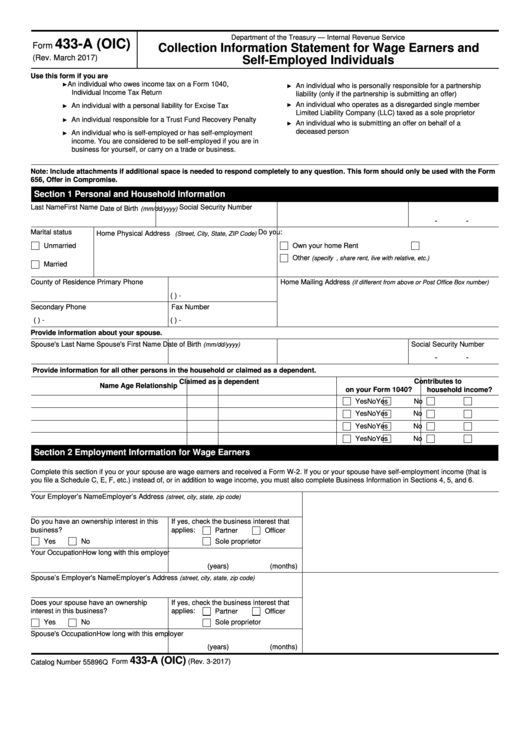

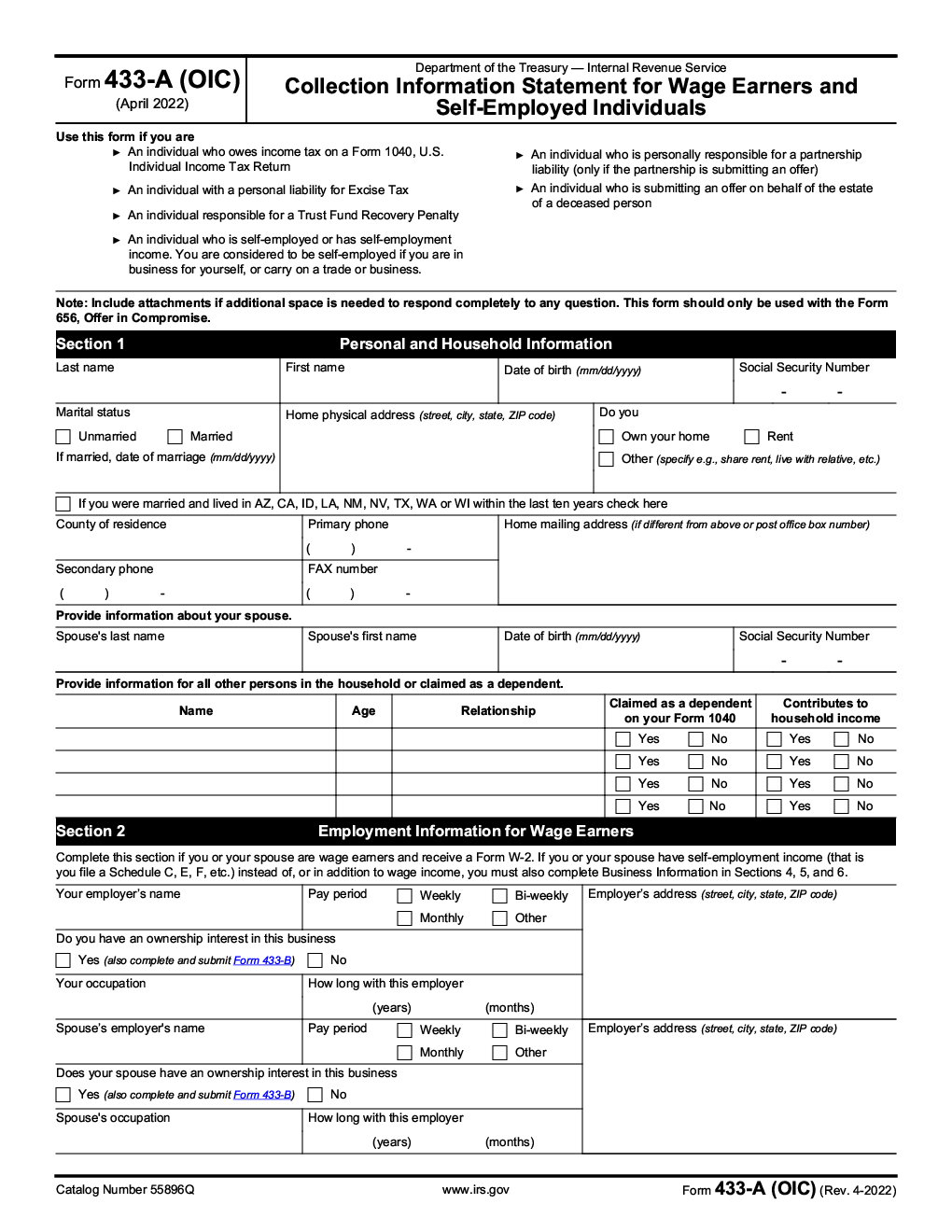

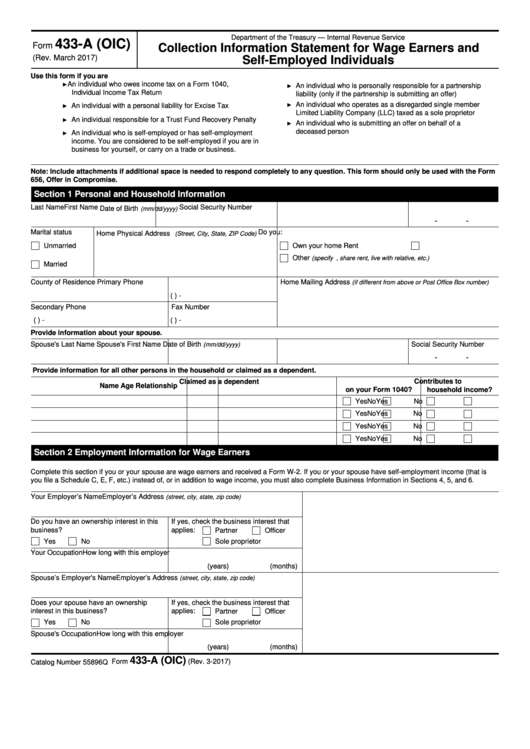

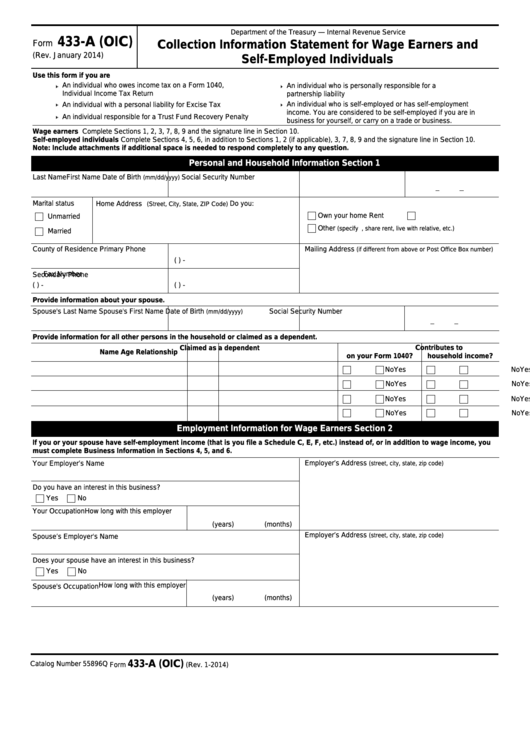

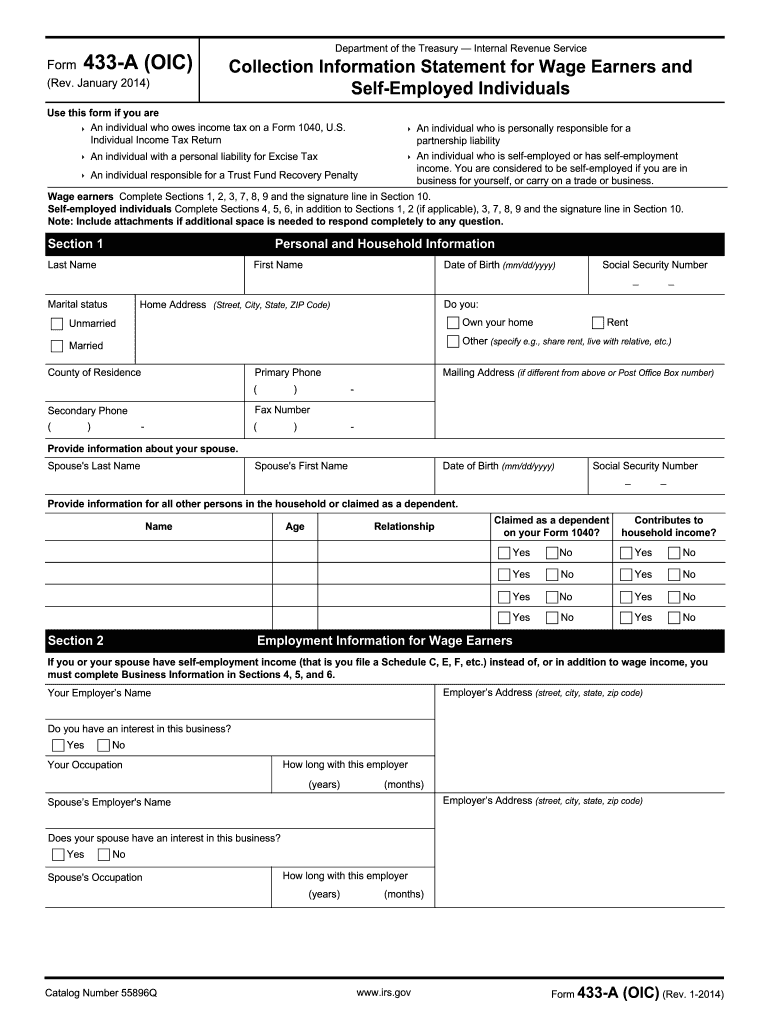

Printable Form 433 A Calculator Catalog Number 55896Q www irs gov Form 433 A OIC Rev 4 2023 Form 433 A OIC April 2023 Department of the Treasury Internal Revenue Service Collection Information Statement for Wage Earners and Self Employed Individuals Use this form if you are An individual who owes income tax on a Form 1040 U S Individual Income Tax Return

