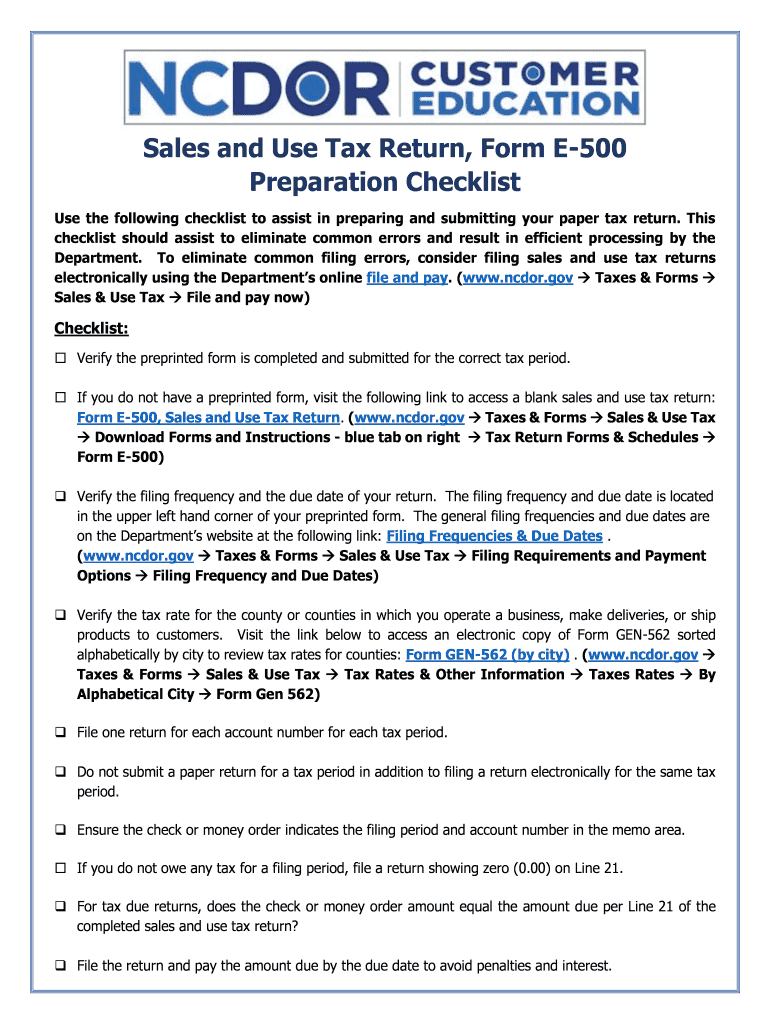

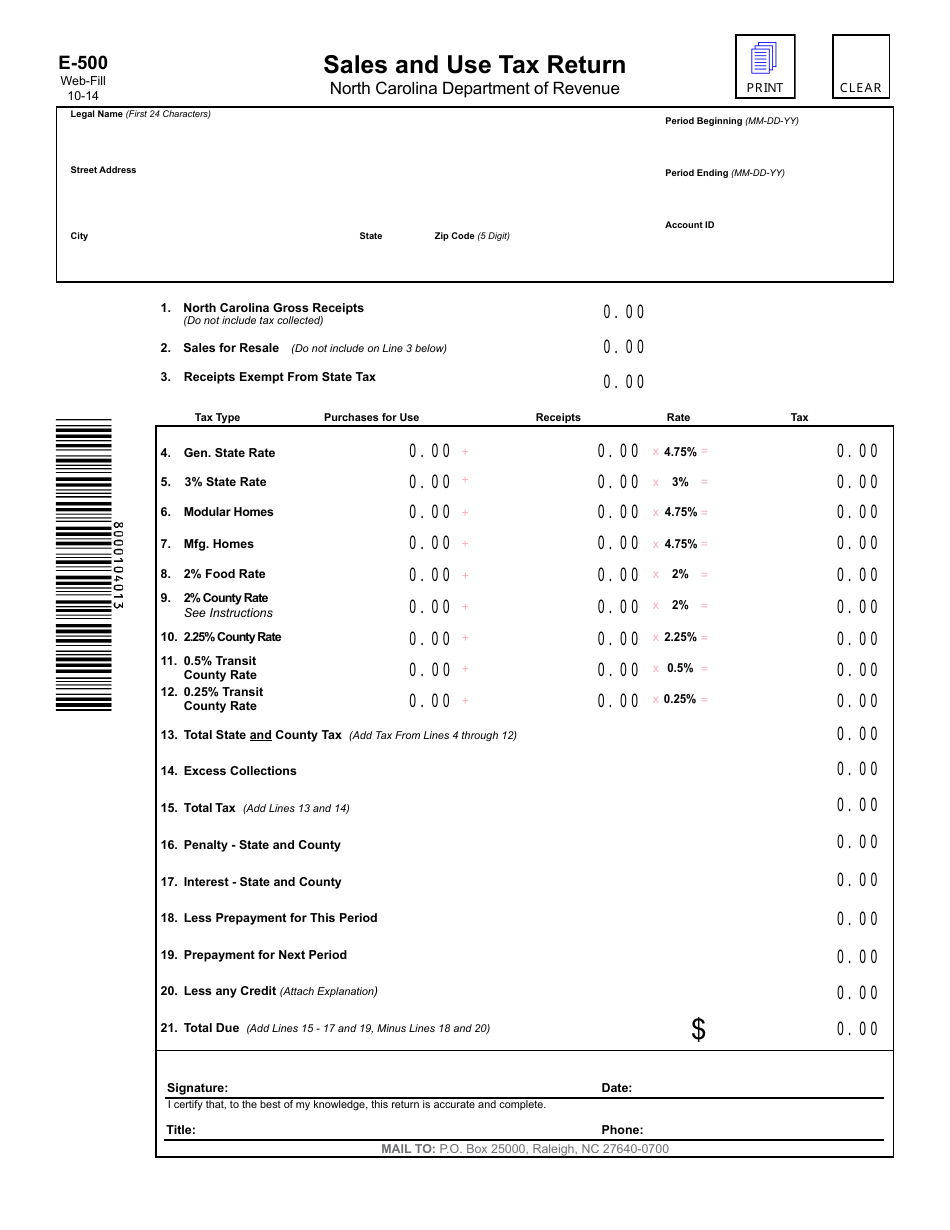

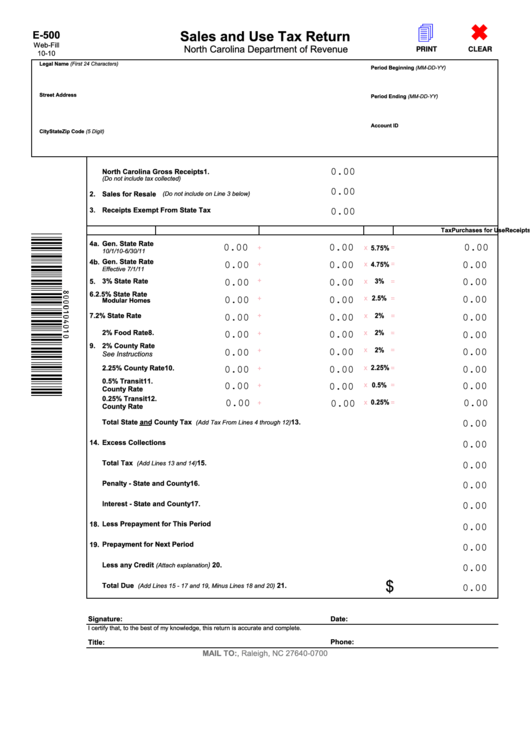

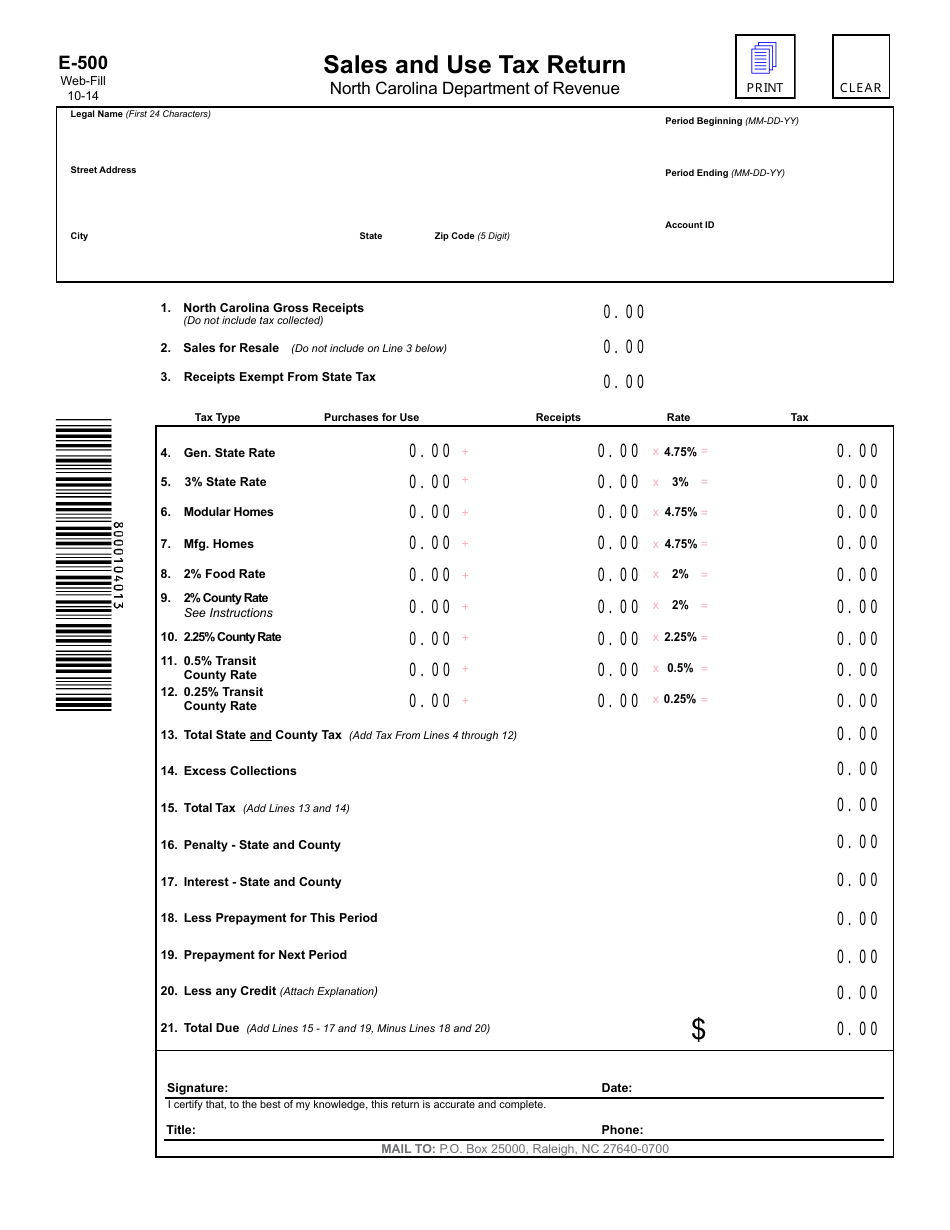

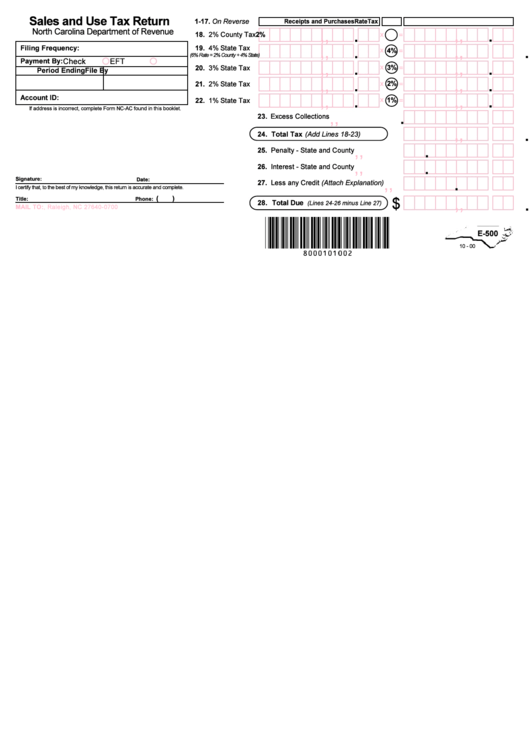

Sales And Use Tax Return Nc E 500 Printable Form Sales and Use Tax Return Web Fill North Carolina Department of Revenue 10 14 E 500 Period Beginning MM DD YY Account ID Period Ending MM DD YY Legal Name First 24 Characters Street Address City State Zip Code 5 Digit MAIL TO P O Box 25000 Raleigh NC 27640 0700 Date Phone Signature Title

Use Form E 500 to file and report your North Carolina State local and transit sales and use taxes Taxpayers who have a filing frequency of Monthly with Prepayment are required to file Form E 500 via our Online Filing and Pay System via our website www dornc A return must be filed for each period by the due date including the period in In order to file an EDI formatted sales and use return you must first complete and submit Form NC 592 Electronic Data Interchange EDI Registration Sales and Use Tax If you have questions about registering to file an EDI formatted return please contact the E File and Development Unit Monday through Friday between the hours of 8 00 am and 5

