When Does Your Work Have To Give You Your W2 Information about Form W 2 Wage and Tax Statement including recent updates related forms and instructions on how to file Form W 2 is filed by employers to report wages tips and other

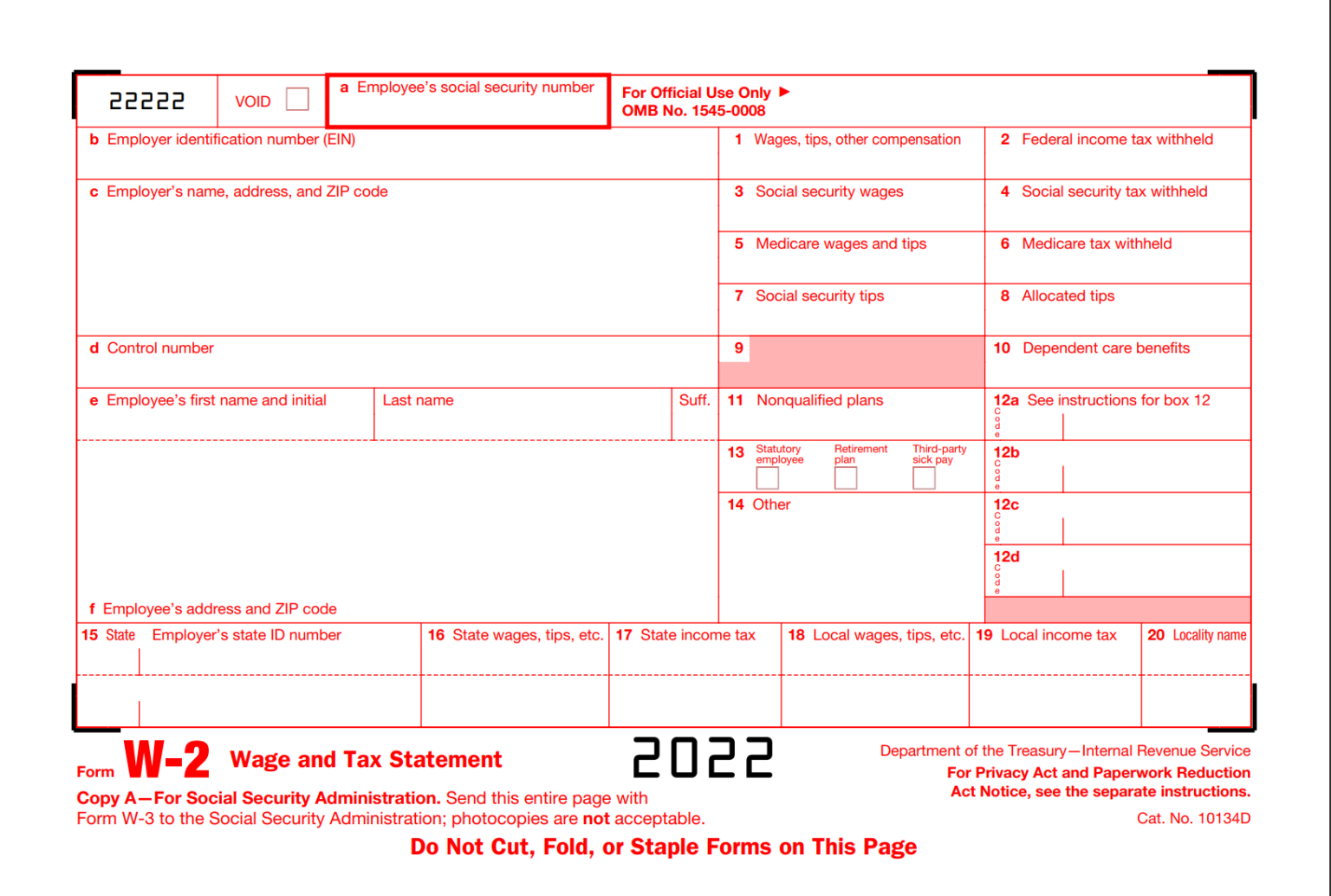

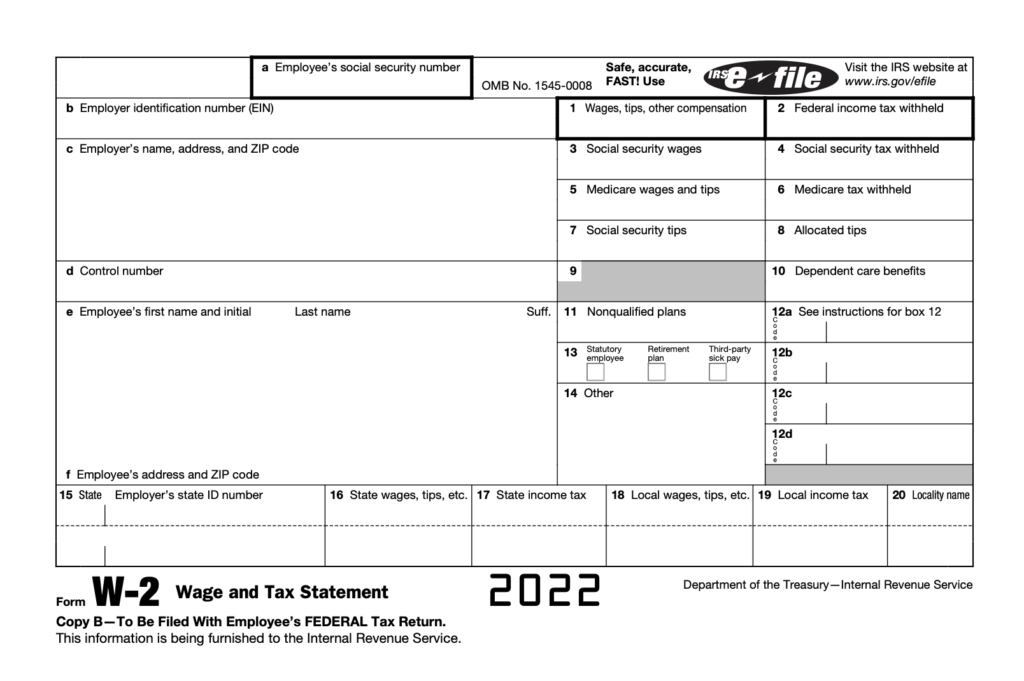

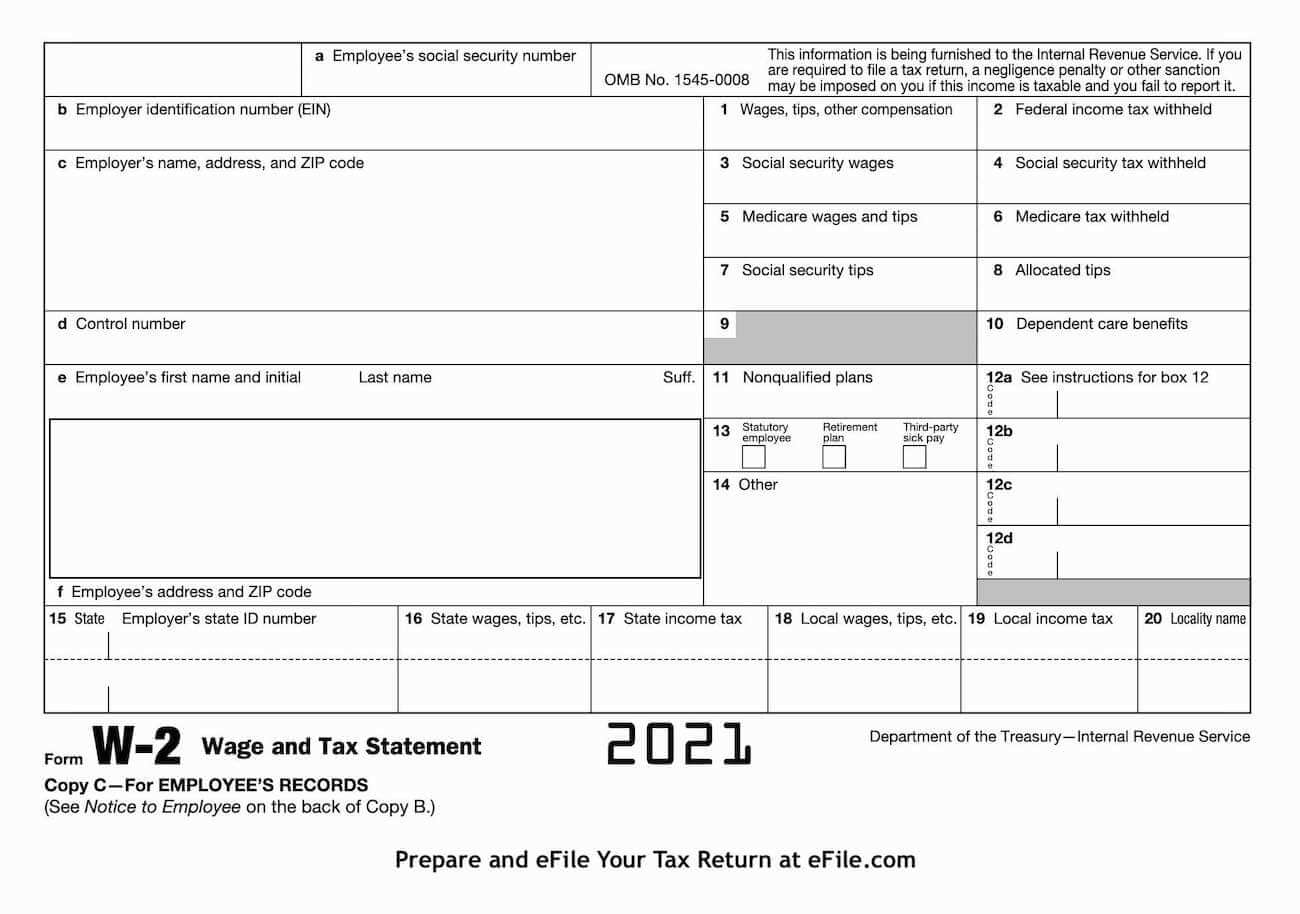

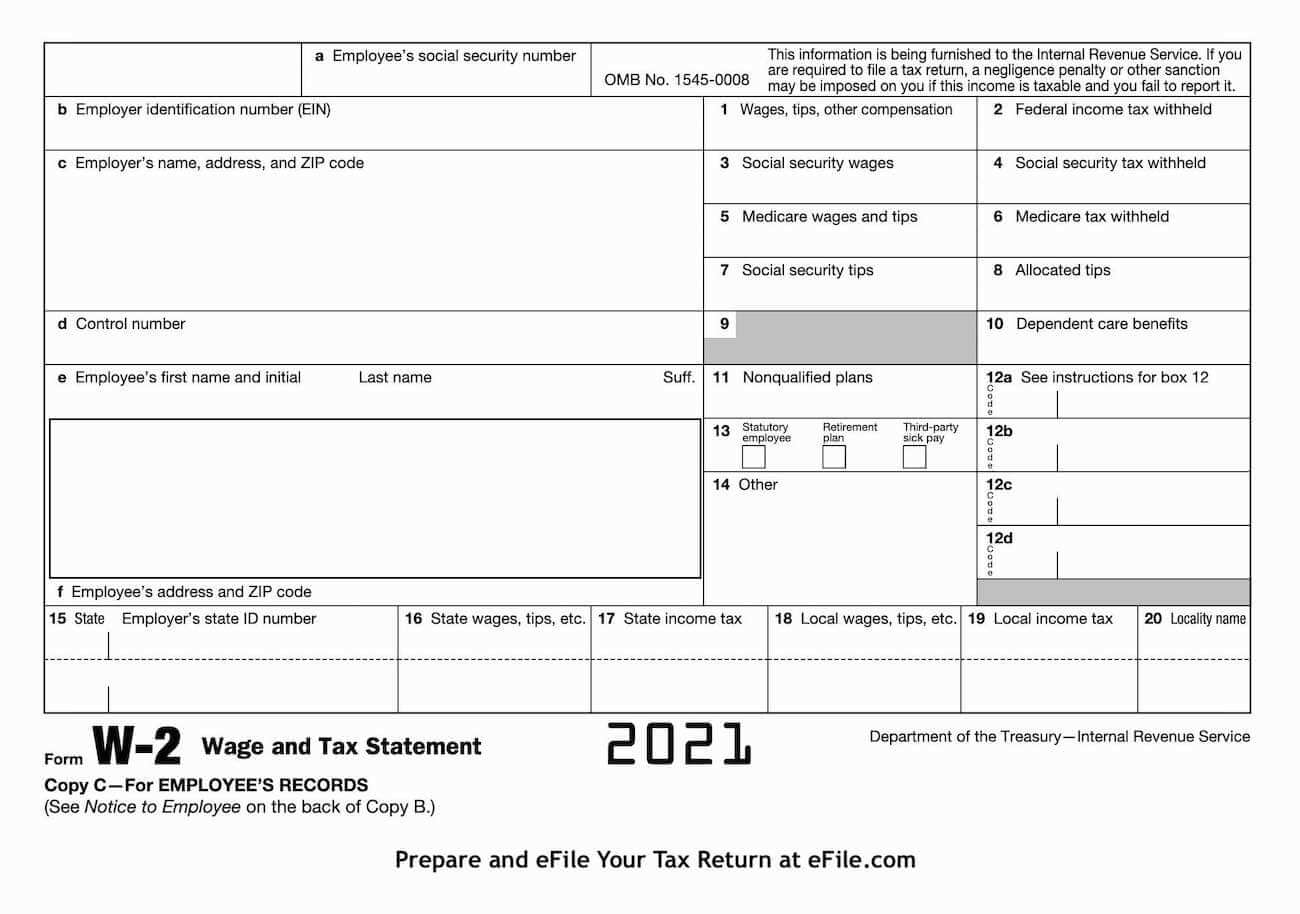

You should receive a W 2 from every employer that paid you at least 600 during the year Tip income may be on your W 2 Freelancers or independent contract workers who do not have taxes You re required to complete and file a W 2 for every employee who earns 600 or more during the year Employers have to create six copies of the W 2 for each employee You keep one copy the employee receives three copies and the

When Does Your Work Have To Give You Your W2

When Does Your Work Have To Give You Your W2

https://www.rachelbeohm.com/wp-content/uploads/2018/07/Give-scaled.jpg

Get Educated Learn How To Read Your W 2

https://www.payentry.com/wp-content/uploads/2018/08/2018-W2-1824x912.png

Adjusted Gross Income How To Find It On Your W2 Form Marca

