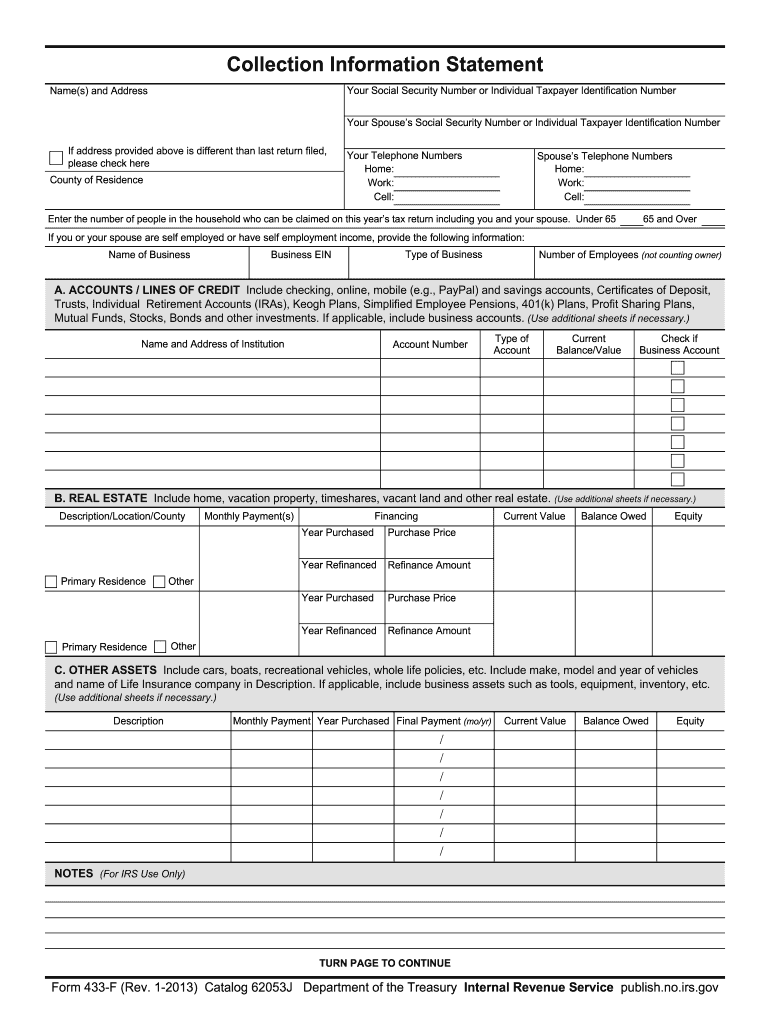

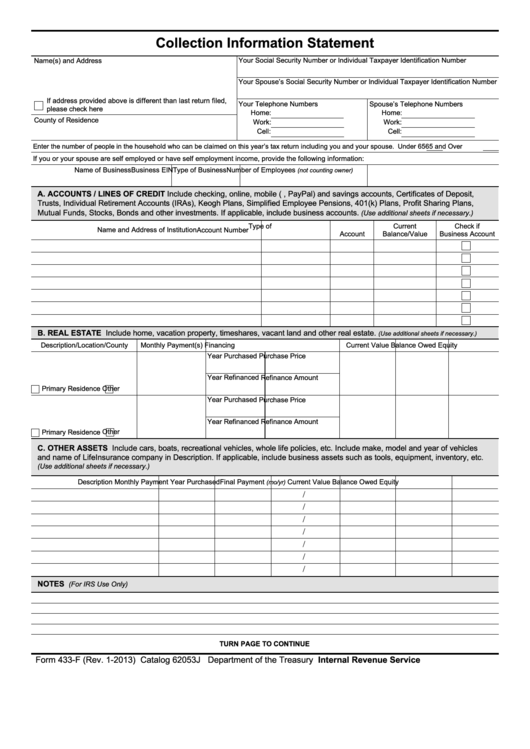

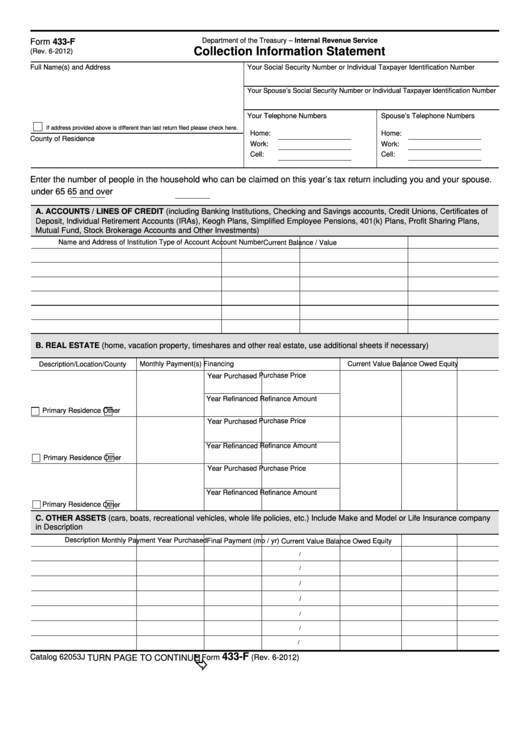

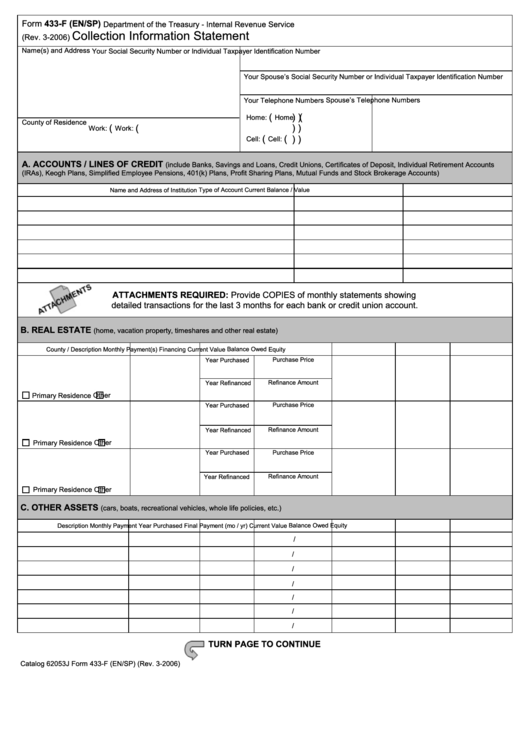

Printable Irs Form 433 F Form 433 F Rev 6 2010 D CREDIT CARDS Visa MasterCard American Express Department Stores etc Type Credit Limit Balance Owed E WAGE INFORMATION If you have more than one employer include the information on another sheet of paper Minimum Monthly Payment

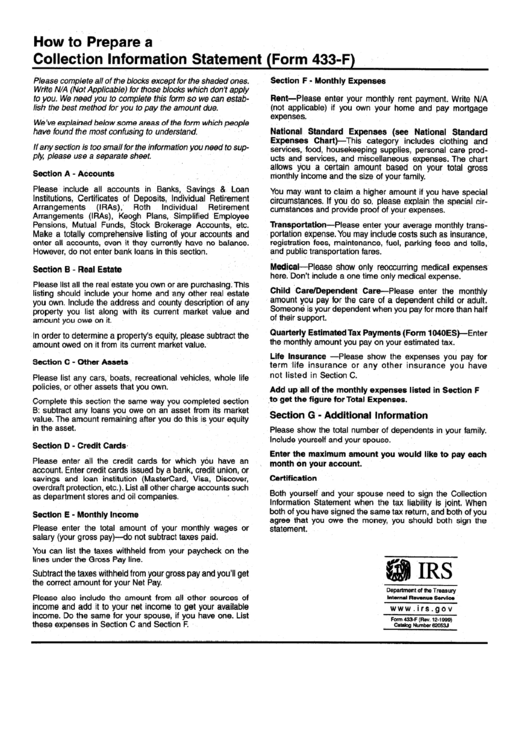

You can use Form 433 F Collection Information Statement to provide your financial information to the IRS Your Collection Information Statement is needed to determine your eligibility for certain installment agreements currently not collectible status and other tax resolution options that the IRS has available based on your ability to pay Key Takeaway Form 433 F reveals your financial future to the IRS helping them understand whether you need help with your tax debt or not So don t worry With careful attention to each detail and correctly filled out boxes this form becomes an invaluable tool for navigating through owed taxes When to Use Form 433 F

