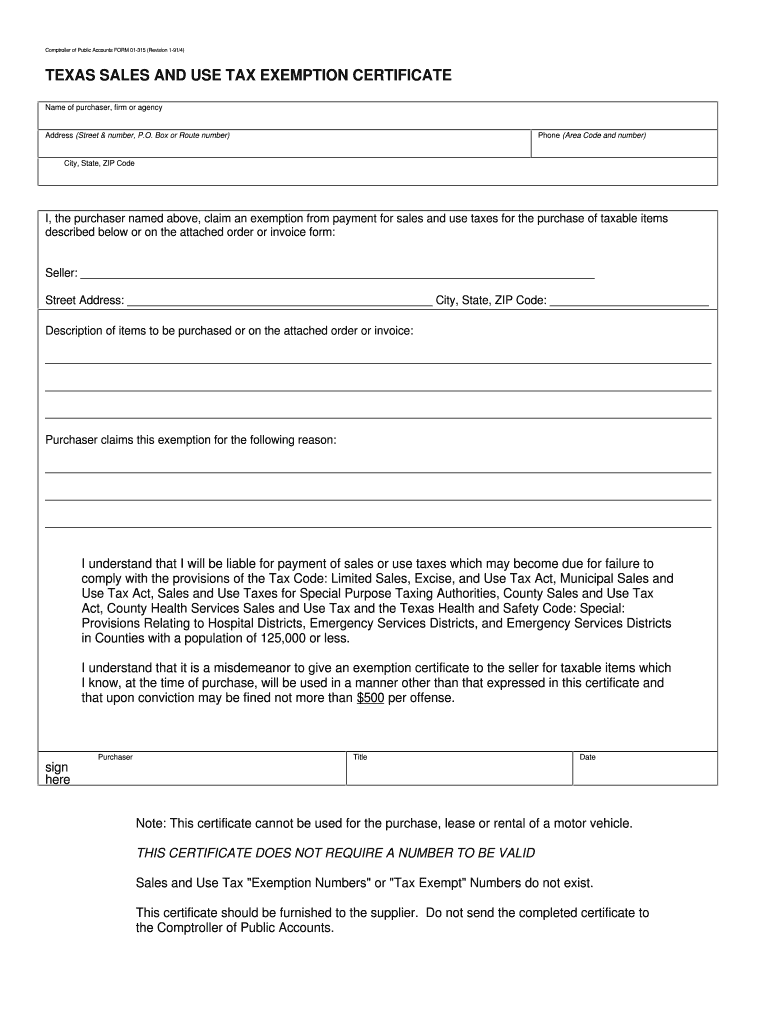

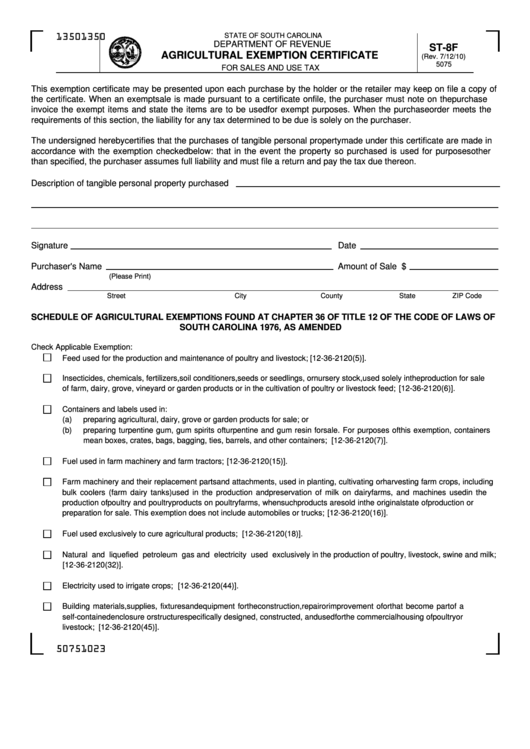

Free Printable Texas Agricultural Or Timber Tax Exemption Form Producers of agricultural products for sale must provide this completed form to retailers when claiming an exemption from sales and use tax on the purchase of qualifying agricultural items The certificate may serve as a blanket certificate covering all qualifying purchases

