Printable 1099 Form Irs Form Listing Sole Proprietorship A sole proprietor is someone who owns an unincorporated business by themselves If you are the sole member of a domestic limited liability company LLC and elect to treat the LLC as a corporation you are not a sole proprietor Forms you may need to file Use this table to help determine some forms you may be required to file as a sole proprietor

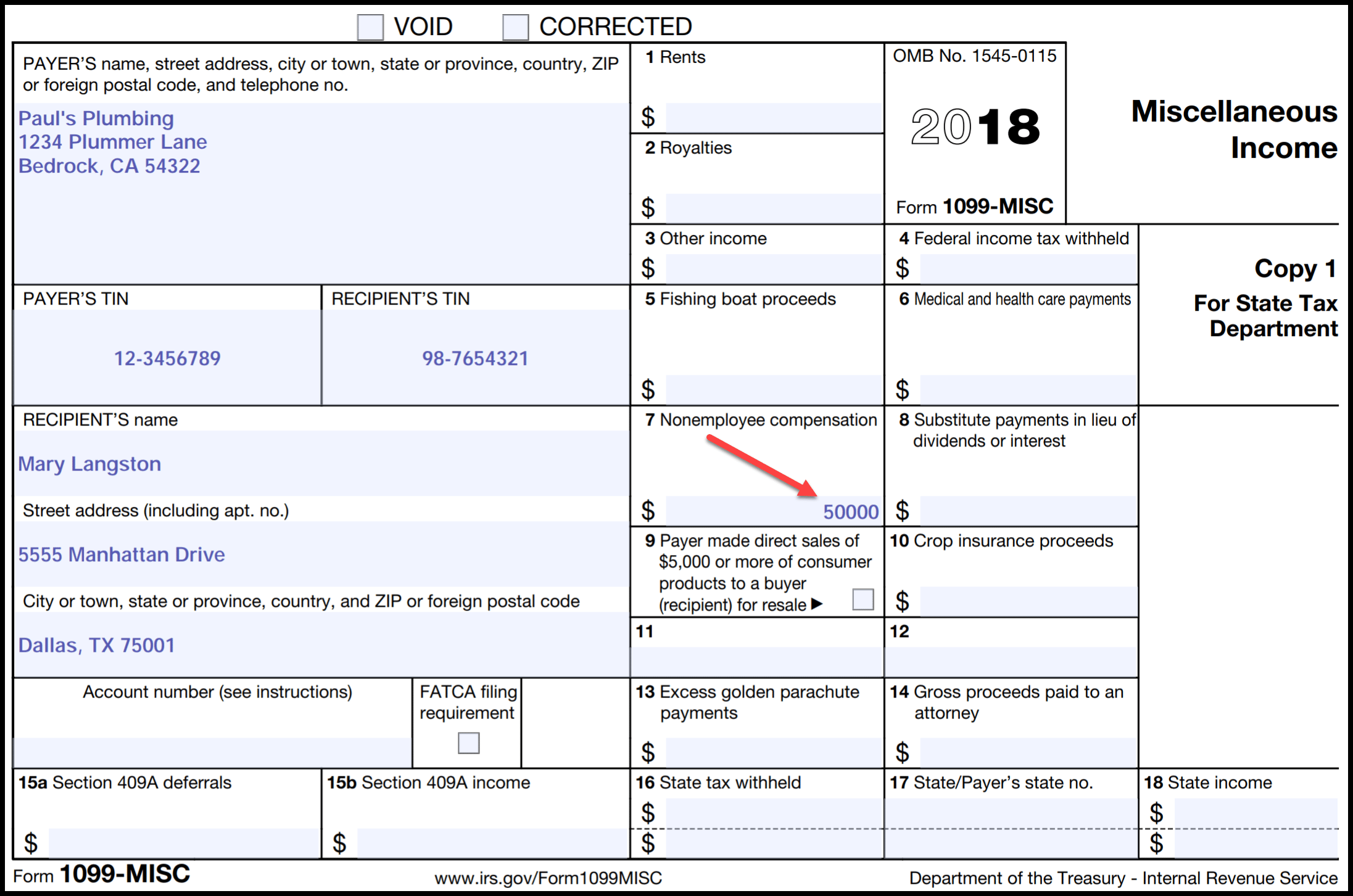

