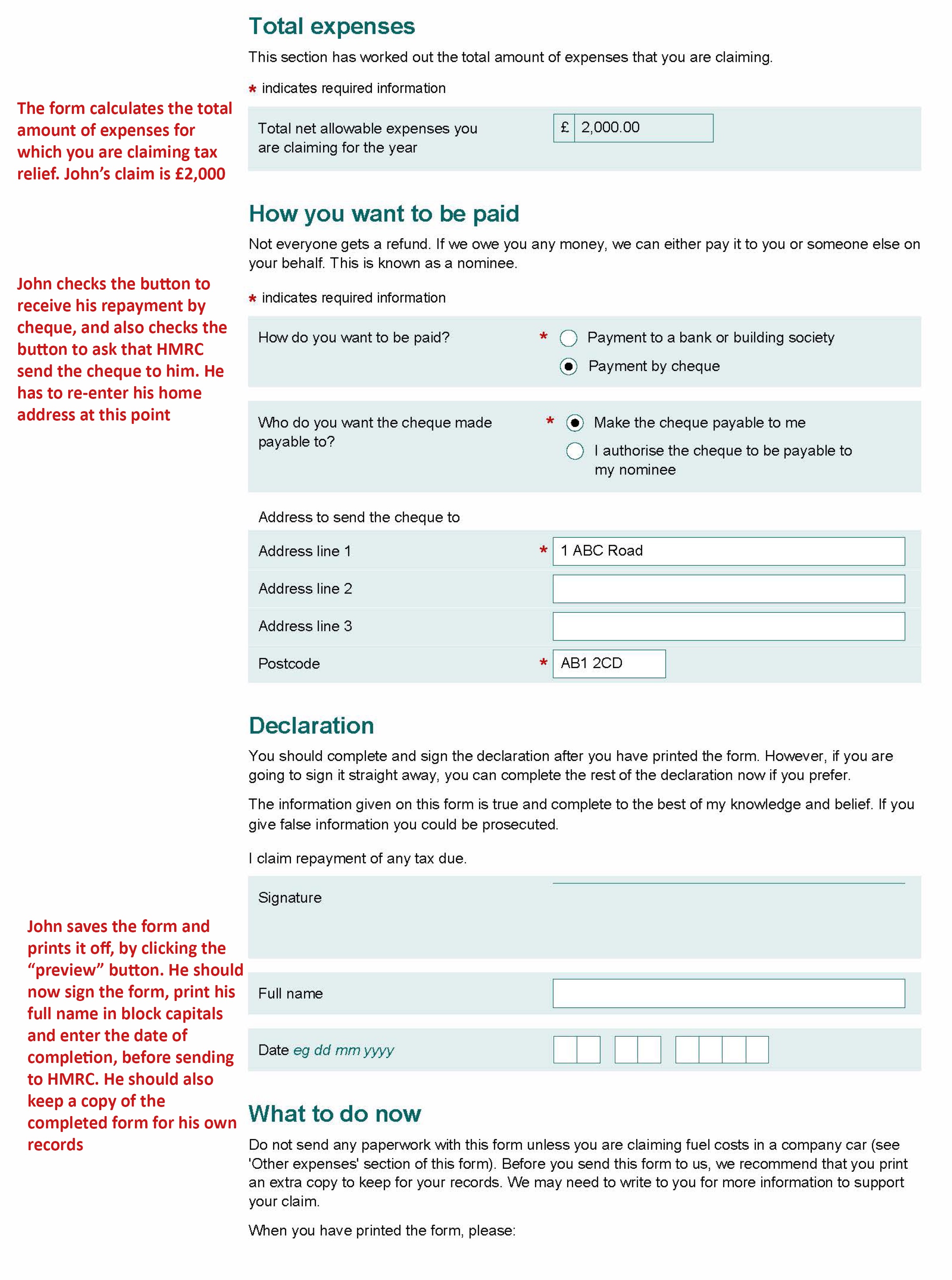

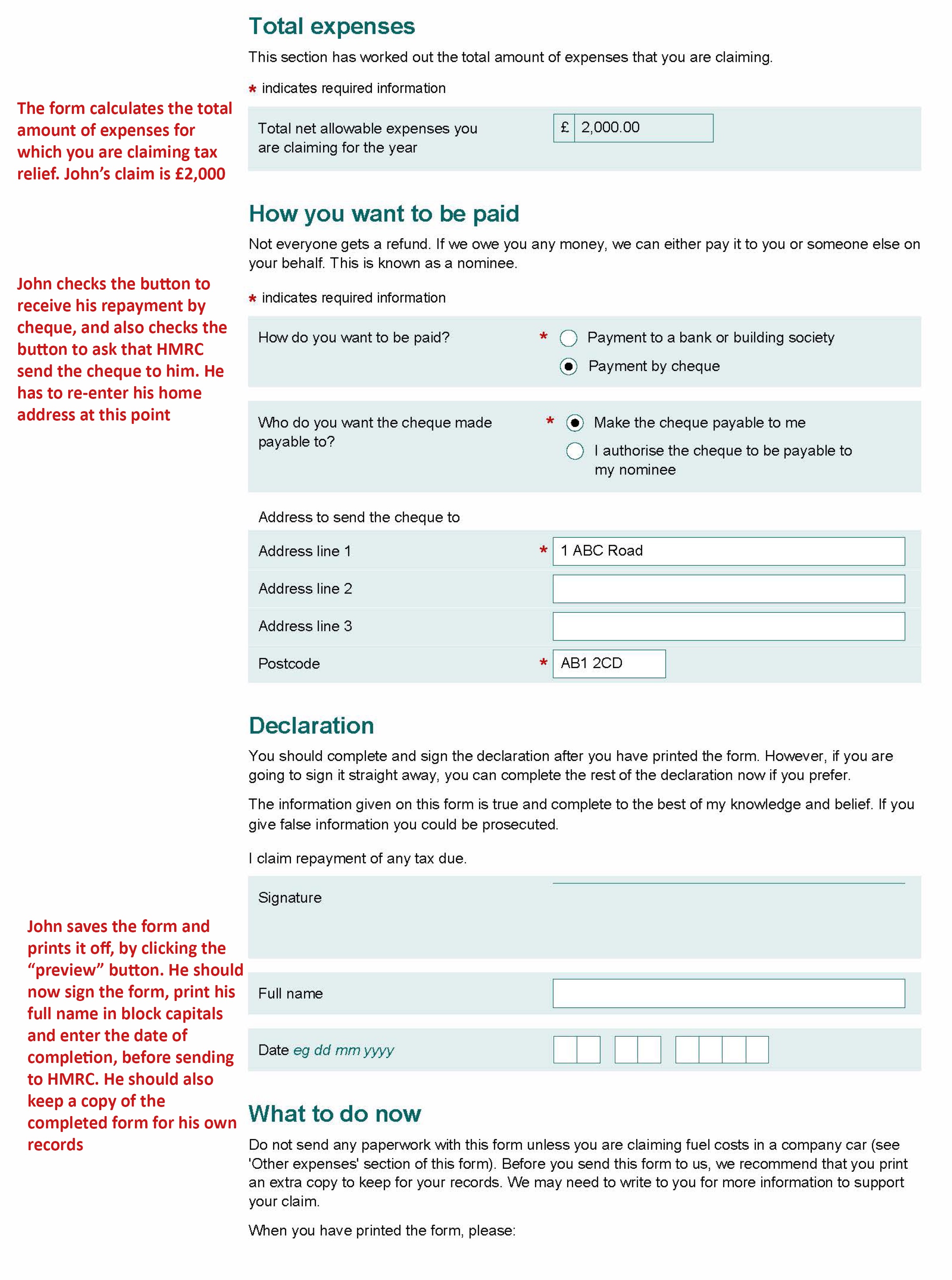

From 7 May 2022 claims for income tax relief on employment expenses must be made on the standard P87 form which can be found on gov uk Robotics will accelerate the processing of the updated form as long as claims don t include attachments You can complete and submit form P87 online through the Government Gateway or you can choose to complete it onscreen and post it to HMRC We use the annotated form plus example below to illustrate how you should complete the onscreen form P87 Please do not use the details provided in the example when completing your own form

29 March 2022 HM Revenue and Customs HMRC has released a new form for P87 claims which will enable them to standardise and streamline the claims process The form allows for multiple tax years and multiple employments to be included in a single claim 01 Edit your p87 form online pdf online Type text add images blackout confidential details add comments highlights and more 02 Sign it in a few clicks Draw your signature type it upload its image or use your mobile device as a signature pad 03 Share your form with others Send p87 form download pdf via email link or fax

More picture related to P87 Tax Relief Form Printable

Fillable Online K 40PT Property Tax Relief Claim Rev 7 12 Homestead Fax Email Print PdfFiller

https://www.pdffiller.com/preview/579/130/579130381/large.png

Home Care Tax Relief Ireland Applewood Homecare

https://applewoodhomecare.ie/wp-content/uploads/2018/06/Revenue-HK1-Form.png

Form P87 Claim For Tax Relief For Expenses Of Employment Low Incomes Tax Reform Group

https://www.litrg.org.uk/sites/default/files/files/P87 2018 page3.jpg

Simply put the P87 is an expense tax relief form It serves to request tax relief on the expenses you ve made as an employee of a company In this article we ll show you how to qualify what the cap amounts are and how to use the form Tax accounting doesn t need to be complicated you re safe with us Here s What We ll Cover Print complete and post the P87 form available on GOV UK by phone subject to limits if a claim has been made for a previous tax year substitute claim form or letter Substitute claim forms are widely used by high volume repayment agents From 7 May 2022 claims for income tax relief on employment expenses can only be made on the standard