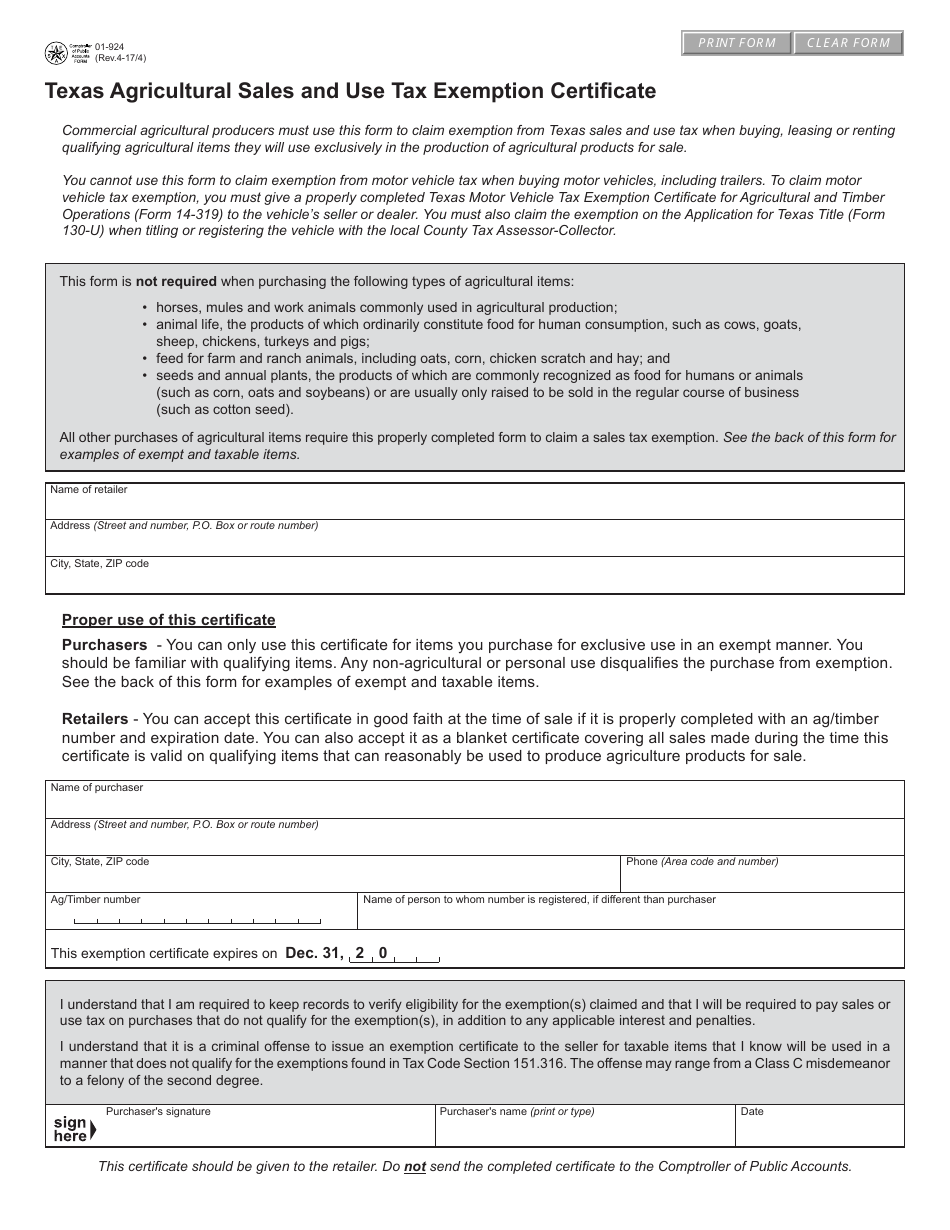

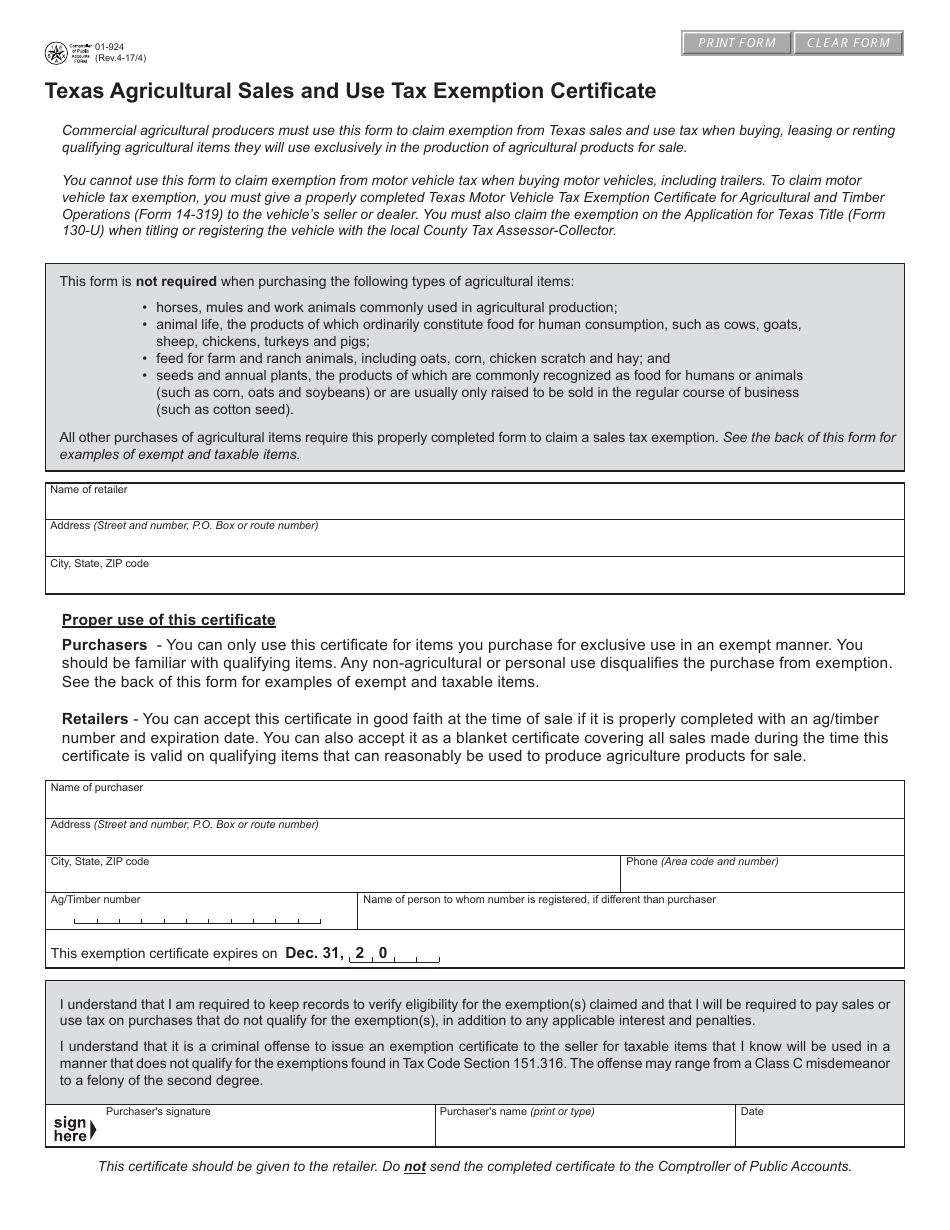

Commercial agricultural producers must use this form to claim exemption from Texas sales and use tax when buying leasing or renting qualifying agricultural items they will use exclusively in the production of agricultural products for sale Now AvailableTexas Agricultural and Timber Exemption Number Online Application Beginning Jan 1 2012 a person claiming an exemption from sales tax on the purchase of certain items used in the production of agricultural and timber products is required to have a Texas Agriculture and Timber Exemption Registration Number Ag Timber Number