Printable Irs Form 433 F

Printable Irs Form 433 F

https://www.pdffiller.com/preview/6/954/6954693/large.png

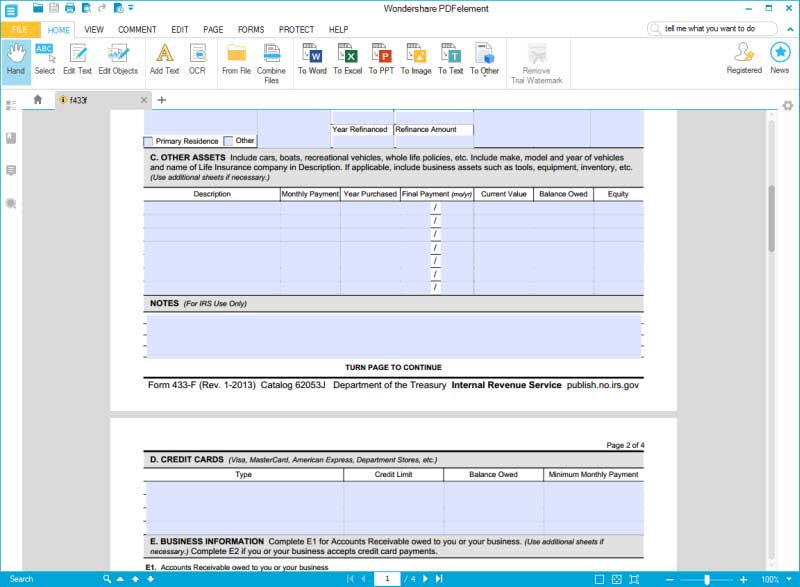

IRS Form 433 F Fill It Out In Style

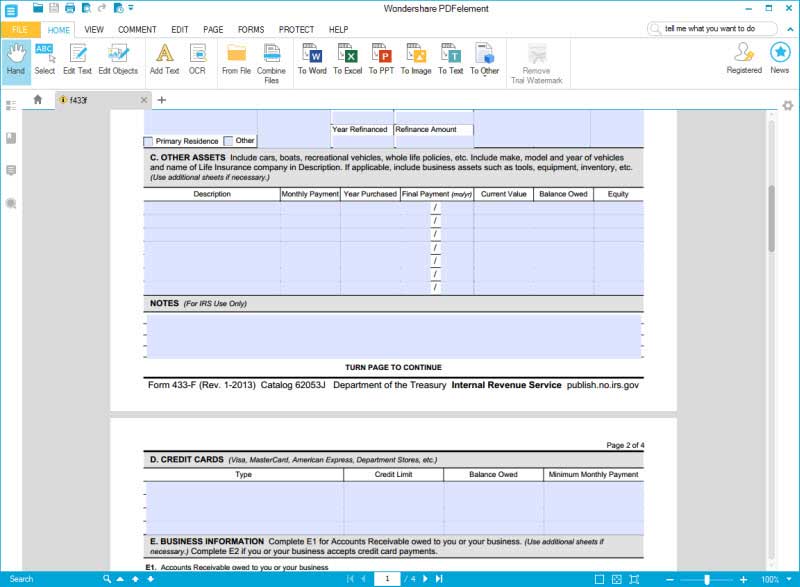

https://pdfimages.wondershare.com/pdf-forms/tax-form/irs-form-433f-section-c-d.jpg