Sales And Use Tax Return Nc E 500 Printable Form

Sales And Use Tax Return Nc E 500 Printable Form

https://www.signnow.com/preview/468/613/468613107/large.png

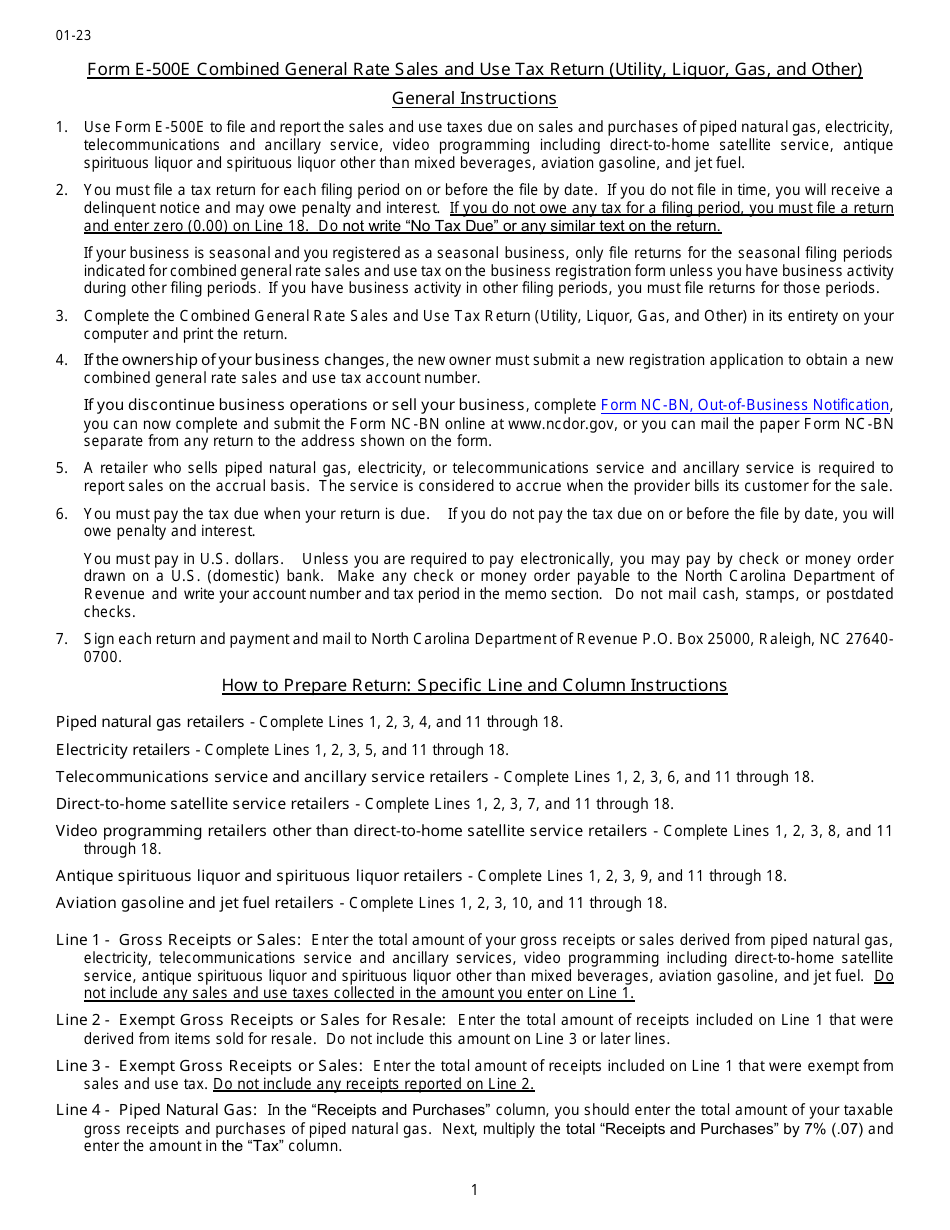

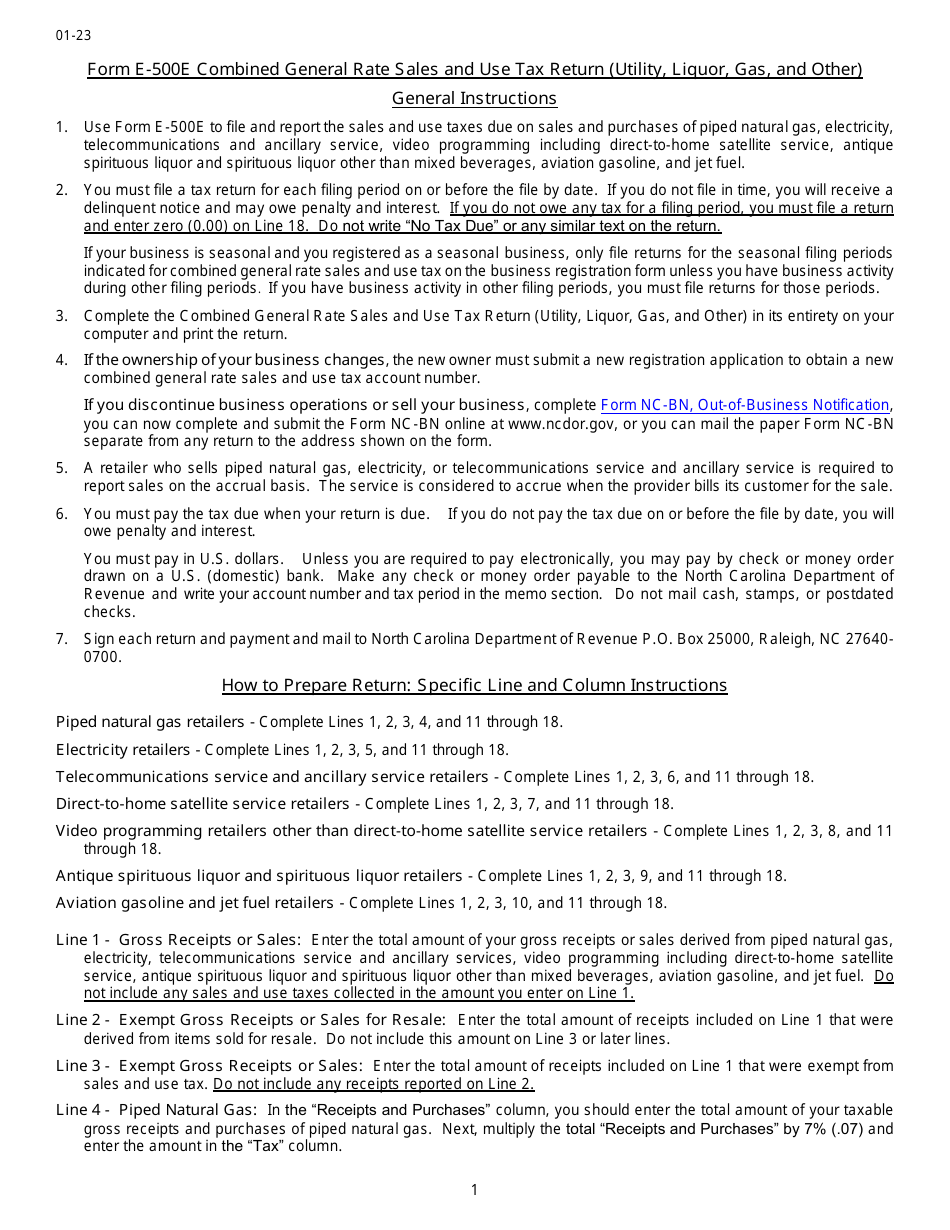

Download Instructions For Form E 500E Combined General Rate Sales And Use Tax Return Utility

https://data.templateroller.com/pdf_docs_html/2589/25894/2589476/page_1_thumb_950.png