A P87 form is an HMRC form that you need to use to claim income tax relief on certain employment expenses These expenses are the ones that you are required to pay for yourself for work purposes but your employer doesn t give you the money back for You can complete the form online on the HMRC website or choose to print and post the form instead If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due You will need to indicate the year you want tax relief for by adding it to the box provided at the top right of this form Only complete this form if your allowable expenses do not exceed 2 500

Form P87 Claim For Tax Relief For Expenses Of Employment Low Incomes Tax Reform Group

https://www.litrg.org.uk/sites/default/files/files/P87 form 2019 FINAL_Page_5.jpg

P87 Printable Form Printable Forms Free Online

https://www.litrg.org.uk/sites/default/files/files/R40_annotated_form_Page_4.jpg

https://assets.publishing.service.gov.uk/media/65c3605a3f634b000d42c5f3/P87_fillable_English_baselined.pdf

About this form Before you fill in this form read the guidance in P87 Notes If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due These may relate to professional subscriptions professional fees mileage laundry or working from home

https://www.litrg.org.uk/tax-nic/how-tax-collected/tax-refunds/form-p87-tax-relief-employment-expenses

Form P87 tax relief for employment expenses From 6 January 2024 the rate of class 1 National Insurance contributions NIC deducted from employees wages is reduced from 12 to 10 From 6 April 2024 self employed class 4 NIC will reduce from 9 to 8 and class 2 NIC will no longer be due

How To Claim The Work Mileage Tax Rebate Goselfemployed co

Form P87 Claim For Tax Relief For Expenses Of Employment Low Incomes Tax Reform Group

Free Printable State Tax Forms Printable Templates

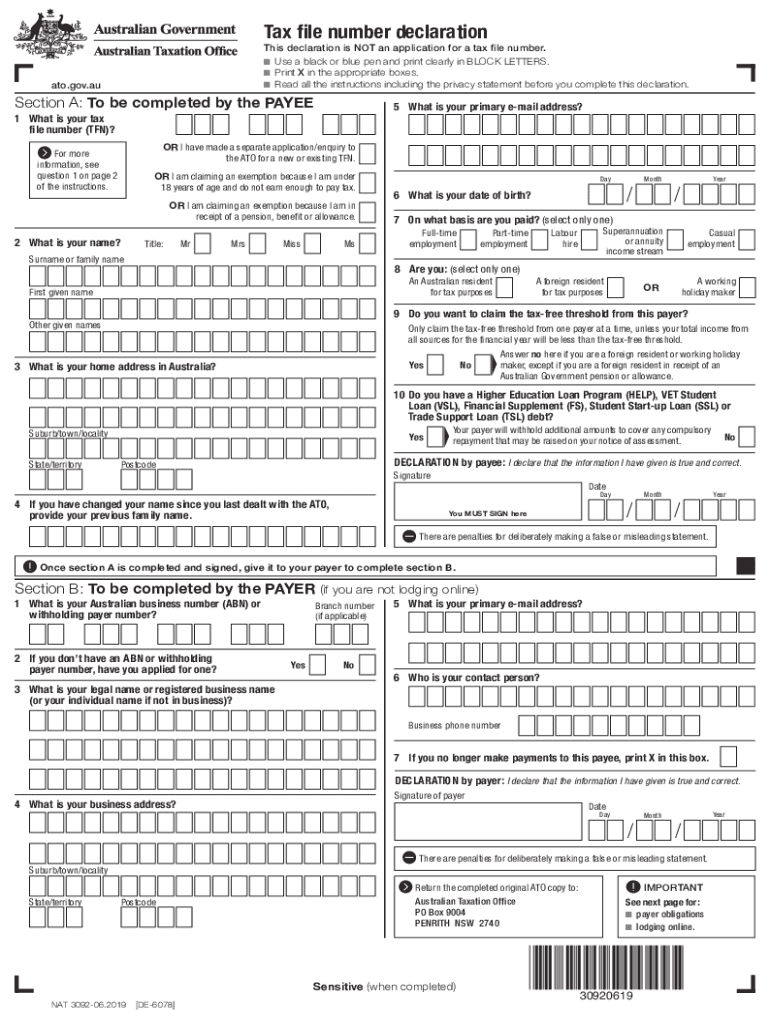

Tax File Number Declaration Form 2023 Fill Out Sign Online DocHub

Form P87 Claim For Tax Relief For Expenses Of Employment Low Incomes Tax Reform Group

Form P87 Claim For Tax Relief For Expenses Of Employment Low Incomes Tax Reform Group

Form P87 Claim For Tax Relief For Expenses Of Employment Low Incomes Tax Reform Group

How To Fill Out Your P87 Tax Form FLiP

Claim Income Tax Relief For Your Employment Expenses P87Equitable ReliefInternal Revenue

How To Fill Out Your P87 Tax Form FLiP

P87 Tax Relief Form Printable - 01 Edit your p87 form online pdf online Type text add images blackout confidential details add comments highlights and more 02 Sign it in a few clicks Draw your signature type it upload its image or use your mobile device as a signature pad 03 Share your form with others Send p87 form download pdf via email link or fax