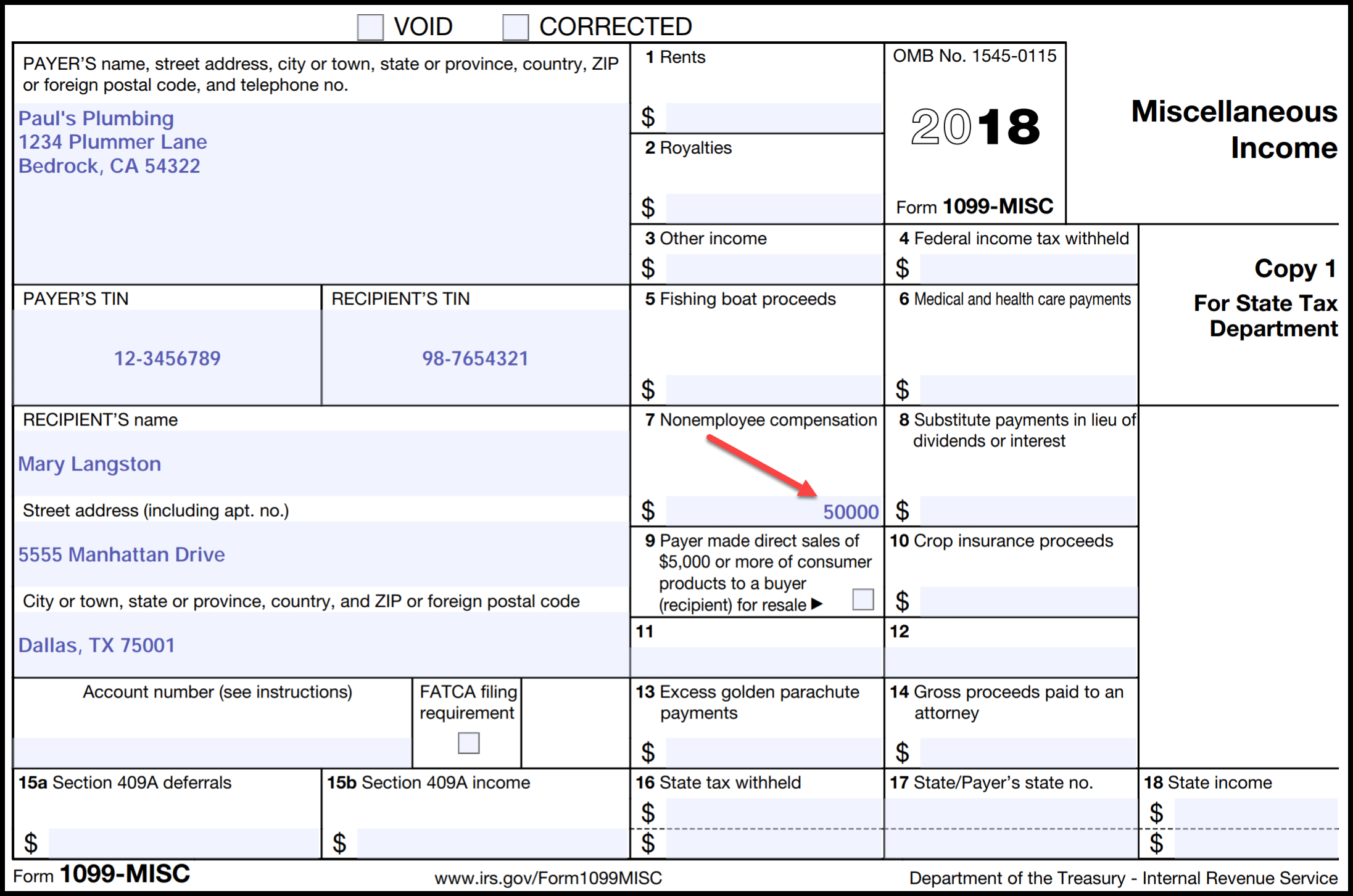

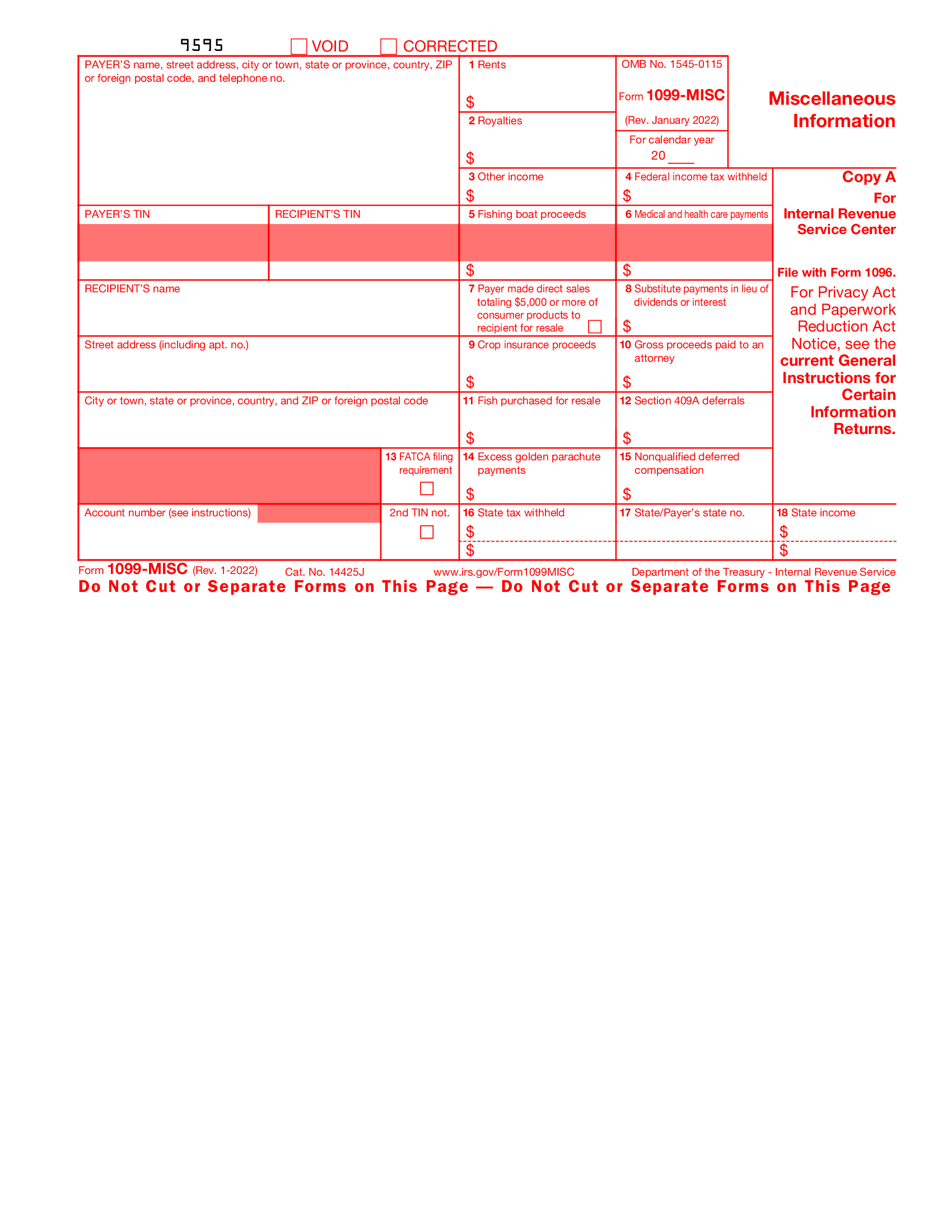

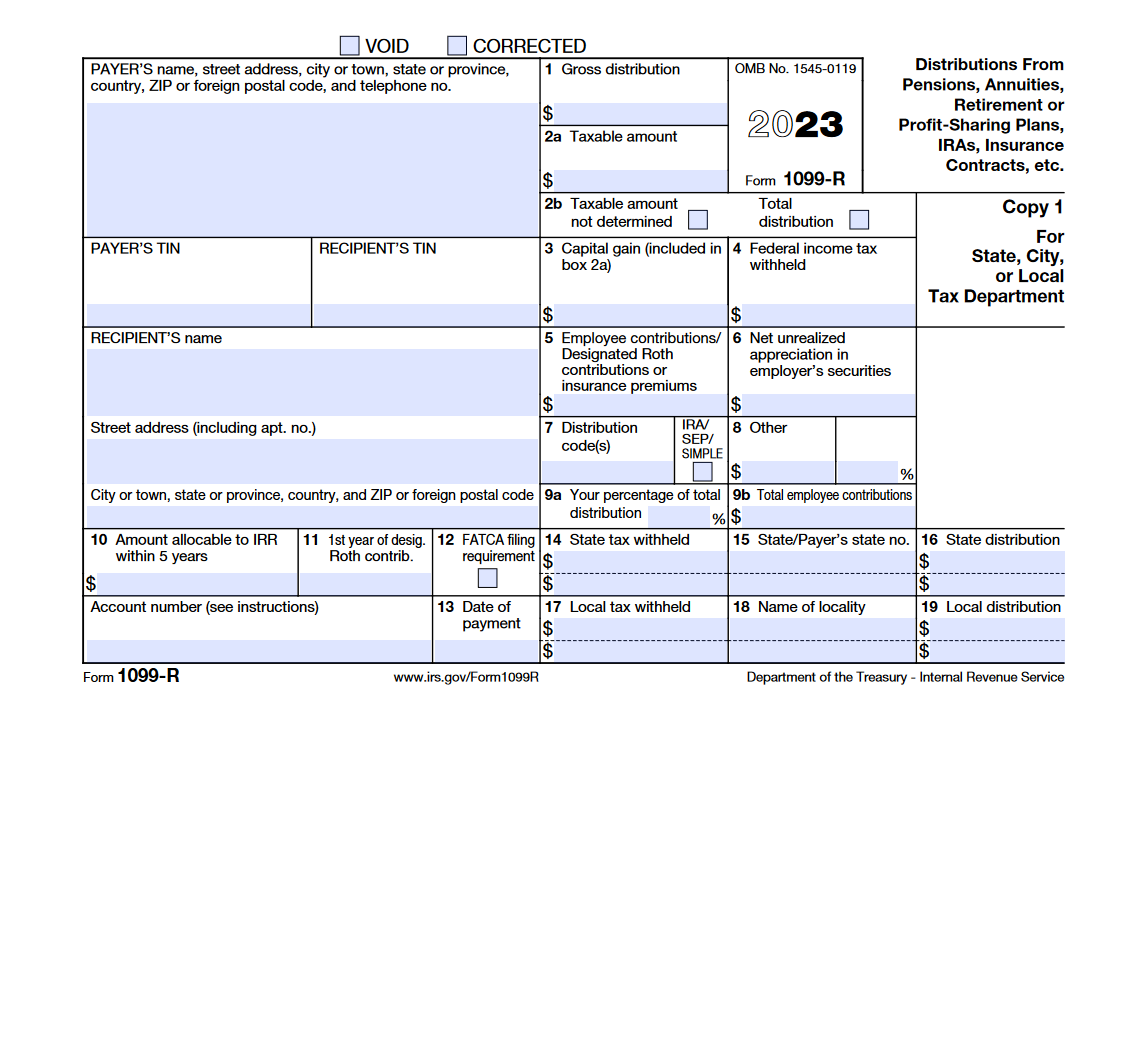

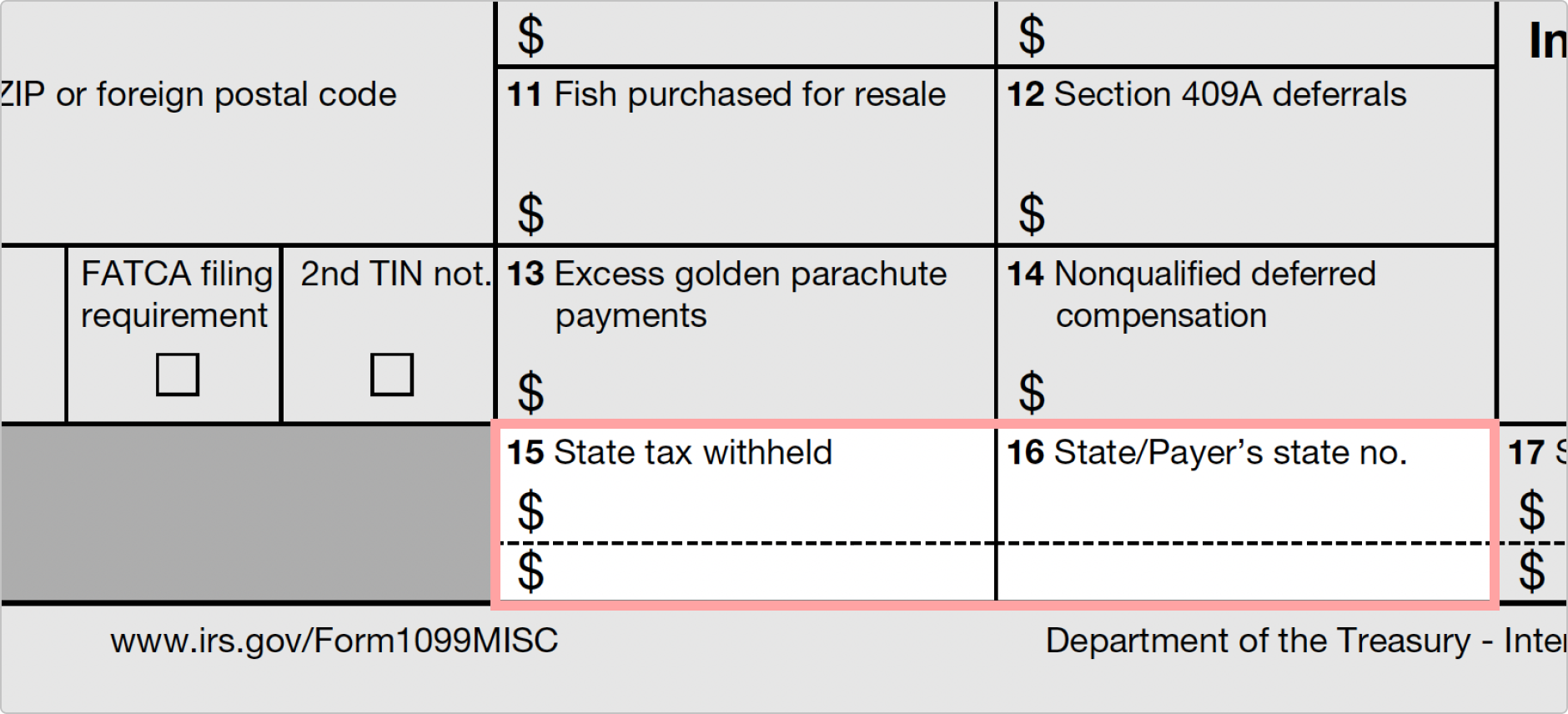

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN Filling Out a 1099 for a Sole Proprietorship Small Business Business Models Organizational Structure Sole Proprietorship By Andra Picincu Updated February 18 2021 Business owners