Free Printable Texas Agricultural Or Timber Tax Exemption Form

Free Printable Texas Agricultural Or Timber Tax Exemption Form

https://data.templateroller.com/pdf_docs_html/1729/17291/1729123/form-01-924-texas-agricultural-sales-and-use-tax-exemption-certificate-texas_print_big.png

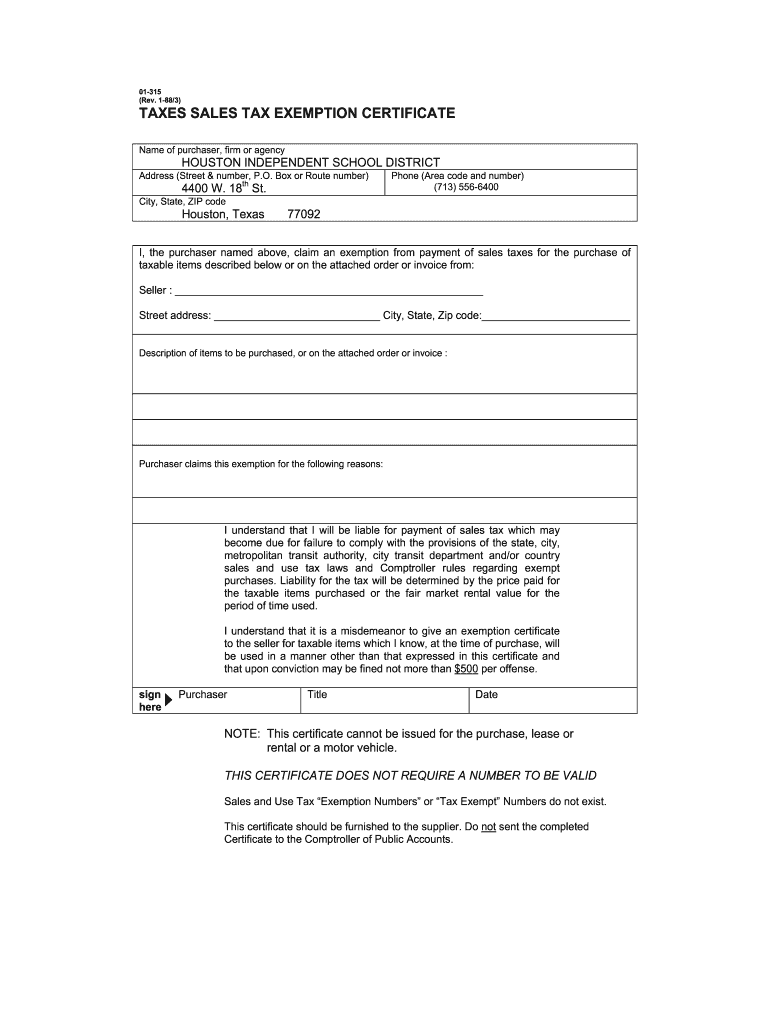

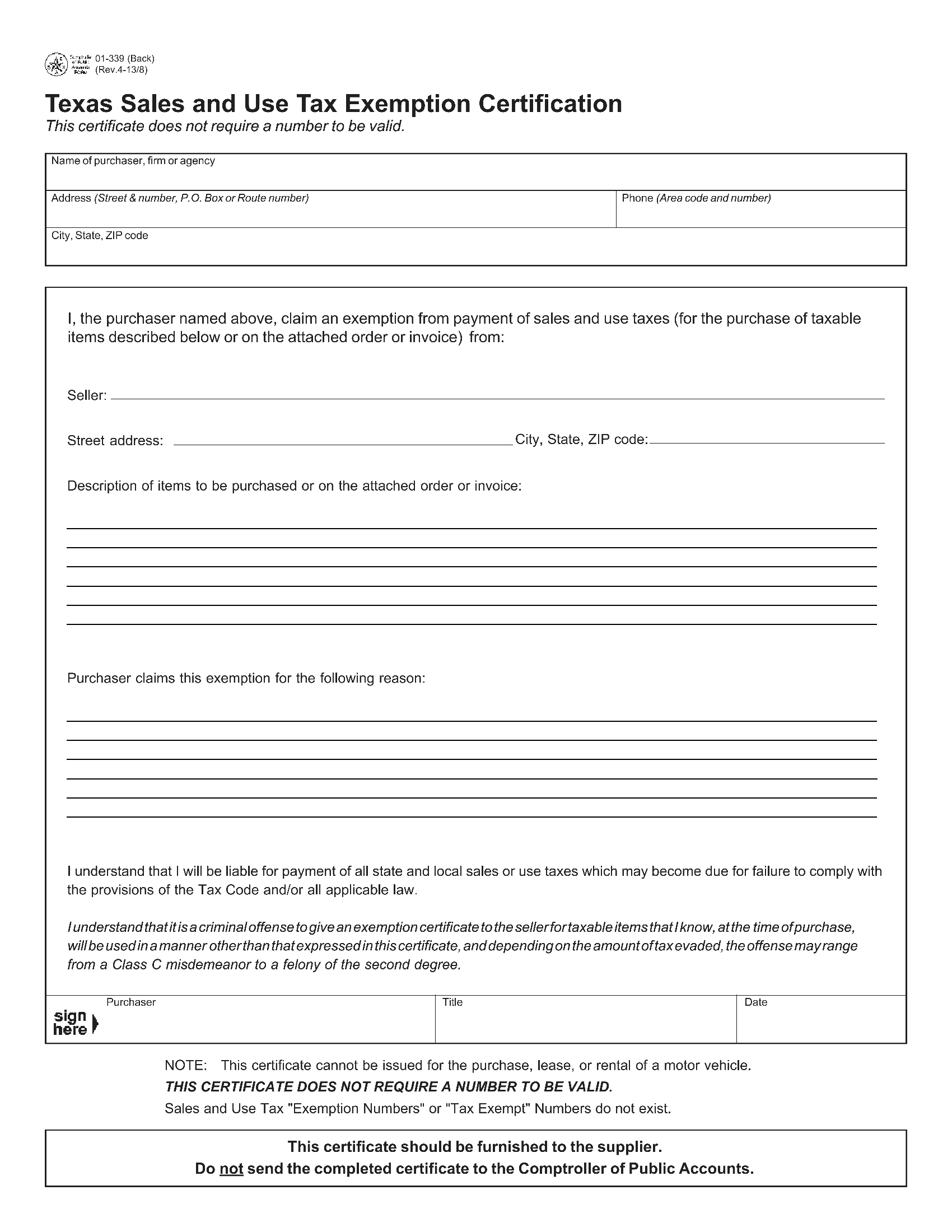

