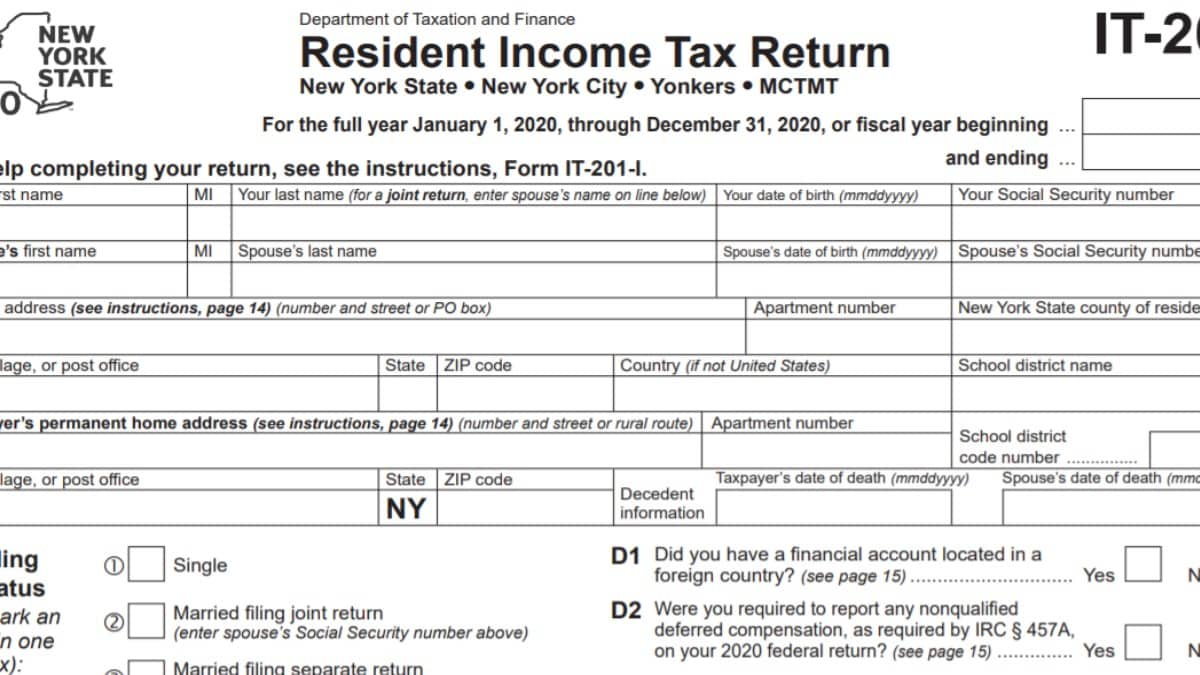

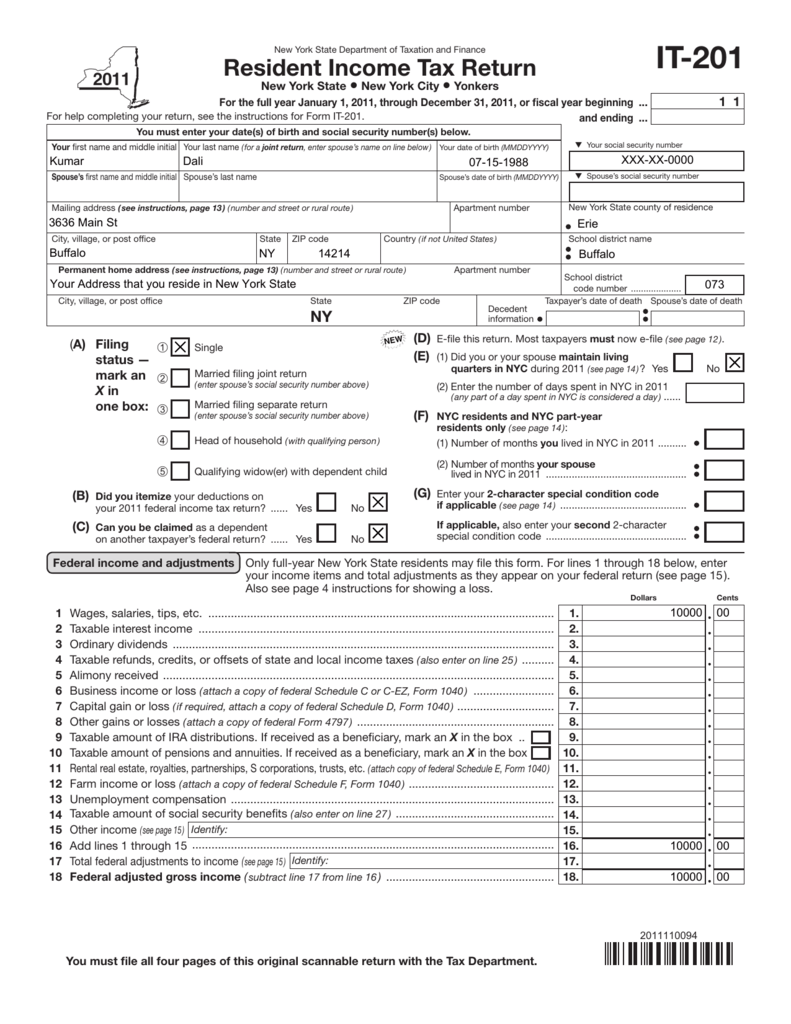

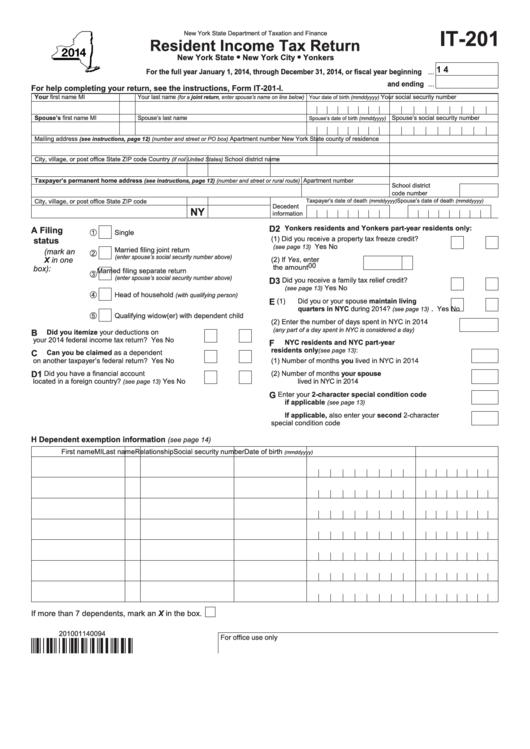

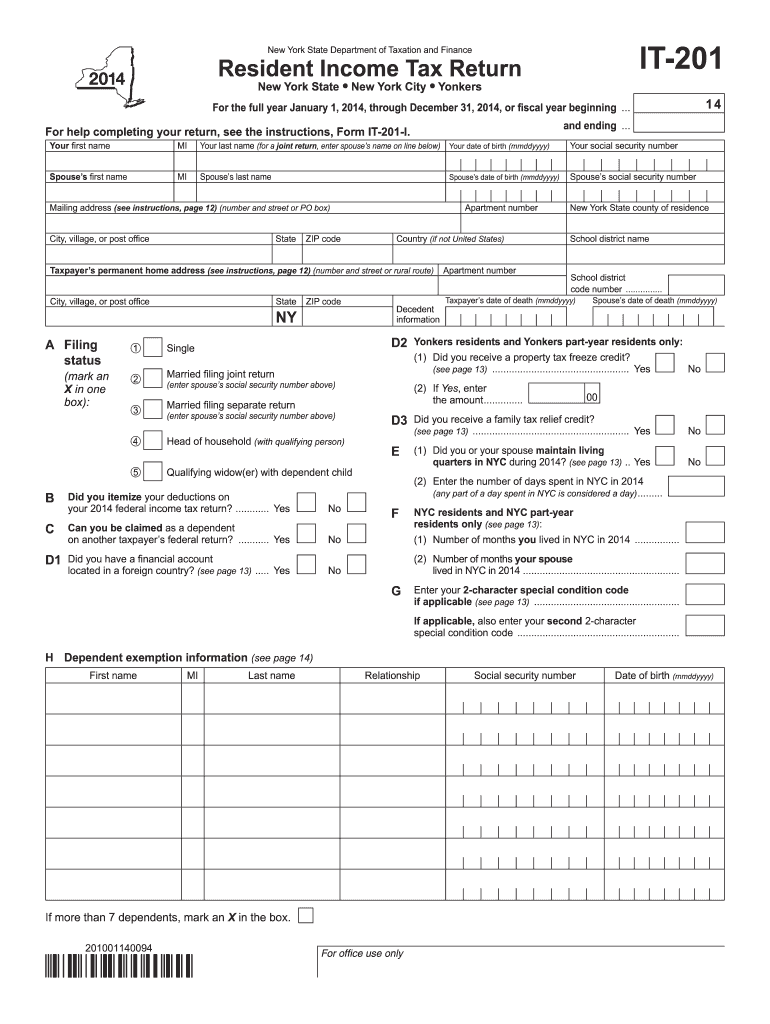

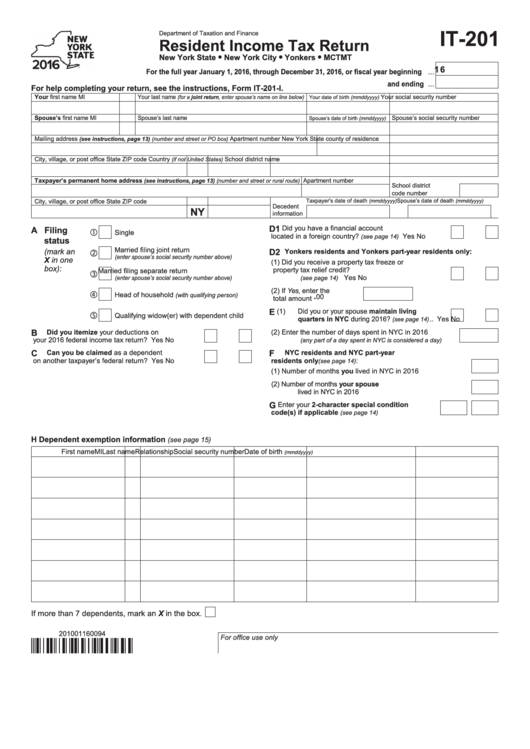

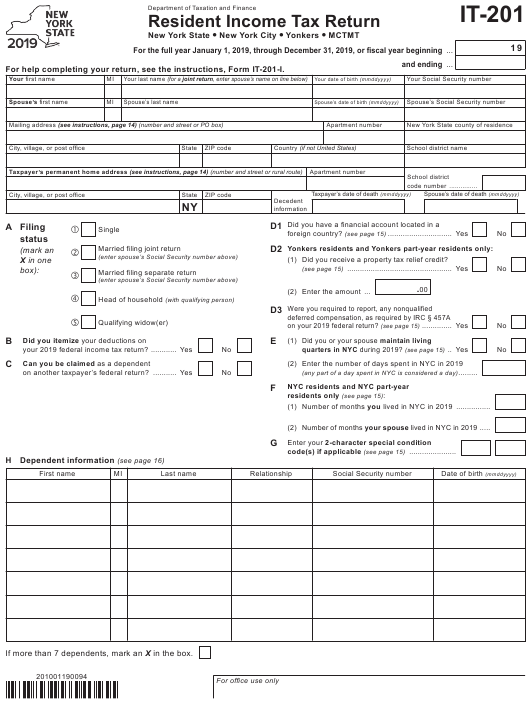

Printable Nys Tax Form It 201 Form IT 201 is the standard New York income tax return for state residents Nonresidents and part time residents must use must use Form IT 203 instead Form IT 201 requires you to list multiple forms of income such as wages interest or alimony

Printable New York Income Tax Form IT 201 Form IT 201 is the standard New York income tax return for state residents Nonresidents and part time residents must use must use Form IT 203 instead For more information about the New York Income Tax see the New York Income Tax page Department of Taxation and Finance Instructions for Form IT 201 Full Year Resident Income Tax Return New York State New York CityYonkers MCTMT including instructions f

Printable Nys Tax Form It 201

Printable Nys Tax Form It 201

https://www.viralcovert.com/wp-content/uploads/2018/11/new-york-state-tax-form-it-201-x.jpg