https://phantom-marca.unidadeditorial.es/1686a5b0675c70b7ae5b1682648280d8/resize/1200/f/jpg/assets/multimedia/imagenes/2022/01/01/16410273150888.jpg

Employers must file their copies of Form W 2 Wage and Tax Statement and Form W 3 Transmittal of Wage and Tax Statements with the Social Security Administration by Forms W 2 must be prepared and provided to employees with copies sent to the Social Security Administration on or before Wednesday February 1 2023 Don t worry if you re not quite prepared we ll explain

Generally if you haven t received your W 2 by January 31 give it some time Employers are legally required to postmark these forms by January 31 meaning W 2s sent by mail may arrive a bit W 2 workers may have to work on an employer s schedule and according to the company s protocols but their taxes are paid automatically with payroll and they may qualify for company benefits

More picture related to When Does Your Work Have To Give You Your W2

I Want To Give You Your First One

http://cdn-webimages.wimages.net/05004f6f810f48698696681f956f52343edac0.jpg?v=3

The Easy Way To Build The BEST Professional Reputation EVER

https://www.cornerstonedynamics.com/wp-content/uploads/Insta-YT-Promo-positive-reputation-at-work.png

Verseoftheday May He Give You The Desire Of Your Heart And Make All

https://i.pinimg.com/originals/0a/a6/c1/0aa6c101c475c83c7434e4db257c42d7.jpg

You still need to report the income on your tax return if you file one If you really want a W 2 and you don t receive one by end of February you can contact IRS to make a W 2 complaint then If you have not received your Form W 2 by April 15 and have completed steps 1 and 2 you may use Form 4852 which the IRS sent you Attach Form 4852 to the return

At the beginning of each year employers have to send Copy A of Form W 2 to the Social Security Administration SSA to report the wages paid and taxes collected for your If you have changed jobs in the past year you must still get a W 2 from your former employer to file your taxes properly In this article we describe how to get your W 2

How W2 Employees Are Taxed Differently Than 1099 Contractors

https://s3.us-east-1.amazonaws.com/co-assets/assets/images/_fbTw/w2-employee.jpg

Take Delight In The Lord And He Will Give You The Desires Of Your

https://i.pinimg.com/originals/91/e7/2f/91e72f23c57e3586bfdd0913b9f60bf4.jpg

https://www.irs.gov › forms-pubs

Information about Form W 2 Wage and Tax Statement including recent updates related forms and instructions on how to file Form W 2 is filed by employers to report wages tips and other

https://www.nerdwallet.com › ... › taxes

You should receive a W 2 from every employer that paid you at least 600 during the year Tip income may be on your W 2 Freelancers or independent contract workers who do not have taxes

ABN AMRO Employee W2 Form W2 Form 2022

How W2 Employees Are Taxed Differently Than 1099 Contractors

Qu Es Un N mero De Control W 2 Los Basicos 2024

Social Security Cost Of Living Adjustments 2023

How To Fill Out Box D On Your W2 Form

Upwork 1099 Taxes The Simple Way To File

Upwork 1099 Taxes The Simple Way To File

How To Make Sense Of Your W 2 Business 2 Community

Everything You Need To Know About Your W 2 Form GOBankingRates Life

Sometimes Things Dont Workout The Way You Want Them To Positive

When Does Your Work Have To Give You Your W2 - Generally if you haven t received your W 2 by January 31 give it some time Employers are legally required to postmark these forms by January 31 meaning W 2s sent by mail may arrive a bit