Printable 1099 Form Irs Form Listing Sole Proprietorship

Printable 1099 Form Irs Form Listing Sole Proprietorship

https://fitsmallbusiness.com/wp-content/uploads/2018/01/word-image-511.png

How To PDF Printing 1099 misc Forms

https://www.halfpricesoft.com/images/1099_edit.jpg

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

https://www.signnow.com/preview/6/961/6961758/large.png

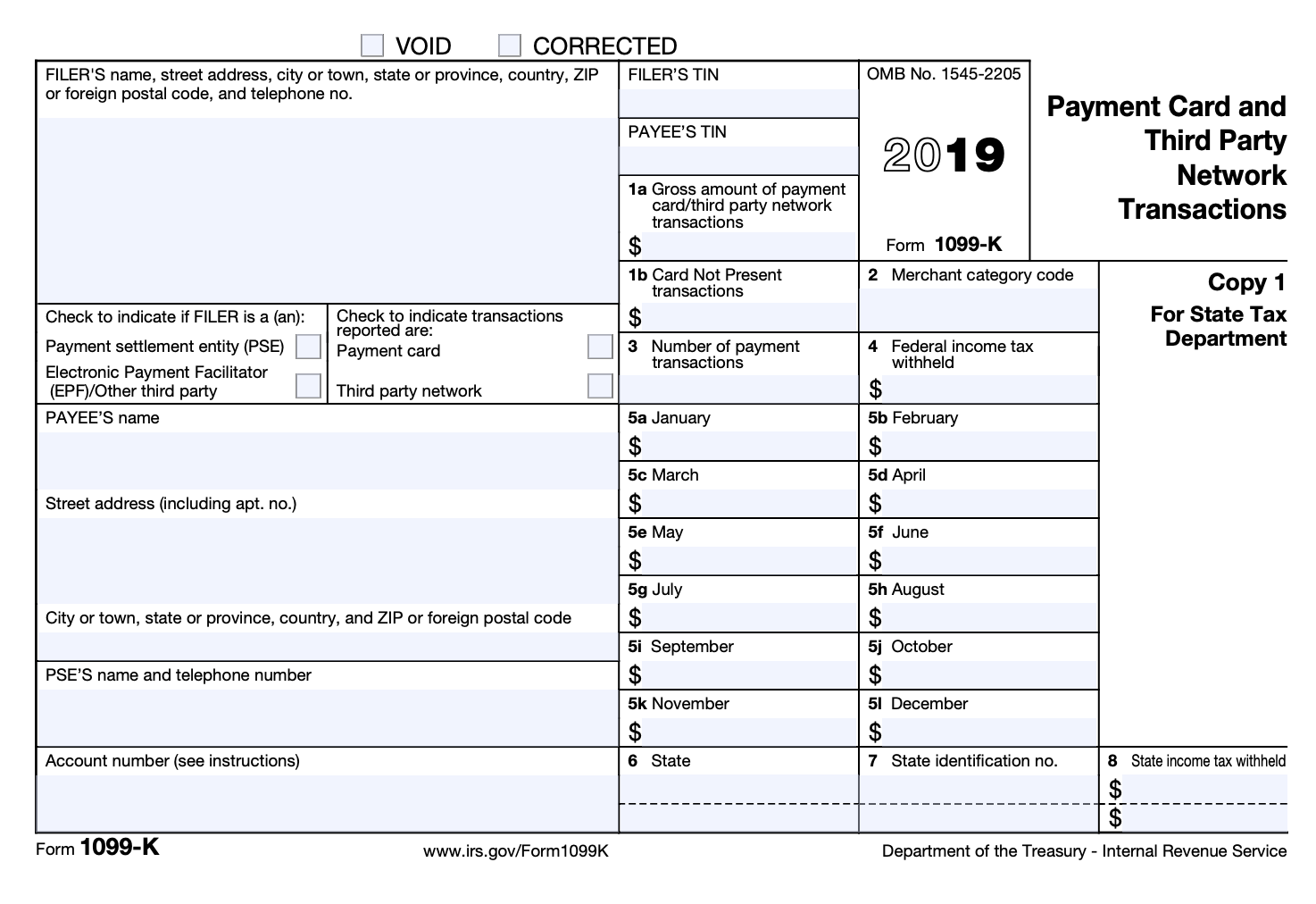

Published on 1 Jan 2021 When you contract a sole proprietor for services the Internal Revenue Service requires you to issue a 1099 to the worker when you pay him more than 600 during the year For most payments you ll use Form 1099 MISC to report the sole proprietor s income to the contractor and to the IRS If you received any 1099 NEC 1099 MISC or 1099 K tax forms reporting money you earned working as a contractor or selling stuff you ll have to report that as income on Line 1 of Schedule C You ll also need to add any other money you earned while being self employed Unfortunately you have to pay taxes on it all