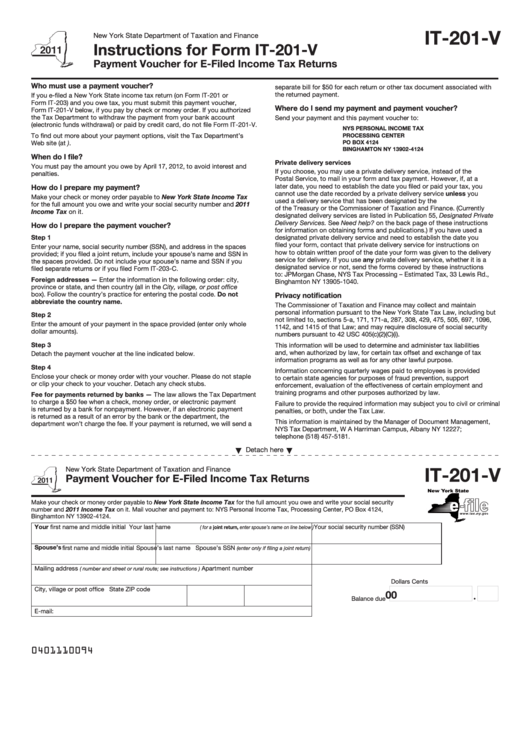

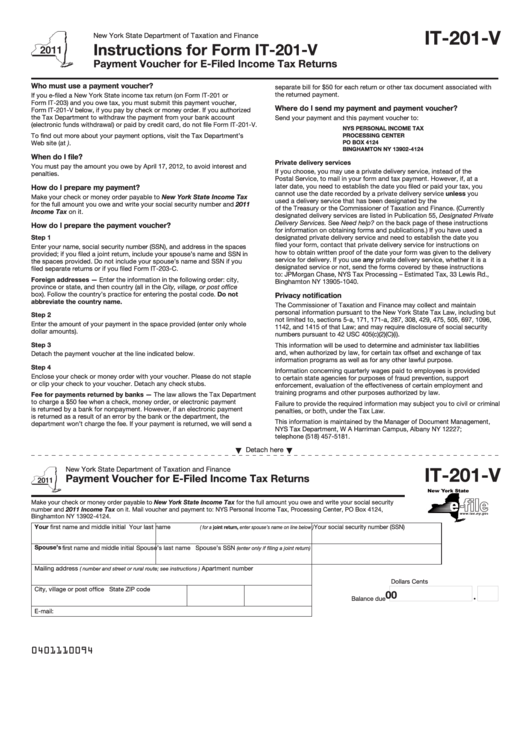

Fillable Form It 201 V 2011 Payment Voucher For E Filed Income Tax Returns New York State