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

https://blanker.org/files/images/01-339b.png

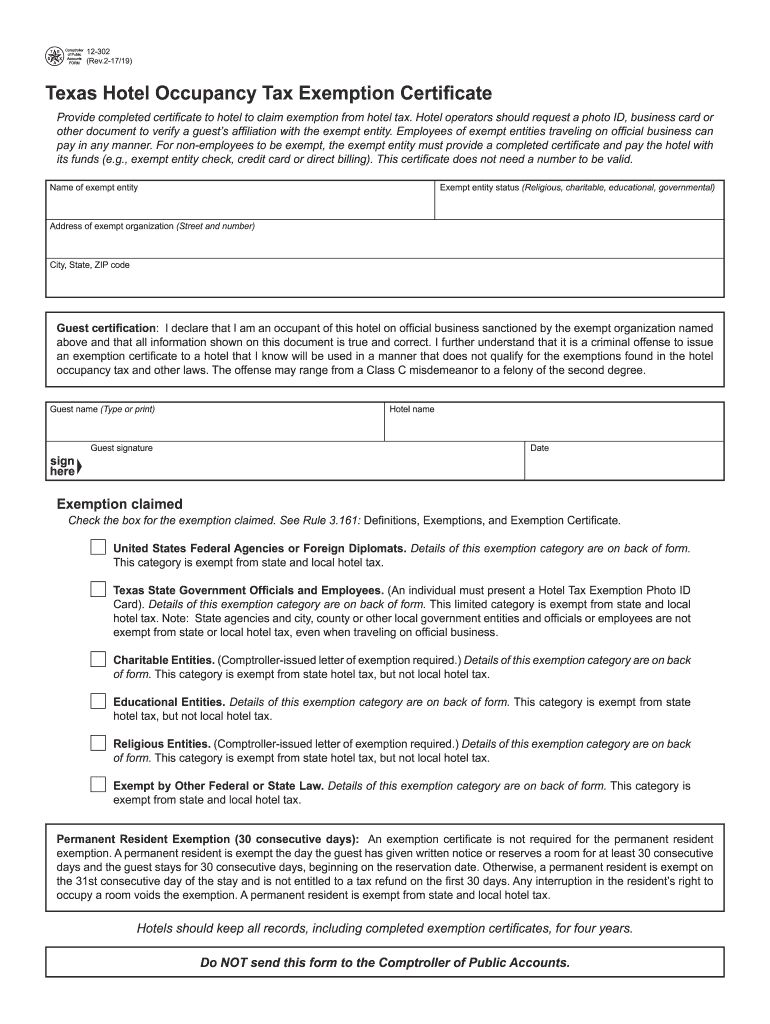

Tax Exempt Form Texas Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/75/100075866/large.png

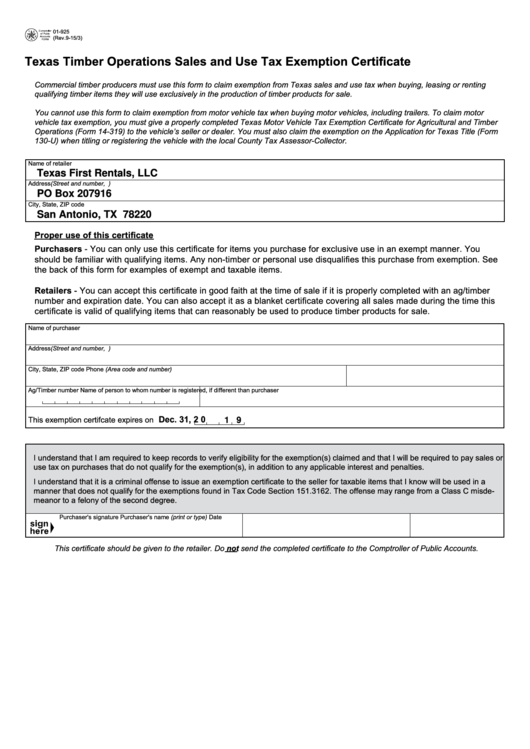

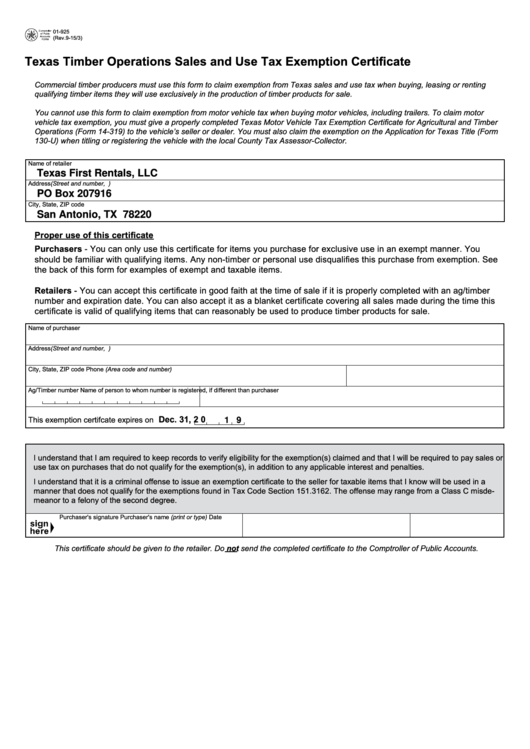

A purchaser claiming a timber operation exemption must provide a properly completed Form 01 925 Texas Timber Operations Sales and use Tax Exemption Certification to the seller at the time of purchase The certificate must include a valid Ag Timber Number Exempt timber machinery and equipment include but are not limited to chainsaws axes Printable Texas Motor Vehicle Tax Exemption Certificate for Agricultural Timber Form 14 319 for making sales tax free purchases in Texas