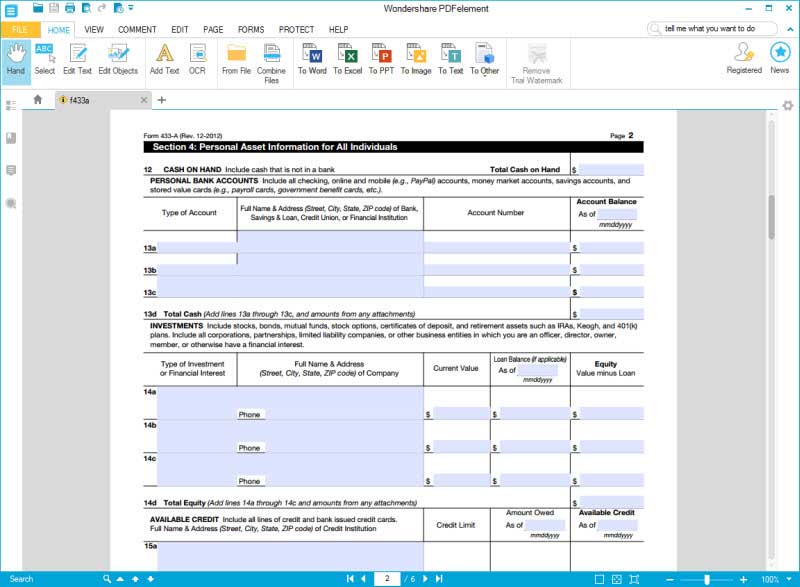

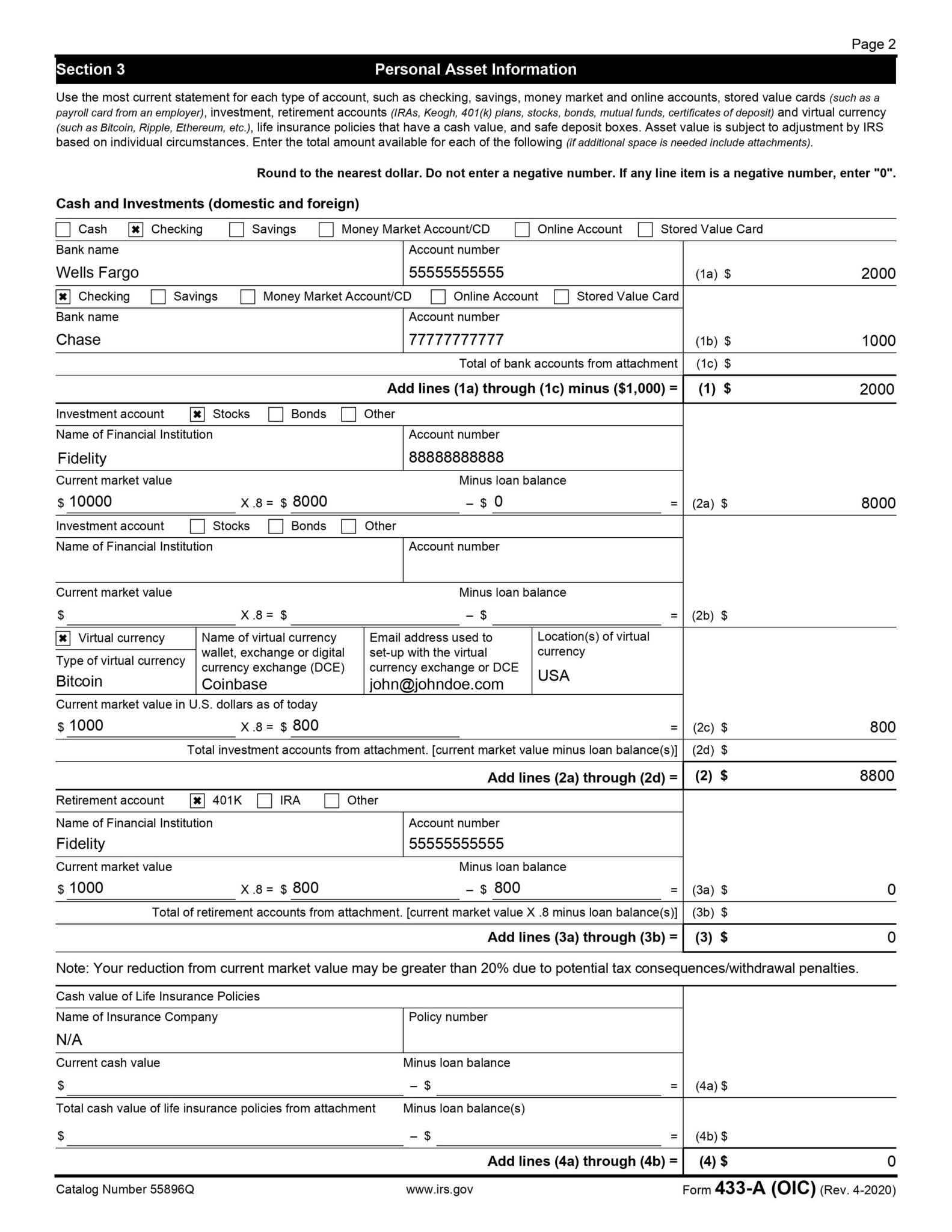

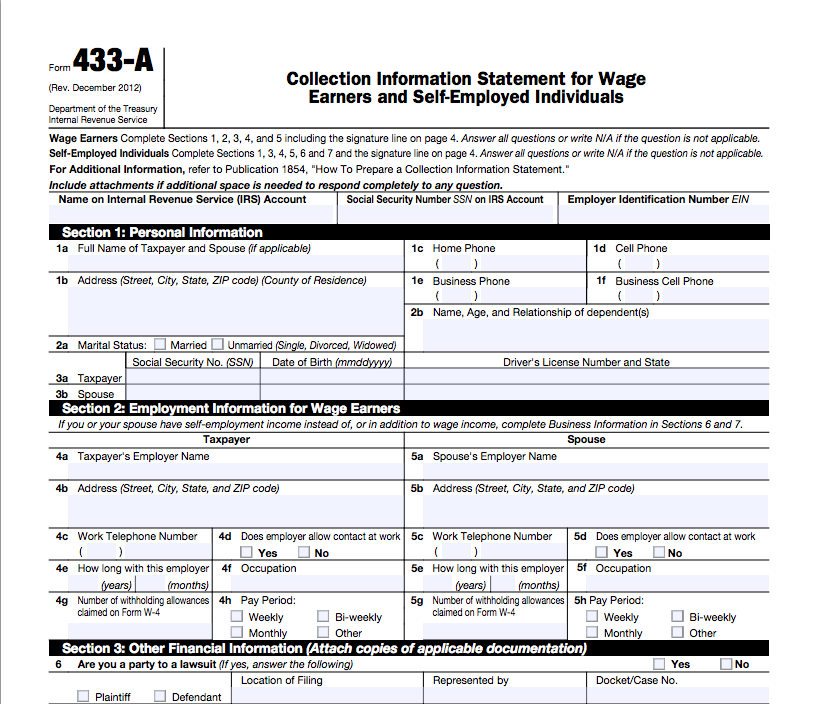

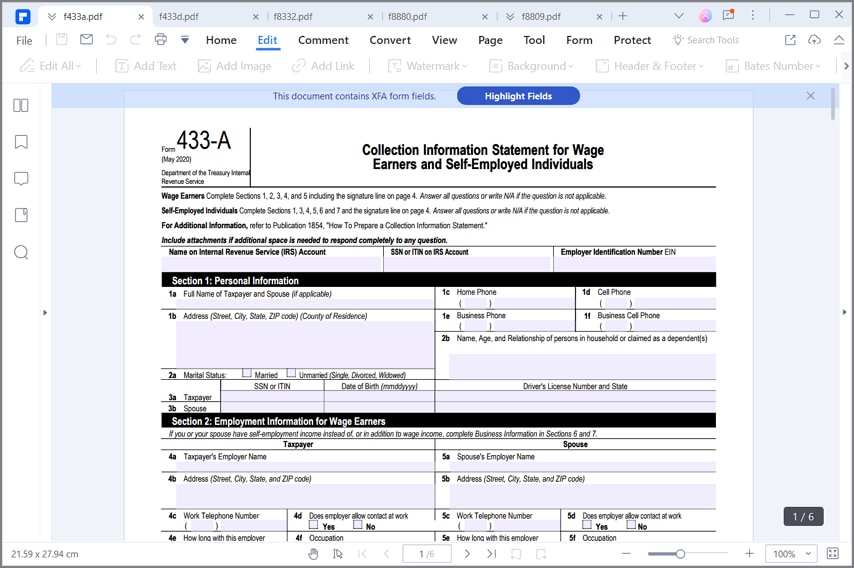

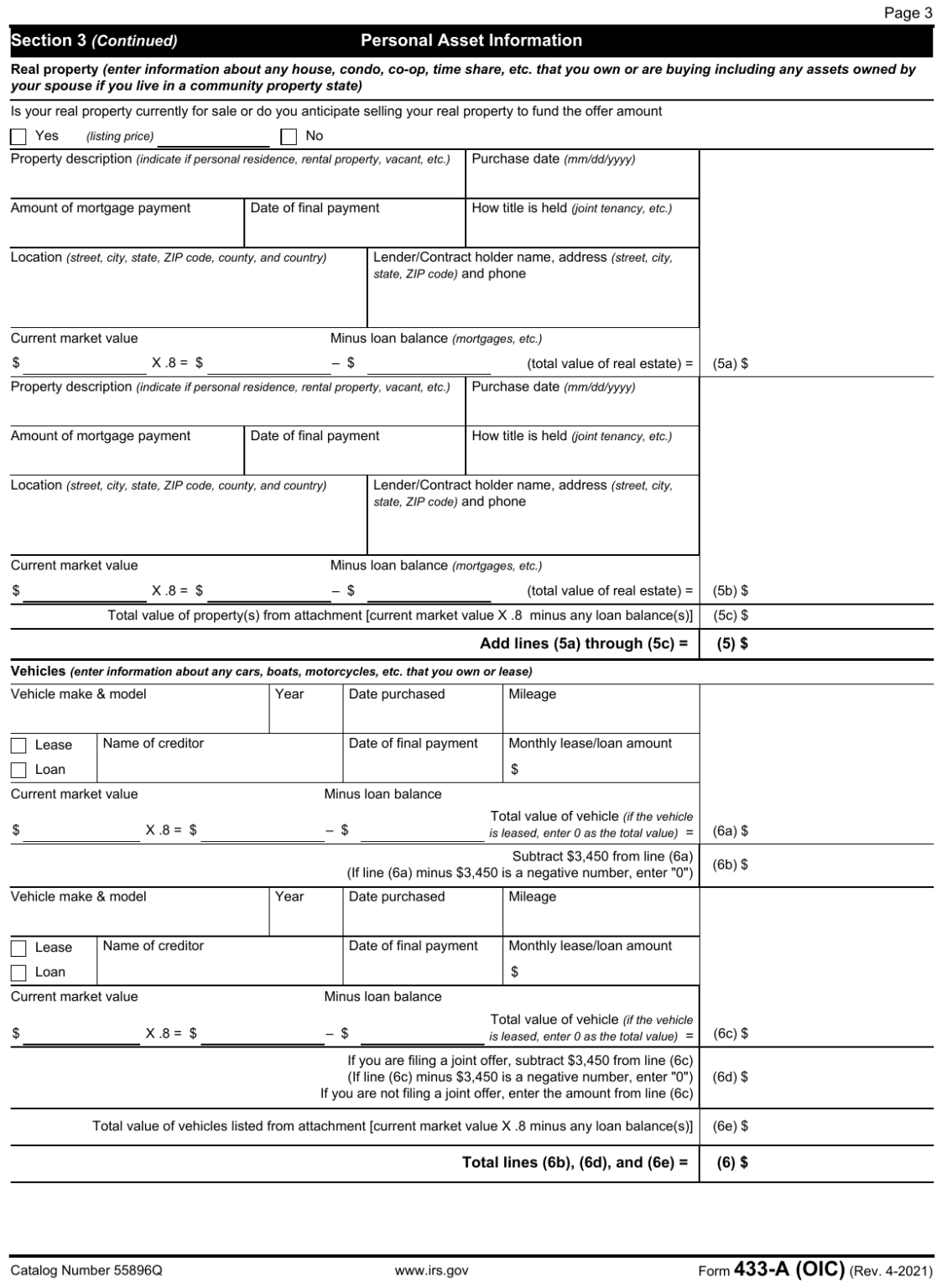

Form 433 A is used to obtain current financial information necessary for determining how a wage earner or self employed individual can satisfy an outstanding tax liability You may need to complete Form 433 A If you are an individual who owes income tax on Form 1040 How to Complete Form 433 A OIC Offer In Compromise Personal and Household Information 2 12 Wage Earners Employment Information Section 2 0 43 Personal Assets Information Section 3 0 46 Personal Assets Checking Section 3 1 39 Personal Assets Investments Retirement and Insurance Section 3 2 00 Personal Assets Real Estate Section 3