https://data.formsbank.com/pdf_docs_html/129/1290/129089/page_1_thumb_big.png

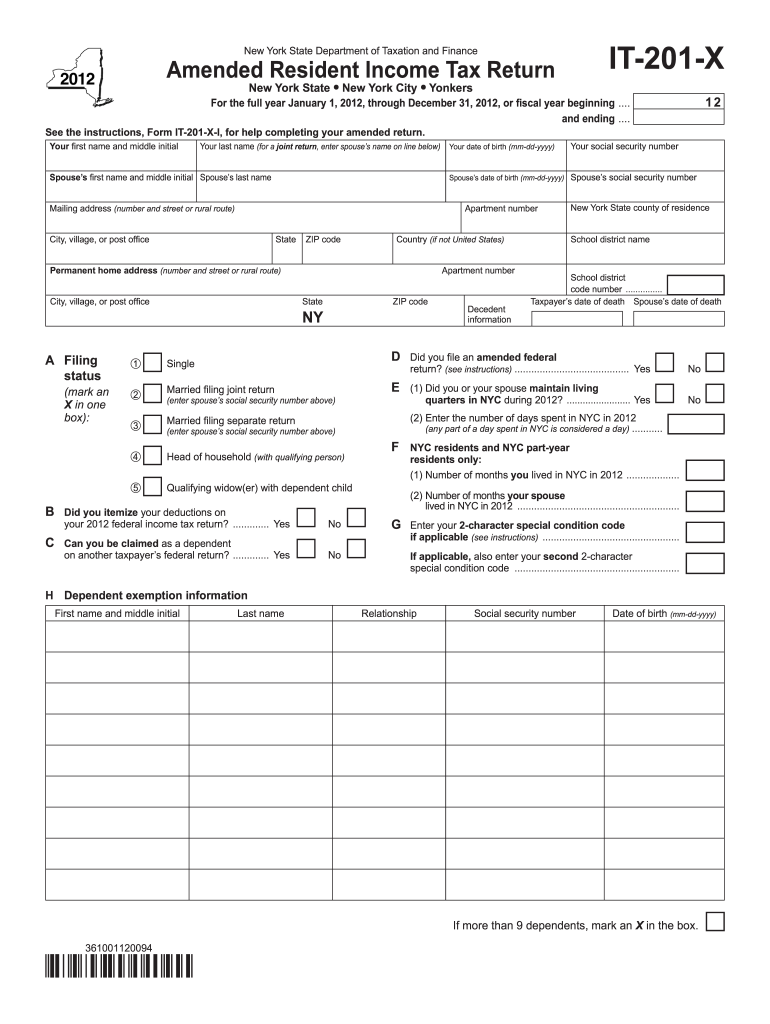

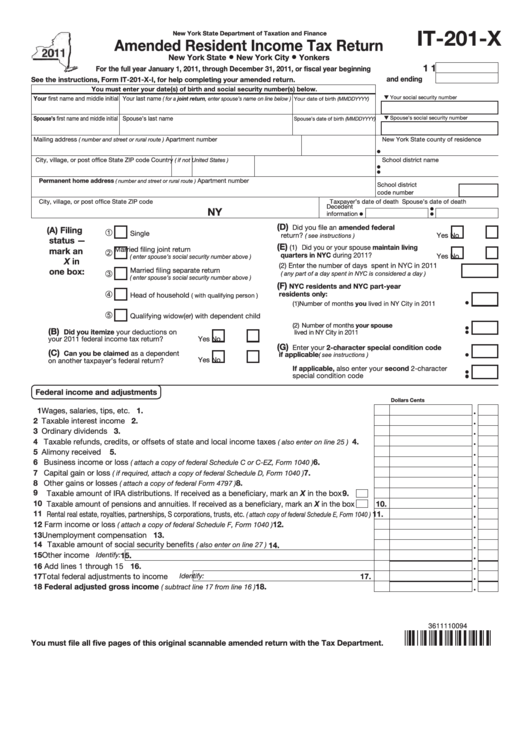

Form It 201 X Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/954/6954723/large.png

New York Individual Income Tax Return Download This Form Print This Form It appears you don t have a PDF plugin for this browser Please use the link below to download 2023 new york form it 201 pdf and you can print it directly from your computer More about the New York Form IT 201 Tax Return eFile your New York tax return now New York state income tax Form IT 201 must be postmarked by April 15 2024 in order to avoid penalties and late fees Printable New York state tax forms for the 2023 tax year will be based on income earned between January 1 2023 through December 31 2023

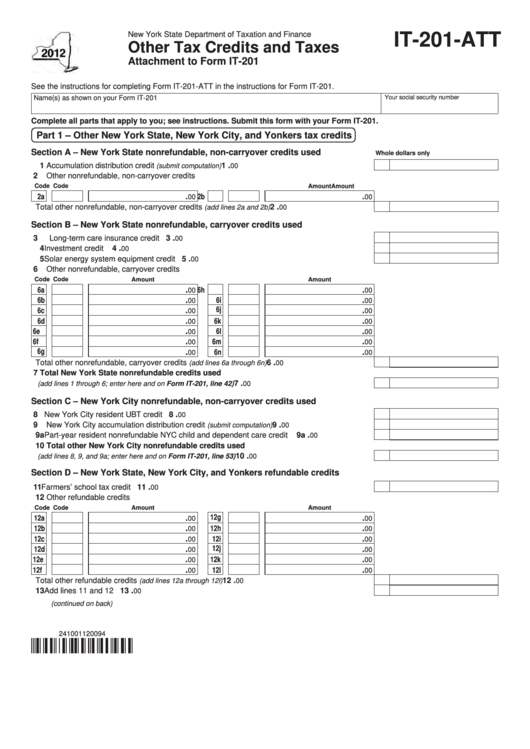

Department of Taxation and Finance Allocation of Refund Attachment to Form IT 201 or IT 203 IT 195 See the instructions for completing Form IT 195 in the instructions for Form IT 201 or Form IT 203 Submit this form with Form IT 201 or IT 203 Name s as shown on return Your Social Security number Instructions for Form IT 201 Full Year Resident Income Tax Return New York State New York City Yonkers MCTMT including instructions for Forms IT 195 IT 201 ATT and IT 201 D Before you prepare a paper return consider filing electronically Electronic preparation and filing is fast easy and secure

More picture related to Printable Nys Tax Form It 201

IT 201 Instructions 2023 2024 State Taxes TaxUni

https://www.taxuni.com/wp-content/uploads/2021/05/IT-201-Instructions.jpg

Form IT 201 2011 Resident Income Tax Return IT201

https://s3.studylib.net/store/data/008799499_1-3727c79fed3523bb42c3b2fcd3ae04e4.png