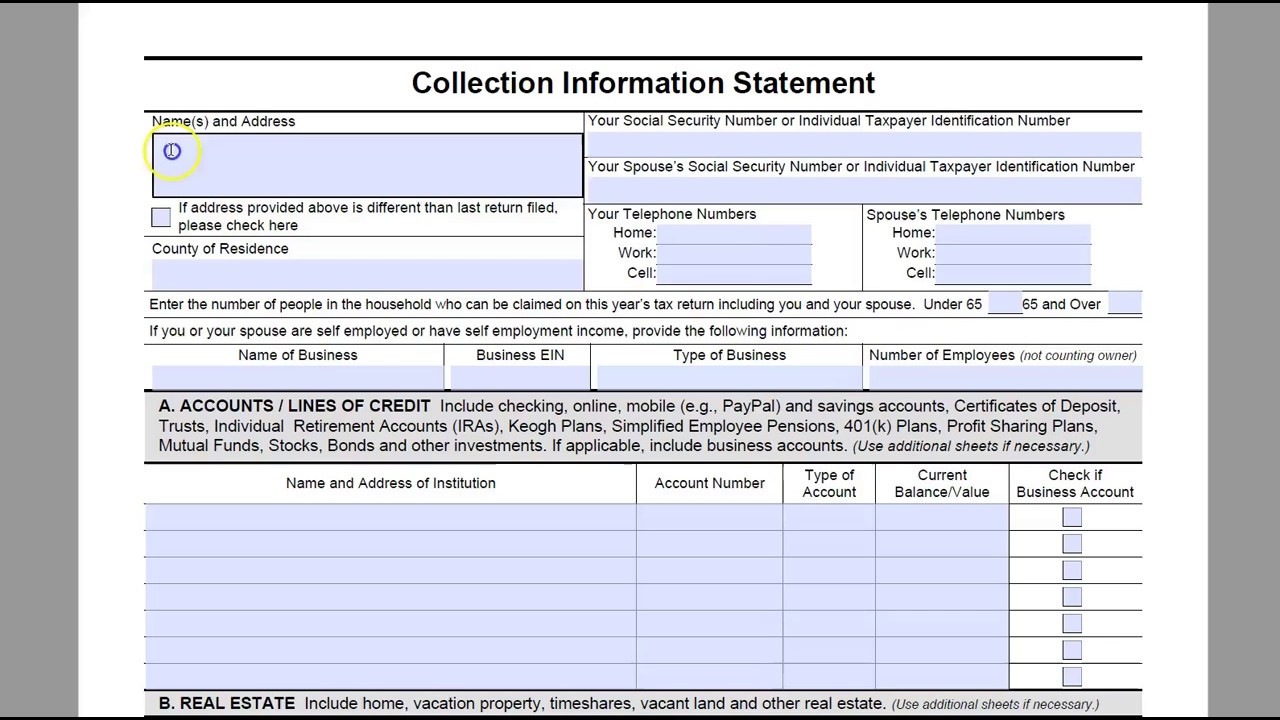

IRS Form 433 F Walkthrough Collection Information Statement YouTube

https://i.ytimg.com/vi/aTYfQvQliWw/maxresdefault.jpg

The Form 433 F might also be used when determining financial hardship caused by wage or social security garnishment bank account levy and other collection actions Payment Plans for Outstanding Debts Taxpayers who owe more than 100 000 to the IRS must file a financial statement that lists all of their sources of income and assets The IRS Form 433 F Collection Information Sheet is one of the ways the government gathers your personal information to better understand your financial status and evaluate your ability to pay back your tax debt It requires you to report your full financial history and will be a necessary step to take before calling the IRS Automated Collection