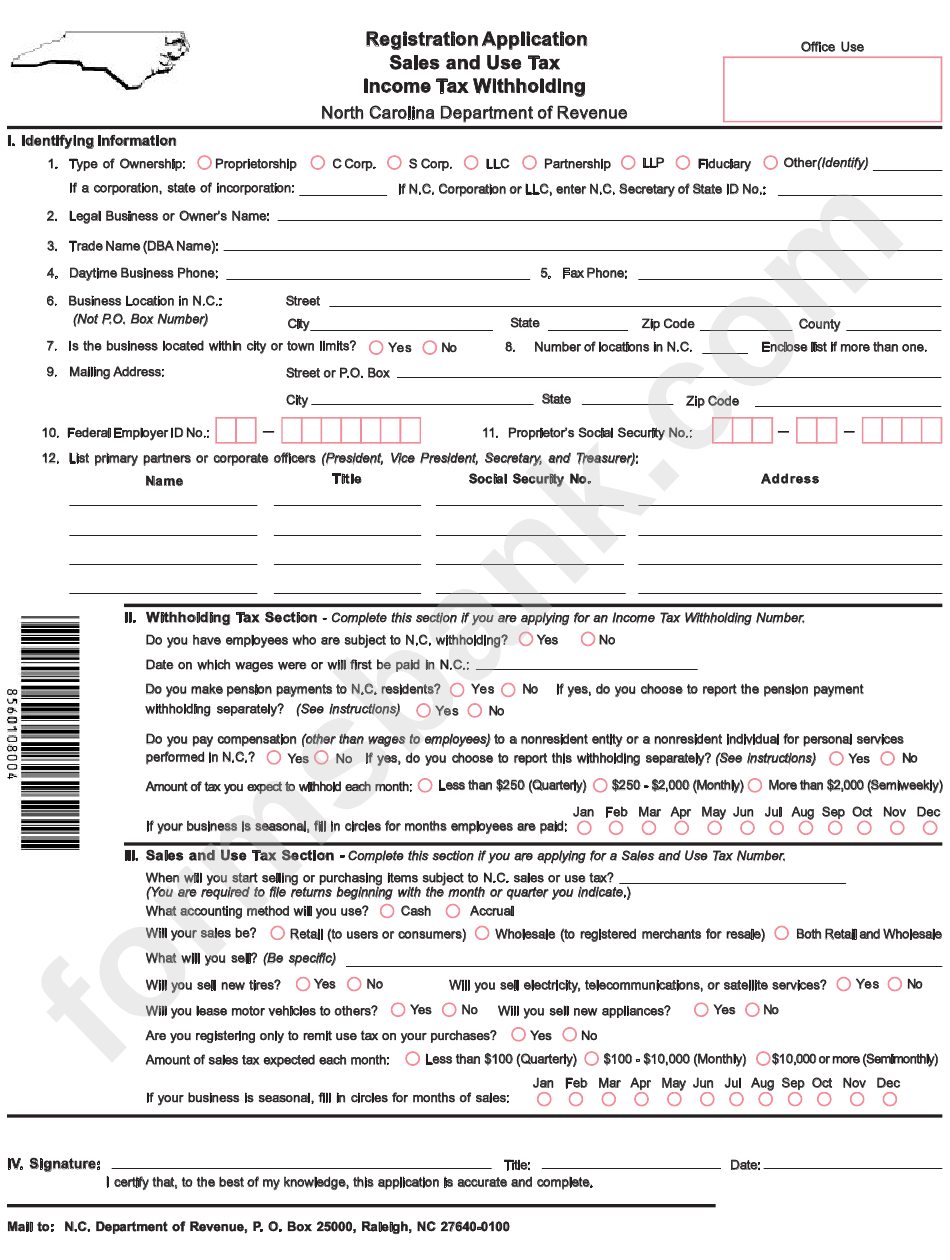

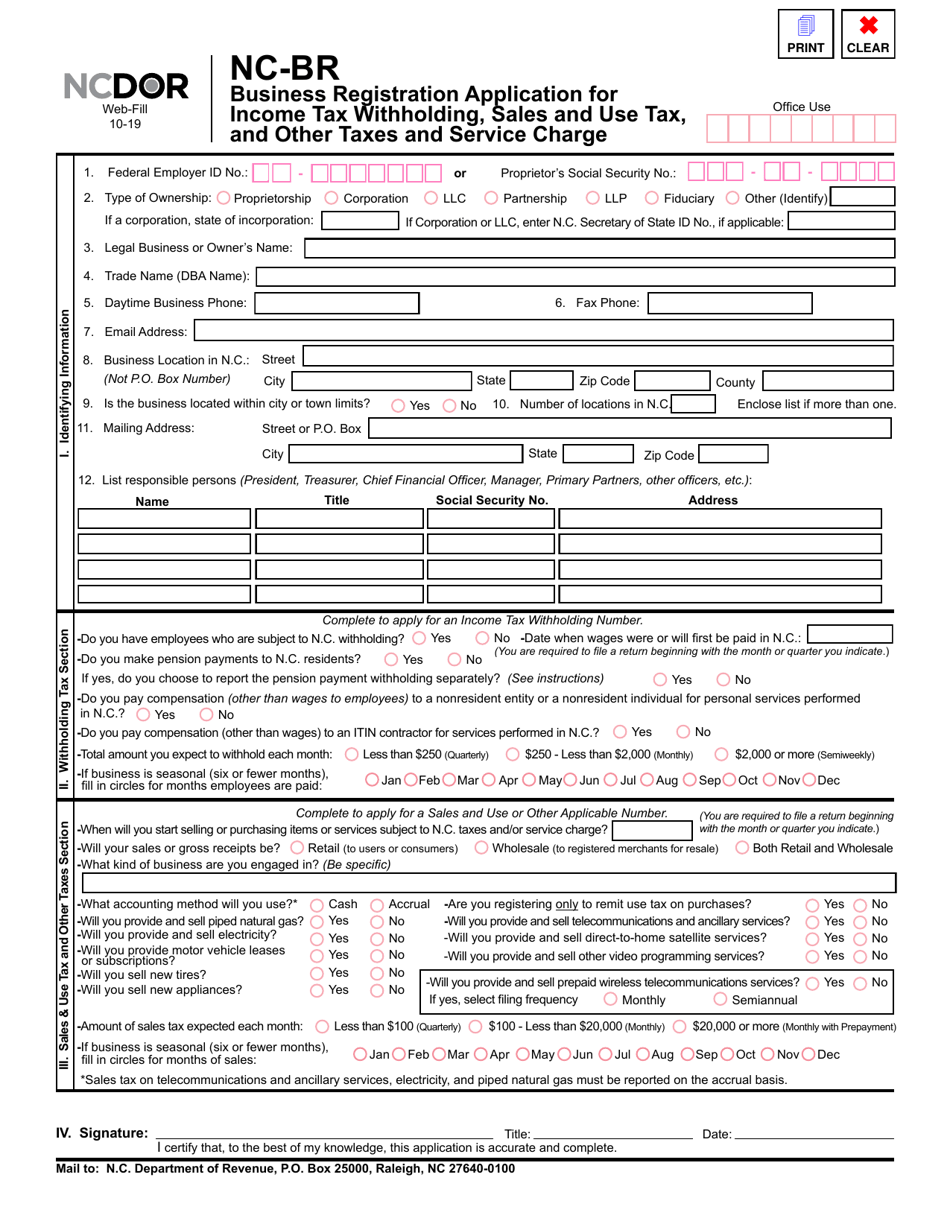

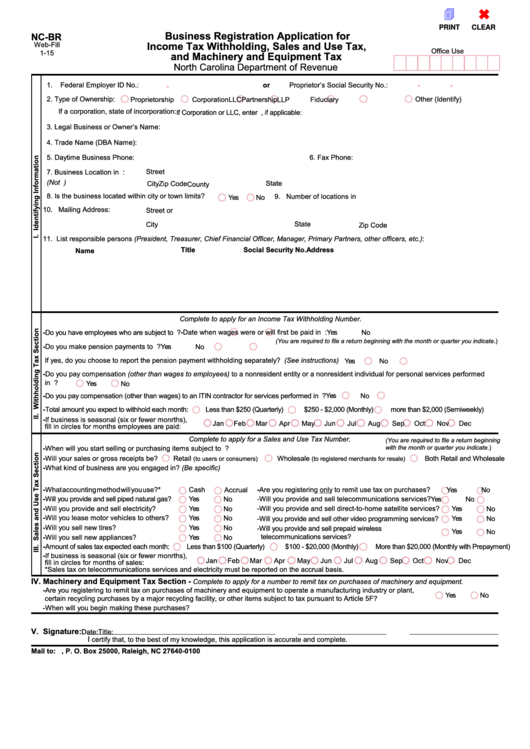

Registration Application Form Sales And Use Tax Income Tax Withholding North Carolina