Form IT 201 Resident Income Tax Return YouTube

http://i.ytimg.com/vi/TSrD30DFkAM/maxresdefault.jpg

TaxFormFinder provides printable PDF copies of 272 current New York income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024 Individual Income Tax 125 Corporate Income Tax 124 Show entries Search Showing 1 to 25 of 125 entries Previous 1 2 3 4 5 Next You can download or print current or past year PDFs of Form 201 I directly from TaxFormFinder You can print other New York tax forms here eFile your New York tax return now eFiling is easier faster and safer than filling out paper tax forms File your New York and Federal tax returns online with TurboTax in minutes

201002130094 20 Interest income on state and local bonds and obligations but not those of NYS or its local governments 20 00 21 Public employee 414 h retirement contributions from your wage and tax statements see page 15 21 00 New York s 22 529 college savings program distributions see page 15 22 00 23 Other see page 16 Identify 23 00 2 Best answer ErnieS0 Expert Alumni You can mail an amended 2021 New York return if you e filed the original TurboTax does support e filing New York amended returns but in some situations you will not be able to e file For example if you did not e file an original form with TurboTax you will not be able to e file the amended return

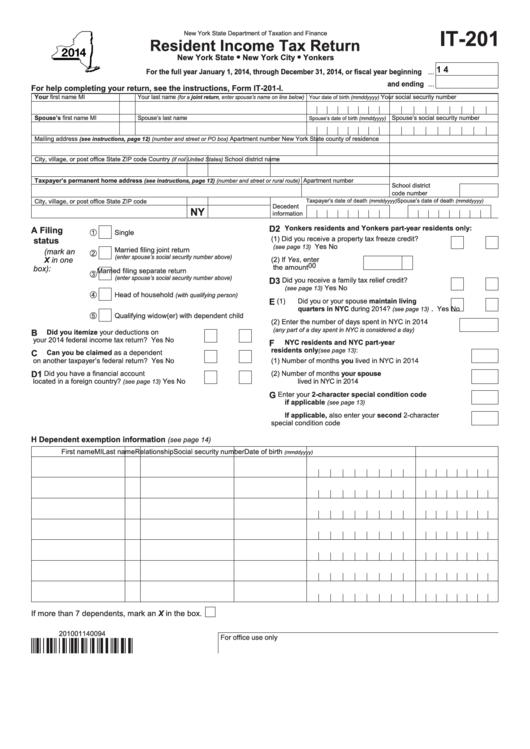

Fillable Form It 201 2014 Resident Income Tax Return New York State Department Of Taxation And

https://data.formsbank.com/pdf_docs_html/115/1150/115073/page_1_thumb_big.png

2014 Form NY DTF IT 201 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/100/654/100654951/large.png

https://www.taxformfinder.org/newyork/form-it-201

Form IT 201 is the standard New York income tax return for state residents Nonresidents and part time residents must use must use Form IT 203 instead Form IT 201 requires you to list multiple forms of income such as wages interest or alimony

https://www.tax-rates.org/forms/new_york/form_it-201

Printable New York Income Tax Form IT 201 Form IT 201 is the standard New York income tax return for state residents Nonresidents and part time residents must use must use Form IT 203 instead For more information about the New York Income Tax see the New York Income Tax page

2017 2024 Form NY DTF IT 201 D Fill Online Printable Fillable Blank PdfFiller

Fillable Form It 201 2014 Resident Income Tax Return New York State Department Of Taxation And

Top 106 New York State Form It 201 Templates Free To Download In PDF Format

Fillable Form It 201 X Amended Resident Income Tax Return 2011 Printable Pdf Download