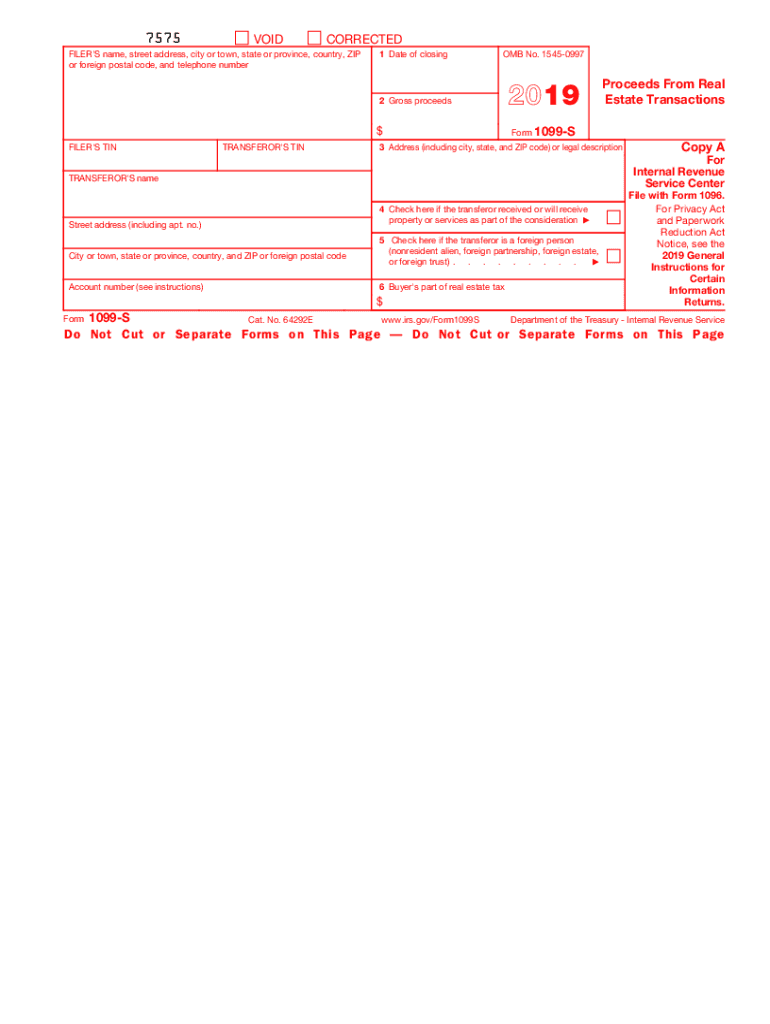

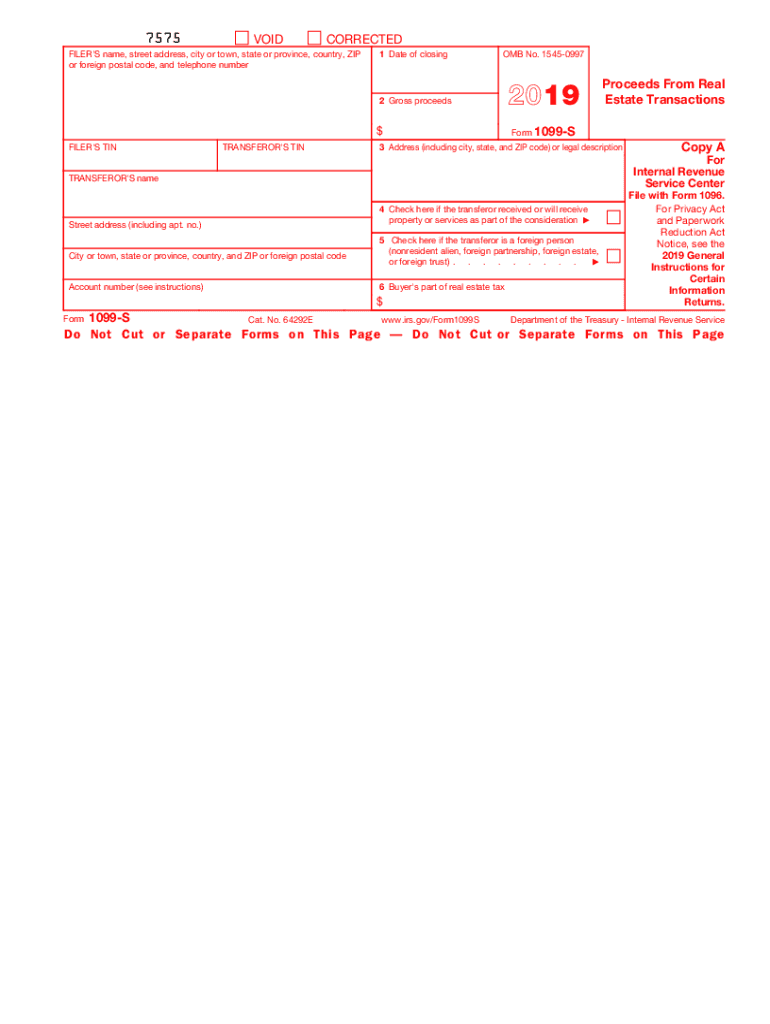

IRS Form 1040 is the form used by individuals and thus by unincorporated sole proprietorships since they file under the same forms as their owners IRS Schedule C is the profit and loss statement for the business Estimated Taxes Step 3 Submit the 1099 form When you produce a 1099 NEC you provide copies of the form to different recipients Submit Copy A to the IRS with Form 1096 which reports all 1099 forms issued to contractors and the total dollar amount of payments Send Copy 1 to your state s department of revenue Provide Copy B to the recipient the

More picture related to Printable 1099 Form Irs Form Listing Sole Proprietorship

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

https://www.investopedia.com/thmb/_h1CHqdnjvV-4nCTHDingOUQvJ4=/1288x1288/smart/filters:no_upscale()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg

What Is A 1099 Misc Form Financial Strategy Center

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

1099 Printable Form

https://gusto.com/wp-content/uploads/2020/12/1099-MISC-1024x663.png

Sole proprietorships are subject to pass through taxation meaning the business owner reports income or loss from their business on their personal tax return but the business itself is not Mail If you prefer to file your 1099 NEC Form by paper you can send your form to the IRS through the mail The address you use depends on the location of your business and will either need to be sent to their Austin Texas Kansas City Missouri or Ogden Utah processing center Mailing instructions can be found on the IRS website