https://data.formsbank.com/pdf_docs_html/254/2541/254173/page_1_bg.png

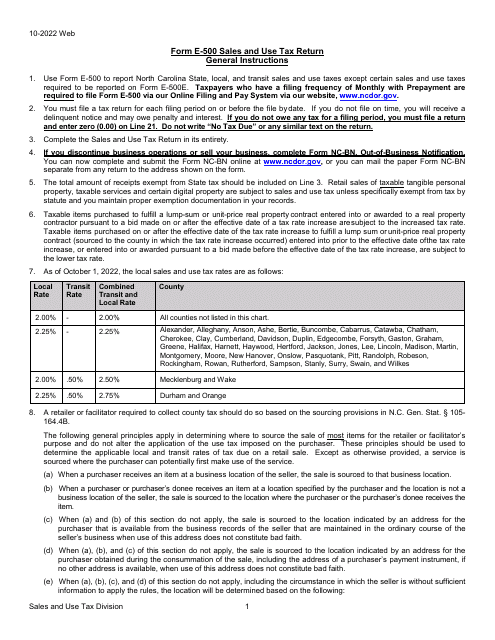

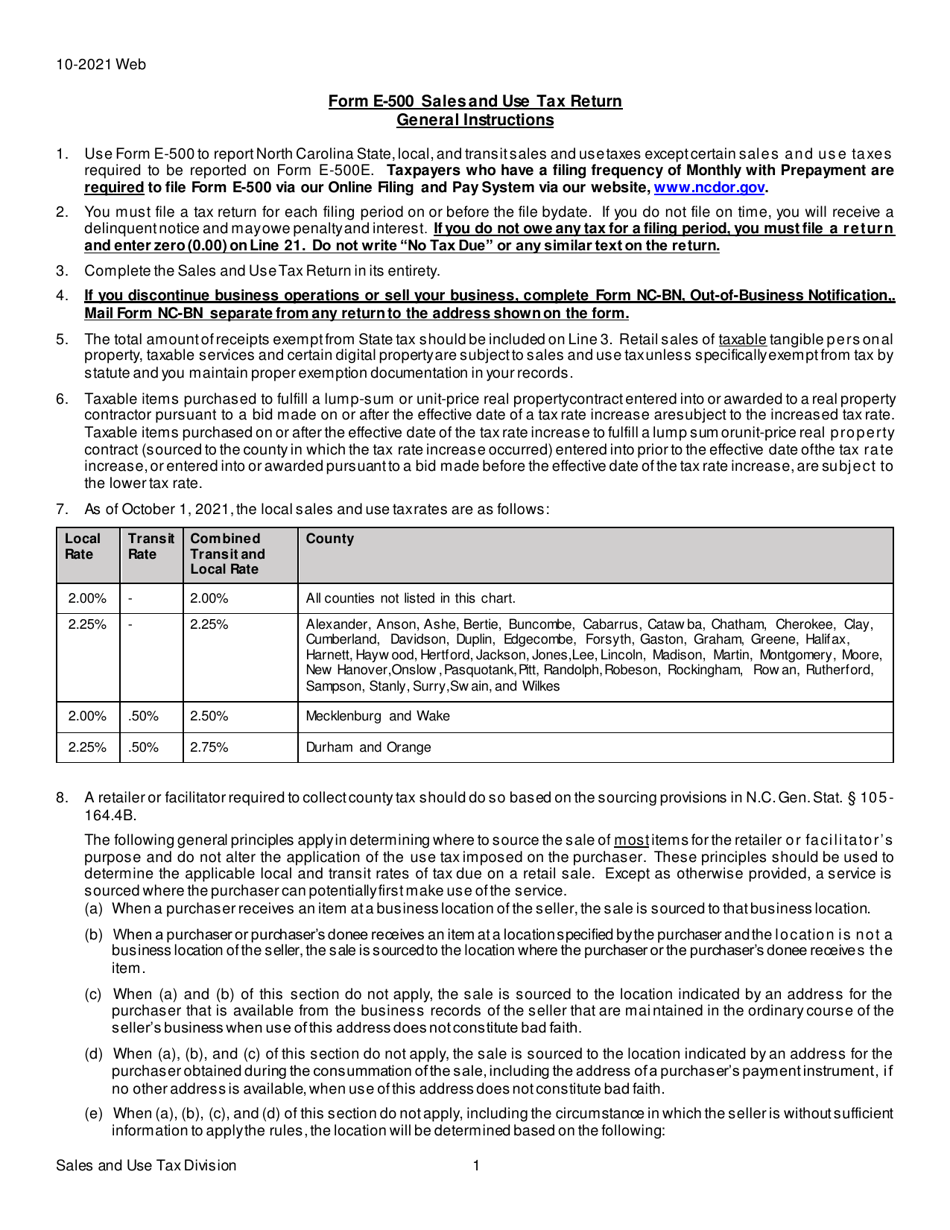

Form E 500 Sales and Use Tax Return General Instructions 1 Use Form E 500 to file and report your State local and transit sales and use taxes except certain sales and use taxes required to be reported on Form E 500E Taxpayers who have a filing frequency of Monthly with Prepayment are required to file Form E 500 via our Online Filing and Pay D 410P Application for Extension for Filing Partnership Estate or Trust Tax Return IFTA Individual Income D 400V Income Amended D 400V Amended Income Extension D 410 Income Estimated NC 40 Motor Fuels NC 3 and withholding statements Sales Use E 500 E 536 Withholding NC 5 NC 5P Withholding NC 5Q