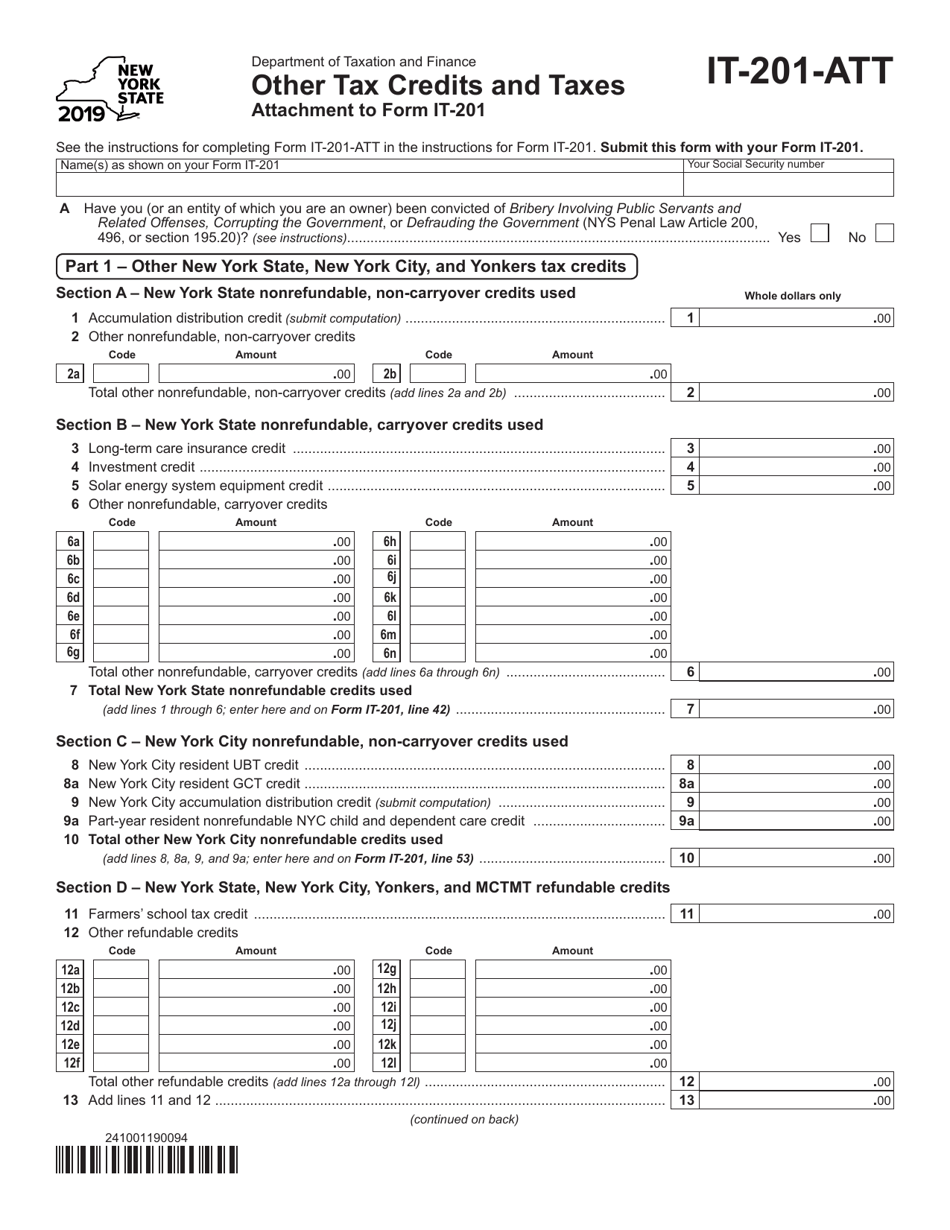

Fillable Form It 201 Att Other Tax Credits And Taxes Attachment To Form It 201 2012