But you will usually need a minimum of 10 15 acres to be eligible for ag exemption These rules could also vary based on the type of agricultural activity For example if you re a beekeeper you ll need a minimum of approximately 5 10 acres to qualify Make sure to check with your county appraisal district Texas producers who have a valid agricultural and timber registration number for sales tax exemptions must renew those numbers by December 31 2023 Photo by Lucas Beck on Unsplash Texas farmers ranchers and timber producers are exempt from paying sales taxes on products used in the course of their agricultural or timber production

More picture related to Free Printable Texas Agricultural Or Timber Tax Exemption Form

How To Get A Farm Tax Exempt Number In Texas Are Farmers Exempt From Income Tax Srkczxlvdweaq

https://www.pdffiller.com/preview/15/65/15065735/large.png

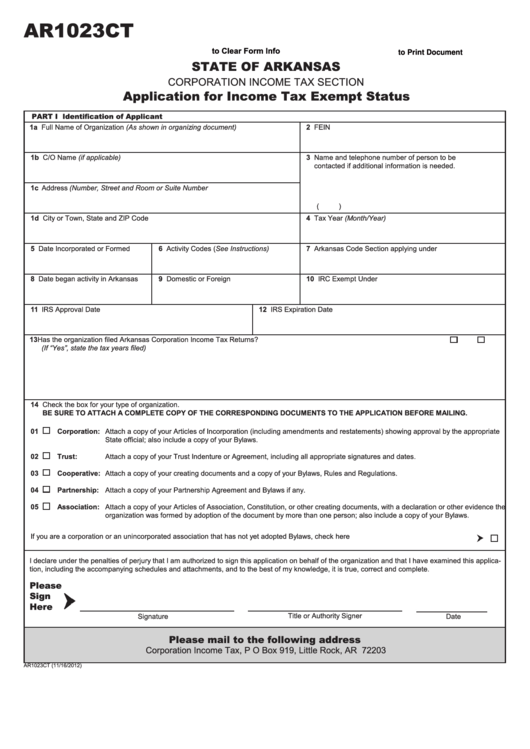

Fillable Form Ar1023ct Application For Income Tax Exempt Status Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/330/3304/330491/page_1_thumb_big.png

Ohio Sales Tax Blanket Exemption Form 2021

https://www.pdffiller.com/preview/15/66/15066252/large.png

Only persons engaged in a qualifying agricultural business can legally obtain an ag timber number An officer of a corporation engaged in such a business for example is not qualified to personally claim an ag timber exemption I did not have an ag timber number when I titled my trailer Can I request a refund Yes After registering for the PRINT FORM01925 Rev 417 4 CLEAR FORMTexas Timber Operations Sales and Use Tax Exemption Certificate Commercial timber producers must use this form to claim exemption from Texas sales and use tax How It Works

Ag Timber Registration Search Registration Number must enter 11 numbers OR First Name Middle Name optional Last Name OR Farm Ranch DBA The Texas Comptroller s most commonly used web browsers are Microsoft Internet Explorer Google Chrome and Firefox Close OTHER STATE SITES texas gov Texas Records and Information Locator TRAIL This application is used to obtain a registration number that can be used to claim an exemption from Texas sales and use tax on the purchase of qualifying items used in the production of agricultural and timber products for sale You can also apply for a Texas Agricultural and Timber Exemption Registration Number online at www GetReadyTexas

Fillable Texas Timber Operations Sales And Use Tax Exemption Certificate Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/135/1359/135919/page_1_thumb_big.png

Texas Tax Exempt PDF 1991 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/31/836/31836164/large.png

https://www.ctmrs.com/forms/01-924.pdf

Producers of agricultural products for sale must provide this completed form to retailers when claiming an exemption from sales and use tax on the purchase of qualifying agricultural items The certificate may serve as a blanket certificate covering all qualifying purchases

https://www.rowletthardware.com/webadmin/uploads/texas-ag-forms.pdf

Commercial agricultural producers must use this form to claim exemption from Texas sales and use tax when buying leasing or renting qualifying agricultural items they will use exclusively in the production of agricultural products for sale