Printable Form 433 A Calculator

Printable Form 433 A Calculator

https://data.formsbank.com/pdf_docs_html/286/2862/286295/page_1_thumb_big.png

IRS Form 433 A How To Fill It Right

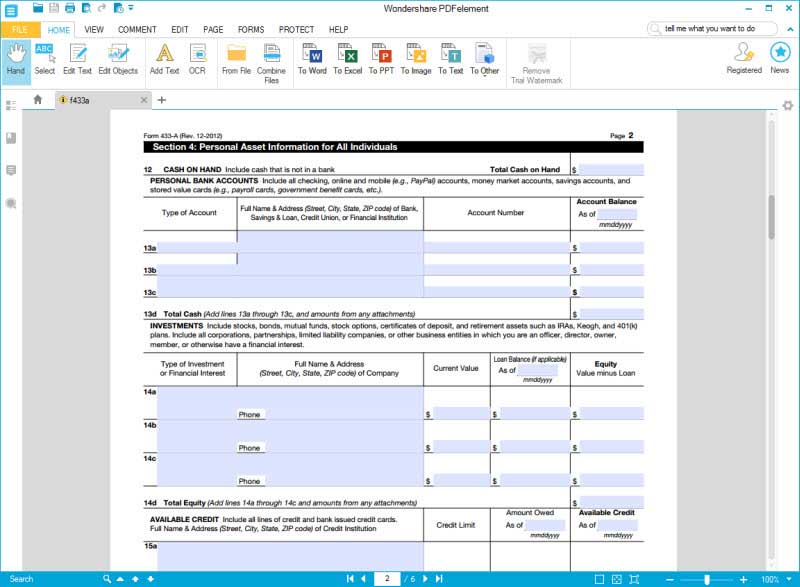

https://pdfimages.wondershare.com/pdf-forms/tax-form/irs-form-433a-section-4.jpg

How To Fill Out Form 433 A OIC 2019 Version Detailed Instructions From IRS 656 Booklet