In order to file an EDI formatted return you must first complete and submit Form NC 592 Electronic Data Interchange EDI Registration Sales and Use Tax For questions concerning uploading an EDI formatted return please contact the E File and Development Unit Monday through Friday between the hours of 8 00 am and 5 00 pm EST toll free at 1 Download Fillable Form E 500 In Pdf The Latest Version Applicable For 2024 Fill Out The Sales And Use Tax Return North Carolina Online And Print It Out For Free Form E 500 Is Often Used In Use Tax Return Sales Tax Return North Carolina Department Of Revenue Tax Preparer Free Tax Filing Tax Return Template North Carolina Legal Forms And United States Legal Forms

More picture related to Sales And Use Tax Return Nc E 500 Printable Form

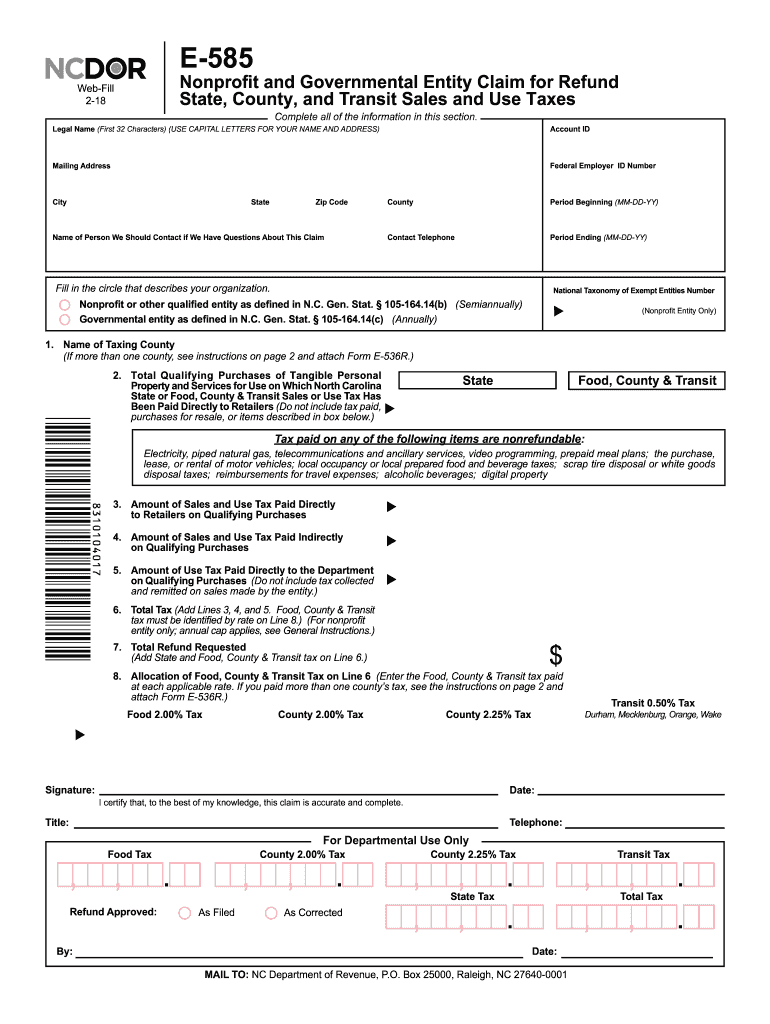

Ncdor Form E 585 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/440/525/440525760/large.png