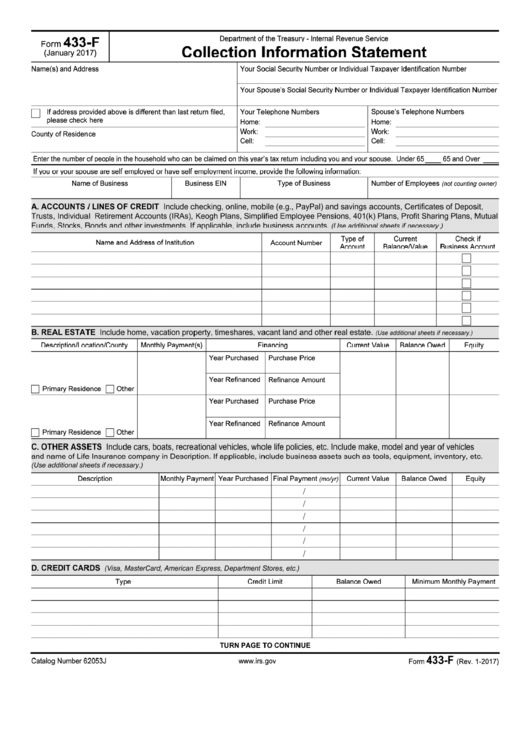

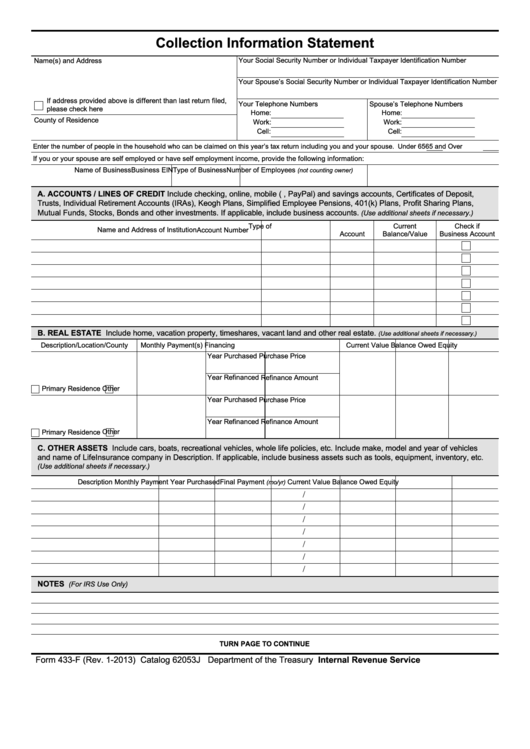

Form 433 F Collection Information Statement is one of the forms the IRS uses to collect financial information from people with taxes owed It shows the IRS the taxpayer s ability to pay monthly cash flow The IRS uses the information on this form to determine eligibility for payment plans and uncollectible status among other resolutions In Part B of IRS Form 433 F the taxpayer must list all of their real estate properties including their primary residence and provide details such as the monthly payment year of purchase purchase price year of refinance if applicable and the amount refinanced

More picture related to Printable Irs Form 433 F

Form 433 F Printable Printable World Holiday

https://data.formsbank.com/pdf_docs_html/291/2917/291734/page_1_thumb_big.png

Fillable Form 433 F Collection Information Statement 2003 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/255/2550/255076/page_1_thumb_big.png