https://trp.tax/wp-content/uploads/2015/03/OIC_Sec-9-Form-433-A-OIC.jpg

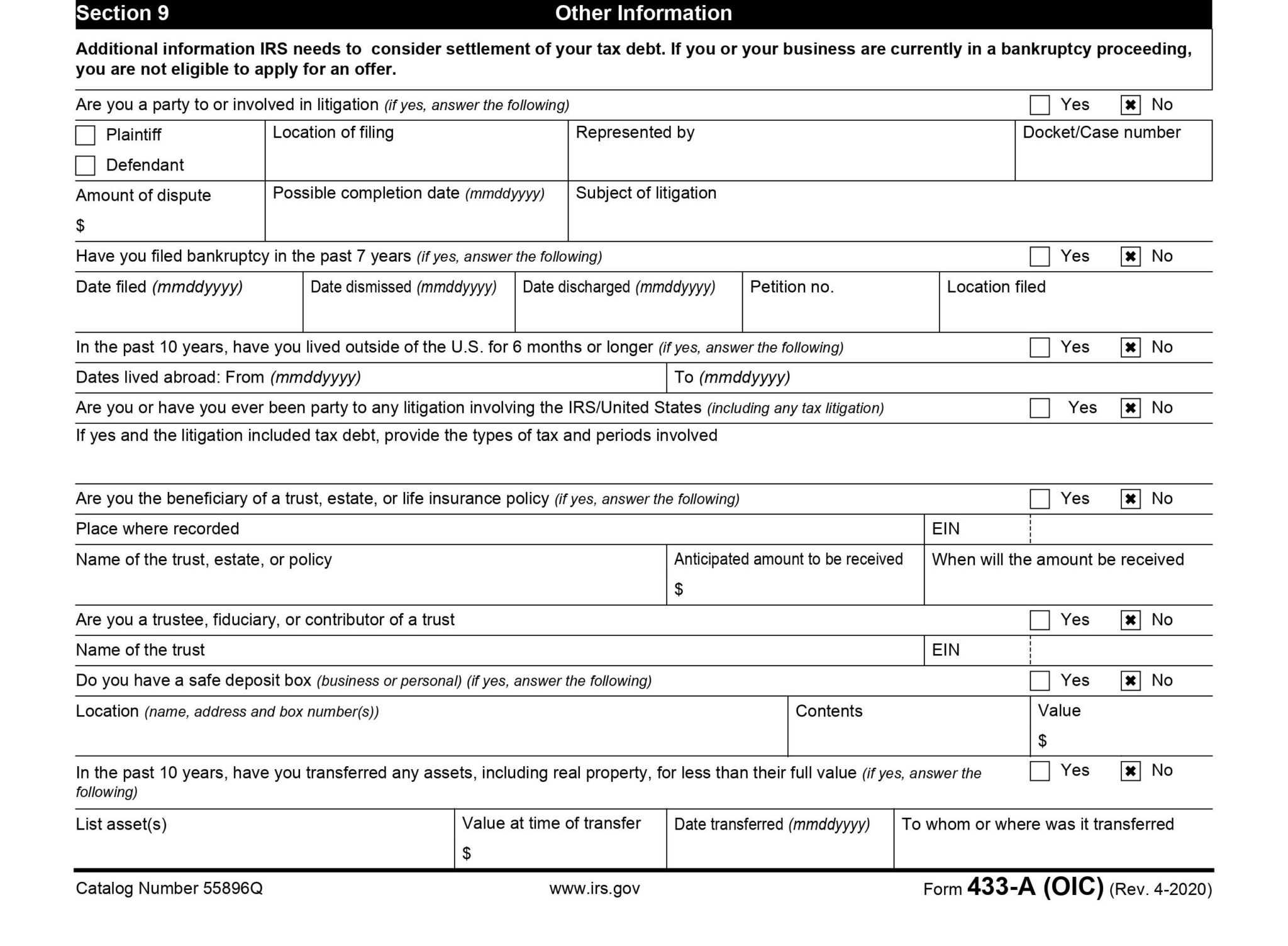

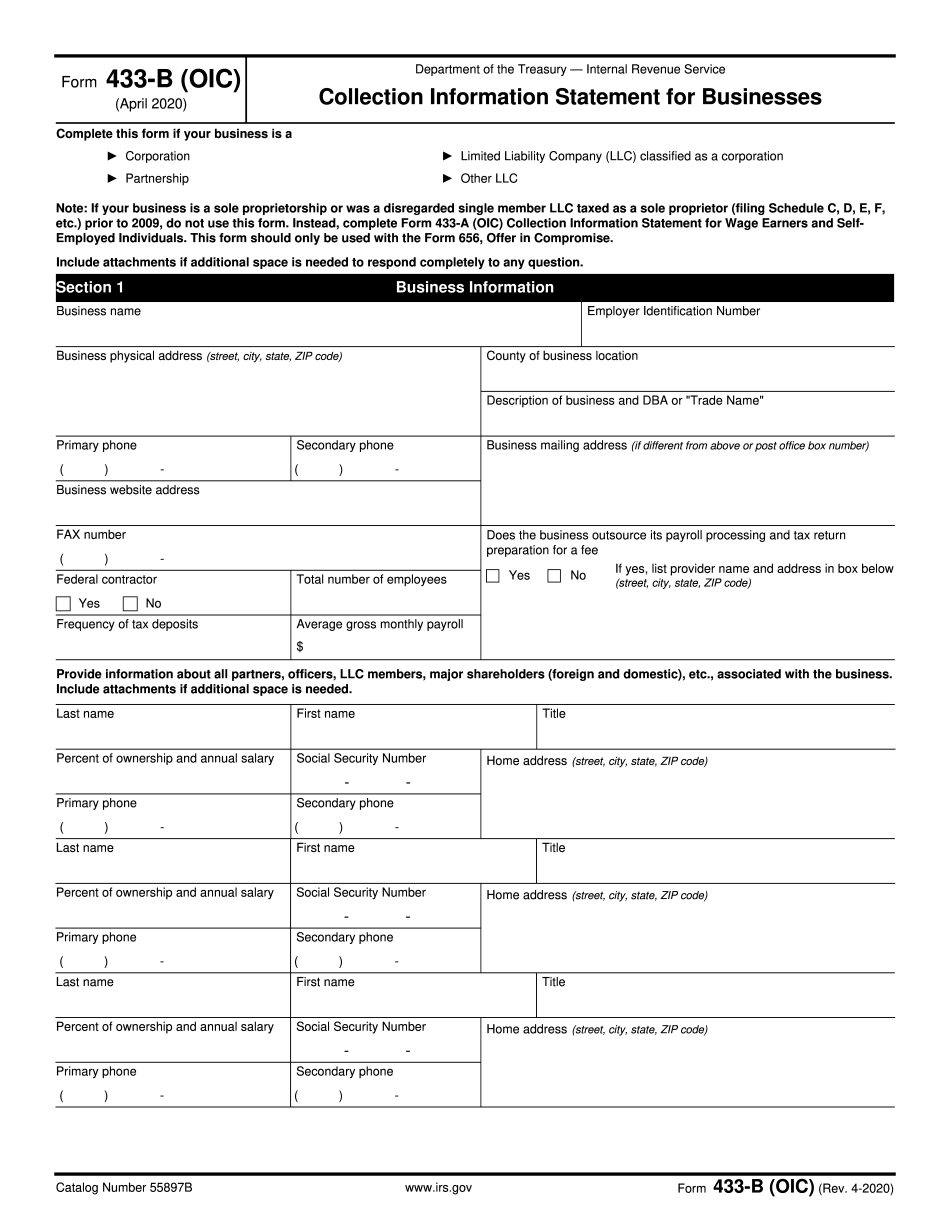

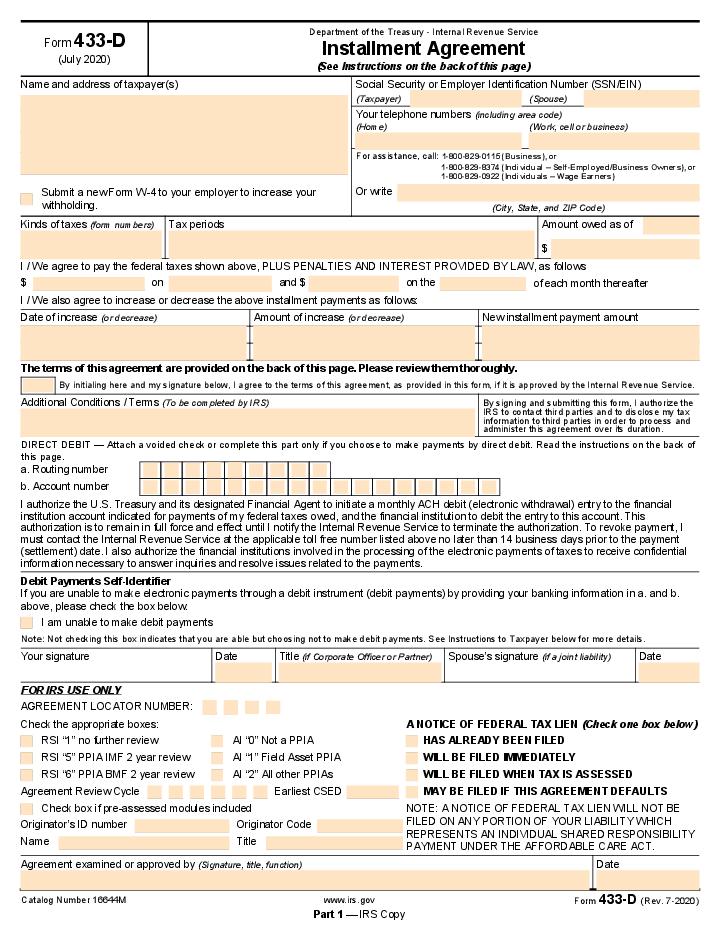

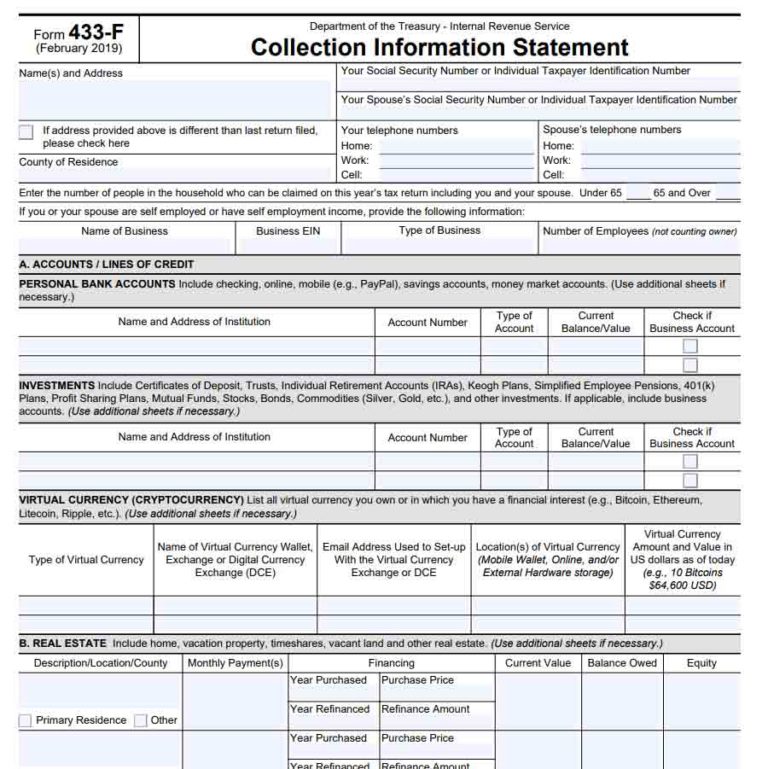

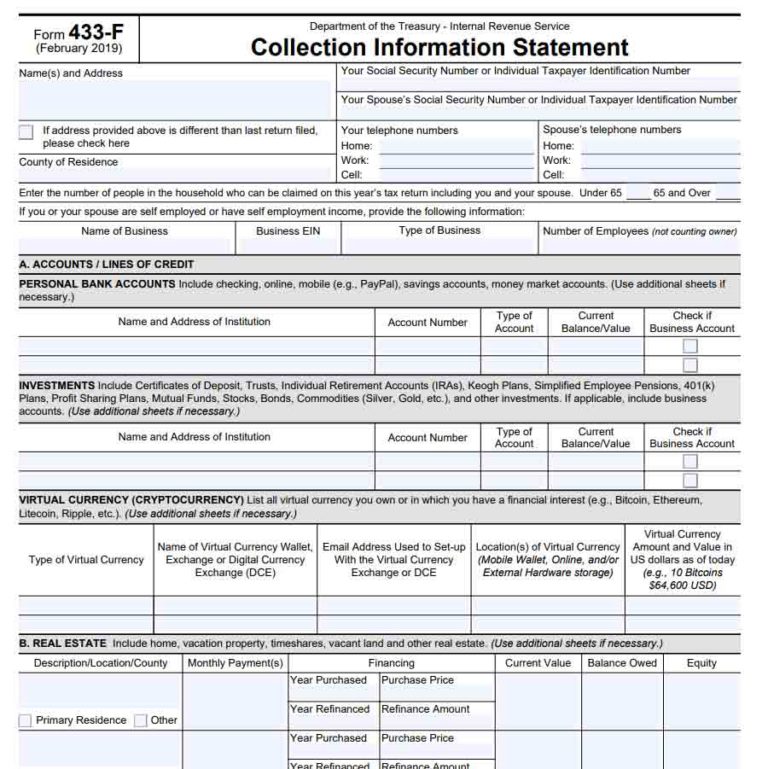

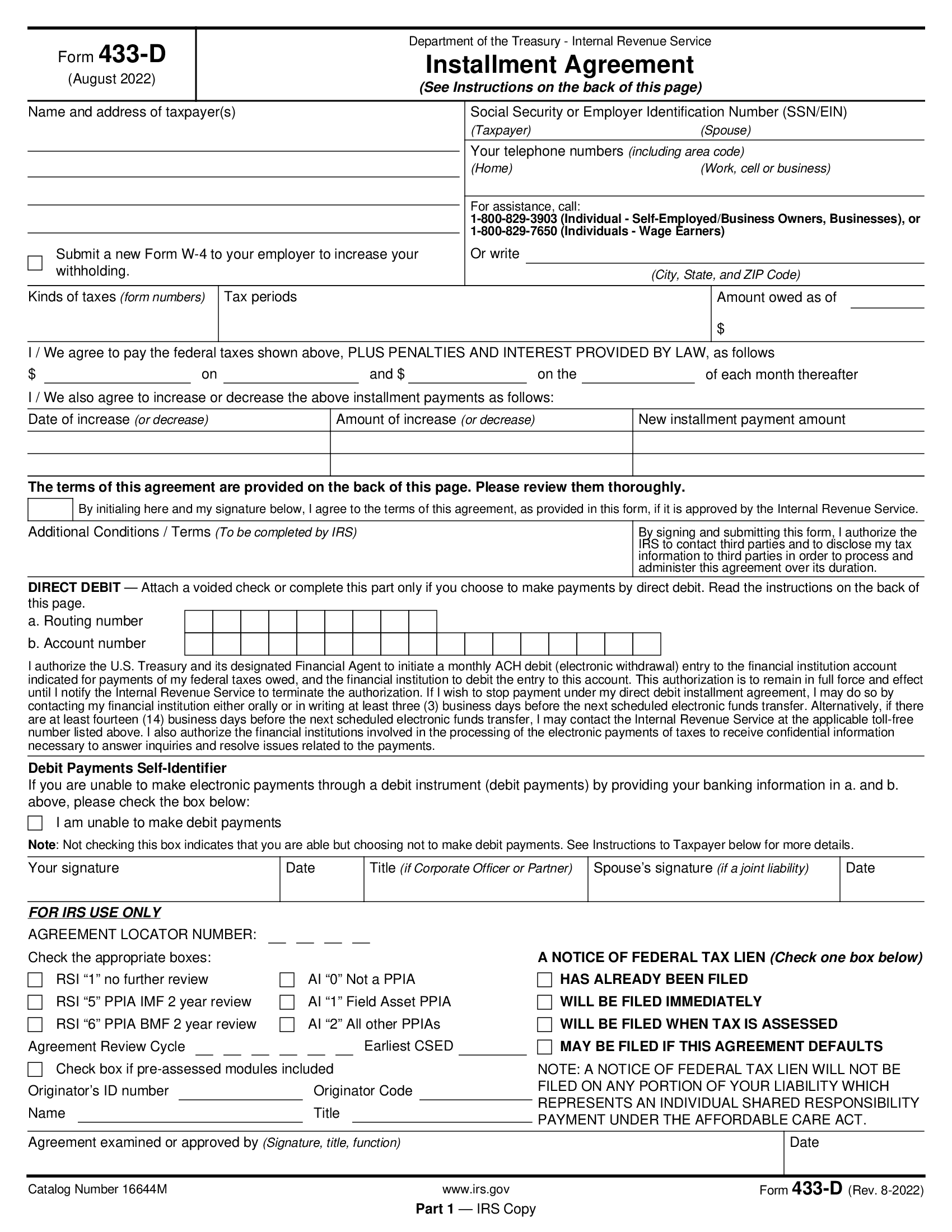

Form 433 A is called Collection Information Statement for Wage Earners and Self Employed Individuals It requires personal information employment information and an accounting of your personal assets business assets and monthly household budget Form 433 A Collection Information Statement for Wage Earners and Self Employed Individuals Form 433 B Collection Information Statement for Businesses Form 433 D Installment Agreement Form 433 F Collection Information Statement Note that any link in the information above is updated each year automatically and will take you to the most recent

Form 433 A is a collection information statement for wage earners and self employed individuals This form provides the IRS with a complete overview of your financial situation by gathering details about your assets liabilities income and expenses This information allows the IRS to assess if you qualify for certain tax relief programs If Catalog Number 20312N www irs gov Form 433 A Rev 5 2020 Form 433 A Rev 2 2019 Page 4 If you are self employed sections 6 and 7 must be completed before continuing Section 5 Monthly Income and Expenses Monthly Income Expense Statement For additional information refer to Publication 1854 Total Income

More picture related to Printable Form 433 A Calculator

Form 433 A Collection Information Statement For Wage Earners And Individuals 2013 Free Download