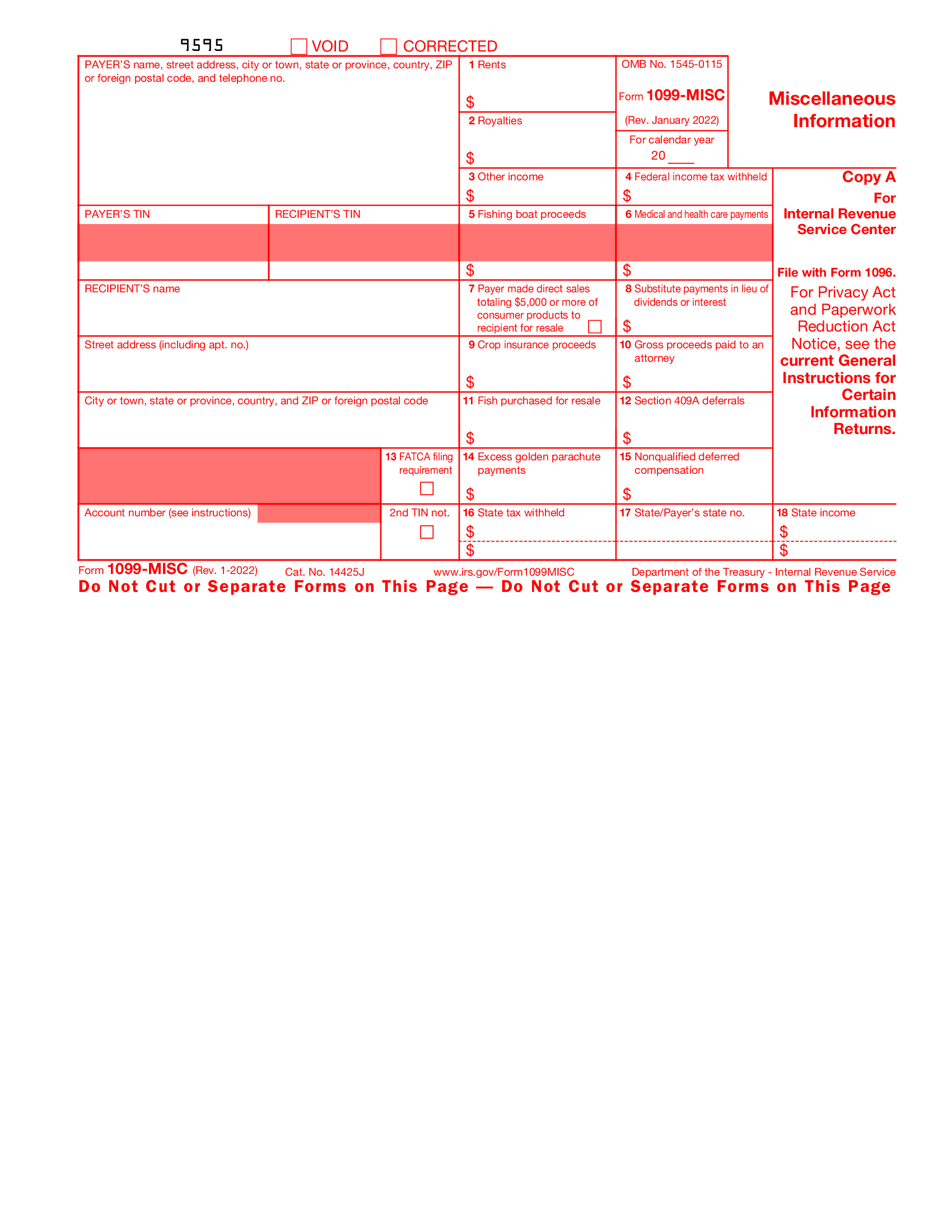

IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more How to become insured under social security Earning credits in 2022 and 2023 The SSA time limit for posting self employment income Who must pay SE tax SE tax rate Maximum earnings subject to SE tax More information Publication 334 2022 Tax Guide for Small Business For Individuals Who Use Schedule C For use in preparing 2022 Returns

Fillable 1099 Misc Irs 2022 Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/09/fillable-1099-misc-irs-2022.png

Tax Form 1099 MISC Instructions How To Fill It Out Tipalti

https://lh4.googleusercontent.com/k2lr2QLf9OvFdt0aPeTtU_t9ryklux-DLzsAEo7vztZzgeWxWNS_bp3Jfmd7RXXBkfSp08oMB_5HICrBpvPTBvPnx0jNx1omGKS0qhbKog9ZnHRxa-ojwuj7dEv81zXye_n3IJKW

https://www.irs.gov/businesses/small-businesses-self-employed/sole-proprietorships

A sole proprietor is someone who owns an unincorporated business by themselves If you are the sole member of a domestic limited liability company LLC and elect to treat the LLC as a corporation you are not a sole proprietor Forms you may need to file Use this table to help determine some forms you may be required to file as a sole proprietor

https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN

Irs Printable 1099 Form Printable Form 2023

Fillable 1099 Misc Irs 2022 Fillable Form 2023

Printable Blank 1099 Form

1099 Forms Printable Printable Forms Free Online

IRS Form 1099 Reporting For Small Businesses In 2023

1099 S Fillable Form Printable Forms Free Online

1099 S Fillable Form Printable Forms Free Online

IRS Tax Form 1099 How It Works And Who Gets One Ageras

IRS Form 1099 R 2023 Forms Docs 2023

1099 MISC Form Fillable Printable Download Free 2021 Instructions

Printable 1099 Form Irs Form Listing Sole Proprietorship - This tax is your personal Social Security and Medicare contributions The rate is a combined 15 3 for the first 132 900 of earnings and 2 9 for Medicare only after that 1040 ES for estimated