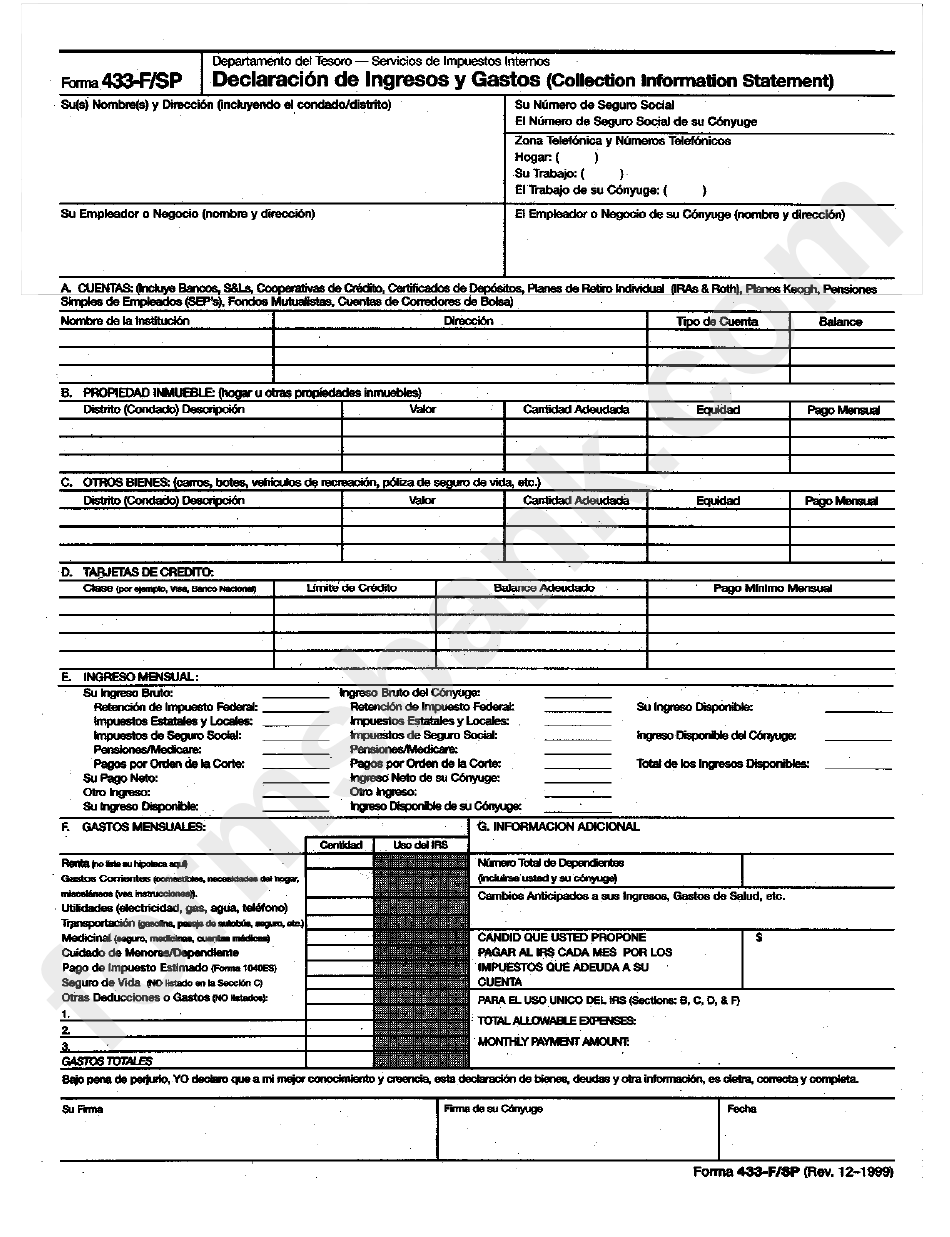

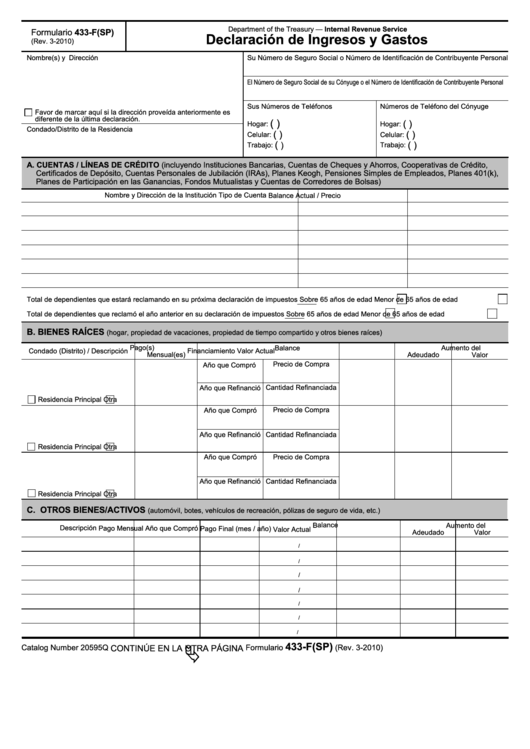

Forma 433 F sp Declaracion De Ingresos Y Gastos Collection Information Statement 1999