https://www.formsbirds.com/formimg/tax-support-document/7811/form-433-a-collection-information-statement-for-wage-earners-and-individuals-2013-l4.png

Form S 433 A Oic Fill Online Printable Fillable Blank Form 433 b oic

https://www.pdffiller.com/preview/517/530/517530540/big.png

Irs Form 433 D Improve Tax Return Accuracy AirSlate

https://www.airslate.com/preview/workflow/document/315/649/8/8/medium.jpeg

Documentation may include previously filed income tax returns pay statements self employment records bank and investment statements loan statements bills or statements for recurring expenses etc IRS USE ONLY Notes Catalog Number 20312N www irs gov Form 433 A Rev 7 2022 Page 5 Form 433 A Rev 7 2022 Sections 6 and 7 must be Form 433 A also known as the Collection Information Statement is a document needed by the Internal Revenue Service IRS when an individual or business owes a tax debt The form is used to determine the taxpayer s ability to pay and come to a favourable resolution regarding the owed amount

The regular tax form 433 A is the long version of the form that allows the IRS to determine how much of a person s tax liability they can reasonably afford to pay Form 433 A OIC is the version of the Collection Information Statement that is used to specifically request an offer in compromise The seven sections of form 433 A include personal Catalog Number 55896Q www irs gov Form 433 A OIC Rev 5 2012 Other valuable items artwork collections jewelry items of value in safe deposit boxes etc List business assets such as bank accounts tools books machinery equipment business vehicles and real property that is owned leased rented

Guide To IRS Form 433 F Collection Information Statement

https://www.backtaxeshelp.com/wp-content/uploads/2019/10/irs-form-433-f-768x769.jpg