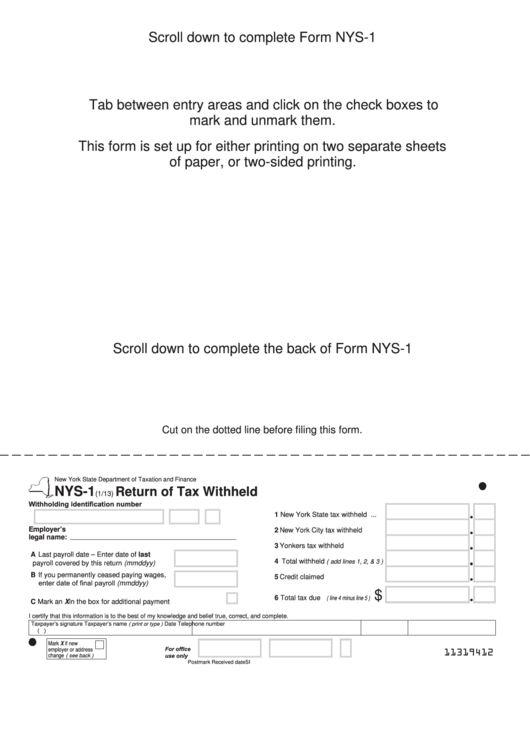

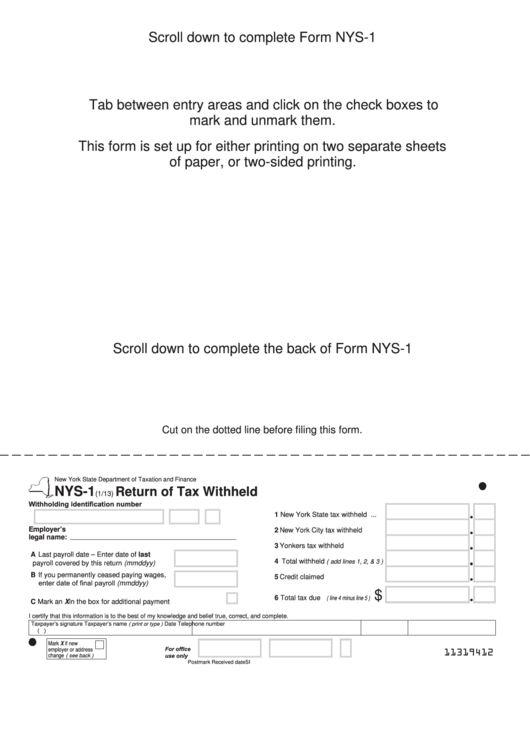

Fillable Form Nys 1 Return Of Tax Withheld Printable Pdf Download

Fillable Form Nys 1 Return Of Tax Withheld Printable Pdf Download

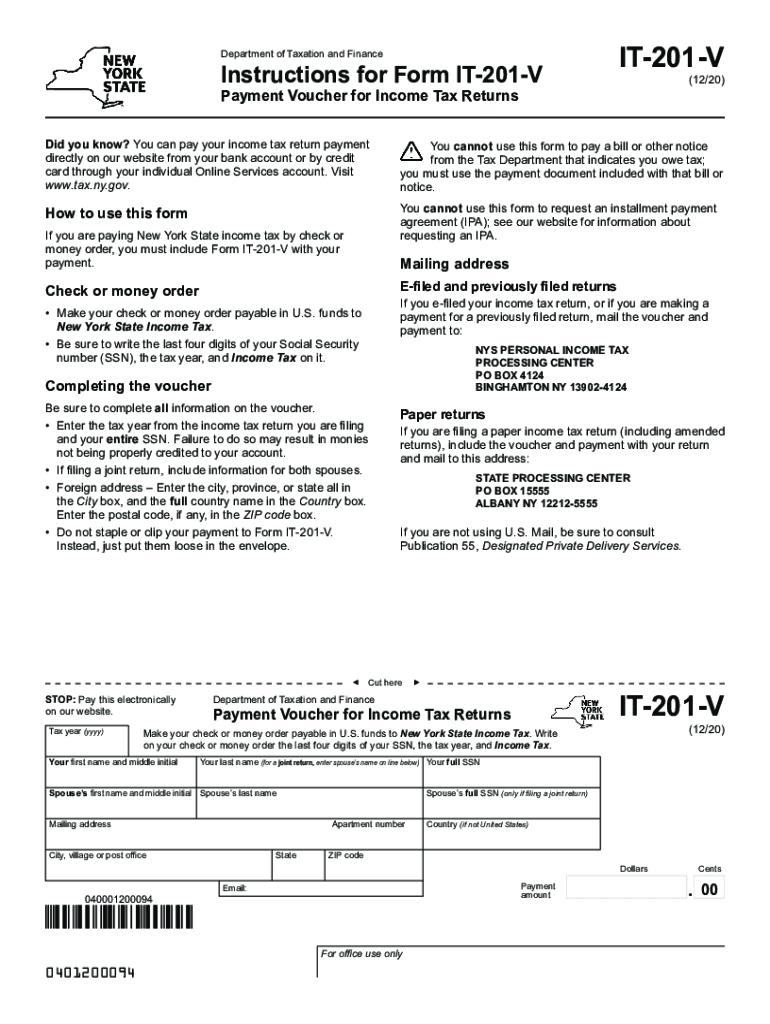

2020 Form NY IT 201 V Fill Online Printable Fillable Blank PdfFiller

Form IT 201 ATT 2019 Fill Out Sign Online And Download Fillable PDF New York Templateroller

Form IT 201 Download Fillable PDF Or Fill Online Resident Printable Form 2021

Printable Nys Tax Form It 201 - T of Taxation and Finance New York State New York City Yonkers beginning Name s as shown on return ending Identification number SSN or EIN Part 1 All filers must complete this part see instructions Form IT 2105 9 I for assistance 1 Total tax from your 2006 return before withholding and estimated tax payments caution see instructions 2 Empire State child credit from Form IT 150