Tax Exempt Form Texas Fill Out Sign Online DocHub

Fillable Texas Timber Operations Sales And Use Tax Exemption Certificate Printable Pdf Download

Tax Exempt Form For Agriculture ExemptForm

Tax Exempt Forms San Patricio Electric Cooperative

Texas Homestead Tax Exemption Form ExemptForm

Free Printable Texas Agricultural Or Timber Tax Exemption Form Printable Forms Free Online

Free Printable Texas Agricultural Or Timber Tax Exemption Form Printable Forms Free Online

Texas Ag Exemption Lookup Fill Out Sign Online DocHub

Texas Fillable Tax Exemption Form Fill Out And Sign Printable PDF Template SignNow

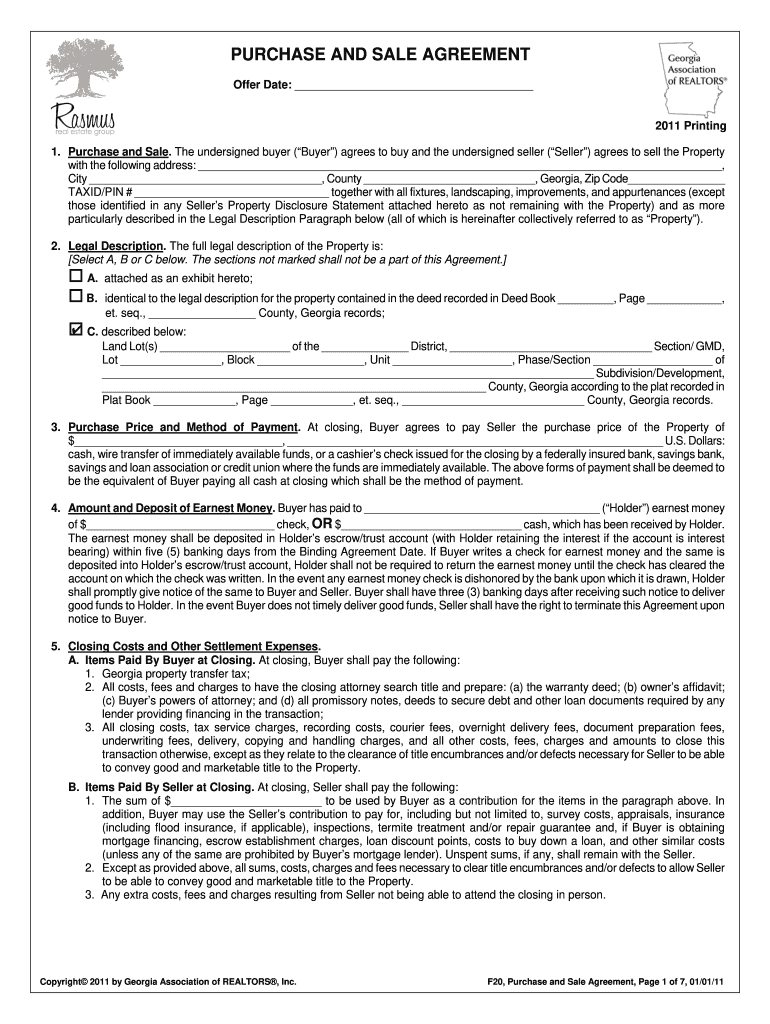

F20 01 01 11 DOC AP 228 Application For Texas Agriculture And Timber Exemption Registration

Free Printable Texas Agricultural Or Timber Tax Exemption Form - A purchaser claiming a timber operation exemption must provide a properly completed Form 01 925 Texas Timber Operations Sales and use Tax Exemption Certification to the seller at the time of purchase The certificate must include a valid Ag Timber Number Exempt timber machinery and equipment include but are not limited to chainsaws axes