IRS Form 433 A Collection Information Statement For Wage Earners And Self Employed Individuals

https://blanker.org/files/images/form-433aoi.png

https://www.irs.gov/pub/irs-pdf/f433aoi.pdf

Catalog Number 55896Q www irs gov Form 433 A OIC Rev 4 2023 Form 433 A OIC April 2023 Department of the Treasury Internal Revenue Service Collection Information Statement for Wage Earners and Self Employed Individuals Use this form if you are An individual who owes income tax on a Form 1040 U S Individual Income Tax Return

https://www.irs.gov/pub/irs-pdf/p1854.pdf

Form 433 A is used to obtain current financial information necessary for determining how a wage earner or self employed individual can satisfy an outstanding tax liability You may need to complete Form 433 A If you are an individual who owes income tax on Form 1040

Fillable Form 433 A Oic Collection Information Statement For Wage Earners And Self Employed

Guide To IRS Form 433 F Collection Information Statement

How To Fill Out Form 433 A OIC 2019 Version Detailed Instructions From IRS 656 Booklet

2014 Form IRS 433 A OIC Fill Online Printable Fillable Blank PdfFiller

The Form 433 a And IRS Collection Actions Mackay Caswell Callahan P C

Fillable 433 Irs Form Printable Forms Free Online

Fillable 433 Irs Form Printable Forms Free Online

IRS Form 433 D Installment Agreement Forms Docs 2023

IRS Form 433 A How To Fill It Right

How To Fill Out Form 433 A OIC 2021 Version Detailed Instructions From IRS 656 Booklet

Printable Form 433 A Calculator - Catalog Number 20312N www irs gov Form 433 A Rev 5 2020 Form 433 A Rev 2 2019 Page 4 If you are self employed sections 6 and 7 must be completed before continuing Section 5 Monthly Income and Expenses Monthly Income Expense Statement For additional information refer to Publication 1854 Total Income