Nc Printable Tax Forms Printable Forms Free Online

https://www.pdffiller.com/preview/100/90/100090131/large.png

Printable State Tax Forms

https://www.pdffiller.com/preview/100/101/100101112/large.png

Exempt Gross Receipts or Sales 2 1 Signature Date MAIL TO P O Box 25000 Raleigh NC 27640 0700 I certify that to the best of my knowledge this return is accurate and complete Combined General Rate Sales and Use Tax Return Utility Liquor Gas and Other E 500E Aviation Gasoline and Jet Fuel Effective 1 1 2016 10 x 7 Title The online filing and payment system allows you to electronically file Form E 500 Sales and Use Tax Return and accompanying schedule Form E 536 Schedule of County Sales and Use Taxes Using this system allows us to process your return and or payment more accurately and efficiently We strongly encourage you to use the online filing and

0 00 Intro and Disclaimer0 27 Navigating to filing and paying 0 52 Entering Business Account and Contact Info2 26 Selecting Filing Options3 53 Completing For Sales and Use Tax Division 1 Form E 500 Sales and Use Tax Return General Instructions 1 Use Form E 500 to file and report North Carolina State local and transit sales and use taxes except certain sales and use taxes required to be reported on Form E 500E Taxpayers who have a filing frequency of Monthly with Prepayment

Form E 500 Fill Out Sign Online And Download Fillable PDF North Carolina Templateroller

https://data.templateroller.com/pdf_docs_html/1728/17285/1728591/form-e-500-sales-and-use-tax-return-north-carolina_print_big.png

Fillable Sales And Use Tax Return North Carolina Department Of Revenue Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/130/1309/130931/page_1_thumb_big.png

https://files.nc.gov/ncdor/documents/forms/e500_10-14_webfill.pdf

Sales and Use Tax Return Web Fill North Carolina Department of Revenue 10 14 E 500 Period Beginning MM DD YY Account ID Period Ending MM DD YY Legal Name First 24 Characters Street Address City State Zip Code 5 Digit MAIL TO P O Box 25000 Raleigh NC 27640 0700 Date Phone Signature Title

https://files.nc.gov/ncdor/documents/forms/e500_instr_10-13.pdf

Use Form E 500 to file and report your North Carolina State local and transit sales and use taxes Taxpayers who have a filing frequency of Monthly with Prepayment are required to file Form E 500 via our Online Filing and Pay System via our website www dornc A return must be filed for each period by the due date including the period in

2004 Form NC DoR E 500Fill Online Printable Fillable Blank PdfFiller

Form E 500 Fill Out Sign Online And Download Fillable PDF North Carolina Templateroller

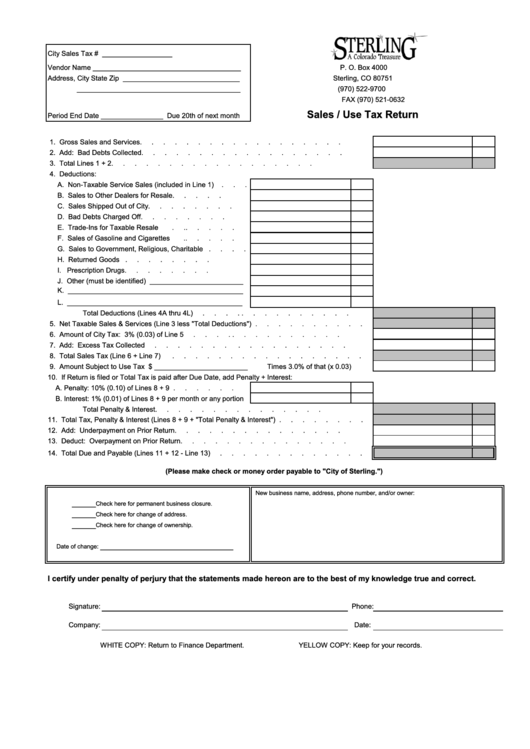

Sales Use Tax Return Form Printable Pdf Download

Form NC BR Download Fillable PDF Or Fill Online Business Registration Application For Income Tax

Fillable Form Nc Br Business Registration Application For Income Tax Withholding Sales And

Tax Return Printable Form

Tax Return Printable Form

Form E 500 Sales And Use Tax Return North Carolina Department Of Revenue Printable Pdf Download

Download Instructions For Form E 500 Sales And Use Tax Return PDF Templateroller

Download Instructions For Form E 500 Sales And Use Tax Return PDF Templateroller

Sales And Use Tax Return Nc E 500 Printable Form - In order to file an EDI formatted return you must first complete and submit Form NC 592 Electronic Data Interchange EDI Registration Sales and Use Tax For questions concerning uploading an EDI formatted return please contact the E File and Development Unit Monday through Friday between the hours of 8 00 am and 5 00 pm EST toll free at 1