https://data.formsbank.com/pdf_docs_html/275/2752/275271/page_1_bg.png

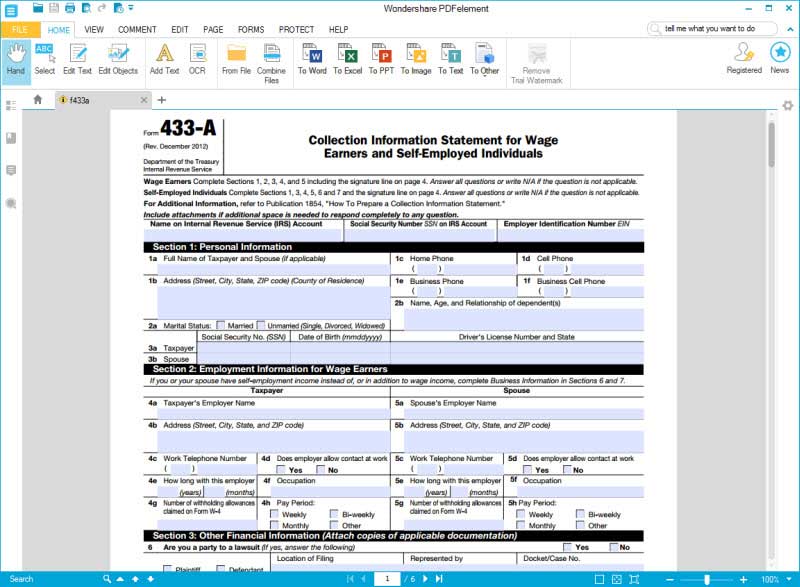

Form 433 F Collection Information Statement Set up Special Payment Plans and Get Relief from IRS Collection Actions When the IRS needs to know more about your financial situation the agency may request Form 433 F Collection Information Statement Depending on the circumstances you may proactively complete this form to apply for an IRS program or an IRS agent may request this form from The IRS may ask you to file any past due returns The IRS may ask you to complete Form 433 A Collection Information Statement for Wage Earners and Self Employed Individuals or Form 433 F Collection Information Statement and or Form 433 B Collection Information Statement for Businesses before making any collection decision

You can download or print current or past year PDFs of Form 433 F directly from TaxFormFinder You can print other Federal tax forms here Other Federal Corporate Income Tax Forms TaxFormFinder has an additional 774 Federal income tax forms that you may need plus all federal income tax forms View all 775 Federal Income Tax Forms Form Sources IRS Form 433 F Collection Information Statement is used to determine taxpayer s ability to pay the IRS Learn more from the tax experts at H R Block In most cases you can file Form 433 F but in certain circumstances the IRS may request that you complete Form 433 A which asks for more detailed information than the 433 F

Fillable Form 433 F Collection Information Statement Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/172/1720/172061/page_1_thumb_big.png

Form 433 F Collection Information Statement Instructions Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/224/2246/224601/page_1_thumb_big.png

https://www.irs.gov/pub/irs-utl/f433f.pdf

Form 433 F Rev 6 2010 D CREDIT CARDS Visa MasterCard American Express Department Stores etc Type Credit Limit Balance Owed E WAGE INFORMATION If you have more than one employer include the information on another sheet of paper Minimum Monthly Payment

https://www.backtaxeshelp.com/resources/tax-relief-forms/form-433-f/

You can use Form 433 F Collection Information Statement to provide your financial information to the IRS Your Collection Information Statement is needed to determine your eligibility for certain installment agreements currently not collectible status and other tax resolution options that the IRS has available based on your ability to pay

32 433 Forms And Templates Free To Download In PDF

Fillable Form 433 F Collection Information Statement Printable Pdf Download

How To Complete IRS Form 433 F YouTube

2003 Form IRS 433 F Fill Online Printable Fillable Blank PdfFiller

32 433 Forms And Templates Free To Download In PDF

Fill Free Fillable Collection Information Statement Jan 2017 Form 433 F PDF Form

Fill Free Fillable Collection Information Statement Jan 2017 Form 433 F PDF Form

IRS Form 433 A How To Fill It Right

Fillable Form 433 F Collection Information Statement Department Of Treasury Printable Pdf

Form 433 F Pdf Printable Printable Forms Free Online

Printable Irs Form 433 F - The Form 433 F might also be used when determining financial hardship caused by wage or social security garnishment bank account levy and other collection actions Payment Plans for Outstanding Debts Taxpayers who owe more than 100 000 to the IRS must file a financial statement that lists all of their sources of income and assets